Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

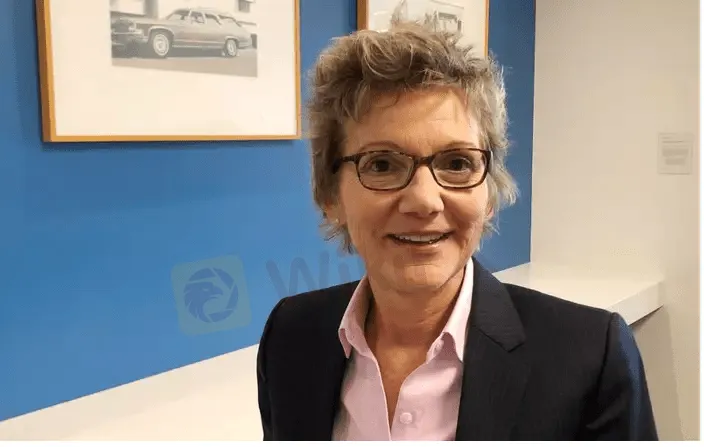

Abstract:San Francisco Fed President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation after new data showed a reprieve in consumer price pressures, the Financial Times reported on Wednesday.

San Francisco Federal Reserve Bank President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation, the Financial Times reported on Thursday.

Dalys remarks comes as U.S. consumer prices remained unchanged in July due to a sharp drop in the cost of gasoline, delivering the first notable sign of relief for weary Americans who have watched inflation climb over the past two years.

In an interview with the Financial Times, Daly did not rule out a third consecutive 0.75% point interest rate rise at the central banks next policy meeting in September, however, she said that a half-percentage point rate rise was her “baseline”. (https://on.ft.com/3SEkQ7E)

“Theres good news on the month-to-month data that consumers and business are getting some relief, but inflation remains far too high and not near our price stability goal,” the newspaper quoted Daly as saying during the interview conducted on Wednesday.

She also maintained that interest rates should rise to just under 3.5 per cent by the end of the year, according to the report. The fed funds rate, the rate that banks charge each other to borrow or lend excess reserves overnight, is currently in the 2.25%-2.5% range.

Slowing U.S. inflation may have opened the door for the Federal Reserve to temper the pace of coming interest rate hikes, but policymakers left no doubt they will continue to tighten monetary policy until price pressures are fully broken.

The Fed is “far, far away from declaring victory” on inflation, Minneapolis Federal Reserve Bank President Neel Kashkari said at the Aspen Ideas Conference, despite the “welcome” news in the CPI report.

Kashkari, the Fed‘s most hawkish member, said he hasn’t “seen anything that changes” the need to raise the Feds policy rate to 3.9% by year-end and to 4.4% by the end of 2023.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Exposed: Amaraa Capital is a forex scam. Protect your funds—read this detailed scam alert now and avoid risky forex investments.

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.