Company Summary

| Securities Japan Review Summary | |

| Founded | 1944 |

| Registered Country | Japan |

| Regulation | FSA |

| Products and Services | Domestic & foreign stocks, investment trusts, bonds, futures, options, insurance |

| Demo Account | / |

| Trading Platform | Online Trading |

| Minimum Deposit | / |

| Customer Support | Phone: 03-3668-3446 |

| Email: online@secjp.co.jp | |

Securities Japan Information

Japan's Financial Services Agency regulates and licenses Securities Japan, which was created in 1944. The organization sells a wide range of financial products, such as stocks, bonds, investment trusts, futures, options, and insurance. However, its fees can be rather high depending on the type of transaction.

Pros and Cons

| Pros | Cons |

| Long-established (since 1944) | Slightly higher fees for certain transaction types |

| Regulated by FSA | No MT4/5 |

| Wide range of products including insurance | Limited information about deposit and withdrawal |

Is Securities Japan Legit?

Yes, Securities Japan is a regulated. It holds a Retail Forex License issued by the Financial Services Agency of Japan, under license number 関東財務局長(金商)第170号.

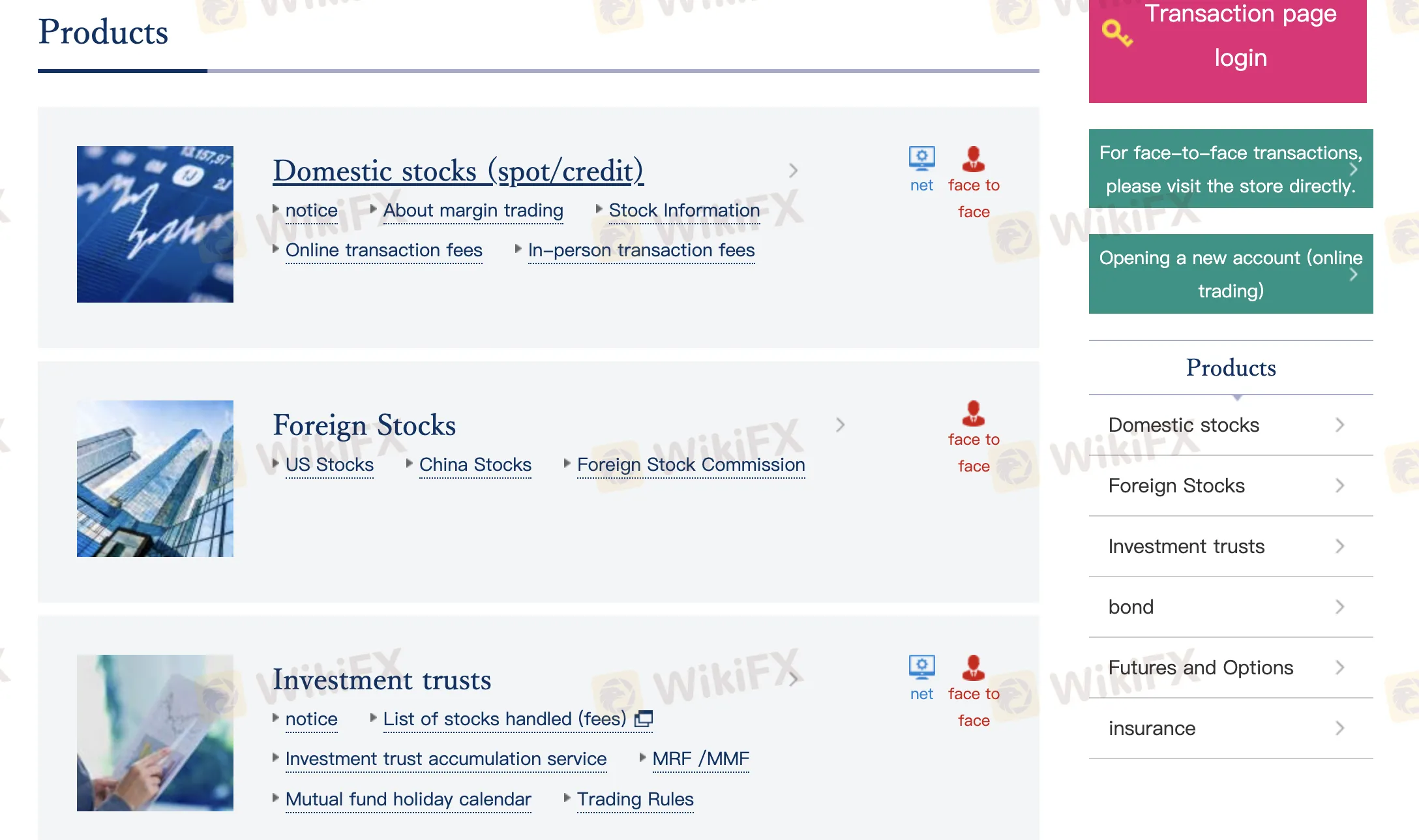

What Can I Trade on Securities Japan?

Securities Japan offers a broad range of financial products and services, covering both domestic and international markets. Its services include stocks, investment trusts, bonds, futures, options, and insurance.

| Trading Products | Supported |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Insurance | ✔ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| ETFs | × |

Securities Japan Fees

Securities Japans fees are generally moderate to slightly above average compared to industry standards, especially depending on whether you trade online, face-to-face, or by phone.

| Trading Fees | Amount |

| Online Spot Trading (<1 million yen) | 1,100 yen per transaction |

| Online Spot Trading (>1 million yen) | 1,650 yen per transaction |

| Online Margin Trading | 1,100 yen per transaction |

| Online Daily Flat Rate | 2,200 yen per 3 million yen daily volume (+22,000 yen if over 30 trades/day) |

| Phone Orders (<500,000 yen) | 2,750 yen |

| Phone Orders (500k–1 million yen) | 6,050 yen |

| Phone Orders (1–5 million yen) | 19,800 yen |

| Phone Orders (5–10 million yen) | 42,900 yen |

| Phone Orders (10–30 million yen) | 69,300 yen |

| Phone Orders (>30 million yen) | 132,000 yen |

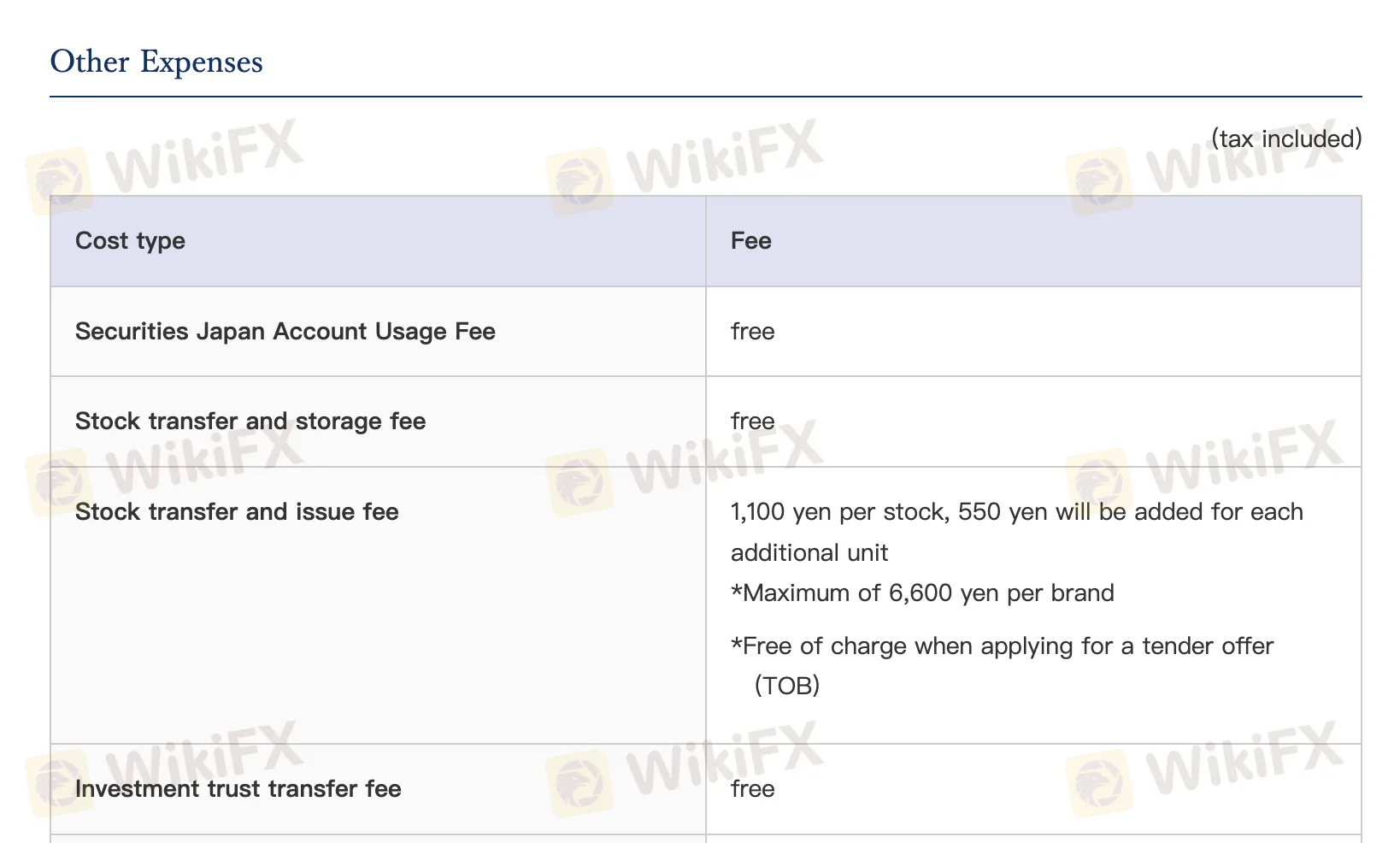

Non-Trading Fees

| Non-Trading Fees | Amount |

| Account Usage Fee | 0 |

| Stock Transfer/Storage Fee | 0 |

| Stock Transfer/Issue Fee | 1,100 yen + 550 yen per extra unit (max 6,600 yen) |

| Investment Trust Transfer Fee | 0 |

| Investment Trust Transfer/Withdrawal | 3,300 yen per stock |

| Government Bonds Transfer/Withdrawal | |

| Odd Lot Share Purchase Commission | Contract price × 1.5% + tax |

| Brokerage Fee for Odd Lot Purchase | 0 |

| Deposit Transfer Fee | Customer pays (no fee for instant deposit) |

| Withdrawal Transfer Fee | 0 |

| Customer Ledger Copy | 3,300 yen per session |

| Balance Certificate Issuance | 1,100 yen per session |

| Annual Transaction Report Reissue | 1,100 yen per session |

| Written Materials Request Fee | 550 yen per brand |

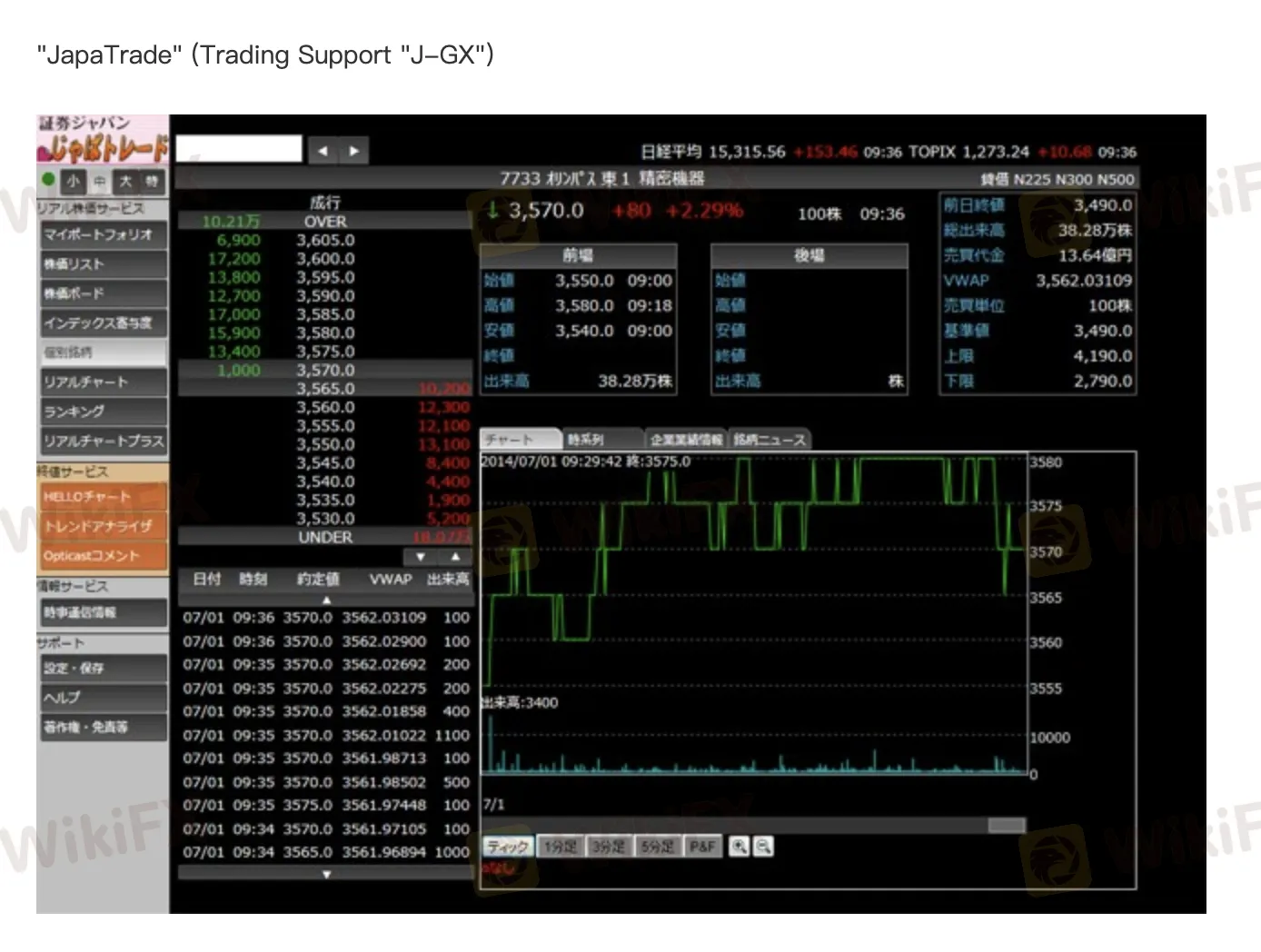

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Online Trading | ✔ | PC, Smartphone, Tablet | / |

| MetaTrader 4 | ✔ | / | Beinners |

| MetaTrader 5 | ✔ | / | Experienced traders |