Company Summary

| OKASAN SECURITIESReview Summary | |

| Founded | 1996 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Precious Metals, Stock & Shares, ETFs, Bonds, Investment Trust, Insurence |

| Demo Account | Not Mentioned |

| Leverage | Not Mentioned |

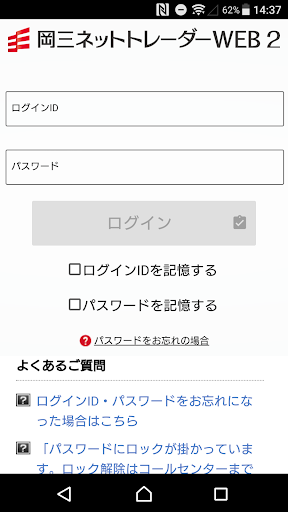

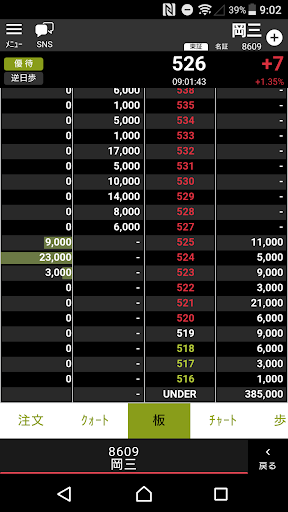

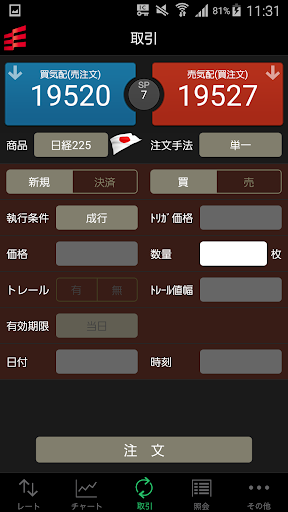

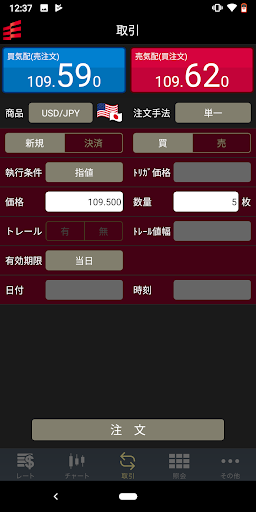

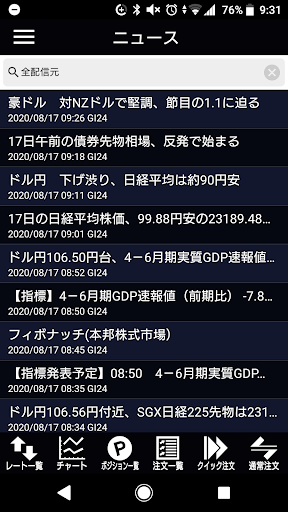

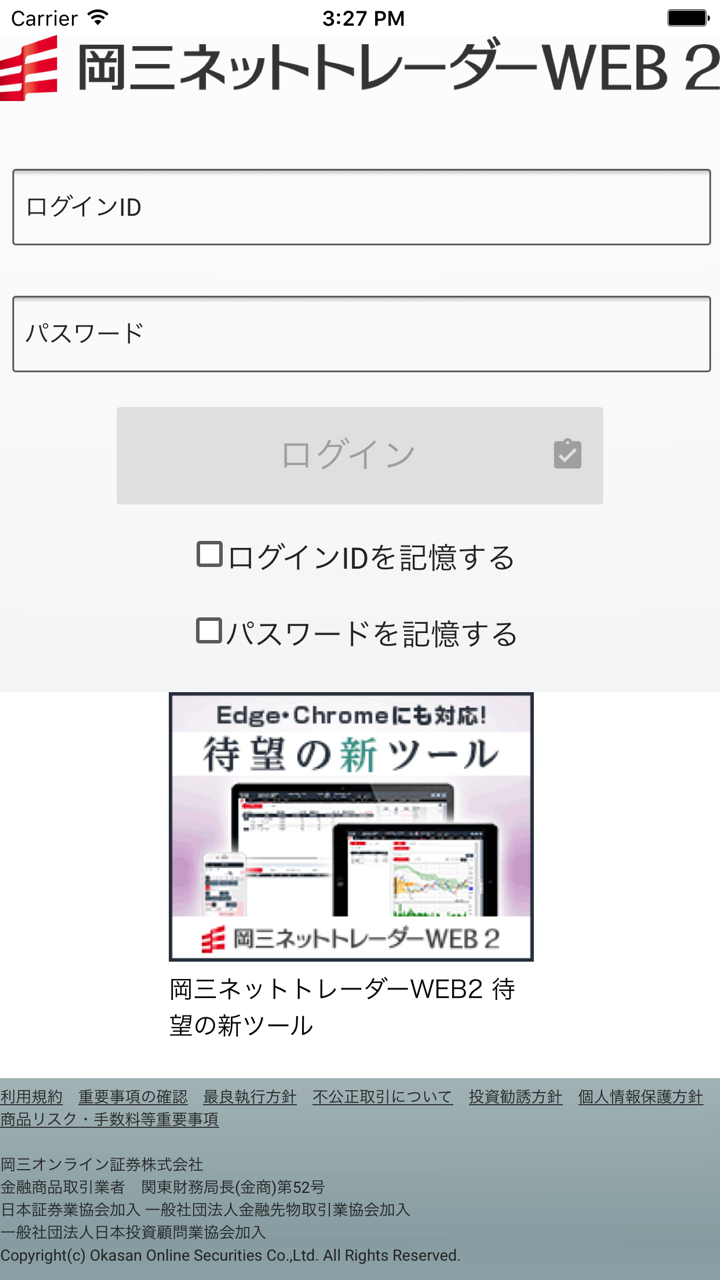

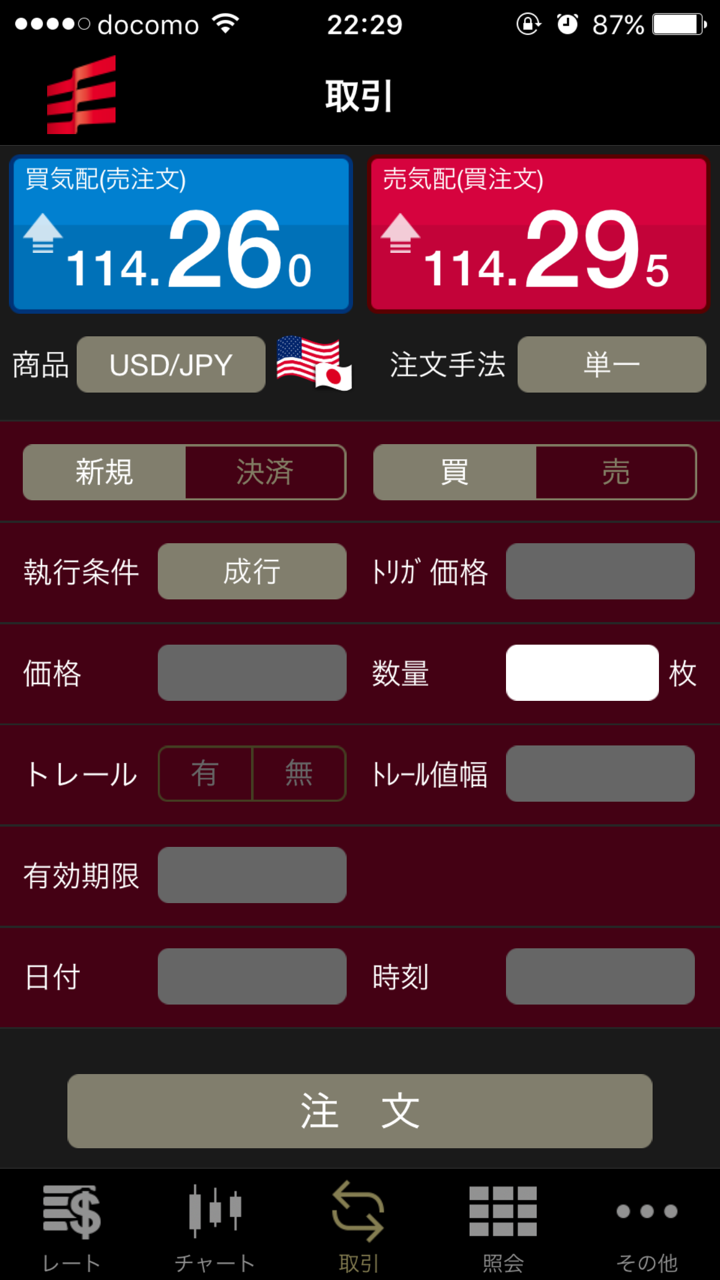

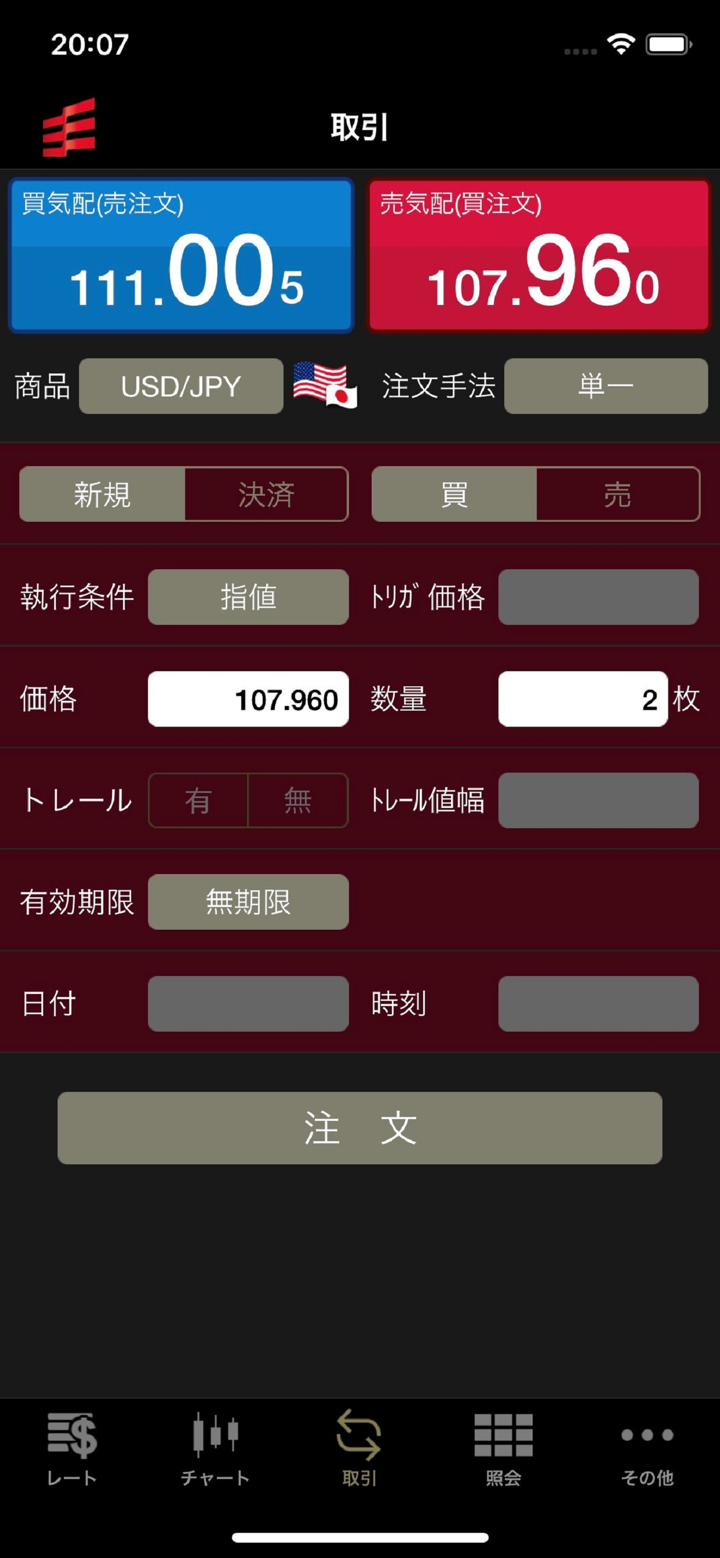

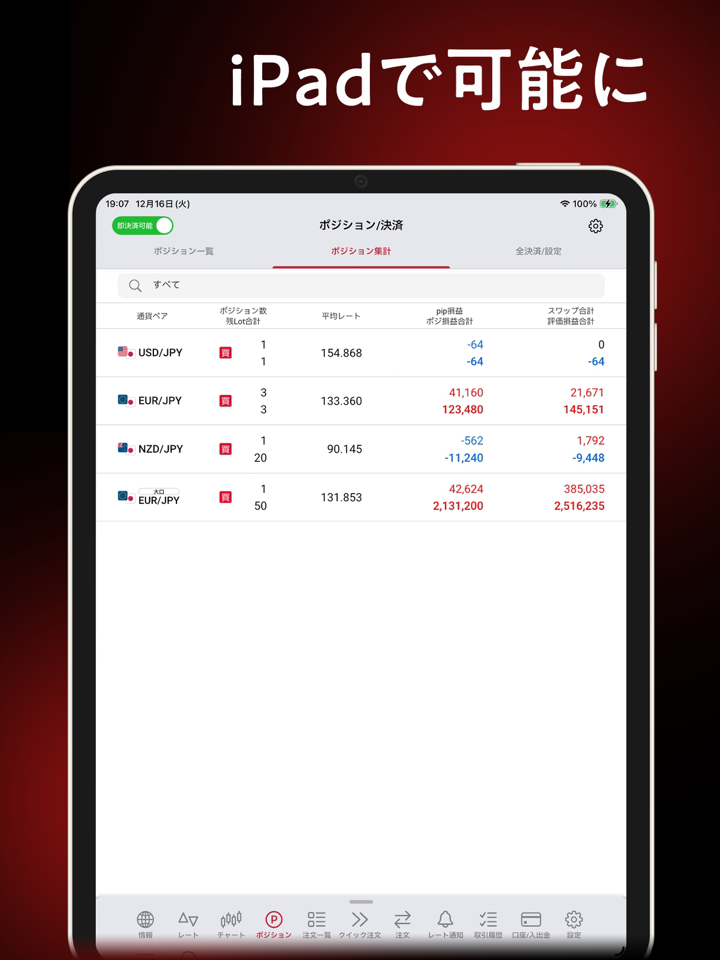

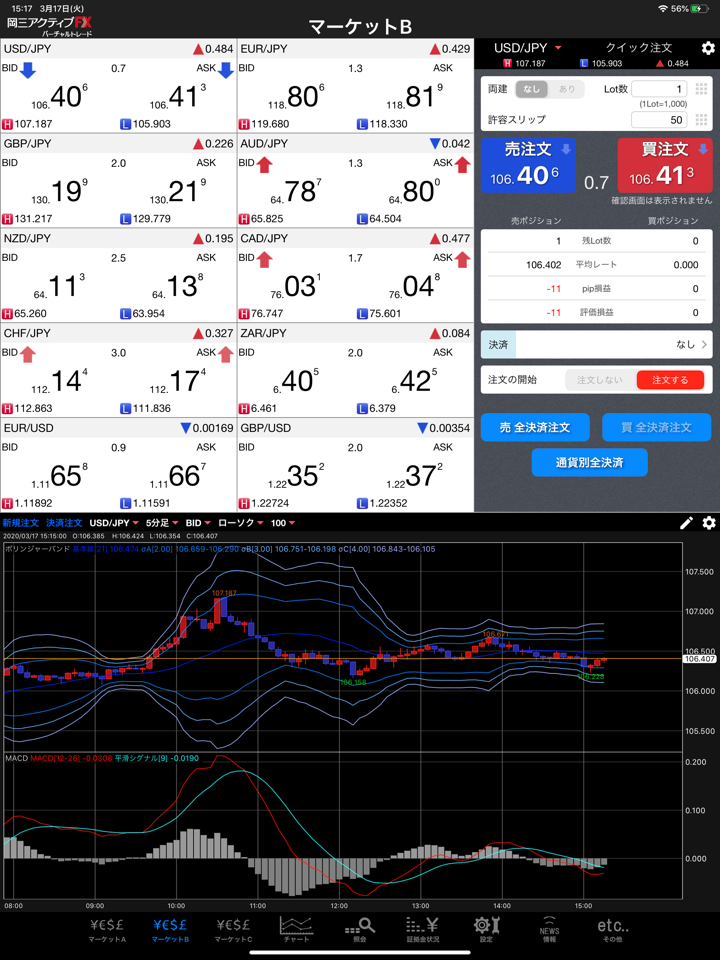

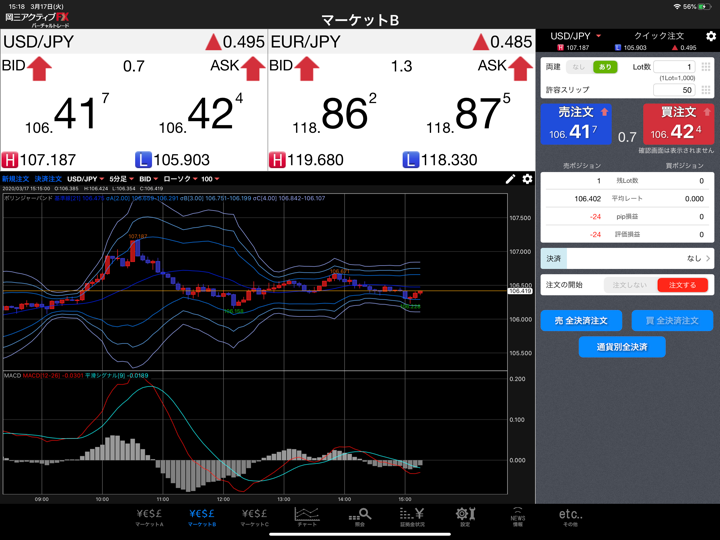

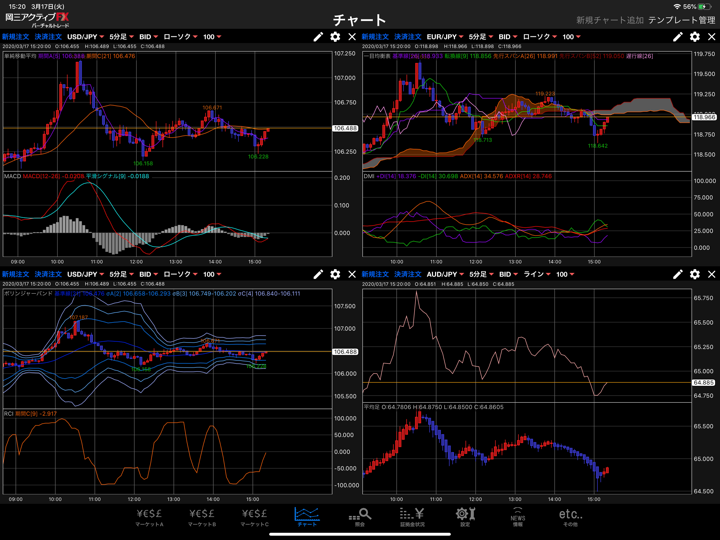

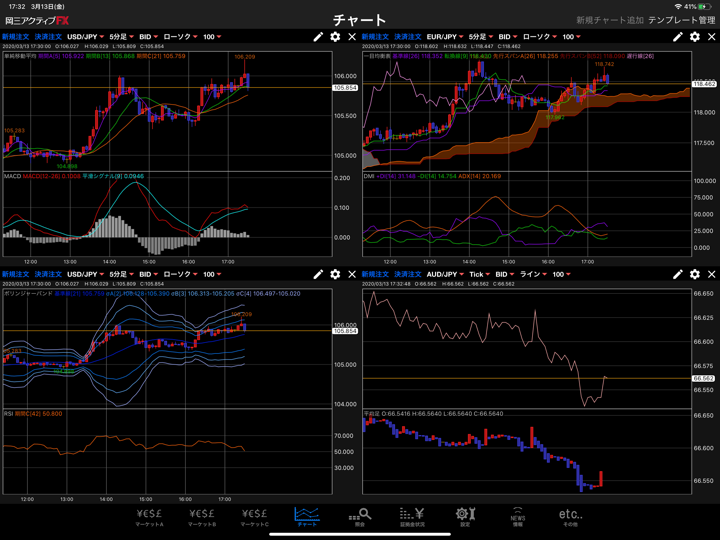

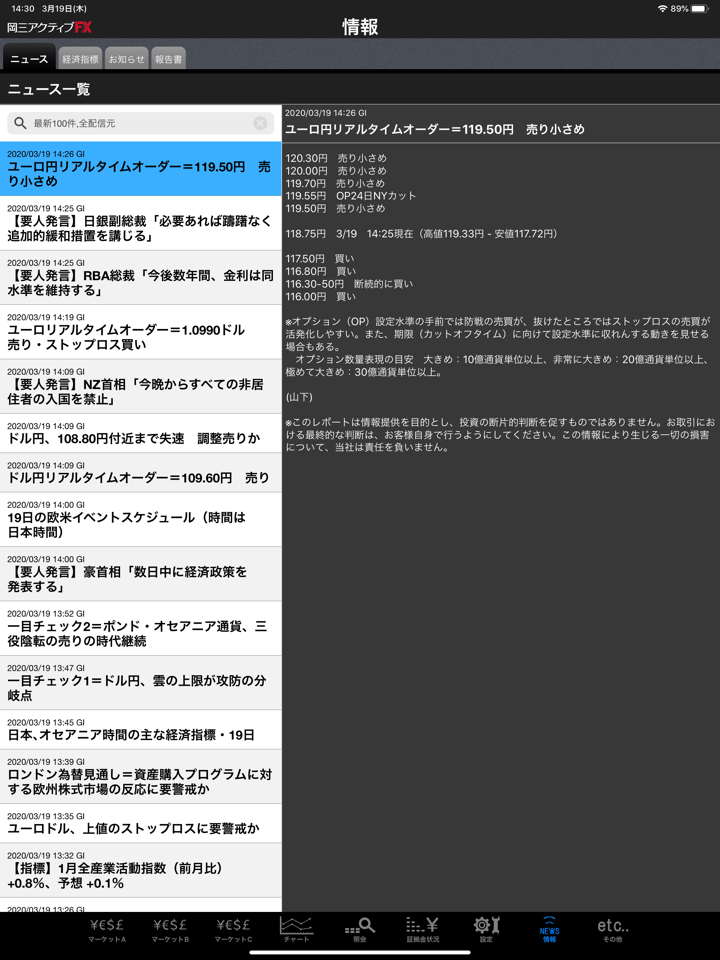

| Trading Platform | Not Mentioned |

| Min Deposit | Not Mentioned |

| Customer Support | Phone: 0120-186988, 03-6386-4482 |

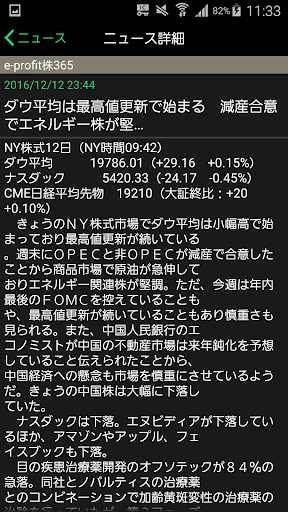

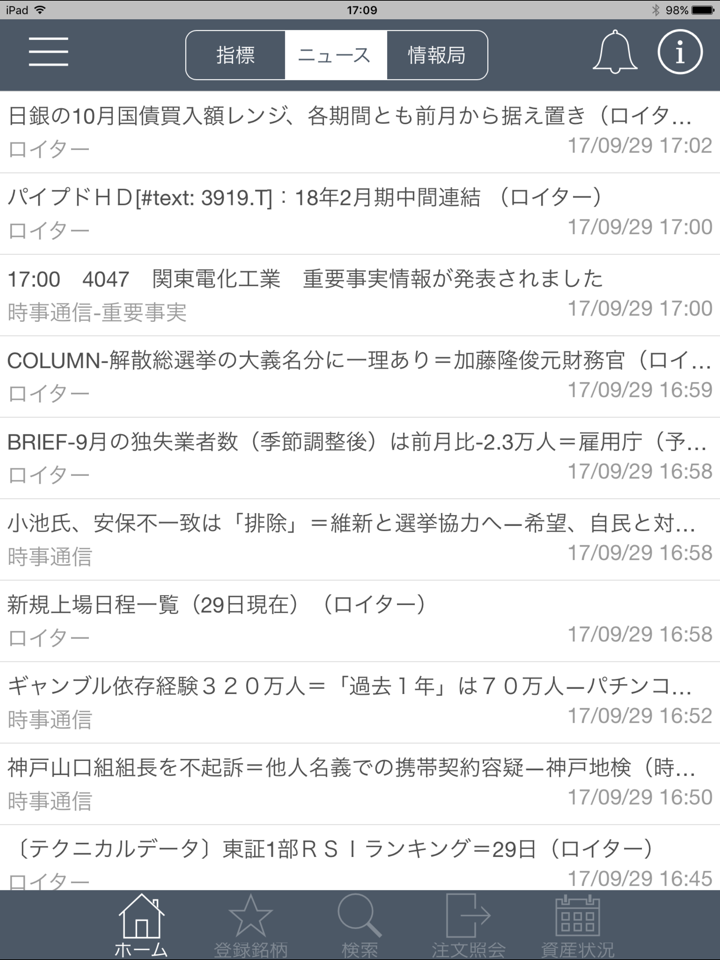

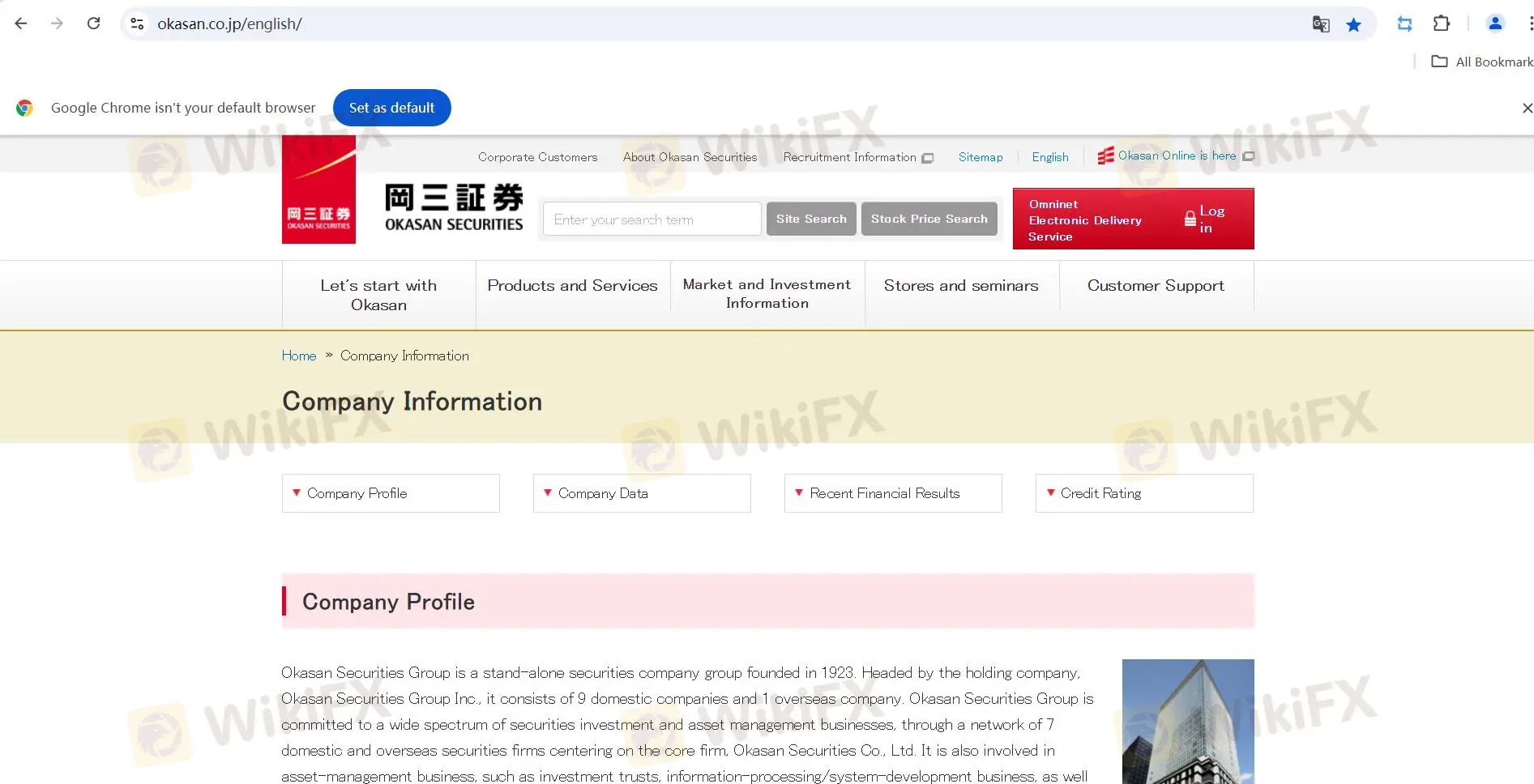

Okasan Securities Co., Ltd (“Okasan Securities”) is the core company of Japan Okasan Securities Group Co., Ltd., providing multiple trading channels and a range of financial products and services to investors. Okasan Securities holds about 60 branch offices throughout Japan, promoting community-based consulting sales, and it has opened representative offices in New York and Shanghai.

Pros & Cons

| Pros | Cons |

| Long-standing history | Limited customer support channels |

| A wide spectrum of securities investment | Untransparent trading conditions |

| Clear fee structure |

Is OKASAN SECURITIES Legit?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| FSA | 岡三証券株式会社 | Retail Forex License | 関東財務局長(金商)第53号 | Regulated |

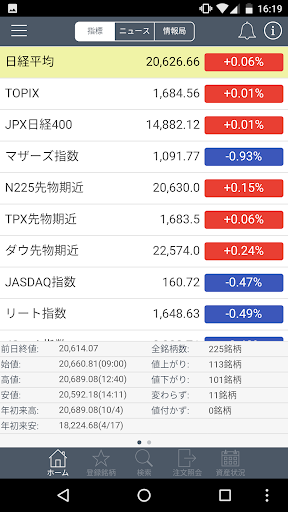

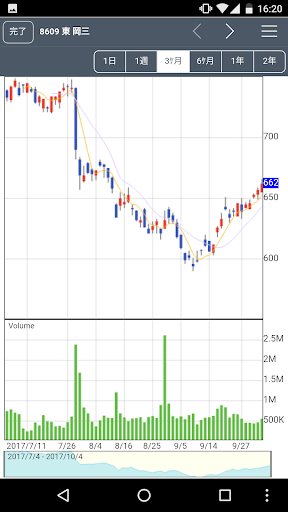

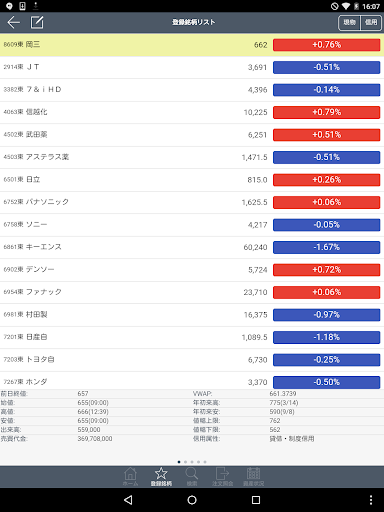

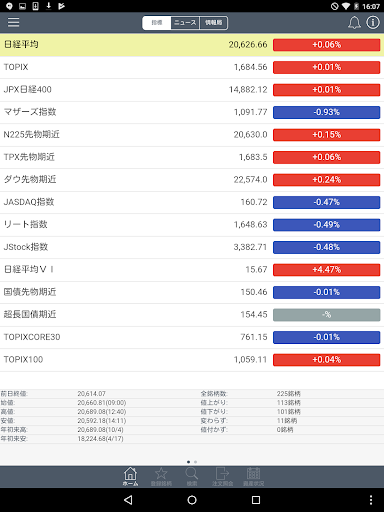

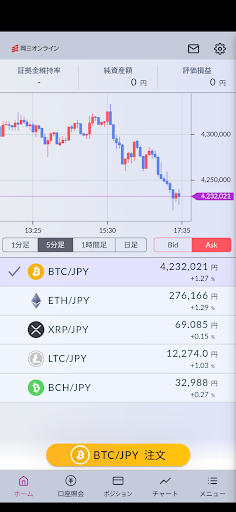

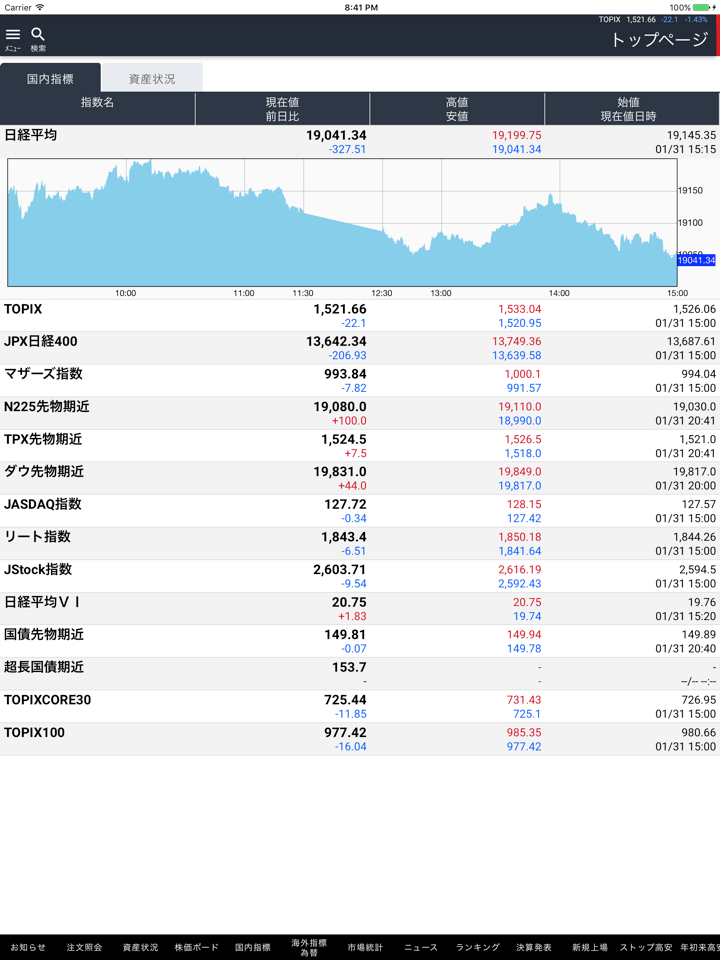

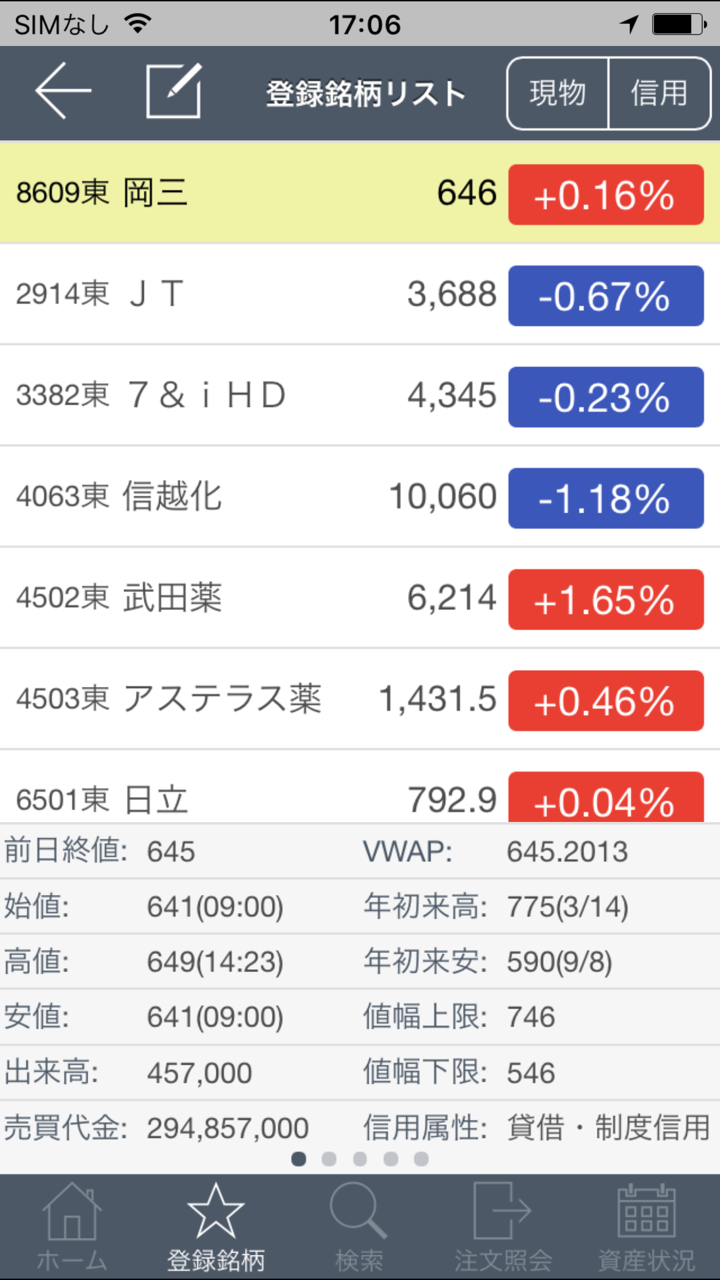

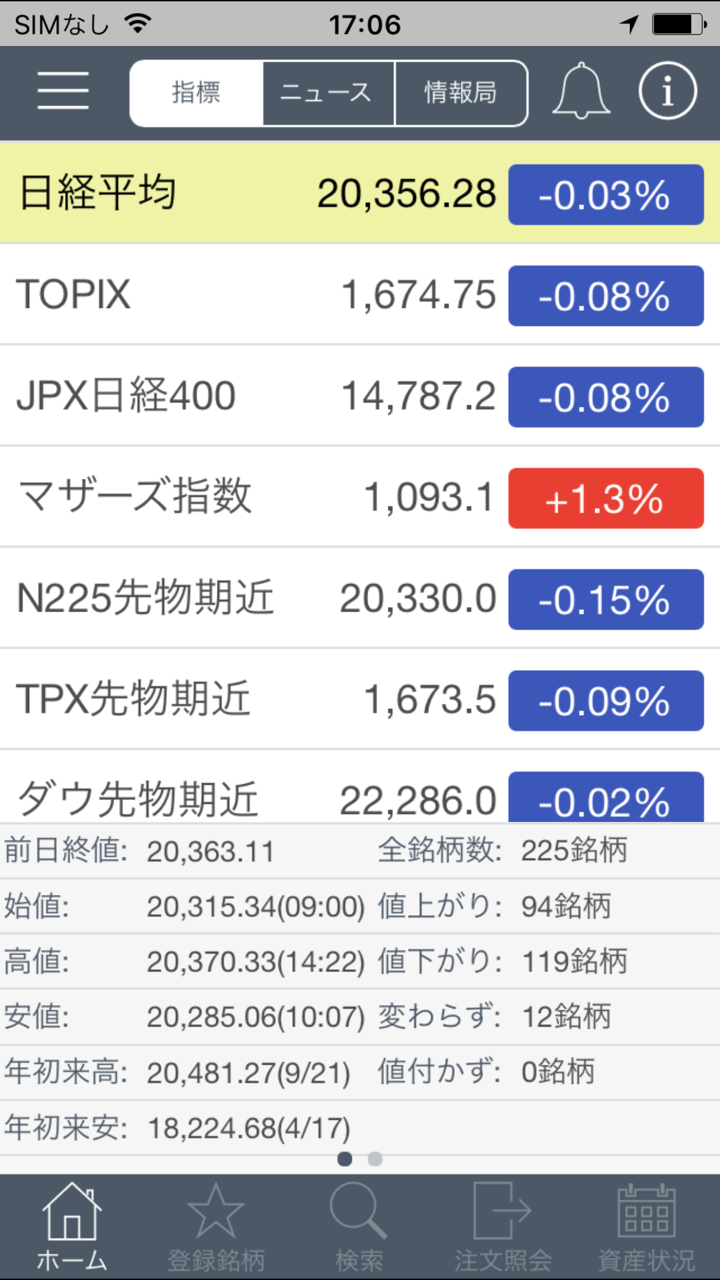

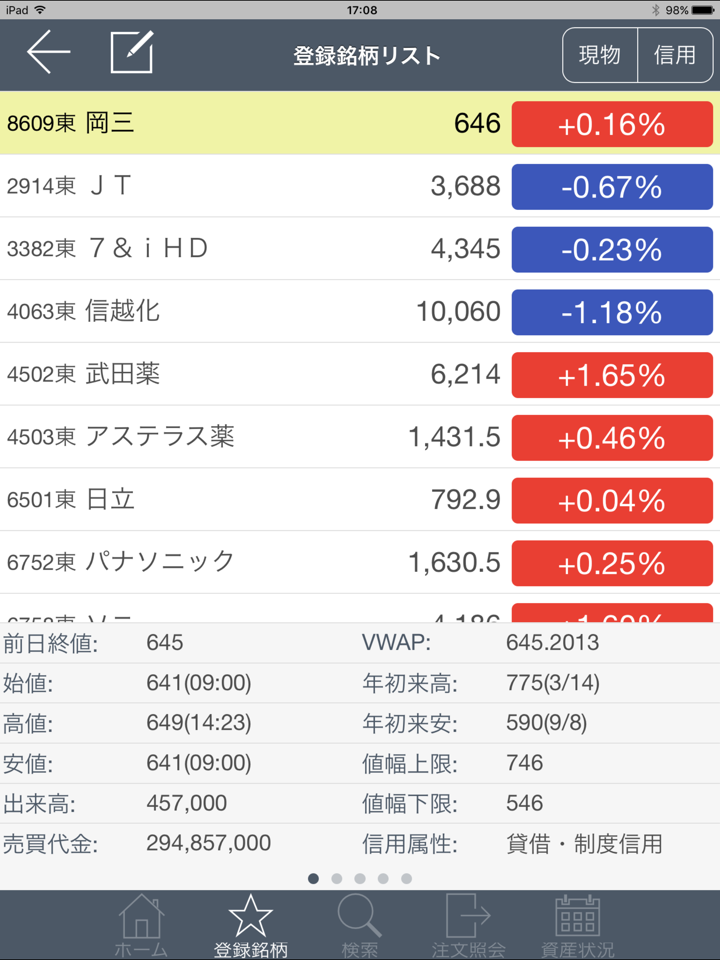

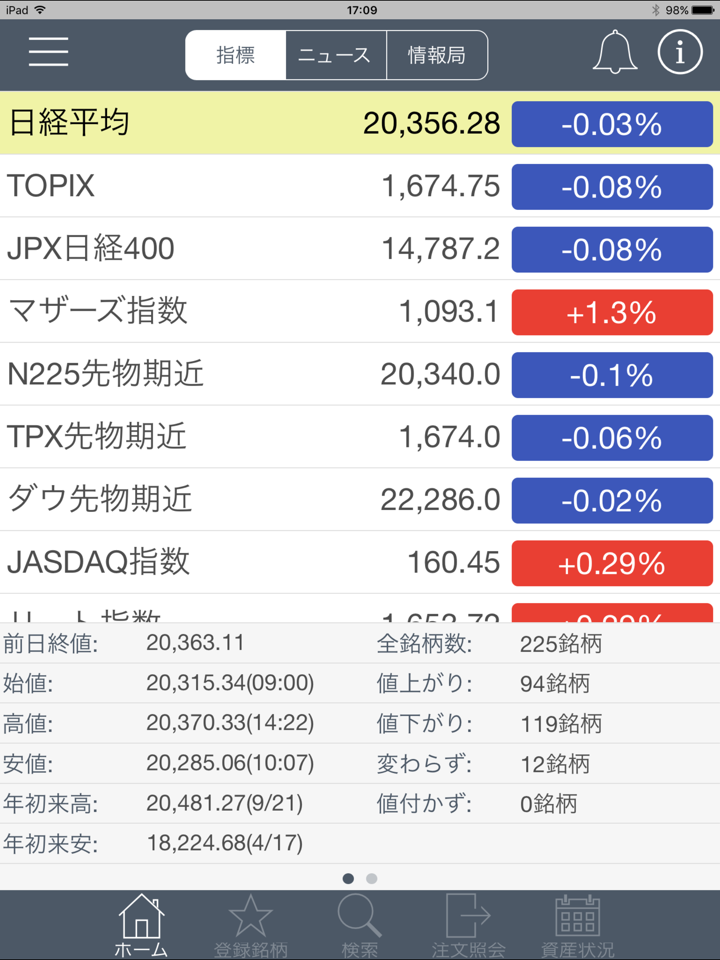

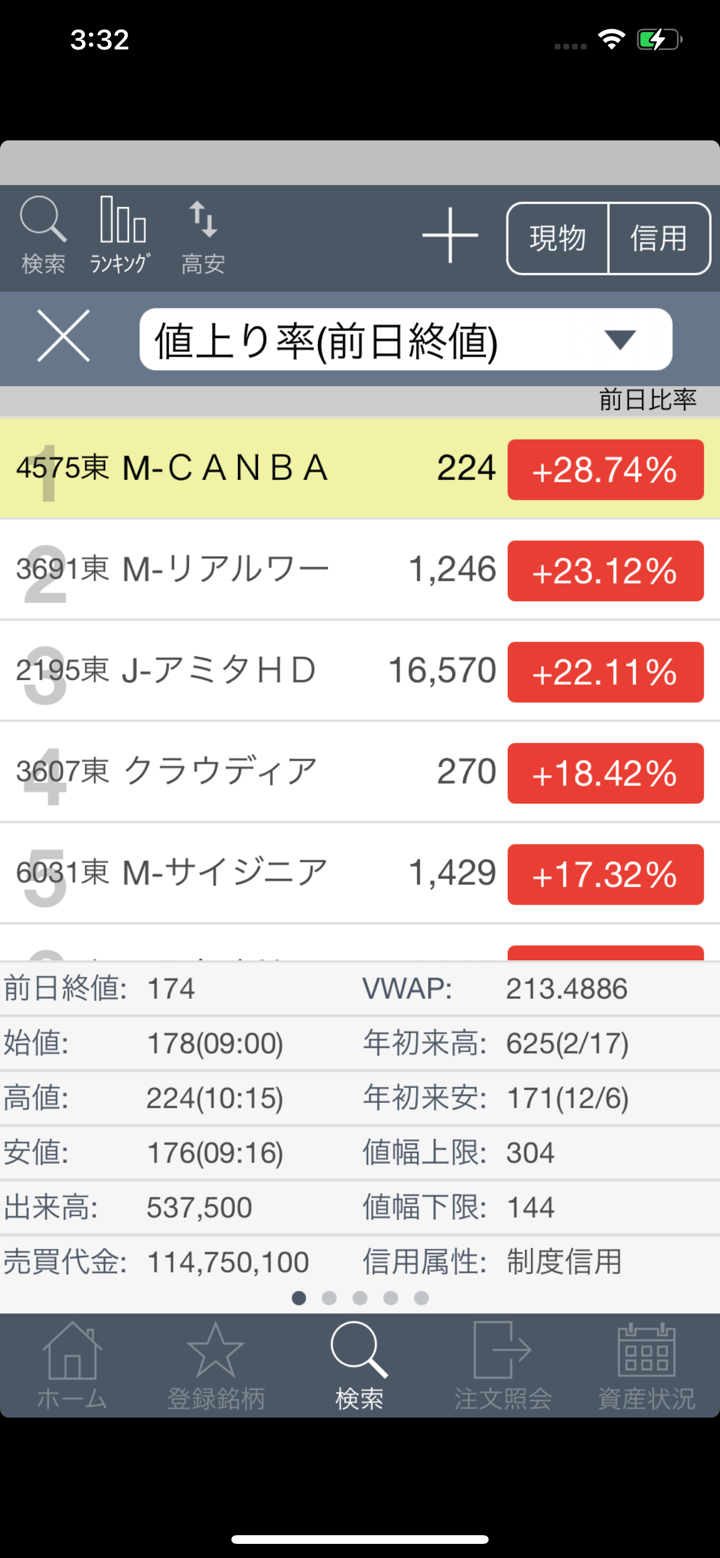

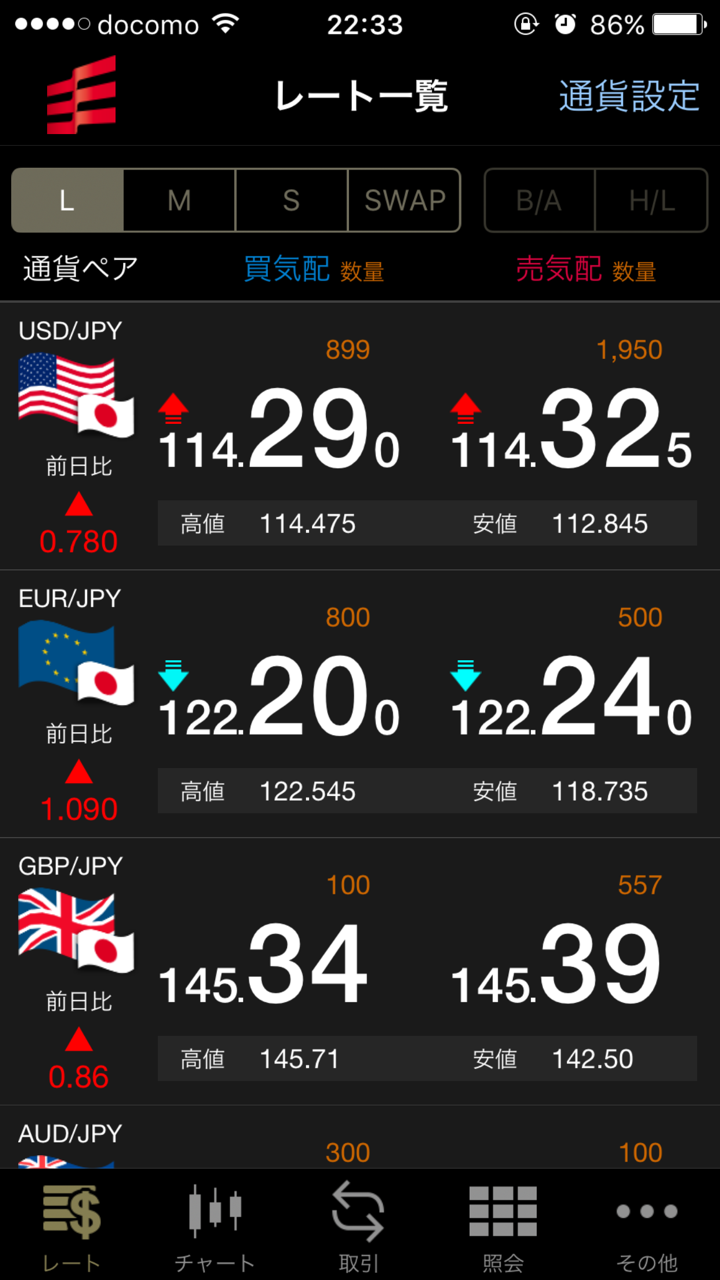

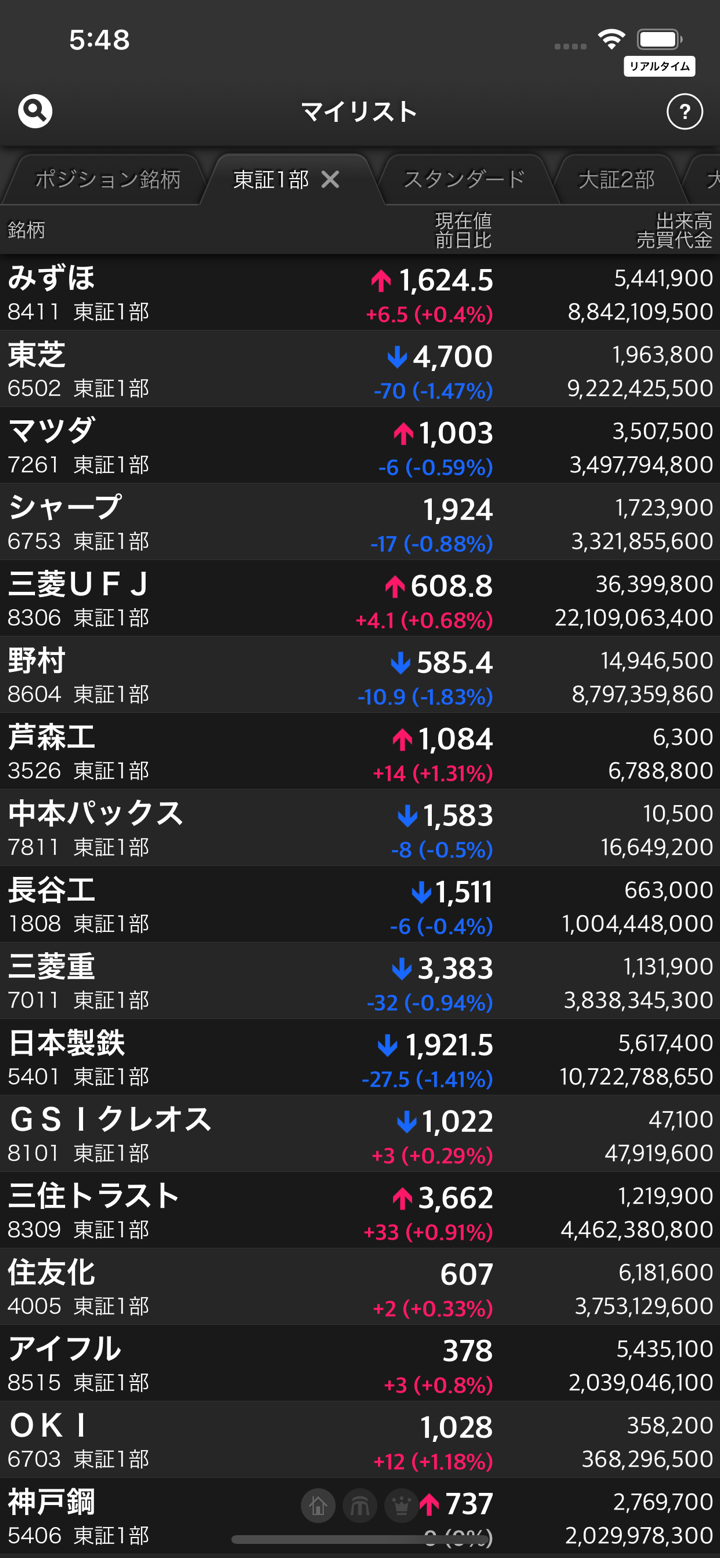

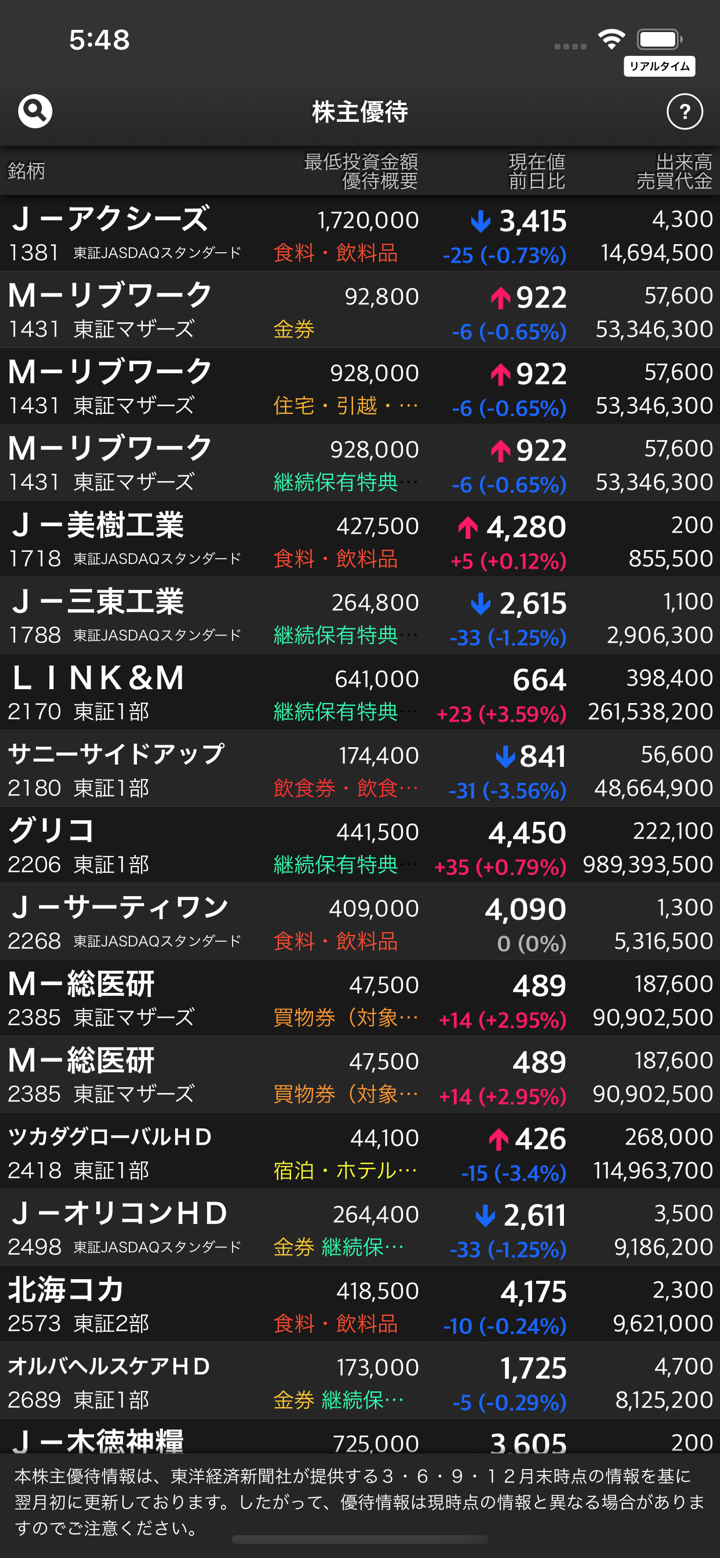

What Can I Trade on OKASAN SECURITIES?

| Trading Asset | Available |

| forex | ❌ |

| metals | ✔ |

| commodities | ❌ |

| indices | ❌ |

| energies | ❌ |

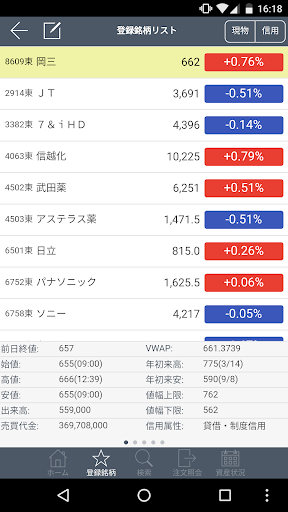

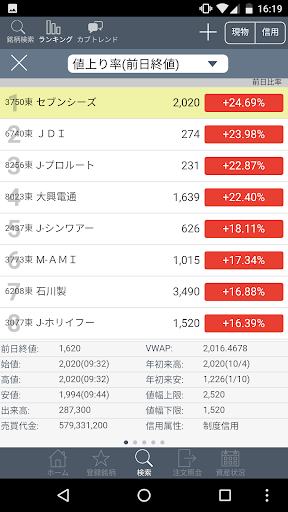

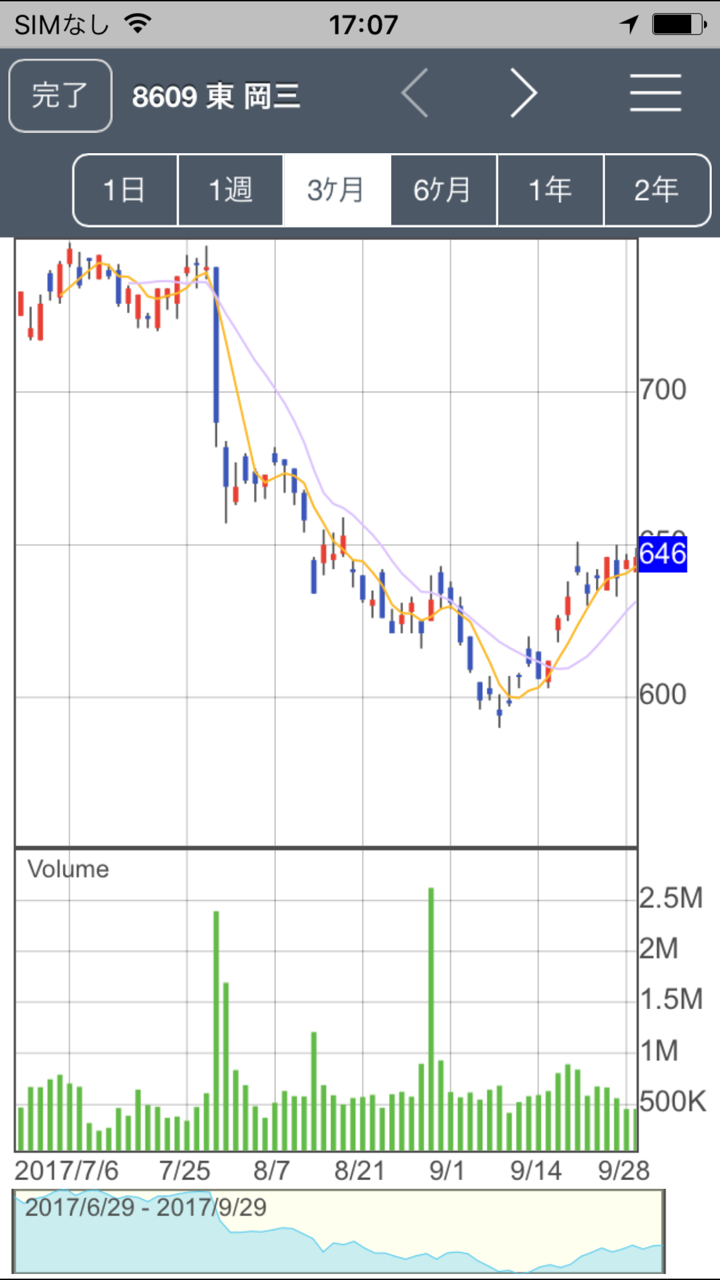

| stocks/shares | ✔ |

| cryptocurrencies | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ✔ |

| Bonds | ✔ |

| Investment Trust | ✔ |

| Insurance | ✔ |

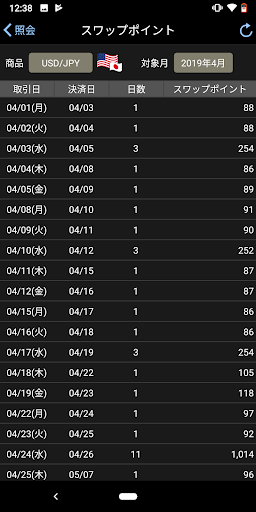

Fee

OKASAN SECURITIES provides transparent fee structure for each of their tradable products.

For example, domestic stocks (stocks, ETFs, J-REITs, etc.)

Standard Fee Calculation

| Contract Price | Branch Account | Online Trading Account | Omni Net |

| Under 1 million yen | 1.26500% of contract price | 0.88550% of the contract price | 0.63250% of the contract price |

| Over 1 million yen and up to 3 million yen | 0.93500% of contract price + 3,300 yen | 0.65450% of contract price + 2,310 yen | 0.46750% of contract price + 1,650 yen |

| Over 3 million yen and up to 5 million yen | 0.82500% of contract price + 6,600 yen | 0.57750% of contract price + 4,620 yen | 0.41250% of contract price + 3,300 yen |

| Over 5 million yen and up to 7 million yen | 0.77000% of contract price + 9,350 yen | 0.53900% of contract price + 6,545 yen | 0.38500% of contract price + 4,675 yen |

| Over 7 million yen and up to 10 million yen | 0.71500% of contract price + 13,200 yen | 0.50050% of contract price + 9,240 yen | 0.35750% of contract price + 6,600 yen |

| Over 10 million yen and up to 30 million yen | 0.55000% of contract price + 29,700 yen | 0.38500% of contract price + 20,790 yen | 0.27500% of contract price + 14,850 yen |

| Over 30 million yen and up to 50 million yen | 0.22000% of contract price + 128,700 yen | 0.15400% of contract price + 90,090 yen | 0.11000% of contract price + 64,350 yen |

| Over 50 million yen | 0.11000% of contract price + 183,700 yen | 0.07700% of contract price + 128,590 yen | 0.05500% of contract price + 91,850 yen |

Upper and lower limits of fees

| Branch Account | Online Trading Account | Omni Net | |

| Maximum Amount | 275,000 yen | 275,000 yen | 275,000 yen |

| Lower limit amount | 2,750 yen | 2,200 yen | 1,980 yen |

Note:

- Discount: A flat 5% discount is available for customers using a “General Securities Account,” but corporate customers are excluded.

- Commission Charges:

- For spot transaction sales with a contract price below the minimum, the commission will be 88.0% (including tax) of the contract price.

- If it exceeds the maximum amount, the maximum fee (including tax) will apply.

- If the calculated commission is below the minimum amount, the minimum fee (including tax) will be charged.

- Tax Inclusion: The calculated fees include consumption tax, and any fractional amounts less than one yen will be rounded down.

Deposit and Withdrawal

OKASAN SECURITIES asserts that when using an OKASAN SECURITIES card to deposit and withdraw, all fees are covered by OKASAN SECURITIES.

| Options | Minimum Amount | Fees | Processing Time |

| OKASAN SECURITIES Card | Not Mentioned | Covered by OKASAN SECURITIES | Not Mentioned |

| Bank Transfer | Not Mentioned | Not Mentioned | Not Mentioned |

| Foreign Currency | Not Mentioned | Not Mentioned | Not Mentioned |

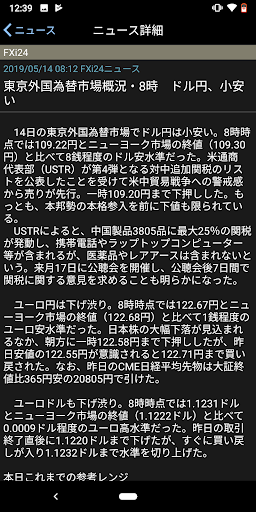

Customer Service

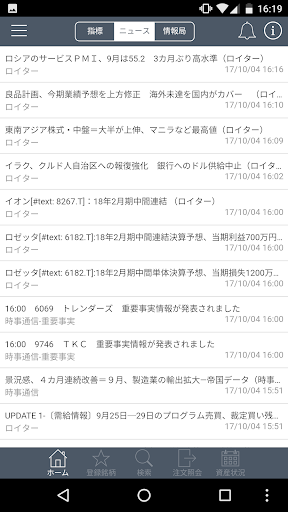

OKASAN SECURITIES' customer service is open from 9:00 to 18:00 and is not available during the weekends and holidays.

| Contact Channel | Details |

| 0120-186988, 03-6386-4482 | |

| Head Office: 2-2-1, Nihonbashi Muromachi, Chuo-ku, Tokyo 103-0022, Japan | |

| Kabutocho Office: 1-4, Nihonbashi Kabutocho, Chuo-ku, Tokyo 103-0026, Japan |

Q&A

Is OKASAN SECURITIES Legit?

Yes. It is regulated by the Financial Services Agency.

Is OKASAN SECURITIES good for beginners?

Yes. It has a regulatory license, multiple tradable products, and a distinct fee structure.

Risk Warning

Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.