Abstract:As NFT trading volumes surge, self-policing across the NFT market place is going to be needed to avoid harsh regulatory action.

OpenSea has had plenty of airtime on the news wires in recent weeks. A surge in NFT trading activity and rise in scams and thefts have put the NFT marketplace in the spotlight.

Recent NFT News to Draw Regulatory Interest

Back in late December, news had hit the wires of a $2.2m NFT theft that led to OpenSeas intervention. A decision by OpenSea to freeze the stolen NFTs on the marketplace raised questions over decentralization at the time. Since then, OpenSea faced its first rug pull of the year, refunded $1.8m as a result of an exploit, and reversed a decision on minting limits as a result of a community backlash.

Amidst all of the activity and chatter, however, NFT trading activity has surged at the turn of the year. According to a report on Monday, NFT trading volume is on target for a $7bn ATH in January.

Joining market leader OpenSea is new comer LooksRare, which looks set to eat into some of OpenSeas market share. According to the report, OpenSea had frequently accounted for over 80% of monthly trading volumes in 2021.

Global Regulatory Scrutiny Continues to Gain Momentum

Increased NFT activity, record trading volumes and new players in the market have drawn regulatory interest. Regulators in China, as well as lawmakers from India, the UK, and the U.S have called for increased NFT market oversight.

With calls for increased oversight and a White House Executive Order imminent, some form of regulatory oversight is likely. How it will impact the NFT marketplace remains to be seen. Some oversight may be needed as market activity continues to surge.

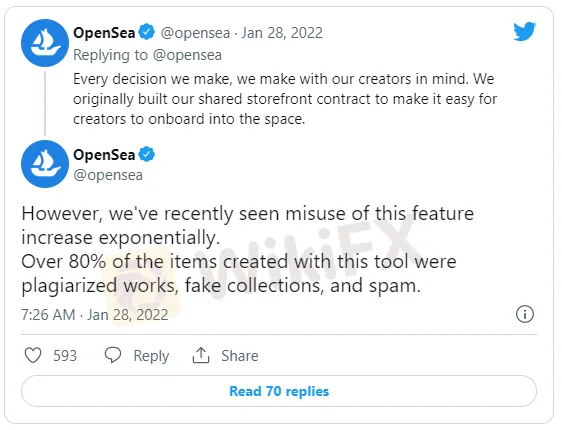

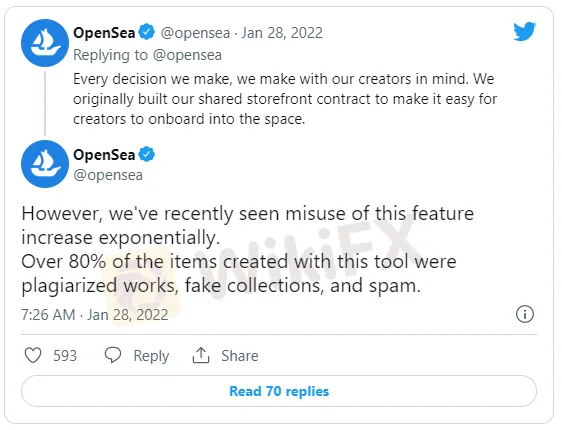

OpenSea Free Mint Feature Drives Plagiarism

In 2021, OpenSea released a new NFT feature called “Lazy Minting”. The move was to allow artists to mint NFTs without having to meet gas costs upfront. Creators can mint NFTs on the Ethereum (ETH) and Polygon (MATIC) blockchains. As a result of a surge in plagiarism and other illicit activity, however, OpenSea briefly introduced a cap on free minting. In spite of talk of plagiarism, a community backlash led to the removal of the cap.

For the NFT marketplace, the numbers will be of concern amidst heightened regulatory scrutiny. Late last week, OpenSea had revealed that over 80% of free minted NFTs were either plagiarized, spam, or fake.

In August of last year, news had hit the wires of a fake Banksy NFT fetching $336,000.

For OpenSea and other marketplaces, stamping out such activity will be key to driving trading volumes higher. Inaction could well end up with action from regulators that could hurt growth in the NFT space.