Company Summary

| AvaFutures Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Ireland |

| Regulation | Not Regulated |

| Market Instruments | Indices, currencies, energy, cryptocurrencies, metals |

| Demo Account | Available |

| Leverage | Up to 1:300 |

| Trading Platform | MT5 |

| Customer Support | Italy: +393512884883United Kingdom: 447466445460France: +33780725768Spain: +34960743106UAE: +97180003110007 |

| 24/7 Live chat | |

AvaFutures Information

AvaFutures, established in 2022, is an online trading platform that offers trading on MT5 with high leverage up to 1:300 across various instruments like indices, currencies, crypto, and metals. While providing different contracts and no deposit/withdrawal fees, the platform has a status of “Suspicious Clone” across multiple regulatory bodies.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

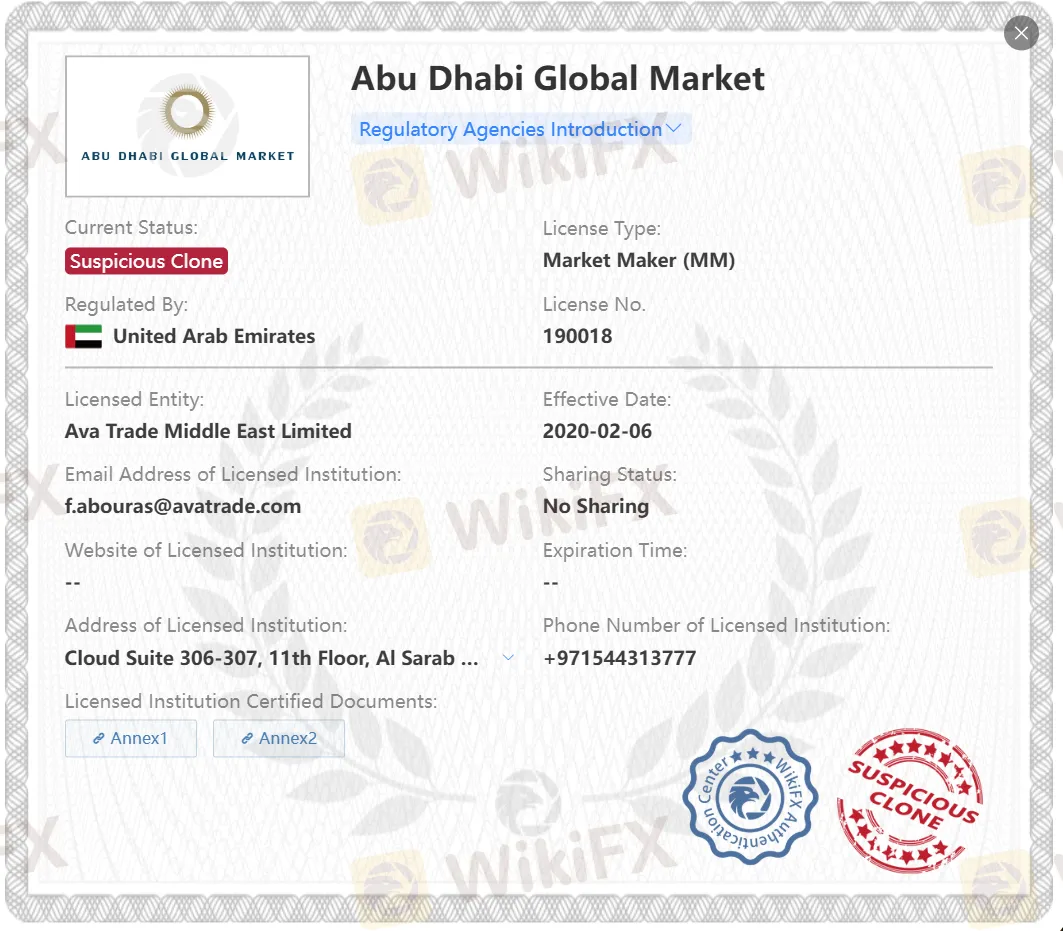

Is AvaFutures Legit?

AvaFutures is currently flagged as a Suspicious Clone across multiple regulatory bodies, including Australia (ASIC), Japan (FSA), UAE (ADGM), Ireland (Central Bank of Ireland), and the Virgin Islands. This platform is likely a potentially fraudulent imitation of regulated brokers in those jurisdictions.

| Regulatory Status | Suspicious Clone | Suspicious Clone | Suspicious Clone | Suspicious Clone | Suspicious Clone |

| Regulated by | Australia | Japan | United Arab Emirates | Ireland | The Virgin Islands |

| Licensed Institution | The Australian Securities and Investments Commission (ASIC) | The Financial Services Agency (FSA) | Abu Dhabi Global Market (ADGM) | Central Bank of Ireland | The enactment of the Financial Services Commission Act in December |

| Licensed Type | Market Maker (MM) | Retail Forex License | Market Maker (MM) | Retail Forex License | Retail Forex License |

| Licensed Number | 000406684 | 関東財務局長(金商)第1662号 | 190018 | C53877 | SIBA/L/13/1049 |

What Can I Trade on AvaFutures?

AvaFutures provides clients with many different tradable instruments, mainly including indices, currencies, energy, cryptocurrencies, metals, etc. Traders can also have transactions related to interest rates and agriculture on the platform.

| Tradable Instruments | Supported |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Energy | ✔ |

| Indices | ✔ |

| Bonds | ❌ |

| Shares | ❌ |

| Futures | ❌ |

Contract Type

AvaFutures offers three types of contracts. Micro contracts suit beginners with less capital and risk appetite, Mini contracts offer a balance, and Standard contracts are for experienced, well-funded traders seeking maximum exposure despite higher risk.

| Contract Type | Detailed Information | Target Audience | Risk/Capital Requirement | Market Exposure/Potential Returns |

| Micro Contracts | Lower cost, lower margin, less risk, easier entry for beginners. | Beginners, Traders with limited capital | Lower | Lower |

| Mini Contracts | Medium size and capital, balance between Micro and Standard. | Traders seeking moderate exposure and risk | Moderate | Moderate |

| Standard Contracts | Largest, highest exposure/return, highest risk, for experienced traders with sufficient capital | Experienced traders with sufficient capital | Higher | Higher |

Leverage

AvaFutures offers high leverage up to 1:300.

AvaFutures Fees

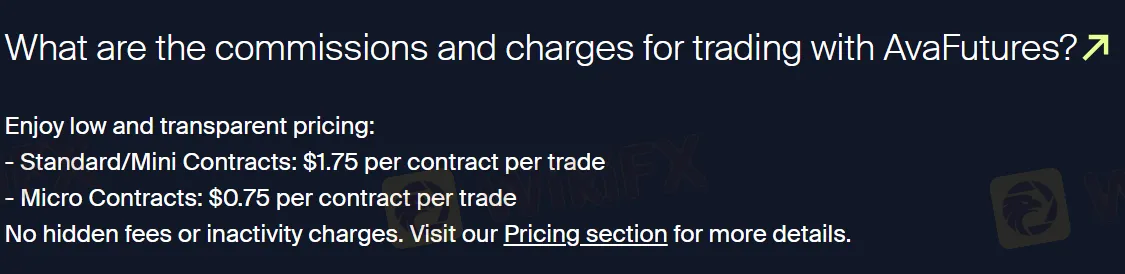

On AvaFutures, different contract charges different commissions:

| Contract Type | Commission per Trade |

| Standard/Mini Contracts | $1.75 |

| Micro Contracts | $0.75 |

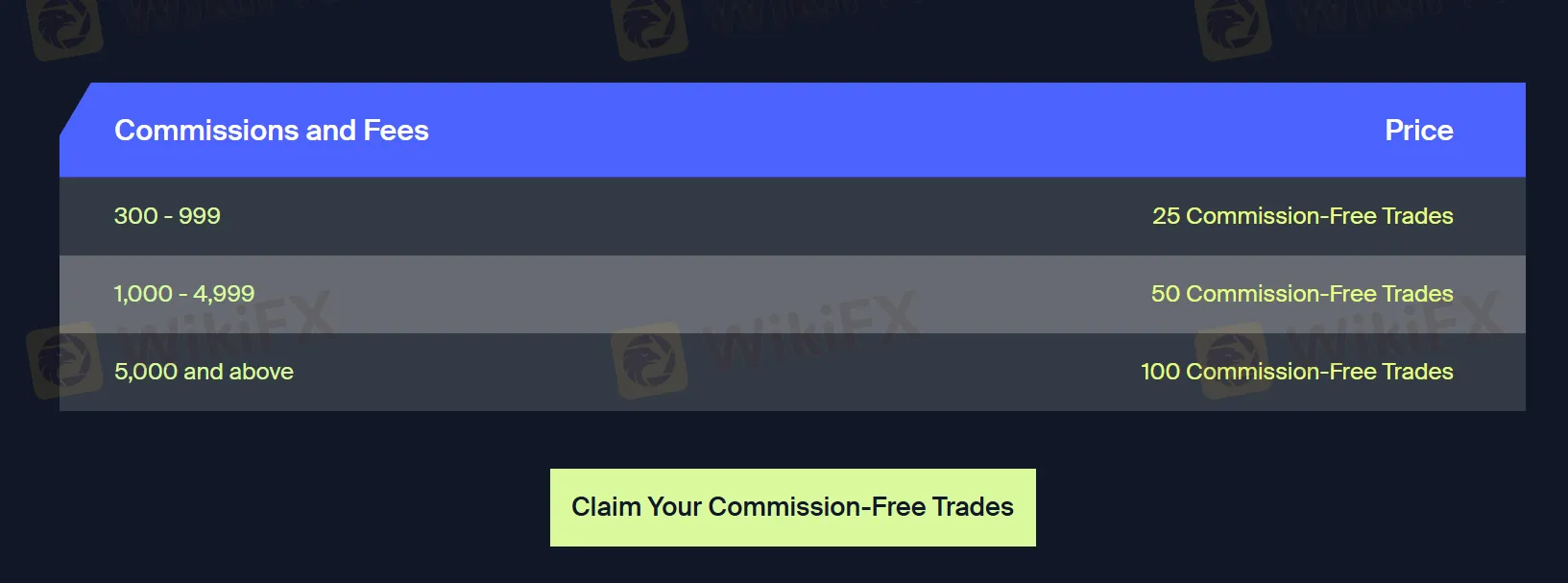

Clients with balances between 300-999 get 25 commission-free trades, those with 1,000-4,999 receive 50, and accounts holding 5,000 or more are entitled to 100 commission-free trades.

| Commissions and Fees | Price |

| 300 - 999 | 25 Commission-Free Trades |

| 1,000 - 4,999 | 50 Commission-Free Trades |

| 5,000 and above | 100 Commission-Free Trades |

Non-Trading Fees

| Deposit Fee | Zero |

| Withdrawal Fee | Zero |

| Inactivity Fee | Zero |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Web, and App Mobile | Investors of all experience levels |

Deposit and Withdrawal

AvaFutures charges no fees for any deposits and withdrawals. However, the minimum deposit is not mentioned on their website.