Abstract:The technical picture for the USD is looking more troubled as the index extends losses below the 103 handle. The latest catalyst stemming from reports that US President Biden is considering a move to cut China tariffs in order to ease inflationary pressures.

USD Price Analysis & News

· USD Losses Extend as China Tariff and ECB REC Hike Talk

· Build up of USD Longs Create Worrying Short Term Picture

The technical picture for the USD is looking more troubled as the index extends losses below the 103 handle. The latest catalyst stemming from reports that US President Biden is considering a move to cut China tariffs in order to ease inflationary pressures. This prompted a modest boost in risk sentiment, sapping demand from the safe-haven Dollar. What‘s more, hawkish comments from ECB’s Laggard further exacerbated losses in the greenback with the ECB President essentially pre-committing to a 25bps rate hike in July and September.

ECB LAGARDE

“Based on current outlook, we are likely to be in a position to exit negative interest rates by the end of the third quarter”

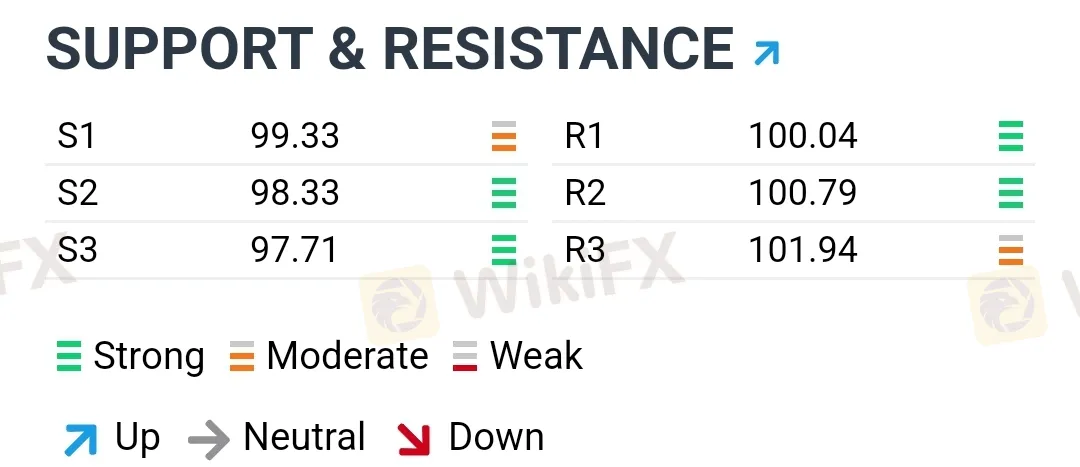

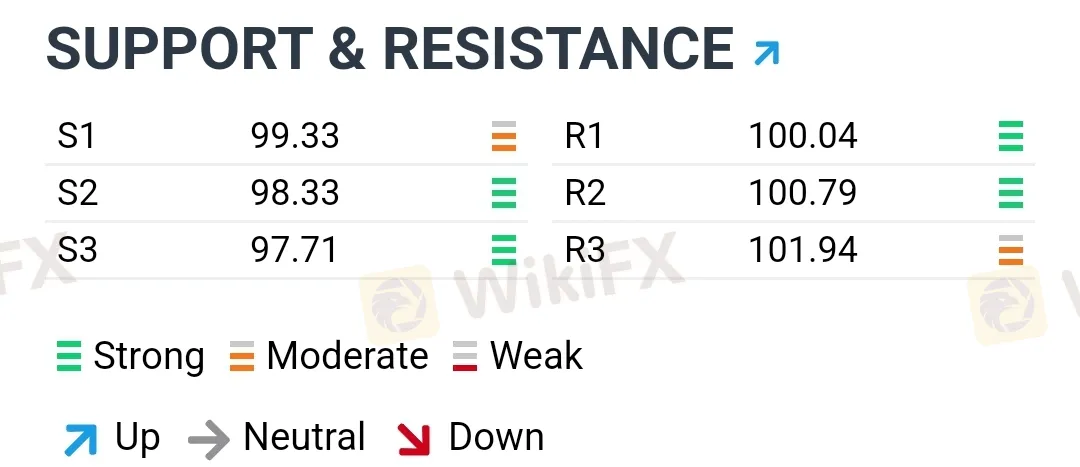

That being said, with positioning also very much on the long USD side, there could more pain for the USD as bullish bets are squeezed, particularly if equities remain stable. In turn, 103 now represents resistance, while short term support sits at 101.28, which marks the 23.6% retracement of the Jan 2021-May 2022 bull trend. Elsewhere, across the majors, while 1.07 will be watched in EUR/USD the area to watch will be 1.0750, meanwhile, 127.00 will be key for USD/JPY

Data shows 67.81% of traders are net-long with the ratio of traders long to short at 2.11 to 1. The number of traders net-long is 0.12% lower than yesterday and 15.26% lower from last week, while the number of traders net-short is 0.94% lower than yesterday

and 26.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR /USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

US Dollar Chart: Daily Time

If you want to know more information about the reliability of certain

brokers, you can open our website (https://www.WikiFX.com/en). Or you

can download the WikiFX APP for free through this link

(https://www.wikifx.com/en/download.html). Running well in both the

Android system and the IOS system, the WikiFX APP offers you the easiest

and most convenient way to seek the brokers you are curious about.