Abstract:From WikiFX news. As the world’s top gold buyer, Central Bank of Russia’s decision to stop gold purchase starting from April may signal an upcoming big decline in global central banks’ net gold-purchase.

From WikiFX news. As the world‘s top gold buyer, Central Bank of Russia’s decision to stop gold purchase starting from April may signal an upcoming big decline in global central banks net gold-purchase.

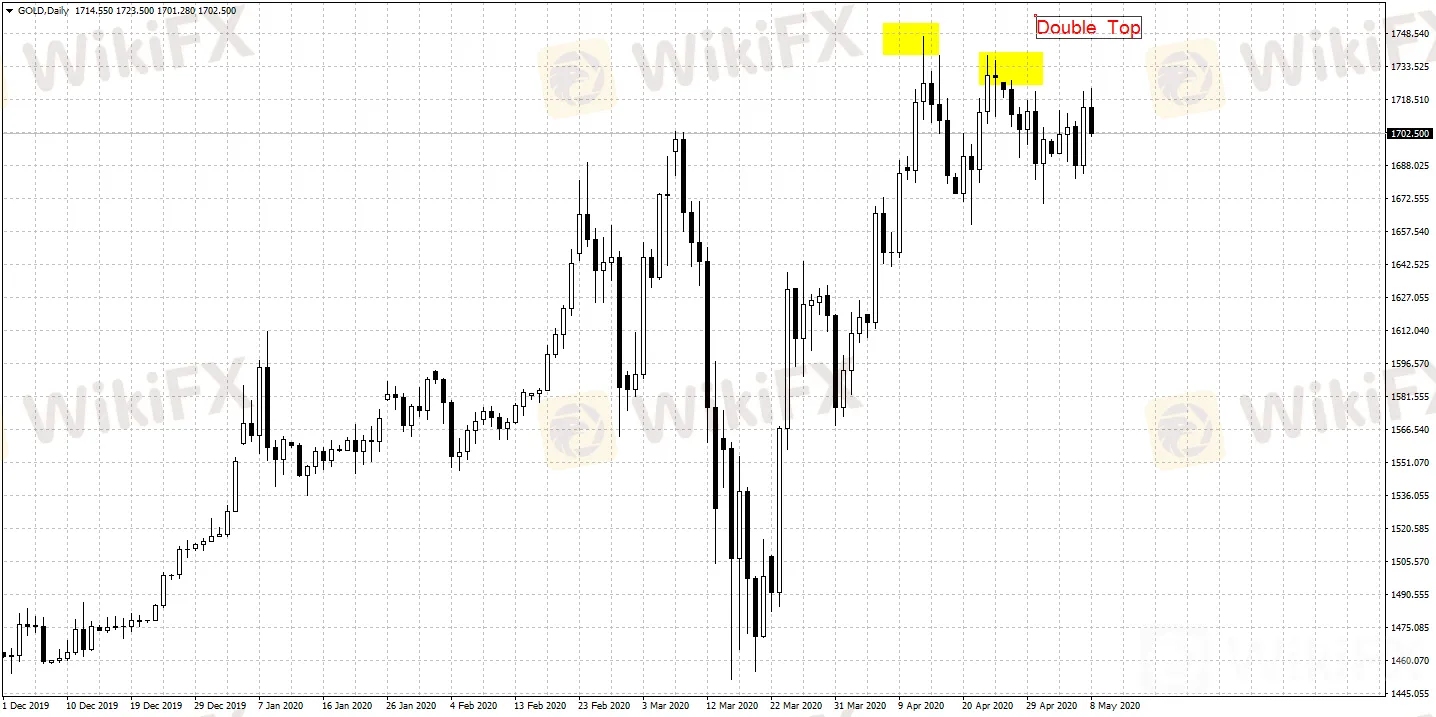

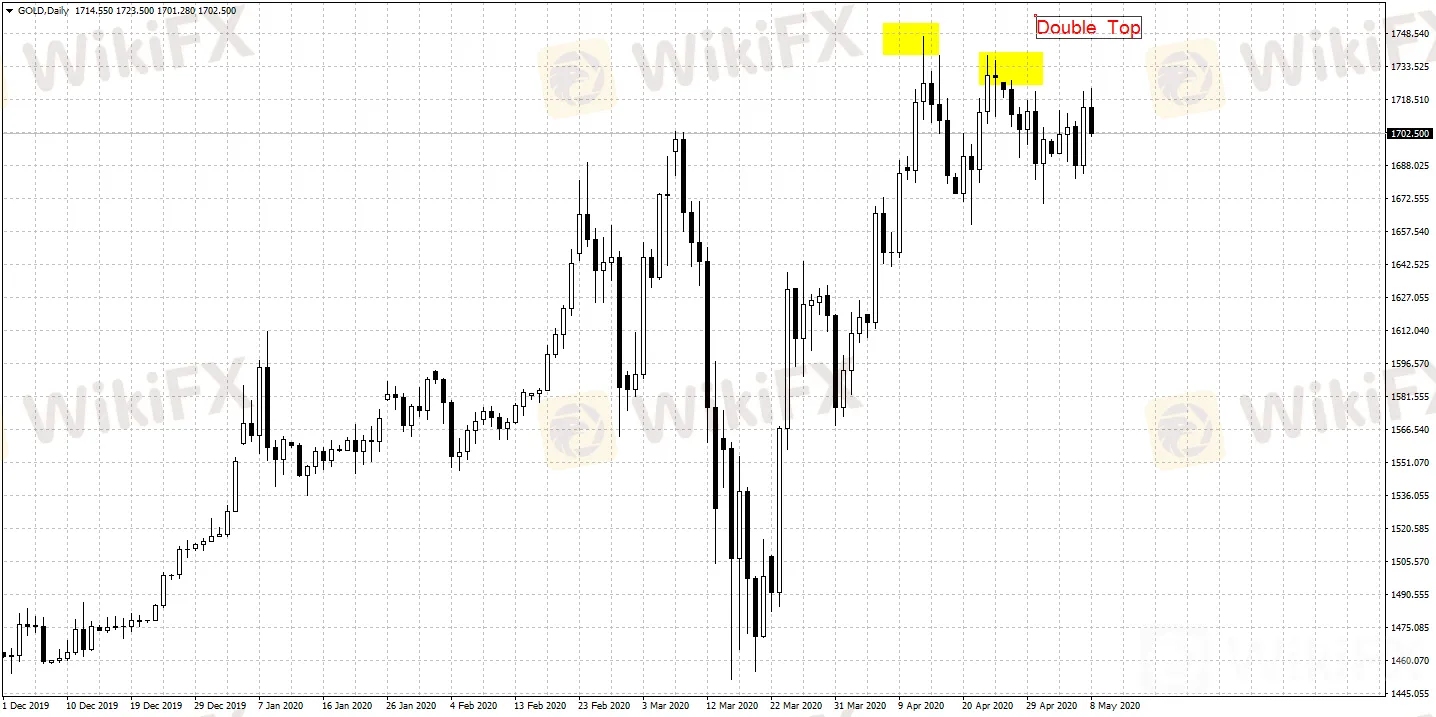

The reason for gold prices plummet is that facing market liquidity drain, investors thus sell off gold for dollars in order to pay margin calls. From our observation, the foreign exchange reserves of global central banks are shrinking rapidly, and a bullish trend of the USDX recently indicates there may be another round of dollar shortage in the market.

Given that many central banks have cut their holdings of US Treasury Bonds and the Fed may reduce quantitative easing scale, it seems that global central banks have few options to acquire dollar liquidity other than selling off gold reserves. As most central banks are currently focused on reviving domestic economy, this only increases their demand for dollar. Central banks in countries such as Sri Lanka, Germany and Tajikistan have begun selling their gold reserves.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.