Company Summary

| KnightsbridgeFX Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Canada |

| Regulation | No regulation |

| Services | Foreign currency exchange for individuals & businesses, bank-beating rates |

| Minimum Deposit | $2,000 CAD |

| Customer Support | Toll-Free (Canada/USA): (877)-355-KBFX (5239) ext. 1 |

| Local: (416) 800-5552 / (416) 479-0834 | |

| Email: contact@knightsbridgefx.com | |

| Address: First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

KnightsbridgeFX Information

KnightsbridgeFX is not a regulated financial service company in Canada. It is not licensed by the IIROC or provincial regulators. Although it is a genuine currency exchange business, it is not regulated by established financial agencies.

Pros and Cons

| Pros | Cons |

| Offers better exchange rates than major Canadian banks | No regulation |

| Same-day transfers available for most transactions | |

| No deposit/withdrawal fees |

Is KnightsbridgeFX Legit?

KnightsbridgeFX is not a regulated financial service provider. It does not hold any licenses from the Investment Industry Regulatory Organization of Canada (IIROC) or any provincial authorities in Canada, where it is registered.

According to WHOIS records, the domain knightsbridgefx.com was registered on June 11, 2009, last updated on June 7, 2023, and will expire on June 11, 2029. Its status is “clientTransferProhibited”, meaning that the domain is secure and live, protected from illegal transfers or modifications.

KnightsbridgeFX Services

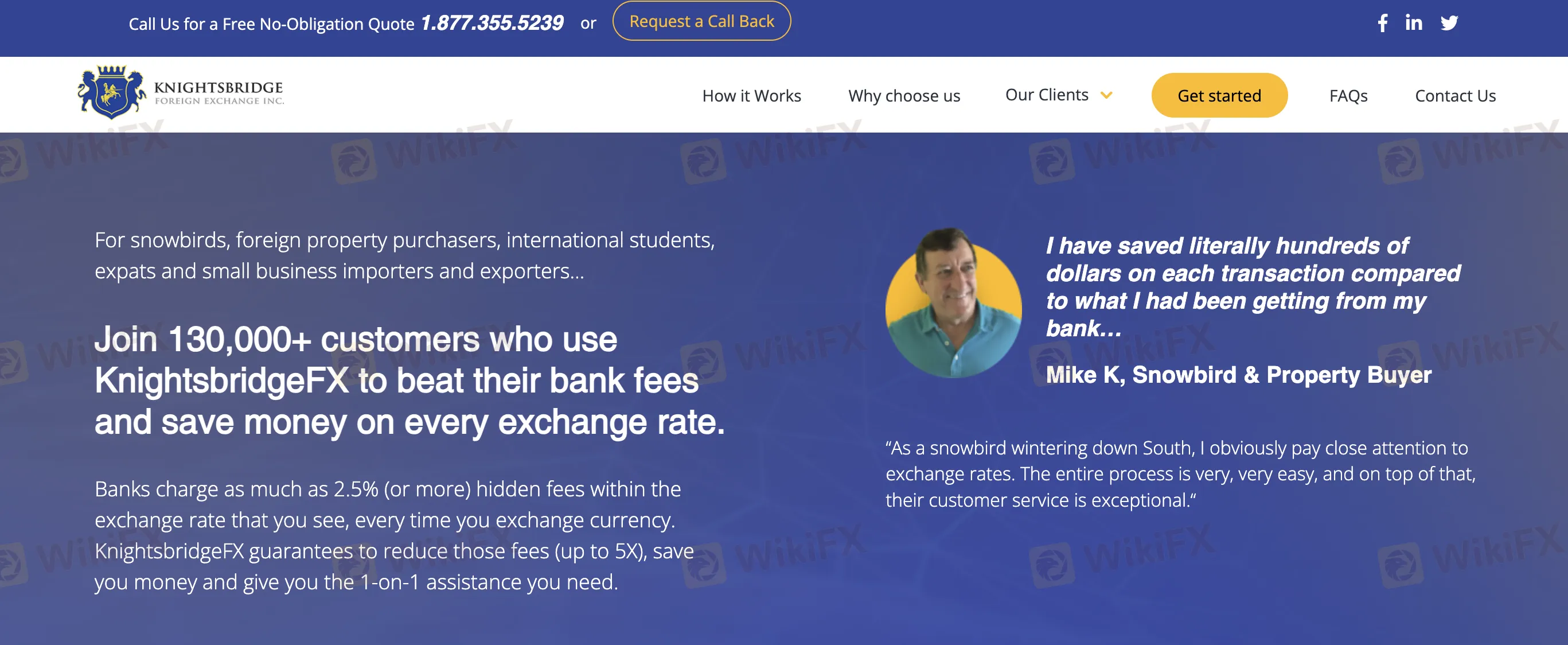

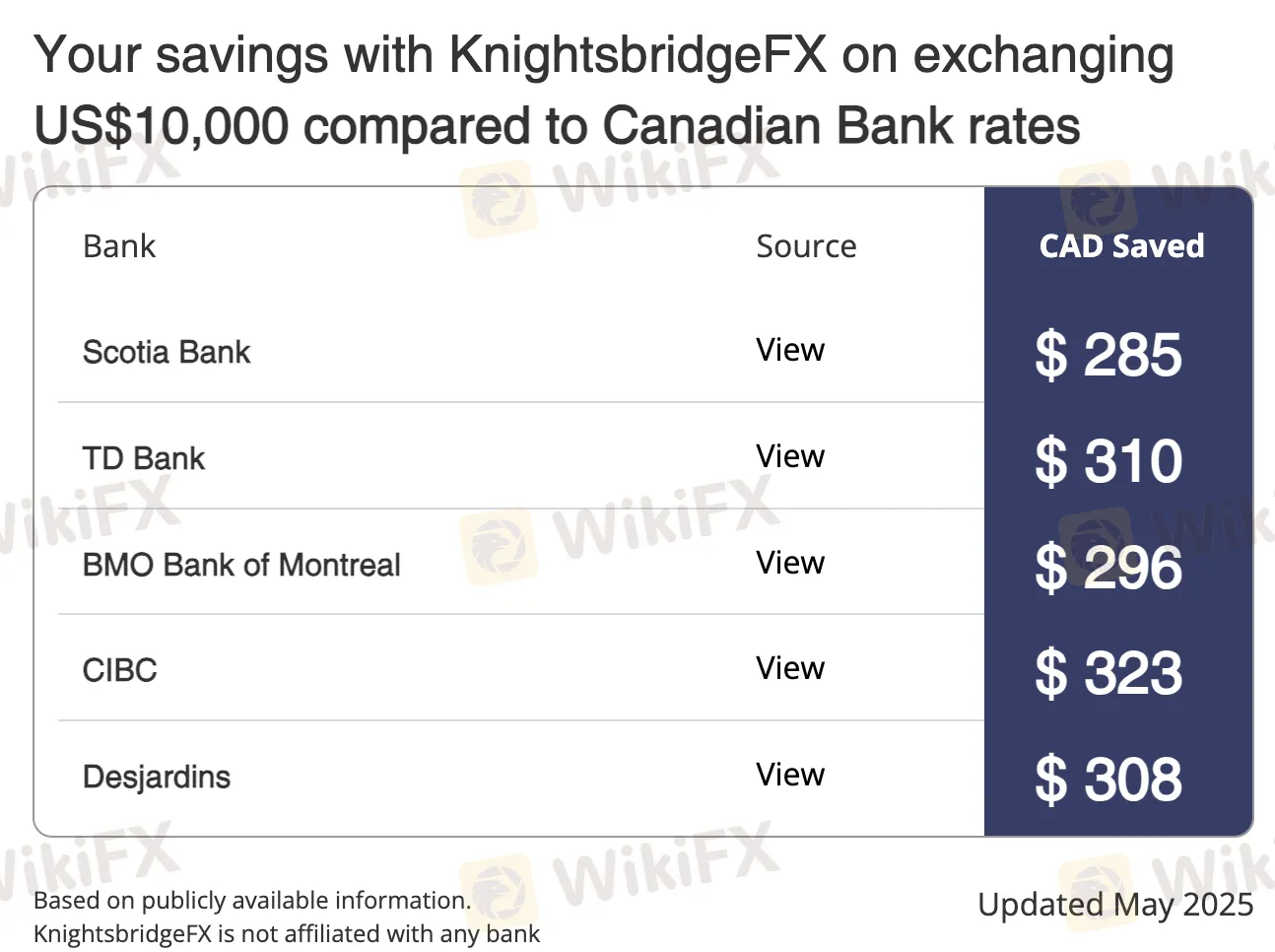

KnightsbridgeFX is a Canadian currency exchange company that provides foreign exchange services to individuals and small businesses, with a focus on better exchange rates than banks. It caters to snowbirds, real estate buyers, expats, international students, and import/export firms, offering no hidden fees, same-day transfers, and personalized service.

| Services | Supported |

| Currency Exchange (CAD/USD & other FX) | ✔ |

| Real Estate Currency Transfers | ✔ |

| Tuition & International Student Payments | ✔ |

| Business FX for Import/Export | ✔ |

Minimum Exchange Amount

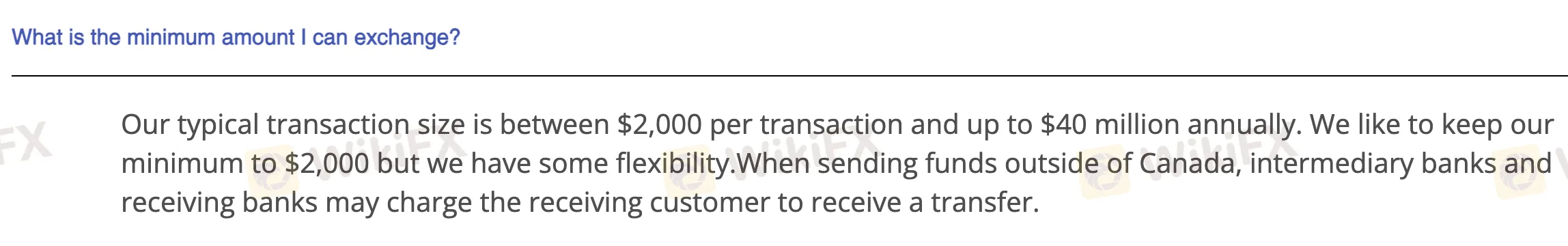

The minimum amount that can be exchanged with KnightsbridgeFX is normally $2,000 CAD per transaction. While that is their baseline level, they admit there is some flexibility based on the circumstances.

Deposit and Withdrawal

KnightsbridgeFX does not charge fees for deposits or withdrawals. Fees may be charged by intermediate and receiving banks when sending payments internationally. The minimum deposit (exchange amount) is usually $2,000 CAD, but they may offer some leeway.

| Payment Method | Minimum Amount | Fees | Processing Time |

| Bill Payment | $2,000 CAD | 0 | Same day (typically) |

| Wire Transfer | Same day or 1 business day | ||

| EFT (Electronic Funds Transfer) | Same day (typically) |