Abstract:Some people complain that their forex trading platform is unstable and there is downtime resulting in the inability to close their positions. This article will introduce

a new WikiFX function that allows you to inspect the stability of your trading environment.

Choosing a regulated and safe forex broker is a prerequisite for a stable trading environment as many fraudulent brokers leverage off a poorly maintained trading environment to capitulate their clients' accounts. However, this does not mean that reliable brokers can provide a high level of stability as many factors can affect an online trading environment.

The stability of the platform directly affects whether your transactions can be carried out properly, whether you can accurately place orders and close positions promptly and how much transaction a trader/investor is paying.

This article is specially written to introduce WikiFX's Trading Environment Ranking tool (https://cloud.wikifx.com/en/data/EnvRanking.html) which will conveniently evaluate and rank your trading environment. These results were collected over time with over 55,000 participants with over 4 million transactions that have an accumulated occupancy margin of approximately 330 million USD.

Source: WikiFX

This is an example to demonstrate how WikiFX evaluates a broker's trading platform. The broker used in this example is Forex.com – for more information about this broker, log on to https://www.wikifx.com/en/dealer/0001378443.html.

WikiFX's VPS will examine 4 different aspects of a trading environment, which are transaction speed, trading slippage, transaction cost, rollover cost, and disconnection rating, before benchmarking the selected brokers with their industry peers.

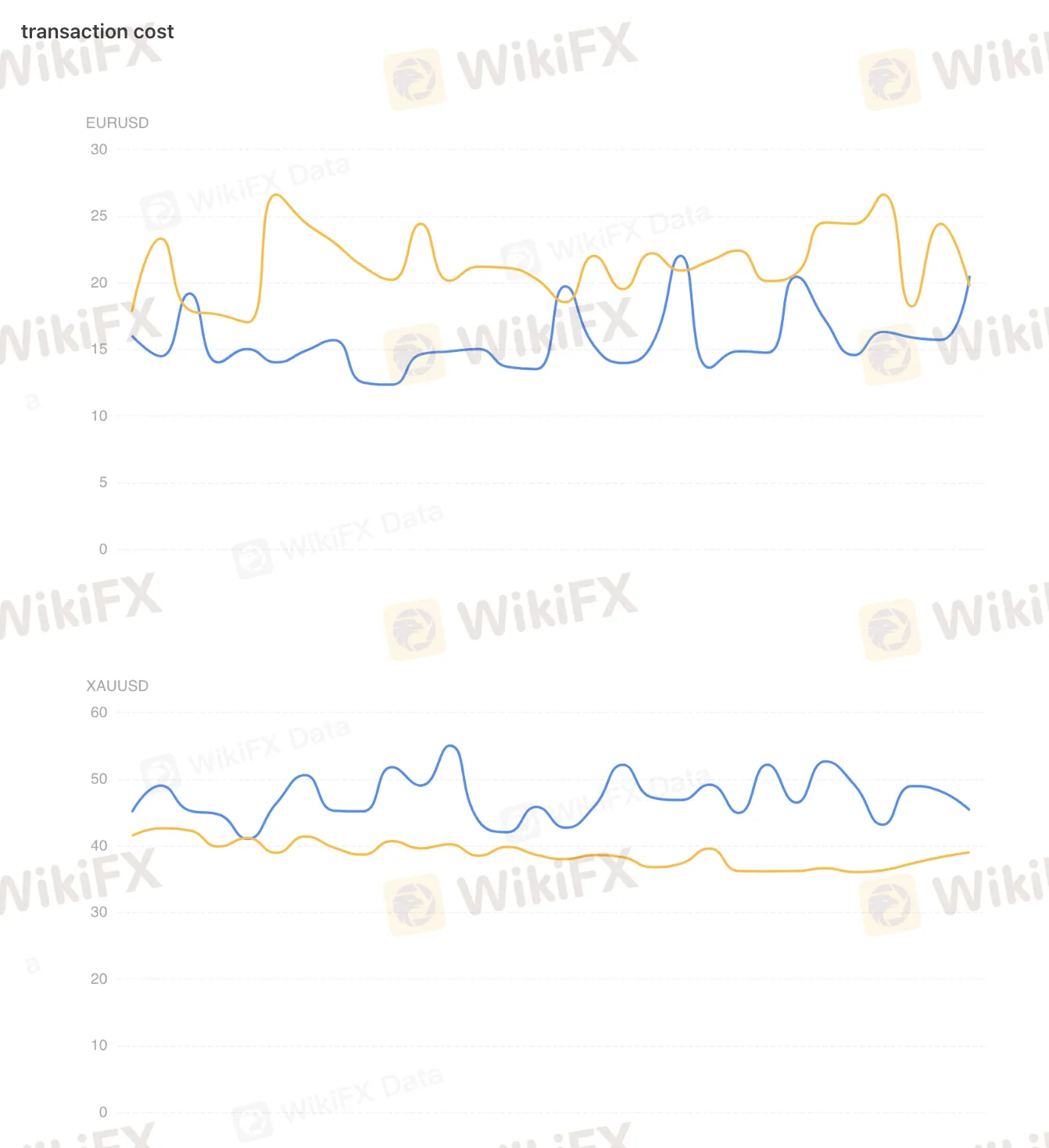

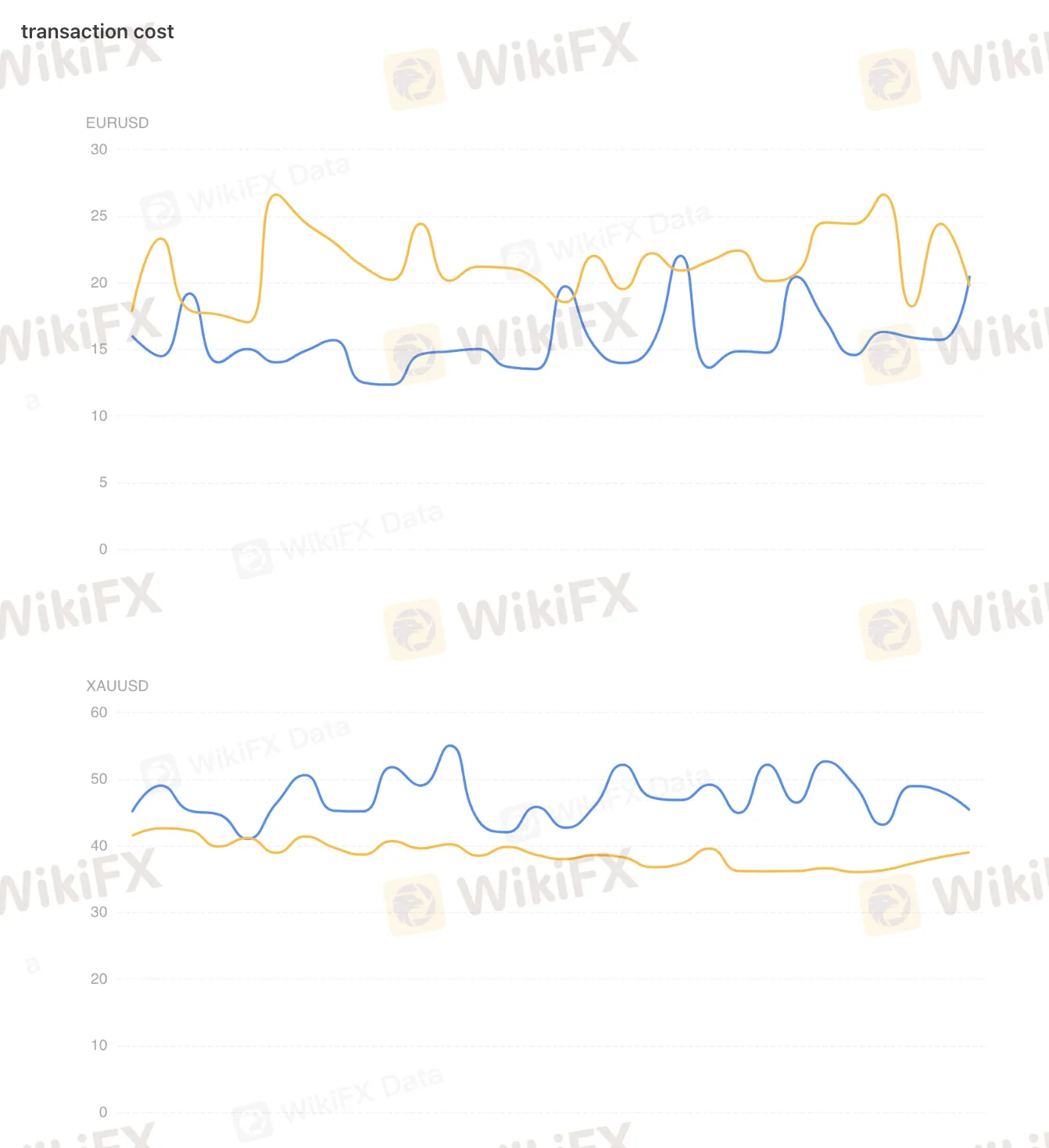

Blue line represents Forex.com; Orange line represents the industry benchmark

(i) The transaction speed is measured by reviewing the below components:

Average transaction speed (ms)

The fastest transaction speed (ms)

The fastest speed of opening positions (ms)

The fastest speed of closing positions (ms)

Slowest transaction speed (ms)

The slowest speed of opening positions (ms)

The slowest speed of closing positions (ms)

(ii) Trading slippage is measured by inspecting these 4 areas:

Average slippage

Maximum transaction slippage

Maximum position slippage

Maximum negative slippage

(iii) Transaction costs are calculated from the average transaction cost of main currency pairs, for example, EUR/USD and XAU/USD.

(iv) The rollover cost ranking is calculated from the cost of holding an overnight trade of main currency pairs, for example, EUR/USD and XAU/USD.

(v) Software disconnection is one of the most frustrating incidents that a trader could occur especially when the market is having fairly high volatility. In this case, it is measured by the average disconnection frequency (times/day) and average reconnection time (millisecond/per request).

If you wish to compare several brokers of your choice, you could click the blue button as shown in the image above and select the names of those brokers.

WikiFXs VPS enables you to compare up to 5 brokers simultaneously and provides detailed insights about their trading environments.

Through this, you could easily avoid brokers that do not have a stable system because making profits from the currency markets is hard enough, the last thing you need are technical issues that could turn your running profits into losses in just a blink of the eye.

It is important to note that finding the most reliable broker should be the utmost priority for a trader and/or investor - before you start evaluating its trading environment. Head over to WikiFXs official website www.wikifx.com or download the free WikiFX mobile app on Google Play and App Store right now to find the trustworthy forex broker for you in every aspect.