Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The Russian government is adjusting its digital asset tax rates in an effort to encourage more adoption as avenues of traditional finance are being increasingly blocked off.

A proposed draft law will drop VAT for local crypto companies by 35%.

Russia is trying to encourage more crypto adoption in the face of financial sanctions.

Crypto markets have shed 46% since the war in Ukraine began.

Russia is increasingly turning to digital assets as Western-imposed sanctions, and financial restrictions continue to erode its ability to transact with other nations.

On June 28, Russian lawmakers approved draft legislation that would potentially exempt issuers of crypto assets from value-added tax (VAT). Currently, the tax rate for companies conducting digital asset transactions is 20%.

Under the new rate, this will be dropped to 13% for Russian exchanges on the first 5 million rubles (around $US94,000) annually. Foreign exchanges and crypto asset companies will be subject to 15% VAT, according to local media.

The Russian central bank, like most others around the world, has taken a harsh stance against cryptocurrencies. In February, financial regulators issued the first digital assets license for local platform Atomyze Russia, and one for leading lender Sberbank followed.

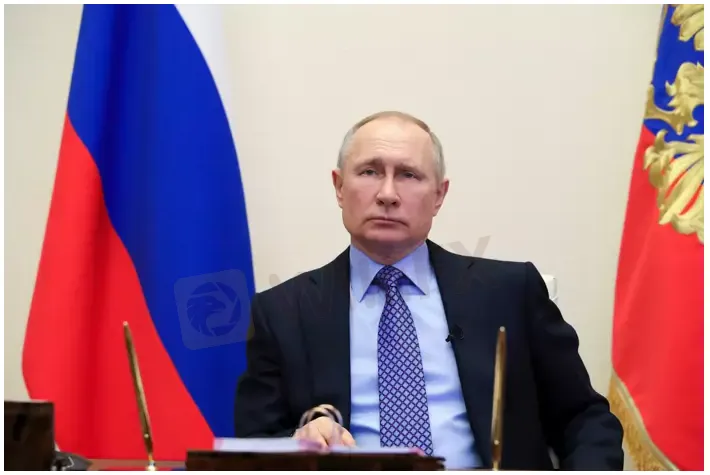

In addition to the tax cuts for issuers, the draft law approved by State Duma members also establishes tax rates on income earned from the sale of crypto assets. However, the legislation must still be reviewed by the upper house and signed by President Vladimir Putin to become law.

The law, if passed, will establish specifics regarding digital asset operations and what the government calls utilitarian digital rights (UTR), which it considers similar to securities.

The move comes as financial restrictions continue to hamper the country‘s ability to transact globally in the wake of Vladimir Putin’s invasion of Ukraine. Most major Russian banks have been blocked from the international payments channel, SWIFT.

Anti-crypto U.S. politicians used the premise that Russia would pivot to crypto to evade sanctions in an effort to further crack down on them, but it simply hasnt happened yet.

Russias financial woes are worsening as this week, it defaulted on its foreign debt for the first time since the Bolshevik revolution, also known as the October Revolution in 1917. Russia failed to pay interest on two bonds during a 30-day grace period that expired on June 26.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Exposed: Amaraa Capital is a forex scam. Protect your funds—read this detailed scam alert now and avoid risky forex investments.

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.