Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

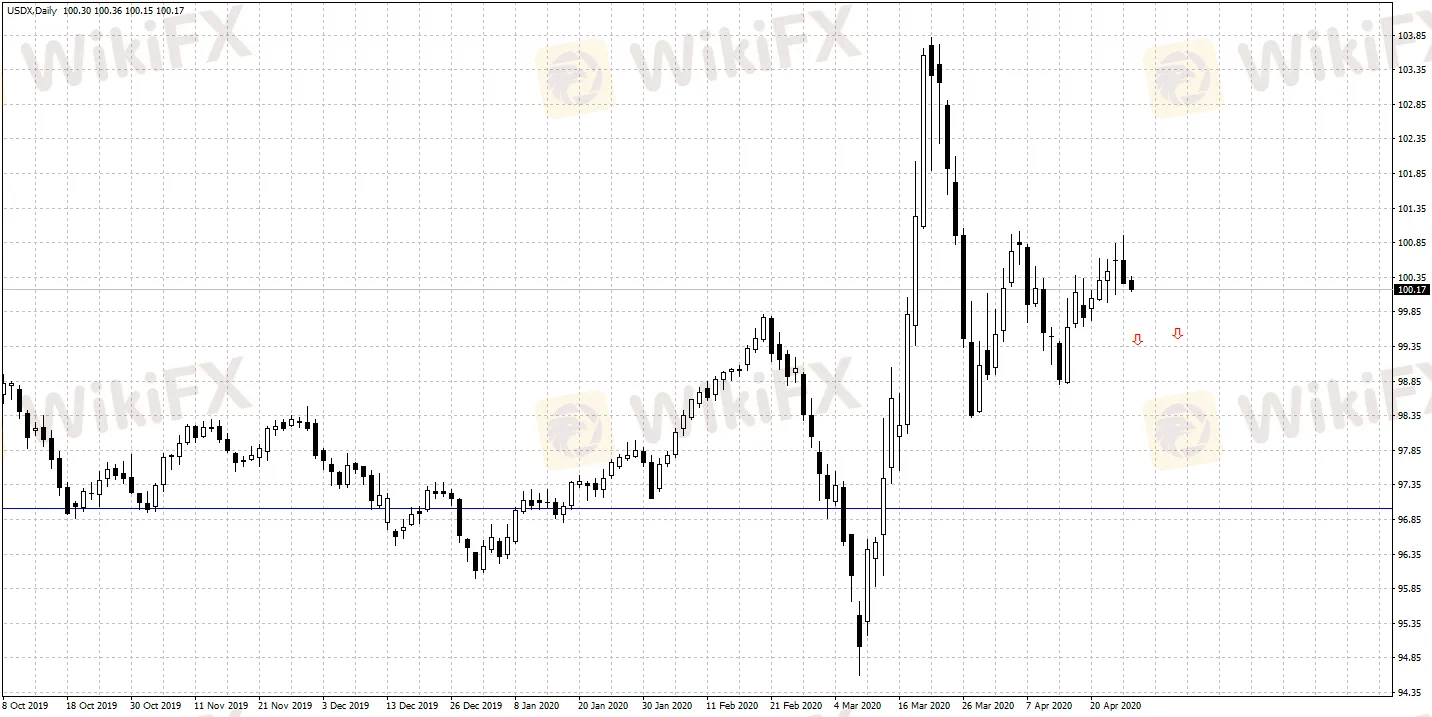

Abstract:According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week

According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week; as of the week ending April 21st, USD net short positions totaled US$11.51 billion. Net short positions of the previous week reached US$ 11.39 billion. Reuters calculation of total USD net position in the Chicago International Monetary Market is based on the net positions of six major currencies: Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar, and Australian Dollar.

Under the impact of the epidemic, the Fed has continuously launched several rounds of quantitative easing that exceeded market expectations, almost exhausting all conventional and unconventional policy ammunition available. As of now, the Fed has reduced interest rates to zero to inject liquidity into various markets. Investors will still pay close attention to the Fed s outlook on the current economy and whether it will give hints on the introduction of negative interest rates in the future.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

USD/JPY just broke through 1-year highs earlier than expected.

A Good Week For the US Dollar As It Gains Strongly Against Other Major Pairs.

Performance like this hasn't been seen since 2021

The EUR/USD pair ended the week in the red last week as many investors remained in a holiday mood. It was trading at 1.1720, down slightly from last year’s high of 1.1910 ahead of key events this week.