Golden Brokers Review: Regulatory Warnings and Investor Risk Overview

Warnings from multiple international regulators regarding Golden Brokers, an unlicensed entity posing high risks to investor funds.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Warnings from multiple international regulators regarding Golden Brokers, an unlicensed entity posing high risks to investor funds.

If you are thinking about depositing money with Traders' Hub, you are likely wondering if your funds will be safe or if this is just another generic offshore broker.

Markets and Fed officials themselves see only modest easing in the year ahead.

Dear Global Users, Thank you for journeying alongside WikiFX. Every query you make, every review you share, and every piece of feedback you provide serves as the most vital driving force behind our continuous efforts to promote transparency and security in the trading industry.

Well, Donald Trump has done it again!He stumped the chumps. The “chumps” in this case were the “bl

Maxco (PT Maxco Futures) currently holds a WikiFX Score of 7.06, indicating a robust safety rating within its operational jurisdiction. The entity is Regulated, operating under the strict oversight of Indonesian financial authorities. Based on the available data, Maxco presents as a secure entity for traders specifically targeting the Indonesian market or those comfortable with its specific regulatory framework. The broker combines high-leverage offerings with a "Main Label" trading infrastructure, suggesting a focus on operational stability, though its services are heavily localized to the Southeast Asian region.

If you are wondering if 4SYTE TRADING LTD is a safe place for your investments, you are asking the right question. Many platforms look professional on the surface but hide risks in the fine print.

When evaluating a financial service provider, the most critical metric is its regulatory standing and safety score. In the case of KIRA (Kira Financial), the data presents immediate and severe warning signs. With a remarkably low WikiFX Score of 1.80, KIRA falls deep into the "High Risk" category.

amari MARKETS currently holds a WikiFX Score of 1.63, placing it firmly in the high-risk category of financial service providers. The entity operates as an unregulated broker, established recently in 2025, with its headquarters registered in the Seychelles.

AURO MARKETS currently holds a WikiFX Score of 1.79 and is classified as an Unregulated entity operating out of Saint Lucia. Despite utilizing the reputable MT5 trading infrastructure, the broker has been flagged by the Central Bank of Russia for signs of illegal market activity. Compounded by severe allegations of account deletion and fund misappropriation, our analyst assessment categorizes AURO MARKETS as a high-risk platform. Investors are advised to exercise extreme caution, as the entity lacks the capitalization oversight and dispute resolution mechanisms standard in Tier-1 jurisdictions.

If you are considering depositing funds with Long Asia Group (also known as Long Asia Forex), we urge you to pause immediately.

Poland's UOKiK slaps $5.7M fines on iGenius & International Markets Live for pyramid schemes posing as trading schools. Recruitment trumped education, breaching EU laws. Explore enforcement, impacts.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

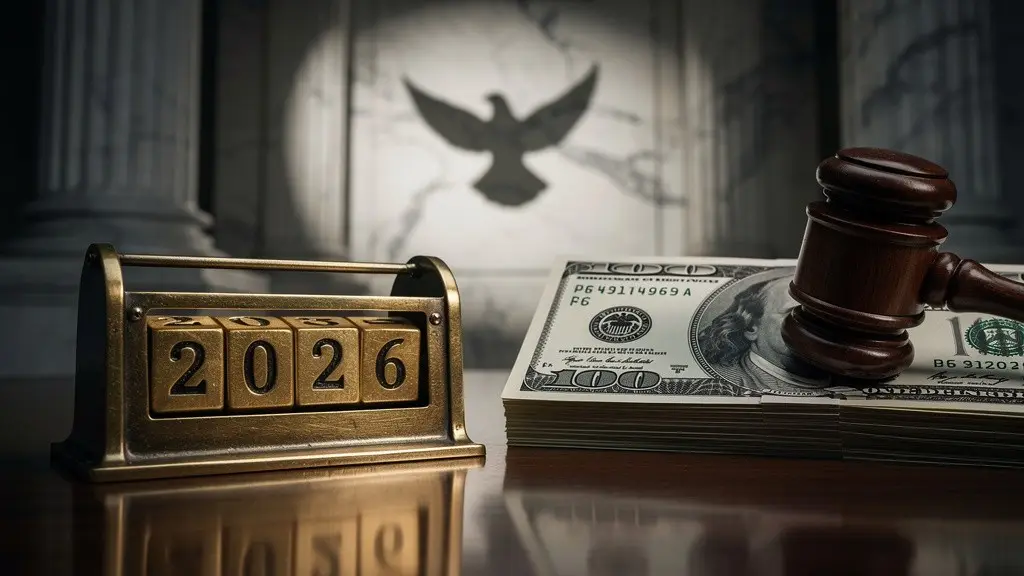

Market caution prevails ahead of Fed Minutes as traders eye a significant 2026 FOMC voting rotation that could tilt the central bank toward a more dovish stance.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

The US Dollar stages a technical rebound following divisive FOMC minutes, though the greenback remains weighed down by a nearly 10% annual decline and lingering fiscal concerns.

Indonesia, the world's top nickel producer, has signaled its intention to cut production in 2026 to support prices, triggering a significant rally in nickel futures. This move could dramatically reshape the global nickel market's supply-demand balance.

The Euro faces renewed downside pressure as France's debt-to-GDP ratio swells to 117.4% and credit agencies downgrade its outlook, creating a fiscal drag on the entire Eurozone economy.

A structural supply deficit and anticipatory buying ahead of potential 2026 tariffs have pushed Copper prices to record highs, outperforming Gold, which faces a short-term technical correction after hitting $4,500.

As the Federal Reserve prepares to release minutes revealing internal rifts over rate cuts, the Bank of Japan's aggressive hiking cycle creates a historic policy divergence, signaling heightened volatility for the USD/JPY pair entering 2026.