JPMorgan’s MONY Pushes Tokenized Cash Mainstream

JPMorgan launches MONY, a blockchain-native money market fund, signaling tokenized finance’s shift into institutional competition.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

JPMorgan launches MONY, a blockchain-native money market fund, signaling tokenized finance’s shift into institutional competition.

In the complex world of online trading, distinguishing between a legitimate financial institution and a fraudulent scheme is the first line of defense for any investor. Tiger Brokers, a significant player in the Asian and global markets with an active presence in regions like the UAE, Australia, and China, presents a unique case study.

You are likely looking into BotBro because you're interested in automated trading or looking for a new place to invest. But before you deposit any money, you need to know if this platform is actually safe or if it’s just another online trap.

Philadelphia Fed President Anna Paulson suggests a 'bending not breaking' labor market could allow for rate cuts later in 2026, while Janet Yellen warns that political pressure on the central bank risks a crisis of 'Fiscal Dominance.'

Gain Capital, Forex.com operator, plans to surrender its UK FCA licence, shifting focus to Dubai under StoneX as part of a broader forex and CFD growth strategy.

Gain Capital, the company behind Forex.com and City Index, is preparing to surrender its United Kingdom licence with the Financial Conduct Authority (FCA).

The sudden removal of Venezuelan President Nicolás Maduro by the United States has sent strong signals across the world.

A global crypto transparency era begins as 48 countries enforce CARF rules; data-sharing to combat tax evasion expands worldwide by 2029.

Geopolitical risk premium has returned to markets following the US military's capture of Venezuelan President Maduro, driving Gold to $4,370 while Oil markets remain unexpectedly subdued due to structural oversupply.

Global oil markets remain largely unfazed by the US military's capture of Venezuelan President Maduro, with analysts citing pre-existing sanctions and robust global supply as buffers against price shocks. Meanwhile, OPEC+ maintains a cautious stance, holding production steady amidst rising geopolitical tensions involving Iran.

Bulgaria has officially joined the Eurozone as its 21st member, marking a significant structural expansion for the single currency block. The move brings Bulgaria's central bank governor into the ECB's decision-making fold as policymakers signal a steady rate path for 2026.

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Dolly Ramaiya, Founder and Senior Executive Officer of Truleum Venture Partners Limited, an asset and fund tokenization focused regulated firm based in Dubai International Financial Center, UAE. With over 18 years of experience in the GCC region, predominantly in the fintech sector, Dolly has been a driving force behind the growth of several transformative companies.

A 67-year-old former civil servant in Penang has lost more than RM1 million after being lured into a fraudulent online share investment scheme promoted through social media

A shock US military operation in Venezuela has captured President Maduro, triggered a geopolitical crisis, and sparked immediate volatility in energy markets. While oil prices are expected to price in a risk premium, domestic US political fallout—including impeachment threats—adds a layer of uncertainty for the Dollar.

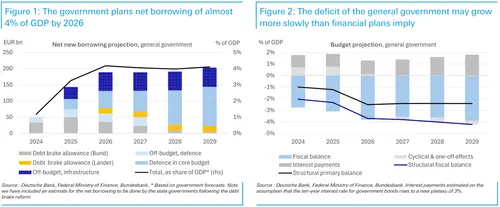

Germany was long seen as a bastion of fiscal stability in the Eurozone. But the erratic fiscal polic

High-level diplomatic thaw between South Korea and China could reshape Asian trade flows, with potential upside for the Korean Won relative to the Dollar.

Long-term USD valuations face headwinds as new projections suggest the Federal Reserve’s 2026 easing path may be shallower than markets anticipate due to persistent inflation and tariff risks.

Geopolitical risk premiums in crude markets remain elevated as OPEC+ signals steady output policy while US military intervention in Venezuela triggers regional instability, potentially stalling production recovery.

You are likely looking into BotBro because you're interested in automated trading or looking for a new place to invest. But before you deposit any money, you need to know if this platform is actually safe or if it’s just another online trap.

WAYONE CAPITAL currently holds a critical WikiFX Score of 1.86 and operates as an Unregulated entity registered in Saint Lucia. Based on the absence of authorized financial oversight and verified reports of withdrawal failures, this broker is classified as a high-risk platform. The operational model suggests an offshore entity targeting specific demographics (primarily India and the UAE) without the requisite liquidity safeguards or legal compliance frameworks expected of a Tier-1 brokerage. Traders are advised to exercise extreme caution, as the platform demonstrates significant indicators of potential insolvency or fraudulent activity.