Gold crashes 21%!!!

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:On Monday, gold prices continued retreating in Asian markets while trimming early losses below $1,900 to $1,882 in U.S. markets.

WikiFX News (22 Sept.) - On Monday, gold prices continued retreating in Asian markets while trimming early losses below $1,900 to $1,882 in U.S. markets. The yellow metal may be hampered by the massive selling for its price is recently more sensitive to bad news than good news.

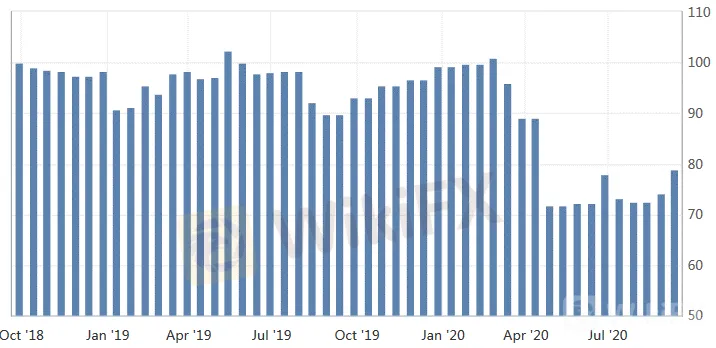

The University of Michigan said its U.S. consumer sentiment index in September rose to 78.9, the best level since March. The data indicates that consumers hold positive expectations about the country's economic prospects.

Kaplan, president of the Dallas Fed, predicted the U.S. will see an economic recovery next year and the unemployment will likely approach 3.5% by 2023. These hawkish words catalyzed the DXY up above $93.50.

Pressed by the strengthening greenback, the intraday price of gold kept declining after a rally to $1,955. Moreover, the Trump administration has softened its stance on Tiktok, which also weakened the markets' safe-haven demand for gold.

The Fed Chair Powell will testify before Congress this Wednesday and Thursday. He is generally considered to reiterate the views that economic prospects will rally and fiscal policy is of vital importance, which could further strengthen the U.S. dollar and send gold prices lower.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: Consumer Sentiment Index

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

Malaysia’s retail gold prices have hit record highs, with 999 fine gold reaching RM700 per gram and 916 gold rising to RM650, driven by surging global gold prices, geopolitical tensions, and growing expectations of further US interest rate cuts.

Gold has made yet another all-time high, but this time, nobody is talking about it.

The spectacular year-end rally in precious metals hit a wall on Monday, as gold and silver prices collapsed from fresh all-time highs. Traders aggressively booked profits in a market thinning out for the holidays, amplifying volatility and triggering a sharp technical correction.