Simulated Trading Competition Experience Sharing

Champion Strategy Revealed: Get a Head Start on Winning

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:India is becoming a more popular country for forex trading. As more people have access to the limitless earning possibilities of this industry, it is on the one hand an encouraging trend. On the other side, it heralds a tremendous flood of individuals with no prior trading experience and inadequate knowledge of the financial markets.

Forex trading is becoming increasingly popular in India. On the one hand, it‘s an inspiring trend as more people get access to this market’s unlimited earning potential. On the other hand, it means a massive influx of people with zero trading experience and a weak grasp of financial markets. Additionally, enthusiastic newbies are often misguided by promises of rapid and easy enrichment. The combination of these three factors increases the risk of loss.

As a responsible broker, Olymp Trade seeks to minimise those risks and create happier customers. Apart from providing its clients with cutting-edge trading tools, the platform attaches great importance to education and training. To help as many people as possible become successful, its important to debunk popular misconceptions about FX trading and highlight seven rules that will guide you safely to sustainable profits.

Here are some dos and donts every ambitious trader should keep in mind:

Dont use money you cannot afford to lose

Although many newbies believe in risk-free trading, no expert can forecast price movements with 100 per cent certainty. Currency pairs, stocks, commodities, and indices may go up and down for no apparent reason. Therefore, even professional market analysts make incorrect forecasts once in a while.

It means you should refrain from using your emergency fund or retirement savings for trading. Also, it would be a bad idea to borrow money from your friends, sell your car, mortgage your house, or get a bank loan to raise funds for trading.

To fund your trading account, use the money you can comfortably lose. Its up to you to decide on the percentage, but never jeopardize your lifestyle, health, and safety in your pursuit of trading profits.

Dont set unrealistic goals

Have realistic expectations. Beginners are often thrilled by incredible rags-to-riches stories worthy of a Bollywood movie. Unfortunately, this mindset makes many people fall for scams or promises of fast multiple returns.

To avoid this trap, make your goals SMART (specific, measurable, attainable, rewarding, time-bound). It could be paying off all your debts, getting a university education, buying a bigger house, or starting a family or a business. Then determine the size of your trading capital, create a realistic roadmap, and make your deadlines clear. If you want to achieve your goal faster, familiarise yourself with the basics of money management.

Follow money management principles in forex trading

When applied to trading, these four money management rules will let you curb your risks and make more profits over time.

Know your risk tolerance: It will help you understand and manage your trading risks. Your risk tolerance depends on your age, your goals best-before date, your experience, and the size of your investment capital. Choose assets that correspond to your risk profile.

Diversify your portfolio: Diversification is a cornerstone of safe trading. Spread your funds across multiple assets to reduce the overall risk of loss. Make sure your assets have negative or low correlation, meaning their prices move in different directions.

Set your risk per trade limit: Risk no more than a small percentage of your deposit when making a trade. Even if you have several losing trades in a row, you will be able to recover from this damage after a few successful trades.

Set the maximum amount you can win or lose: Use stop loss and take profit to exit the trade at the right moment. It will let you optimally balance your gains and losses. Besides, it will save you a lot of stress.

Keep learning

Behind every good trader, there is a lot of learning. While the idea of trading is easy to understand, it requires practice to become successful.

Read books, watch explainer videos, stay updated on the market news, attend trading webinars, and absorb expert advice. Also, it‘s highly recommended to hone your skills using a demo account funded with virtual money. It’s a safe way to learn from the mistakes all traders make early in their careers. When you switch to a live account, this experience will reduce your trading risks.

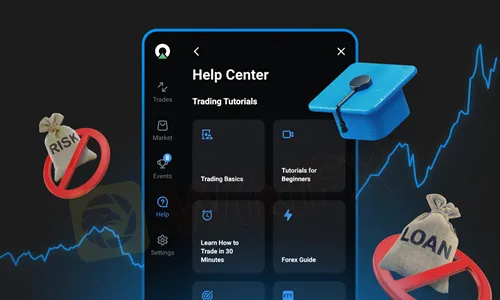

Olymp Trade goes to great lengths to provide its customers with all the educational resources they need. The platforms analysts regularly hold webinars on various trading strategies and share their price forecasts. Whatever learning format you prefer, Olymp Trade has got you covered.

There is an official YouTube channel with dozens of helpful videos and a help center with compartmentalised how-to guides. Additionally, Olymp Trade uses its social media pages to keep you updated on major economic news and explain how to use this info for your benefit.

Control your emotions

You would be amazed how many people see trading as an emotionally-charged game with huge potential gains. This approach is often ruinous, and responsible brokers always warn their clients against it. So does Olymp Trade.

Keep your emotions under control during good and bad days. It helps you avoid the dangers of FOMO trading when you are ruled by anxiety and fear of missing an opportunity. Its essential to understand what stands behind your emotions, what factors trigger them, and how they negatively affect your results.

Keep a record of all your trades and have a solid strategy. It will guide your decisions and keep emotions in the backseat.

Dont ignore safety measures

There are many scammers who prey on beginner investors and traders using social engineering techniques. Even if you use the safest trading platform in the world, following the basic security rules is a must.

Here are ways to protect your money and sensitive information:

● Set a strong password that would be hard to guess or crack.

● Avoid using public wi-fi networks. They are not secure. Dont trade convenience for safety.

● Use a bookmark to enter the platforms official website to avoid phishing schemes.

● Pass the verification procedure on the platform to secure your account.

● Run high-quality anti-virus software. Remember that freeware products offer limited protection. Its not enough for safe trading.

● Dont log in to your account using a public or co-used computer.

● Log out every time you leave your device unattended.

● Don‘t trust your funds to ’experts who are ready to trade for you, especially if they promise significant returns.

● If your broker‘s ’representative‘ contacts you directly with an exclusive offer, it’s most likely a scam.

● In case of doubt, contact your brokers customer support.

Choose a trustworthy broker

This point should probably be at the top of the list. Make sure the broker you select is trustworthy.

Olymp Trade is an excellent example of a safe and reliable broker. This top-tier platform has been in the market since 2014 and has an excellent record. As for credentials, Olymp Trade is a Category A member of the Financial Commission and is certified by Verify My Trade, an independent auditor. It guarantees that the platform offers the best-quality service and fair pricing.

The broker builds its relationships with customers based on trust, so its always honest about the trading risks they run. To minimise those risks, Olymp Trade encourages its customers to keep learning and provides them with all the necessary resources and advice.

This explains why Olymp Trade has more than 60 million registered user accounts and successfully operates in 194 countries including India.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Champion Strategy Revealed: Get a Head Start on Winning

The formation of the SkyLine Guide 2026 Thailand judge panel has officially begun. This year’s selection brings important upgrades to both the evaluation mechanism and participation approach, further emphasizing the role of local perspectives and authentic investor experiences within the judging framework.

WikiFX Elite Club Focus is a monthly publication created exclusively for members of the WikiFX Elite Club. It spotlights the individuals, ideas, and actions that are genuinely driving the forex industry toward greater transparency, professionalism, and long-term sustainability.

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!