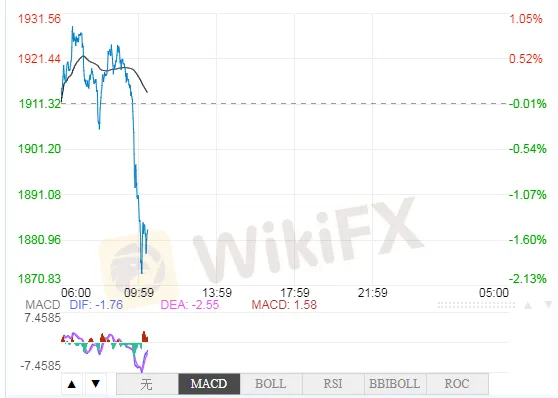

Gold crashes 21%!!!

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Gold prices recorded the biggest loss for seven years this Tuesday, returning markets into anxiety about precious metals. Nevertheless, they are expected to rise again according to Commerzbank.

WikiFX News (15 Aug)- Gold prices recorded the biggest loss for seven years this Tuesday, returning markets into anxiety about precious metals. Nevertheless, they are expected to rise again according to Commerzbank.

On Tuesday, spot gold breached below $1,910/oz, down 6% on the day.

According to Carsten Fritsch, the analyst of Commerzbank, gold prices saw extensive gains in the last few weeks - first penetrating $1,920, then soaring above $2,000, and even approaching $2,100 last week. “The scale of the upswing over the past four weeks has been excessive. Sentiment towards gold became positive in the extreme, with only a minority of participants sounding a note of caution,” said Fritsch.

In addition, this rally was largely driven by investors appetite, which might be enough to put premium on gold prices but not enough to sustain the uptrend. “The price rise was almost solely attributable to robust investor demand, with all other demand components playing hardly any role. It is understandable that investors now appear to be taking profits.”

However, the analyst indicated that a very significant correction like in mid-March is very unlikely. Most importantly, Fritsch noted, this is not the end of the road for gold and silver prices, and the rally will resume after prices consolidate lower.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

You can also find us here-

Vietnam: www.facebook.com/wikifx.vn

Thailand: www.facebook.com/wikifx.th

Indonesia: www.facebook.com/wikifx.id

South Asia: www.facebook.com/wikifxglobal

Italy: www.facebook.com/wikifx.it

Japan: www.facebook.com/wikifx.jp

India: www.facebook.com/wikifx.in

Pakistan: www.facebook.com/wikifx.pk

Bangladesh: www.facebook.com/wikifx.bd

Arabian countries: www.facebook.com/wikifx.arab

Russian countries: www.facebook.com/wikifx.russian

French countries: www.facebook.com/wikifx.French

Western Pacific area: www.facebook.com/wikifx.westernpacific

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

Malaysia’s retail gold prices have hit record highs, with 999 fine gold reaching RM700 per gram and 916 gold rising to RM650, driven by surging global gold prices, geopolitical tensions, and growing expectations of further US interest rate cuts.

Gold has made yet another all-time high, but this time, nobody is talking about it.

The spectacular year-end rally in precious metals hit a wall on Monday, as gold and silver prices collapsed from fresh all-time highs. Traders aggressively booked profits in a market thinning out for the holidays, amplifying volatility and triggering a sharp technical correction.