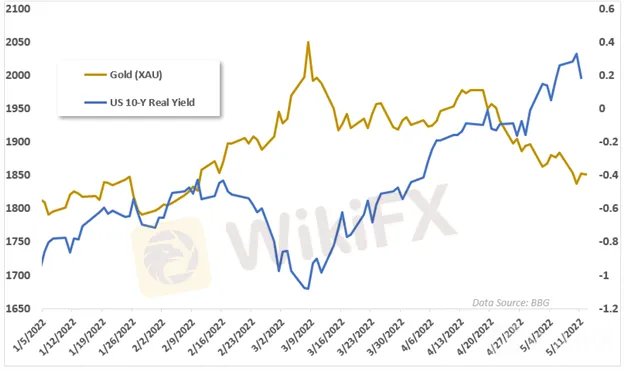

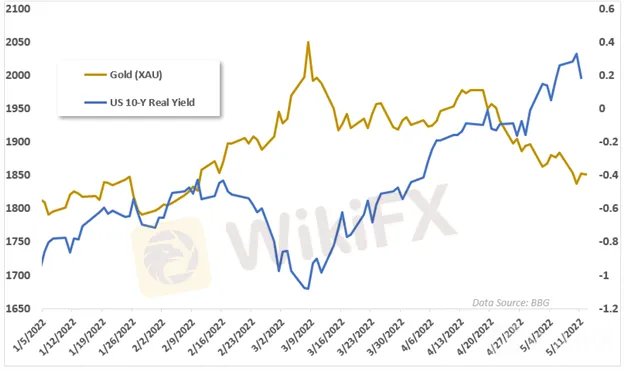

Abstract:The reaction in gold was likely due to the Treasury market’s behavior. Real yields – a major driver for bullion prices, fell following the CPI print. Lower real yields benefit gold because it is a non-interest-bearing asset, which lowers the opportunity cost of gold. The 10-year inflation-indexed rate fell 15-basis points overnight but remain in positive territory. The yellow metal may continue to gain if real yields drop further.

Gold, USD/XAU, Inflation, Real Yields, producer prices - Talking Points

US producer price index (PPI) may sway bullion prices further

Gold gains as CPI data hints that inflation may have peaked

XAU climbs above January high, potentially fueling further gains

Gold prices staged a rebound overnight after inflation cooled slightly in the United States, according to the latest consumer price index (CPI) for April. The CPI crossed the wires at 8.3% on a year-over-year basis. That was higher than the 8.1% Bloomberg consensus estimate. However, it was slightly lower from Marchs 8.5% y/y figure.

The reaction in gold was likely due to the Treasury markets behavior. Real yields – a major driver for bullion prices, fell following the CPI print. Lower real yields benefit gold because it is a non-interest-bearing asset, which lowers the opportunity cost of gold. The 10-year inflation-indexed rate fell 15-basis points overnight but remain in positive territory. The yellow metal may continue to gain if real yields drop further.

Tonight will bring the US‘s producer price index (PPI) data for April. Analysts see PPI cooling to 0.5% on a month-over-month basis, according to a Bloomberg survey. That would be down from 1.4%, representing a rather significant drawdown. That may help to calm inflationary fears, as factory-gate prices are sometimes seen as a leading indicator for downstream inflation. Gold may move higher if tonight’s data comes in below expectations.

USD/XAU Technical Forecast

Gold prices are moving above the January swing high through Asia-Pacific trading, a level that has previously provided support. Holding that level may ignite further bullish energy to drive prices higher. If so, the falling 20-day Simple Moving Average (SMA) may cap upside. Meanwhile, MACD and the RSI oscillators appear to be improving.

USD/XAU Daily Chart

If you want to know more information about the reliability of certain market new, you can open our website (https://www.WikiFX.com/en). Or you

can download the WikiFX APP for free through this link

(https://www.wikifx.com/en/download.html). Running well in both the

Android system and the IOS system, the WikiFX APP offers you the best information.