Company Summary

| RGL Review Summary | |

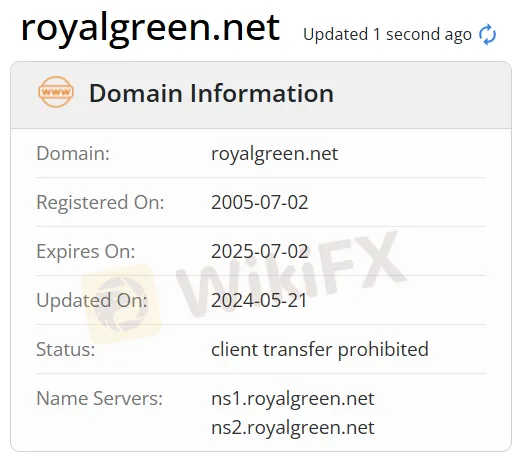

| Founded | 2005 |

| Registered Country/Region | Bangladesh |

| Regulation | No regulation |

| Services | Private, Public Cloud, Virtual Private Server, IaaS, PaaS, SaaS, Firewall as a Service, Router as a Service, DDoS Protection as a Service (F5 Solution), Backup as a Service, DR as a Service, LB as a Service, Elastic, Compute as a Service, Bare Metal as a Service, Data Security- Embedded, Data Encryption, Containers-as-a-Service, WAF as a Service- WAP (F5 Solution), Dedicated Internet Connectivity, Nationwide Data Connectivity, IP Telephony & IPPBX Solutions, Managed IT Services, Cloud Services & Solutions, Domain Registration & Web Hosting, Mail Service & Solutions, Software Solutions |

| Trading Platform | bKash |

| Customer Support | 24/7 support, contact form |

| Tel: +880 9603-111999; +88-09603-777777 | |

| Email: sales@royalgreen.net; support@pacecloud.com | |

| Address: Royal Green Ltd, 114 Motijheel C/A, Level-9,11,12,17,18 Dhaka-1000 | |

| Social media: Facebook, X, YouTube, LinkedIn | |

RGL Information

RGL is an unregulated Internet Service Provider, which was founded in Bangladesh in 2005. It offers products and services for Private, Public Cloud, Virtual Private Server, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Firewall as a Service, Router as a Service, DDoS Protection as a Service (F5 Solution), Backup as a Service, DR as a Service, LB as a Service, Elastic, Compute as a Service, Bare Metal as a Service, Data Security- Embedded, Data Encryption, Containers-as-a-Service, WAF as a Service- WAP (F5 Solution), Dedicated Internet Connectivity, Nationwide Data Connectivity, IP Telephony & IPPBX Solutions, Managed IT Services, Cloud Services & Solutions, Domain Registration & Web Hosting, Mail Service & Solutions, Software Solutions.

Pros and Cons

| Pros | Cons |

| Long operation time | Inaccessible website (partful) |

| Various contact channels | Lack of regulation |

| Various services | Lack of transparency |

| Diverse payment options | Fees charged |

Is RGL Legit?

No. RGL currently has no valid regulations. Please be aware of the risk!

RGL Services

| Services | Supported |

| Private, Public Cloud | ✔ |

| Virtual Private Server | ✔ |

| Infrastructure as a Service (IaaS) | ✔ |

| Platform as a Service (PaaS) | ✔ |

| Software as a Service (SaaS) | ✔ |

| Firewall as a Service | ✔ |

| Router as a Service | ✔ |

| DDoS Protection as a Service (F5 Solution) | ✔ |

| Backup as a Service | ✔ |

| DR as a Service | ✔ |

| LB as a Service | ✔ |

| Elastic | ✔ |

| Compute as a Service | ✔ |

| Bare Metal as a Service | ✔ |

| Data Security- Embedded | ✔ |

| Data Encryption | ✔ |

| Containers-as-a-Service | ✔ |

| WAF as a Service- WAP (F5 Solution) | ✔ |

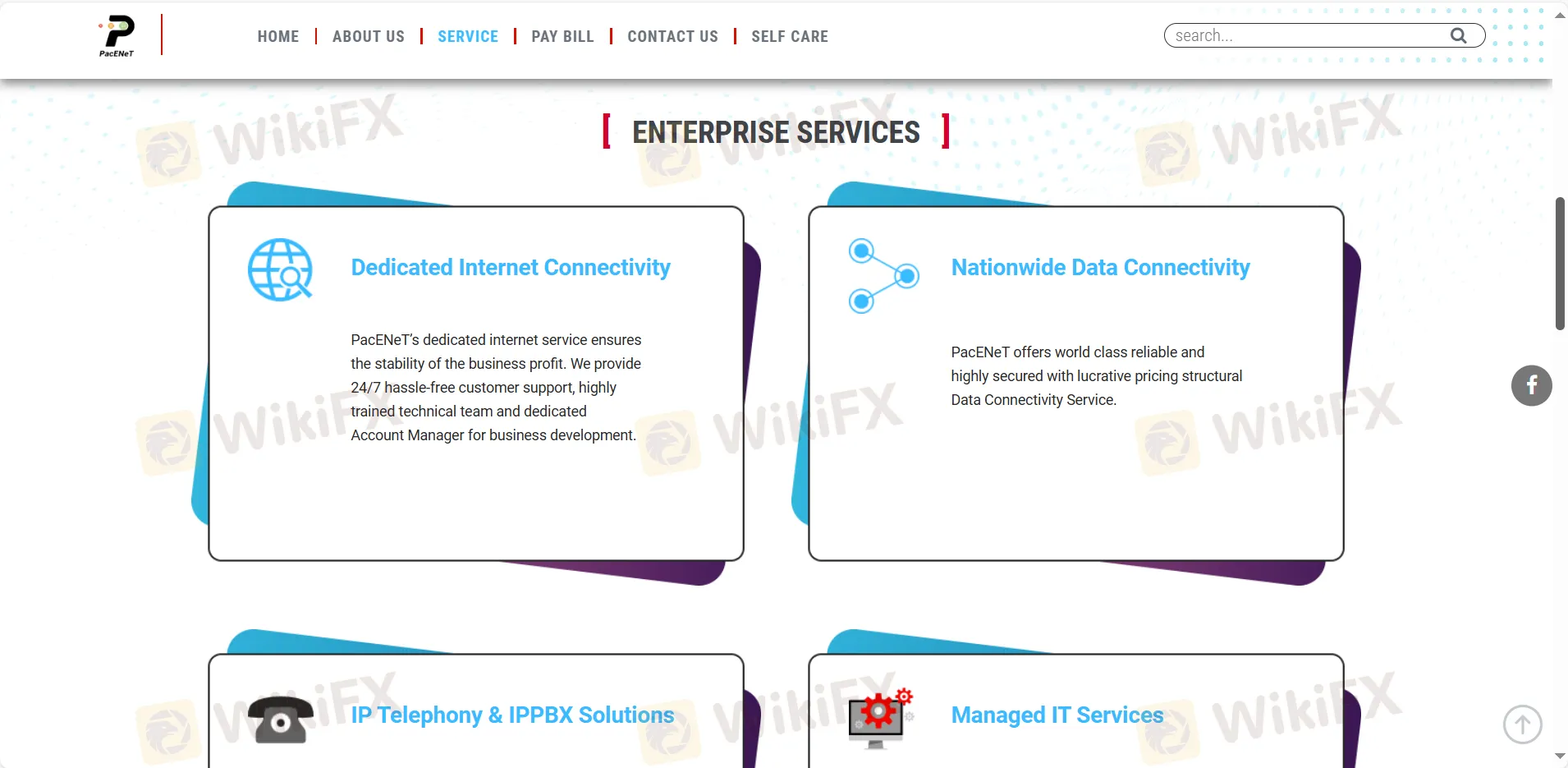

| Dedicated Internet Connectivity | ✔ |

| Nationwide Data Connectivity | ✔ |

| IP Telephony & IPPBX Solutions | ✔ |

| Managed IT Services | ✔ |

| Cloud Services & Solutions | ✔ |

| Domain Registration & Web Hosting | ✔ |

| Mail Service & Solutions | ✔ |

| Software Solutions | ✔ |

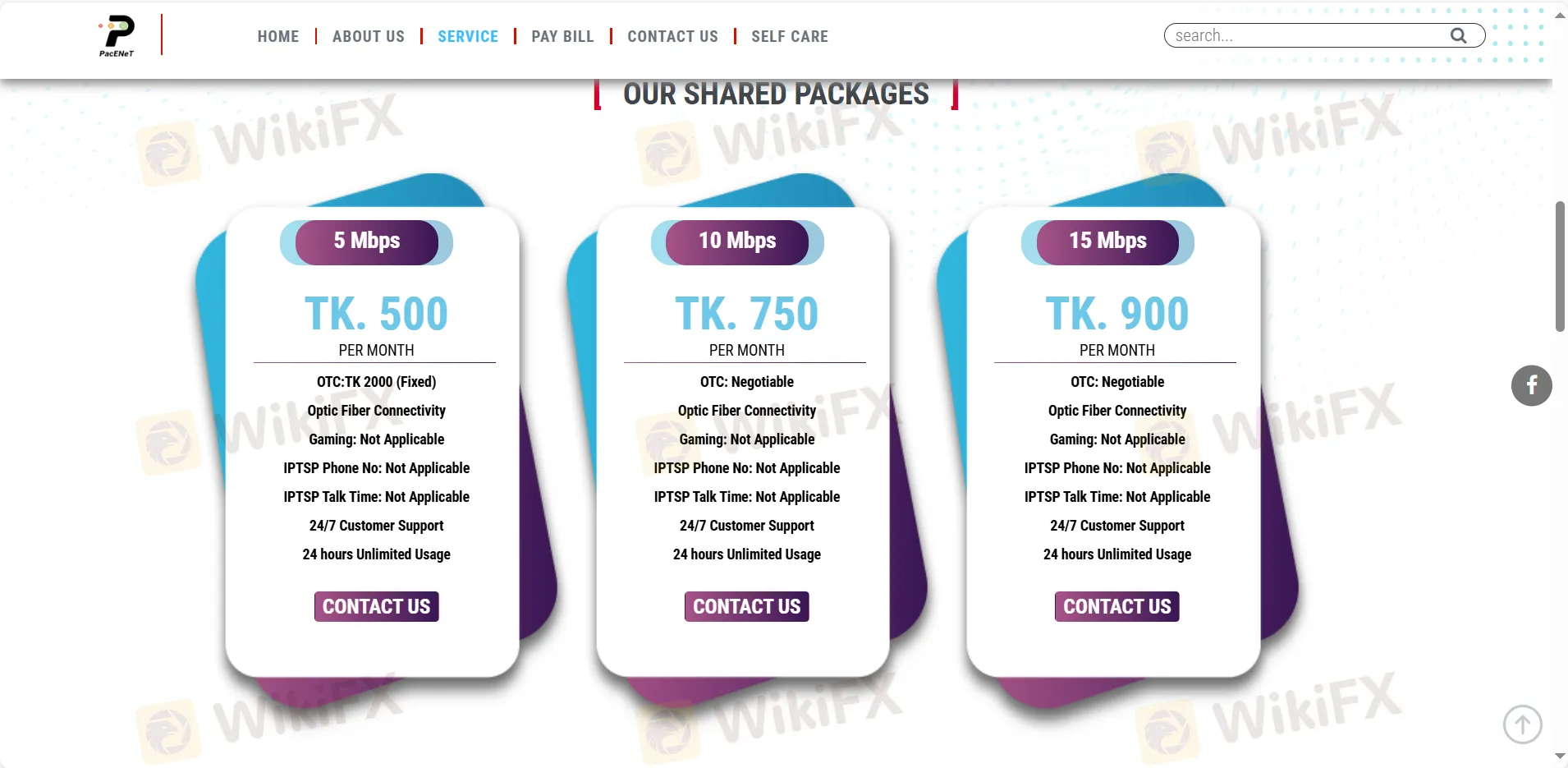

RGL Fees

| Type | Fees |

| 5 Mbps | TK. 500 per month |

| 10 Mbps | TK. 750 per month |

| 15 Mbps | TK. 900 per month |

| 20 Mbps | TK. 1050 per month |

| 30 Mbps | TK. 1550 per month |

| 40 Mbps | TK. 1950 per month |

| 50 Mbps | TK. 2450 per month |

| 75 Mbps | TK. 3400 per month |

| 100 Mbps | TK. 4500 per month |

Trading Platform

| Trading Platform | Supported | Available Devices |

| bKash app | ✔ | Mobile |

Deposit and Withdrawal

The Internet Service Provider accepts payments done via Master, Visa, UnionPay and so on. No minimum withdrawal amount defined and no fees or charges specified.