Company Summary

| Aspect | Information |

| Registered Country/Area | Mexico |

| Founded Year | 2-5 years |

| Company Name | InverForx |

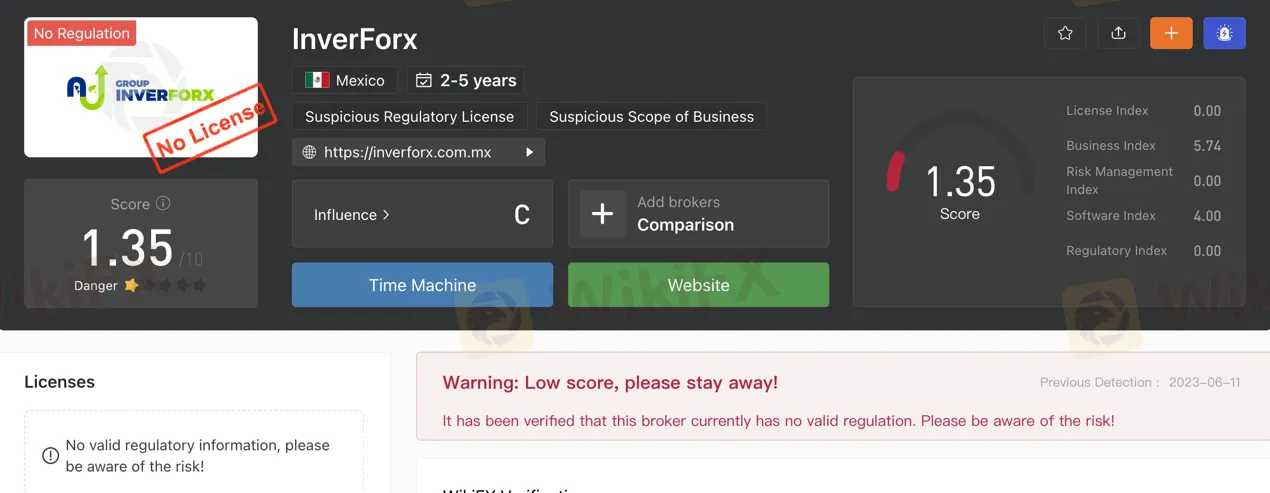

| Regulation | No Regulation |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | Not specified |

| Tradable Assets | Currencies, Stocks, Derivatives, Other Assets (Commodities, Bonds, Indices) |

| Account Types | Not specified |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Telephone: 55 59 41 63 75, Email: contacto@inverforx.com.mx, Social media presence (Twitter, Facebook, Instagram, YouTube, LinkedIn) |

| Payment Methods | Not specified |

| Educational Tools | InverForx Blog with a wide range of topics, including personal finance, technology, financial inclusion, successful Mexican investors, and North American leaders summit |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

InverForx presents itself as a financial services company founded in 2017 and registered in Mexico. InverForx is a fictional financial investment company portrayed as operating in a regulatory gray area. It offers market instruments such as currencies, stocks, derivatives, and other assets to investors, providing opportunities for potential profit, diversification, and access to global markets. However, there are risks associated with market volatility and limited control over asset management. InverForx promotes investment strategies like the Inverforx Promissory Note, Promissory Note Plus, and Smart Investment Inverforx, each with its own potential returns and risks.

The company's educational resources, available through the InverForx Blog, cover topics such as personal finance, technology in the economy, financial inclusion, successful Mexican investors, and North American leaders summit. These resources offer valuable insights, guidance, and inspiration, but may have limitations such as inconsistent blog post frequency and lack of interactive features.

In terms of customer support, InverForx provides multiple channels for communication, including phone and email. Customers can also engage with the company through social media platforms. A physical address is provided for those who prefer in-person contact or need to correspond regarding fiscal matters.

Here is the home page of this brokers official site:

Pros and Cons

Equinox offers a diverse range of market instruments, providing traders with access to global markets and the opportunity to explore various investment options. The platform also offers valuable educational resources, allowing users to enhance their trading knowledge and stay informed about market trends. Equinox provides multiple communication channels for customer support, ensuring that users can easily reach out for assistance when needed. Furthermore, the platform claims to provide legal support for 100% of invested capital, instilling a sense of security for traders. However, it is important to note that Equinox operates with limited regulatory oversight, which may raise concerns for some users. Additionally, the inconsistent frequency of blog posts and the limited interactive features for reader engagement may affect the overall user experience. The platform does not explicitly mention the credentials or contributions of expert contributors, potentially diminishing trust. Furthermore, Equinox's transparency and disclosure practices are perceived to be limited, which may impact users' ability to make fully informed investment decisions.

| Pros | Cons |

| Diverse range of market instruments | Lack of regulatory oversight |

| Access to global markets | Inconsistent frequency of blog posts |

| Valuable educational resources | Limited interactive features for reader engagement |

| Multiple communication channels for customer support | No mention of expert contributors or credentials |

| Legal support for 100% of invested capital | Reliance on market conditions |

| Limited transparency and disclosure |

Is InverForx Legit?

InverForx is a fictional financial investment company that operates in a regulatory gray area. It is important to note that this description is purely fictional and does not represent any real-world entity.

InverForx is portrayed as an unregulated investment firm, meaning that it is not subject to oversight or supervision by any financial regulatory authority. This lack of regulation can have significant implications for investors and the financial markets.

Market Instruments

InverForx advertises that it invests in the largest market in the world where all types of assets are traded, including currencies, stocks, derivatives, etc.

Currencies: InverForx provides investment opportunities in the foreign exchange market, where investors can trade different currencies. Currency trading allows investors to speculate on the fluctuations in exchange rates between different currencies. This market is known for its high liquidity and potential for profit.

Stocks: InverForx offers investments in stocks, which represent ownership in publicly traded companies. Investors can buy and sell shares of these companies to potentially benefit from their growth and profitability. Stock investments can provide dividends and capital appreciation, depending on the performance of the underlying companies.

Derivatives: InverForx also deals in derivatives, which are financial contracts that derive their value from an underlying asset. Derivatives include options, futures, and swaps, among others. These instruments allow investors to speculate on the price movements of assets without directly owning them. Derivatives can offer opportunities for hedging, leveraging, and risk management.

Other Assets: InverForx may provide investment options in various other assets such as commodities, bonds, and indices. Commodities can include precious metals, energy resources, agricultural products, and more. Bonds represent debt instruments issued by governments or corporations, while indices track the performance of a group of stocks or other assets.

How to Open an Account?

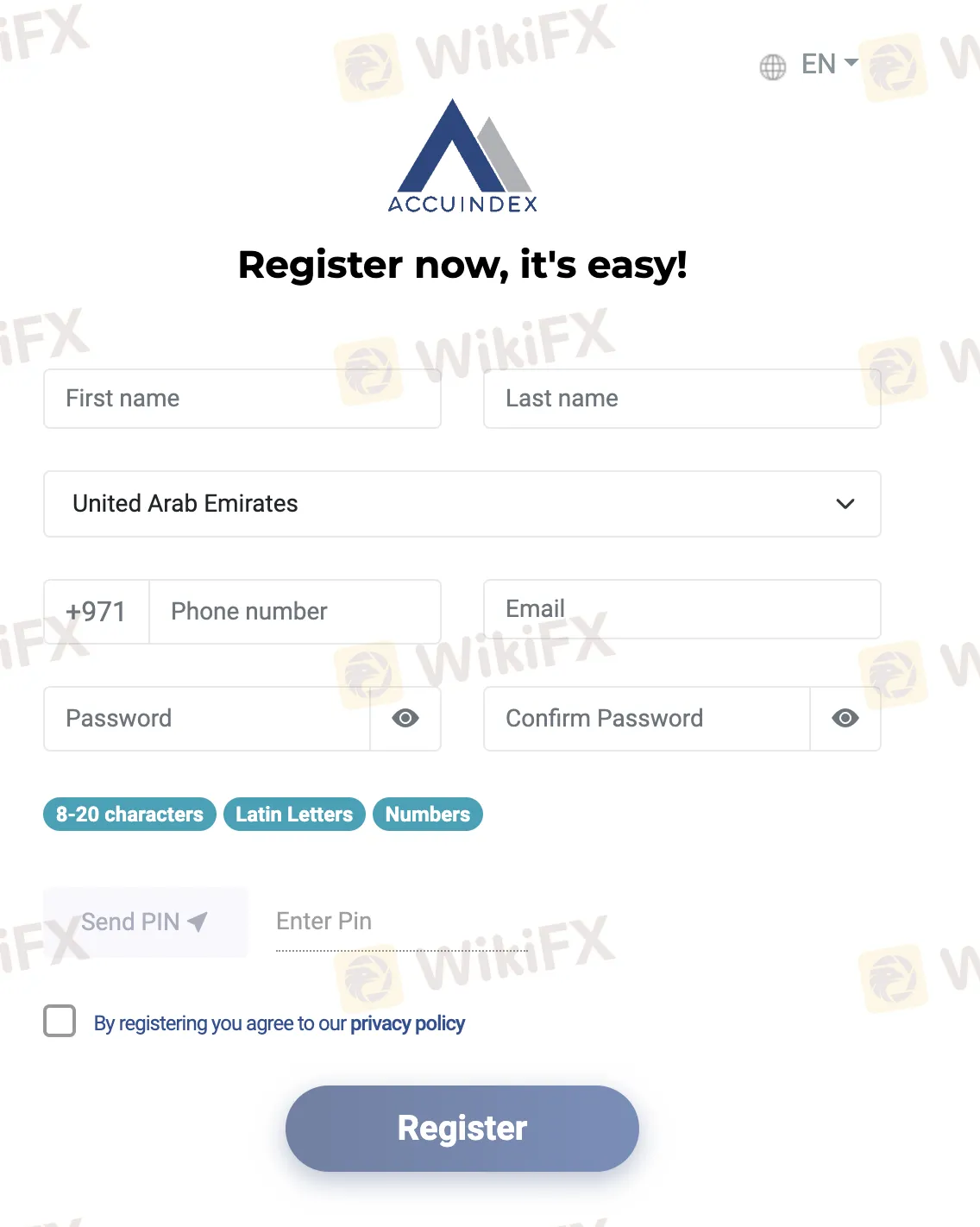

To open an account with AccuIndex, follow these steps:

Visit the AccuIndex website and click on the “Start Trading” button or “Try Free Demo” if you want to practice with a demo account.

2. On the registration page, provide your first name, last name, country (in this case, United Arab Emirates), phone number, email address, and choose a password. Make sure the password is between 8-20 characters and includes a combination of Latin letters and numbers.

3. Confirm your password to ensure accuracy.

4. Create a PIN for added measures.

5. Review the information you entered to ensure its accuracy.

6. Complete the registration process by clicking on the appropriate button or submitting the form.

Once you have successfully registered, you will receive further instructions on how to proceed with your account, including any additional verification steps that may be required.

Leverage

AccuIndex offers leverage of up to 1:400 for all its trading account types, including the Standard, Pro, and Raw accounts. Leverage allows traders to control larger positions in the market with a smaller initial investment. However, it's important for traders to understand the risks associated with leverage and to use it responsibly, considering their risk tolerance and employing proper risk management strategies.

Spreads & Commissions

AccuIndex offers different account types with varying spreads and commissions. The Standard account has a spread starting from 1.4 pips and no commission charges, while the Pro account offers a lower spread starting from 0.8 pips with no commissions. The Raw account provides very low spreads starting from 0.0 pips but charges a commission of $2.5 per side. It's important to consider these factors when choosing an account type with AccuIndex.

AccuIndex offers multiple methods for depositing and withdrawing funds. The available options include bank wire transfer, credit/debit cards, Neteller, and Skrill. However, it is important to note that the exact commissions or charges imposed by AccuIndex for these transactions are not specified in the provided information. While no fees are charged by AccuIndex for the mentioned methods, there might be charges applied by third-party payment processors.

For deposits, AccuIndex supports various payment methods. CASHU, NETELLER®, Skrill, VISA, bitpay (crypto), Perfect Money, and ThunderX Pay are all accepted. These methods provide instant deposit processing times, allowing investors to quickly fund their accounts. The supported currencies for deposits include USD, AED, and EUR.

When it comes to withdrawals, AccuIndex offers a range of payment methods as well. The supported methods include wire transfer, NETELLER®, Skrill, CASHU, PAY YOUR WAY, and Perfect Money. Withdrawals are subject to remitting charges imposed by the respective payment methods, and the exact charges are not specified in the provided information. The processing time for withdrawals varies depending on the method used. Wire transfer withdrawals typically take 2 to 5 working days, while withdrawals through NETELLER®, Skrill, CASHU, PAY YOUR WAY, and Perfect Money are usually processed on the same day.

| Pros | Cons |

| Instant deposit processing | Unclear information about transaction charges |

| Multiple payment methods available | Lack of transparency regarding commissions |

| Same-day processing for certain withdrawals | Charges imposed by third-party payment processors |

| Support for various currencies |

Trading Platform

AccuIndex offers multiple trading platforms to cater to the diverse needs of traders. These platforms include MT5 Desktop, MT4 Desktop, MT5 Mobile, MT4 Mobile, and Web Trader.

MT5 Desktop:

MT5 is a widely recognized and powerful trading tool used by traders worldwide. AccuIndex provides the AccuIndex MT5 Desktop platform for both Windows and iOS operating systems. Traders can download this platform for free and take advantage of its features when trading with an AccuIndex MT5 Trading account.

MT4 Desktop:

Similar to MT5, MT4 is also highly regarded in the trading industry. AccuIndex offers the AccuIndex MT4 Desktop platform for Windows operating system. Traders can download this platform for free and utilize its features in conjunction with an AccuIndex MT4 Trading account. The platform caters to the needs of both experienced and novice traders, providing access to pre-existing trading strategies and customizable options.

MT5 Mobile:

The MT5 Mobile platform is designed for traders who prefer trading on the go. AccuIndex provides the AccuIndex MT5 Mobile platform for both Windows and iOS devices. Traders can download the platform for free and enjoy its benefits when connected to an AccuIndex MT5 Trading account.

MT4 Mobile:

AccuIndex also offers the MT4 Mobile platform, allowing traders to access their trading accounts using their mobile devices. The AccuIndex MT4 Mobile platform is available for both Windows and iOS devices. Traders can download the platform for free and utilize its features along with an AccuIndex MT4 Trading account.

Web Trader:

AccuIndex provides a web-based trading platform known as Web Trader. This platform offers traders the convenience of accessing their trading accounts through a web browser without requiring any downloads or installations.

Pros and Cons

| Pros | Cons |

| Widely recognized tools | Limited platform availability (MT5 Desktop is not available for iOS) |

| User-friendly functionality | Lack of advanced features for expert traders |

| Availability of trading strategies | Limited range of supported technical indicators |

| Customizable options | Possible stability issues during high market volatility |

| Mobile trading convenience | Limited charting capabilities on mobile platforms |

| Accessible web-based platform | Limited availability of educational resources |

Investment Strategies

Inverforx Promissory Note: The Inverforx Promissory Note is a strategy that offers investors the opportunity to earn returns by investing in top-level international companies. Investors can choose the term that suits them best, with options ranging from 28 to 360 days. Returns can be received on a monthly basis or capitalized to increase profits. The strategy aims to provide investments with returns higher than CETES (Mexican Treasury Certificates) and inflation.

Promissory Note Plus: Promissory Note Plus is an annual investment strategy that promises higher returns. In this strategy, InverForx invests the money in top-level international companies, offering a special interest rate of 20%. Investors can withdraw their interest on a monthly basis or capitalize it for higher profits. The minimum investment amount for this strategy is $700,000 pesos.

Smart Investment Inverforx: The Smart Investment Inverforx strategy aims to provide investors with the opportunity to earn extraordinary returns. The company invests the money in the international market, particularly in raw materials or commodities. This strategy offers short, medium, and long-term investment options with returns well above traditional instruments.

Pros and Cons

| Pros | Cons |

| Clear knowledge of returns from the beginning | Lack of regulatory oversight |

| Potential for higher returns compared to traditional investments | Limited transparency and disclosure |

| Minimum investment amounts starting from affordable levels | Higher risk due to unregulated operations |

| Option to withdraw earnings or capitalize for compound profits | Limited recourse for fraudulent practices or losses |

| Legal support for 100% of invested capital | Potential lack of diversification |

Educational Resources

The InverForx Blog provides a range of educational resources on various topics related to personal finance, technology in the economy, financial inclusion, successful Mexican investors, and North American leaders summit. Each blog post offers valuable insights and information to readers seeking knowledge in these areas.

Pros and Cons

| Pros of the Educational Resources System | Cons of the Educational Resources System |

| Wide range of topics | Inconsistent frequency of blog posts |

| Provides valuable insights and information | Lack of interactive features for reader engagement |

| Helps readers understand financial concepts and strategies | No mention of expert contributors or credentials |

| Offers inspiration and guidance for personal finance and investment | Absence of a search function for easy navigation |

Customer Support

InverForx provides multiple channels for customer support. They can be reached through telephone at 55 59 41 63 75 or via email at contacto@inverforx.com.mx. Additionally, customers can connect with the company through various social media platforms, including Twitter, Facebook, Instagram, YouTube, and LinkedIn. This allows for easy access and communication with the broker.

The company also provides its physical address, which is Avenida Nuevo León 161 Piso 4, Oficina 401, Col Hipódromo Condesa, CP 06100, Alcaldía Cuauhtémoc, CDMX. This address serves as a point of contact for customers who may prefer to visit the office in person or for any correspondence related to fiscal matters.

Conclusion

InverForx operates as a fictional investment company with some notable advantages and disadvantages. On one hand, they offer a diverse range of market instruments, educational resources, and multiple customer support channels for easy accessibility. However, it is important to consider the lack of regulation and oversight associated with InverForx, which may raise concerns about investor protection and transparency. Additionally, the inconsistency in blog post frequency and the absence of interactive features may impact the overall user experience. It is crucial for potential investors to carefully evaluate these factors and exercise caution before engaging with InverForx or any similar entity.

FAQs

Q: Is InverForx a legitimate investment company?

A: InverForx is a fictional financial investment company and does not represent any real-world entity.

Q: What market instruments does InverForx offer?

A: InverForx offers a range of market instruments, including currencies, stocks, derivatives, and other assets.

Q: What are some investment strategies offered by InverForx?

A: InverForx offers investment strategies such as the Inverforx Promissory Note, Promissory Note Plus, and Smart Investment Inverforx.

Q: What educational resources does InverForx provide?

A: InverForx offers an educational blog covering topics related to personal finance, technology, financial inclusion, successful Mexican investors, and North American leaders summit.

Q: How can I contact InverForx for customer support?

A: You can reach InverForx's customer support via telephone at 55 59 41 63 75 or email at contacto@inverforx.com.mx. They can also be contacted through social media platforms like Twitter, Facebook, Instagram, YouTube, and LinkedIn.

Q: What is InverForx's physical address?

A: InverForx's physical address is Avenida Nuevo León 161 Piso 4, Oficina 401, Col Hipódromo Condesa, CP 06100, Alcaldía Cuauhtémoc, CDMX.