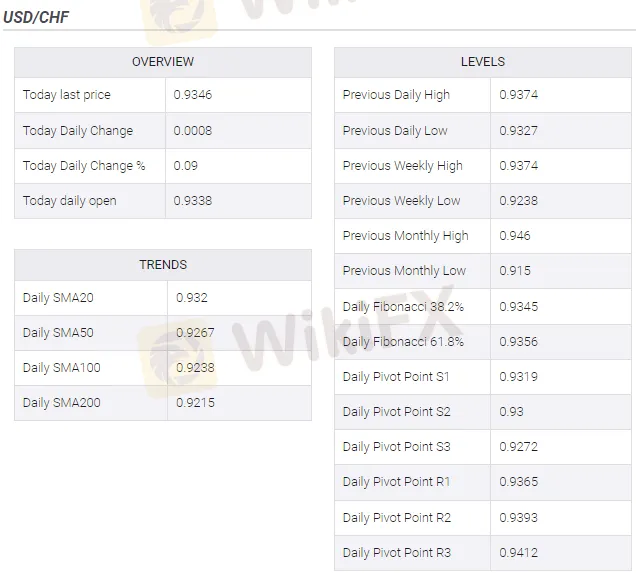

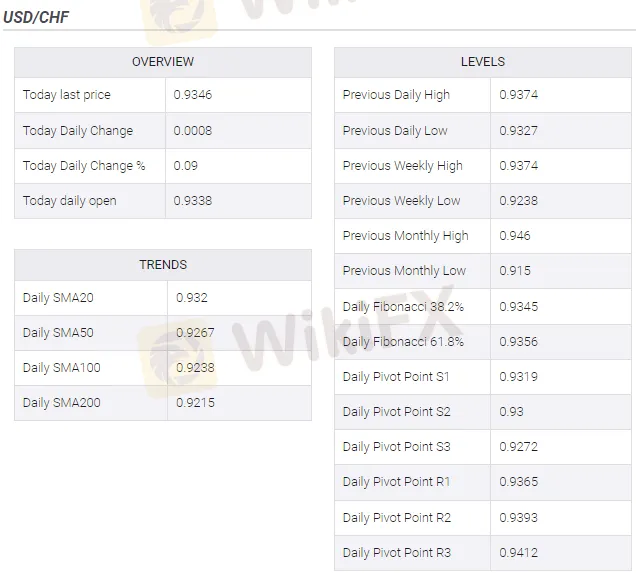

Abstract:USD/CHF shrugs off the negative opening and is aiming toward the previous weeks high at 0.9370.

An estimate of a higher US CPI print at 8.3% is underpinning a jumbo interest rate elevation by the Fed.

Feds Mester is expecting that inflation will continue to remain higher even next year.

The USD/CHF pair is witnessing a sheer upside move on Monday after a tad negative opening gap at around 0.9310. Usually, a firmer responsive bullish move by the market participants after a gap-down opening denotes a bargain buy for investors.

The pair is carry-forwarding the optimism of last week as the Swiss Unemployment Rate remained unchanged at 2.2%, which underpinned the mighty greenback against the Swiss franc.

The asset is tracing the movement of the US dollar index (DXY), which is likely to remain to print wild swings as investors are waiting for the release of the US Consumer Price Index (CPI) on Tuesday. This will have a significant impact on the likely monetary policy action by the Federal Reserve (Fed) in May.

Market consensus is displaying the print of the yearly US inflation at 8.3%, principally higher than the previous figure of 7.9. On the US inflation front, Cleveland Federal Reserve (Fed) president Loretta Mester on Sunday has stated that Inflation will remain high this year and next even as the Fed moves steadily to lower the pace of price increases, as per Reuters. To contain the inflation below the targeted figure of 2%, a decent healthy period is required and till then an aggressive hawkish stance is the expectation from the Fed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.