Company Summary

| CMCU Review Summary | |

| Founded | 2025 |

| Registered Country/Region | Australia |

| Regulation | ASIC (Exceeded) |

| Products & Services | Savings, loans, and travel-related products |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | $5 per month |

| Customer Support | Contact form |

| Phone: 03 5744 3713/1800 648 027 | |

| Email: info@centralmurray.bank | |

| Location Address: 58 Belmore Street, Yarrawonga Vic 3730 | |

| Facebook, Instagram, Linkedin | |

CMCU, founded in 2025 in Australia, offers diverse financial services like savings, loans, and travel - related products. It has various account types for individuals and businesses. However, its ASIC license has been exceeded. Also, its complex fee structure and new-entrant status can also deter some clients.

Here is the home page of this brokers official site:

Pros and Cons

| Pros | Cons |

| Various account types for targeted clients | Exceeded ASIC license |

| Social media presence | Newly established |

| Security methods offered | Complex fee structure |

Is CMCU Legit?

CMCU provides a variety of ways to ensure the security of its clients. These methods include safeguarding your Member Number and Access Code, being vigilant against fraudulent emails, properly logging in and out of the system, and implementing virus and spyware protection.

However, CMCUs license of the Australian Securities and Investments Commission (ASIC) (Investment Advisory License, No.239446 ) has been exceeded.

| Regulatory Status | Exceeded |

| Regulated by | Australia |

| Licensed Institution | Central Murray Credit Union Limited |

| Licensed Type | Investment Advisory License |

| Licensed Number | 239446 |

Products and Services

CMCU offers various financial services including savings, loans, investment, insurance, financial planning and sort out your travel products such as cash passport, travelx foreign cash, and covert foreign transfers.

Account Type

CMCU provides three types of accounts for individuals: Transactional, Saving, and Youth accounts. Meanwhile, for business brokers, there are three options available: Business, Premium Business, and GST accounts. Thus, you can select the appropriate account type based on your objectives.

CMCU Fees

CMCU charges $5 monthly access fee for most account types. Besides, it also charges other fees for each account. For example:

Transaction Accounts:

| Account Type | Monthly Access Fee | Monthly Fee for Sub - accounts | Fee - free Transactions per Month |

| S8 (Everyday Account (S10)) | $5.00 | 0 | Unlimited |

| S10 (Mortgage Offset) | |||

| S65 (Single Pension Account) | |||

| S66 (Joint Pension Account) |

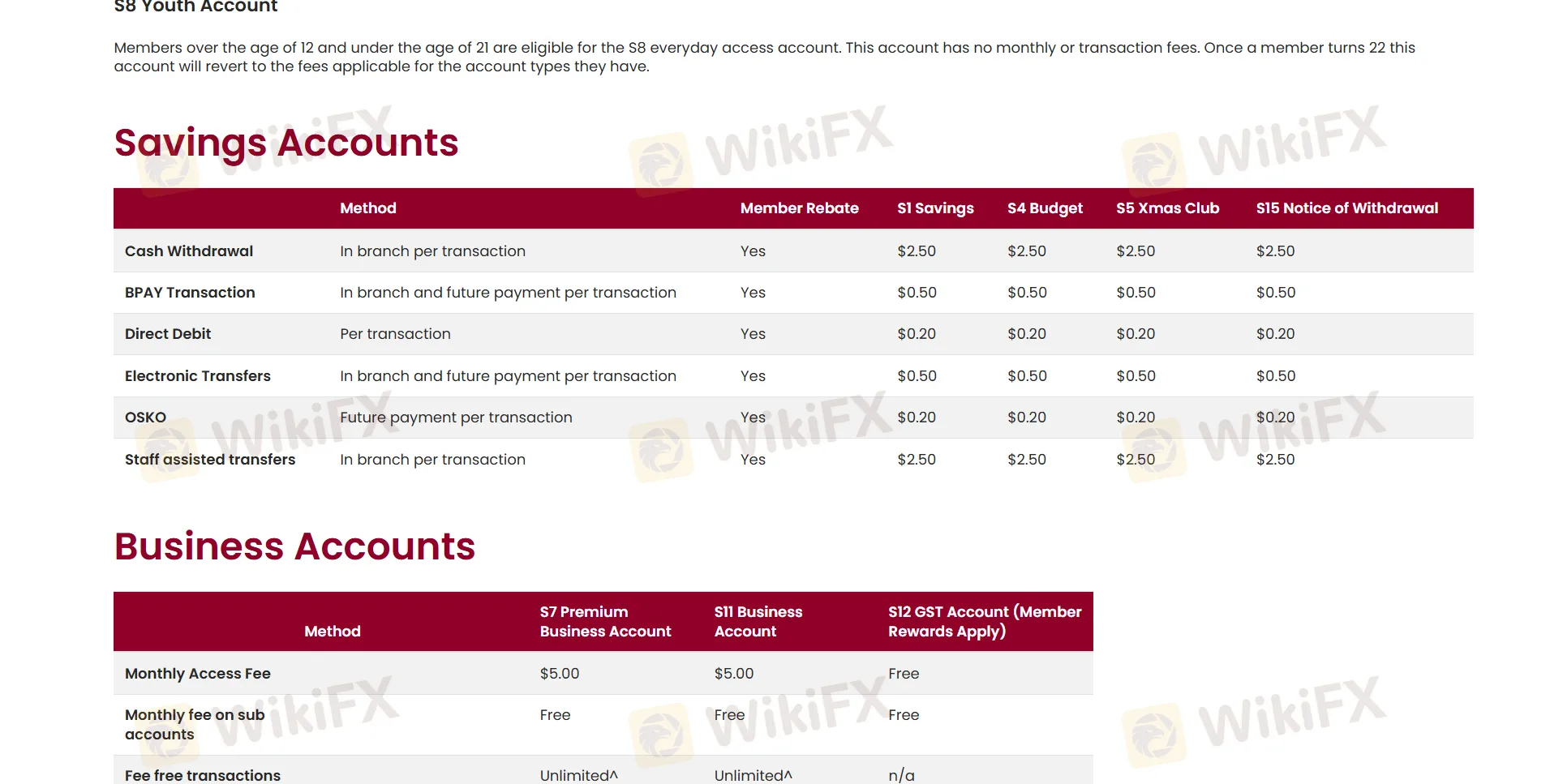

Savings Accounts:

| Method | Member Rebate | S1 Savings | S4 Budget | S5 Xmas Club | S15 Notice of Withdrawal |

| Cash Withdrawal (In branch per transaction) | ✔ | $2.50 | |||

| BPAY Transaction (In branch and future payment per transaction) | $0.50 | ||||

| Direct Debit (Per transaction) | $0.20 | ||||

| Electronic Transfers (In branch and future payment per transaction) | $0.50 | ||||

| OSKO (Future payment per transaction) | $0.20 | ||||

| Staff assisted transfers (In branch per transaction) | $2.50 | ||||

You can learn from clicking: https://www.centralmurray.bank/personal-banking/fees-charges-and-rewards/