Company Summary

| Quick E*TRADE Review Summary | |

| Founded Year | 1982 |

| Registered Country/Area | United States |

| Regulation | NFA (Suspicious clone) |

| Tradable Assets | Stocks, ETFs, mutual funds, options, bonds, futures |

| Min Deposit | $0 |

| Trading Platforms | Power E*TRADE, E*TRADE |

| Customer Support | Tel: 800-387-2331 |

E*TRADE Overview

E*TRADE is a US-based online investment platform that offers a wide range of tools for traders and investors. Founded in 1982 and currently have no valid regulations. E*TRADE provides access to a diverse range of market instruments, including stocks, ETFs, mutual funds, options, bonds, and futures. At E*TRADE, Traders can choose trading platforms between Power E*TRADE and E*TRADE.

Pros & Cons

| Pros | Cons |

| Wide range of trading instruments | Suspicious clone NFA license |

| Multiple account types to suit different needs | Higher futures contract fees for traders with fewer than 30 trades per quarter |

| Power E*TRADE trading platform with intuitive charting tools and advanced risk analysis | Only phone support |

| Prebuilt portfolios designed by investment professionals | |

| Commission-free trading for over 100 ETFs | |

| Free educational resources to help traders improve their knowledge and skills |

Is E*TRADE Legit or a Scam?

E*TRADE does not currently have any valid regulation, which may present potential risks for traders. The NFA regulation claimed by the broker (license number: 0320906) is suspected to be a clone, further adding to the risk for traders. It is important for traders to exercise caution and thoroughly research the broker before investing with them. Choosing a regulated broker can greatly reduce the risks associated with trading.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License No. |

| NFA | Suspicious Clone | E TRADE Securities LLC | Common Financial Service License | 0320906 |

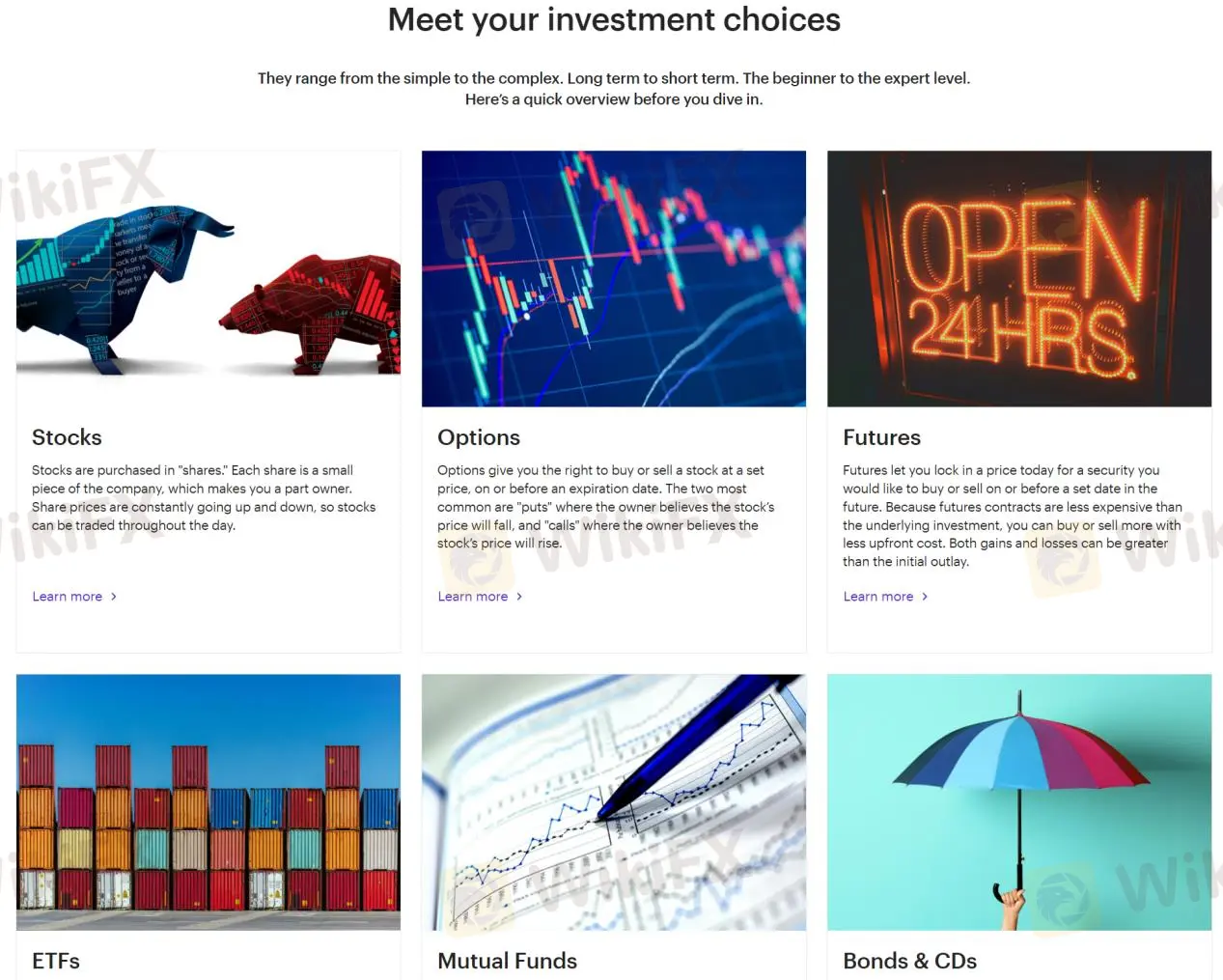

Market Instruments

E*TRADE offers trading in stocks, ETFs, mutual funds, options, bonds, and futures.

| Trading Assets | Available |

| Stocks | ✔ |

| ETFs | ✔ |

| Mutual funds | ✔ |

| Options | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

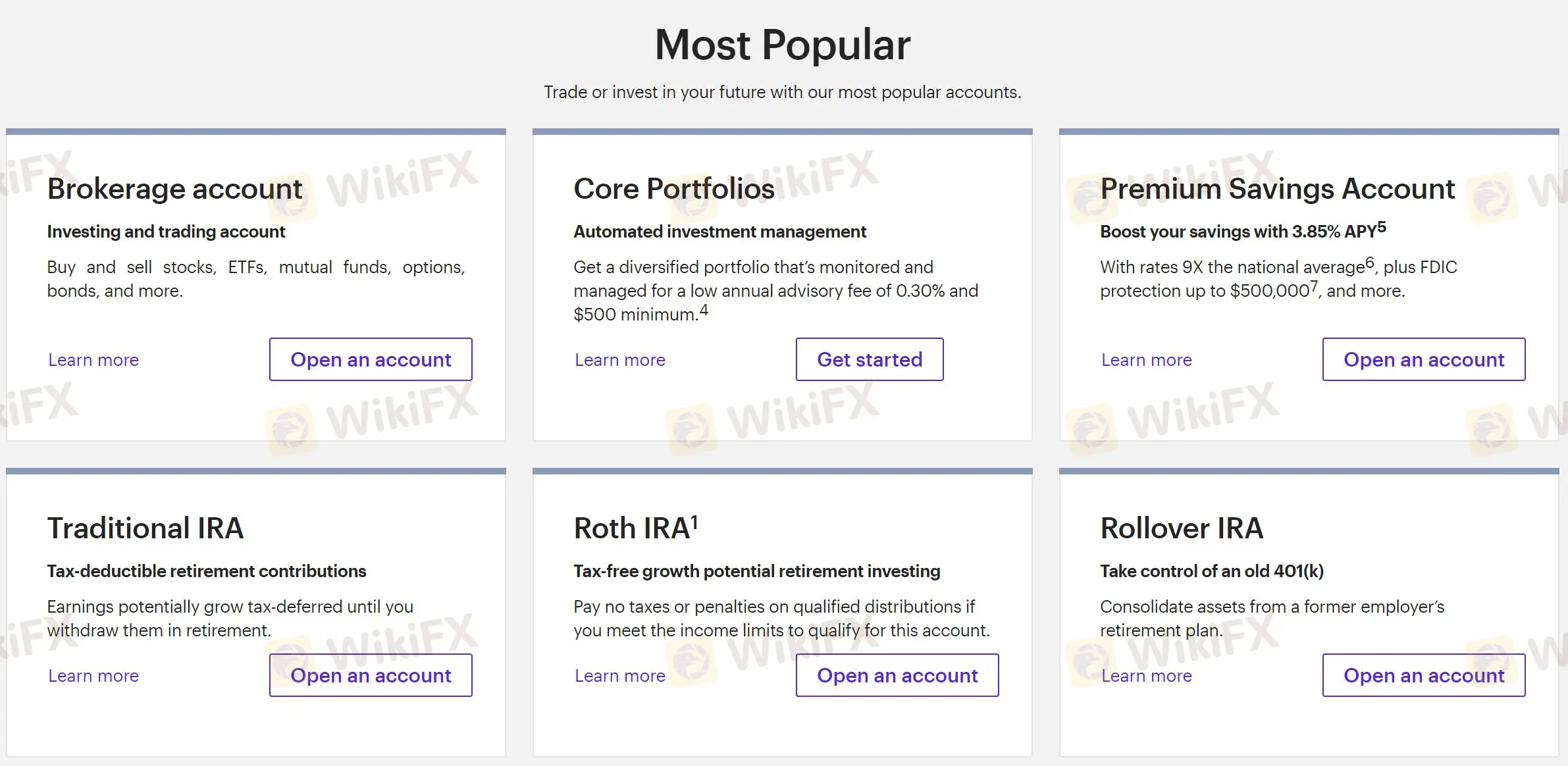

Account Types

E*TRADE offers several different types of accounts to suit the needs of different traders and investors:

- Brokerage accounts: These are standard accounts for buying and selling securities, including stocks, bonds, options, and mutual funds.

- Retirement accounts:E*TRADE offers several types of retirement accounts, including traditional and Roth IRAs, as well as SEP and SIMPLE plans for self-employed individuals.

- Core Portfolios: These are automated investment portfolios managed by E*TRADE's robo-advisor technology. They are designed for investors looking for a hands-off approach to investing.

- Managed Portfolios: These are personalized investment portfolios managed by professional portfolio managers. They are designed for investors who want a more customized approach to investing.

- Small Business accounts:E*TRADE offers several options for small business owners, including retirement plans and business brokerage accounts.

Bank accounts:E*TRADE also offers a range of banking products, including checking accounts, savings accounts, and mortgage loans.

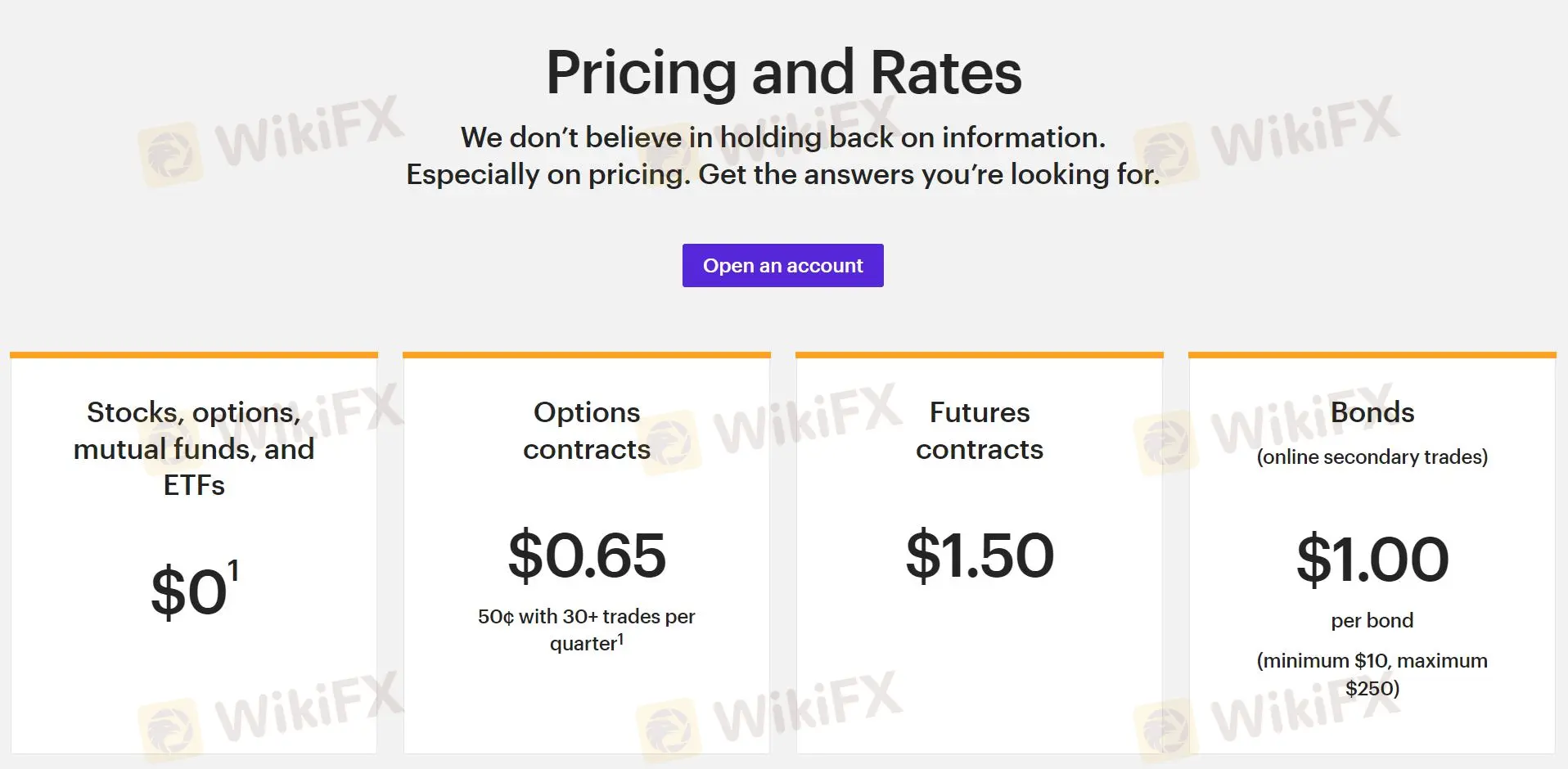

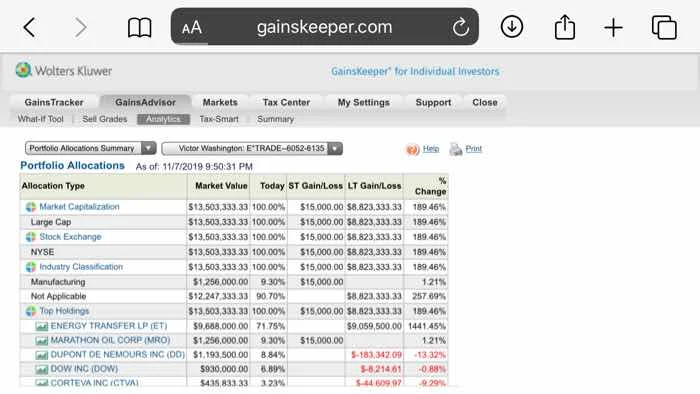

Fees

Traders with 0 to 29 trades per quarter will pay $0 for stock and options trades and $0.65 for options contracts. For traders with 30 or more trades per quarter, the futures contract fee is $0.50. Online secondary trading is subject to a fee of $1 per bond (minimum $10, maximum $250). Commission for trading futures contracts is $1.50 per contract and $19.99 for shared funds.

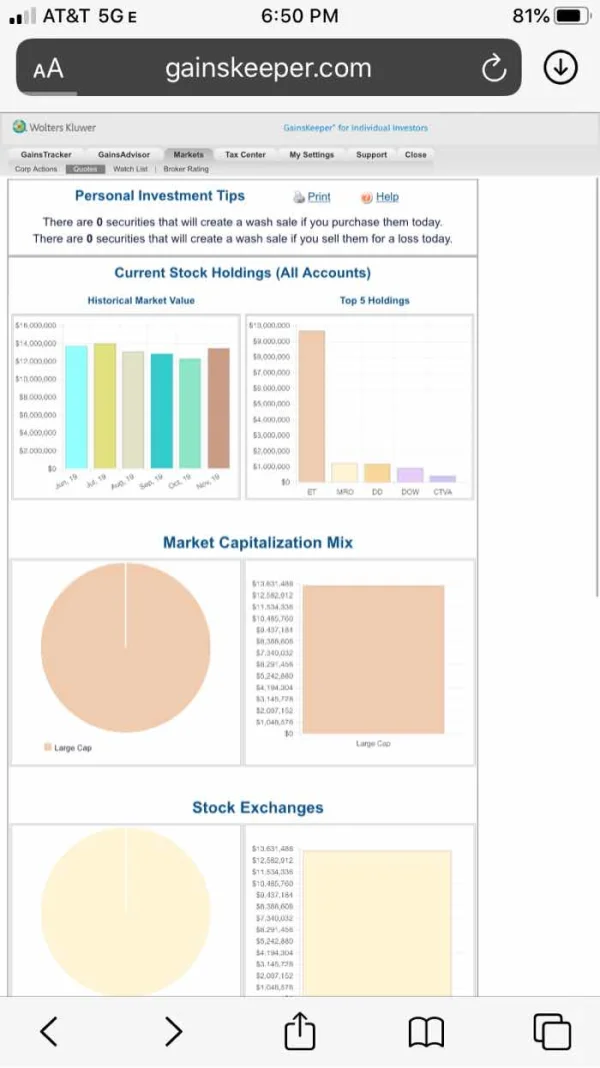

Trading Platform

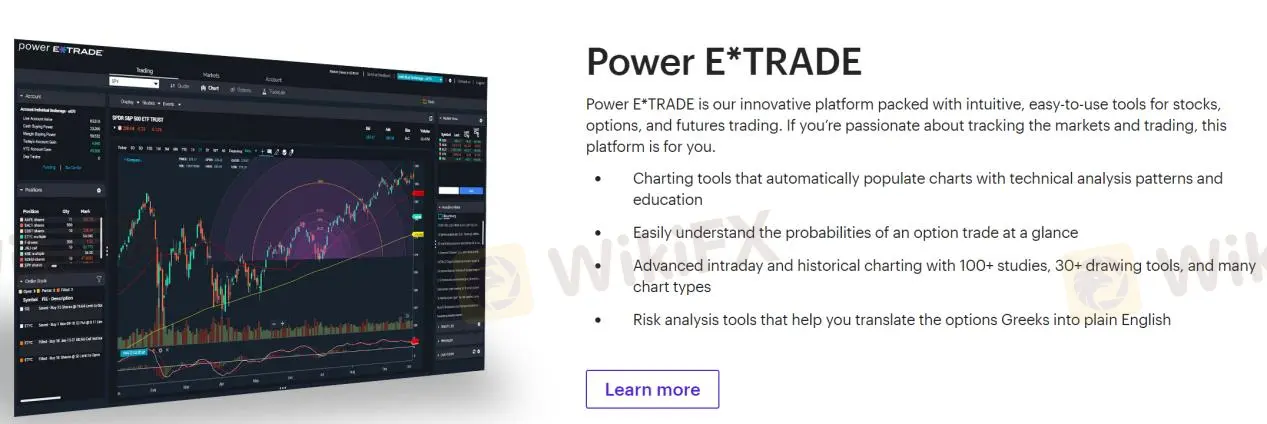

E*TRADE offers traders the Power E*TRADE trading platform, which can be used to trade stocks, options, and futures with ease of use and is certainly the most suitable trading platform if traders are keen to track markets and trading movements. Investors can also use E*TRADE, as well as the mobile version of the trading platform to trade.

Power E*TRADEis an innovative platform that features intuitive and easy-to-use tools for stocks, options, and futures trading. Here are its main features:

1. Charting tools that automatically populate charts with technical analysis patterns and education, making it easier for traders to analyze trends.

2. Traders can easily understand the probabilities of an option trade at a glance.

3. The platform offers historical charting with over 100 studies, 30+ drawing tools, and multiple chart types, providing traders with a wealth of data to analyze.

4. Risk analysis tools are available that help translate the options Greeks into plain English, enabling traders to assess potential risks and rewards.

Overall, Power E*TRADE is an ideal platform for traders passionate about tracking markets and trading, with a wide range of features and tools to suit their needs.

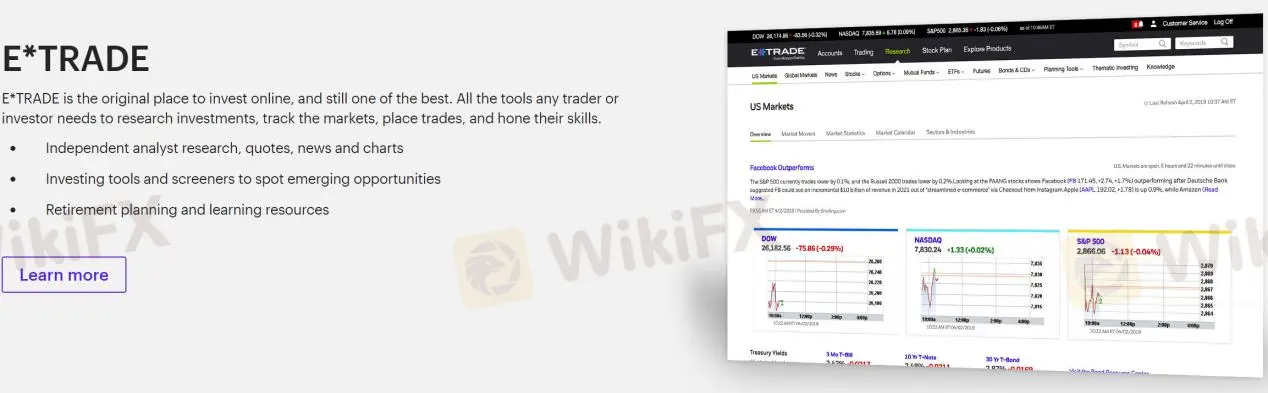

E*TRADE is a well-established online investment platform that offers a wide range of tools for traders and investors. Here are some key features of the platform:

- Independent analyst research, quotes, news, and charts, providing traders with a wealth of information.

- Investing tools and screeners to spot emerging opportunities, helping traders to identify potential investment opportunities.

- Retirement planning and learning resources to help traders plan for the long-term and improve their investing skills.

Overall, E*TRADE is an excellent platform that offers a broad set of features and tools to help traders and investors achieve their financial goals.

Conclusion

In conclusion, E*TRADE is a well-established online investment platform that provides traders and investors with a wide range of trading instruments, account types, trading platforms, and educational resources.

However, it is important to note that E*TRADEcurrently has no valid regulations, which may present potential risks for traders.

Therefore, traders should exercise caution and thoroughly research the broker before investing with them. Despite this, E*TRADE's Power E*TRADE trading platform and prebuilt portfolios make it a viable platform for those looking to invest in the financial markets.

FAQs

Is E*TRADE a regulated broker?

No, E*TRADE currently has no valid regulations.

What type of account can I open with E*TRADE?

E*TRADE offers a variety of account types to meet different needs, including brokerage accounts, retirement accounts, managed portfolios, and small business accounts.

Is there a minimum deposit requirement to open an account with E*TRADE?

No, E*TRADE does not have a minimum deposit requirement for their brokerage accounts.

What trading platforms does E*TRADE offer?

E*TRADE offers two different trading platforms, Power E*TRADE and E*TRADE, both of which provide advanced charting tools and other features to help traders.

Are there any fees associated with using E*TRADE?

Yes, E*TRADE charges various fees for different services, including commissions on trades, account maintenance fees, and other charges.

FX4079826056

United States

I had an E*TRADE Capital Market and we Etrade Clearing accounts I didn't like the services the provider was giving and ask to transfer out all my accounts. I was sent a letter that stated until all maturity and interest are paid back too the brokerage they half before any transfer are to be made they was 2004 and still refuse to settle my transfer instead they closed the E*TRADE capital market and when I mentioned my accounts were told they didn't exist Eight billion they owe since 2004

Exposure

awakemime

Thailand

The system offers a variety of tools and resources in multiple formats, but the drawback is that international currency exchange transactions take too long.

Neutral

David Wilson

United Kingdom

I experienced a floating loss of approximately $244.55 on my EURAUD positions, which were unexpectedly closed by E*TRADE several days ago. It appears that they may be intervening in traders' accounts. I have submitted a ticket to them and will provide an update on this situation once I receive a response.

Neutral

铮 福

New Zealand

This platform helped me flourish my trading skills. The advice provided by the personal account manager is remarkable and useful. The profits I made here are shocking. A wonderful site!

Positive

FX1240943476

United States

please don't trade in e trade. It is totally a scam forex broker! In the forex trading industry, an unregulated forex broker is almost a synonym for scammers. please stay alert!

Neutral

FX1153297136

Malaysia

I really don’t recommend you to trade with this company. We all know that the NFA regulation in the United States is very powerful, but we must see whether it is Li Gui or Li Kui... The company’s NFA license is not a real license, so keep your eyes open!

Neutral

不穿虾皮的皮皮虾大王

Malaysia

The company's website does not provide Chinese services, so I tend not to deal with it. Later I found out that it has no regulatory license at all, which is too dangerous, and I would not choose this company. The safety of funds is the most important thing in foreign exchange trading, not one of them.

Neutral