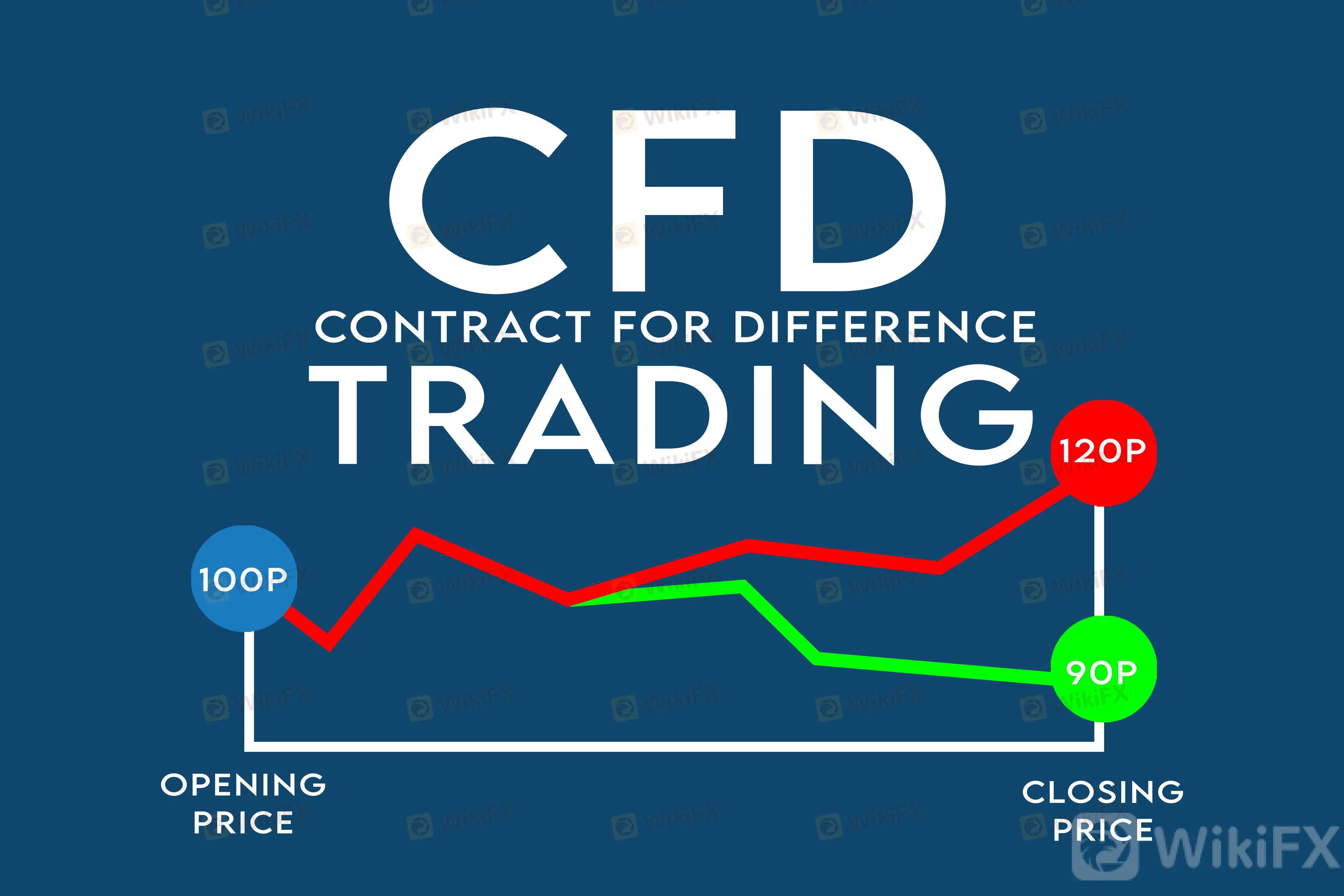

Abstract:We explain how CFD trading works, so you can decide whether you want to start buying and selling contracts for difference today, or in the near future.

What are the mechanics of CFD trading?

CFDs provide access to a wide range of markets, alongside leverage and flexible short trades, so it isnt hard to understand why traders have picked up on them in recent years. CFD (contract for difference) trading is not available in the United States, but our clients in Canada can take advantage of these special trading instruments. In this article, we summarize some of the appeal of CFDs.

Profit from falling markets

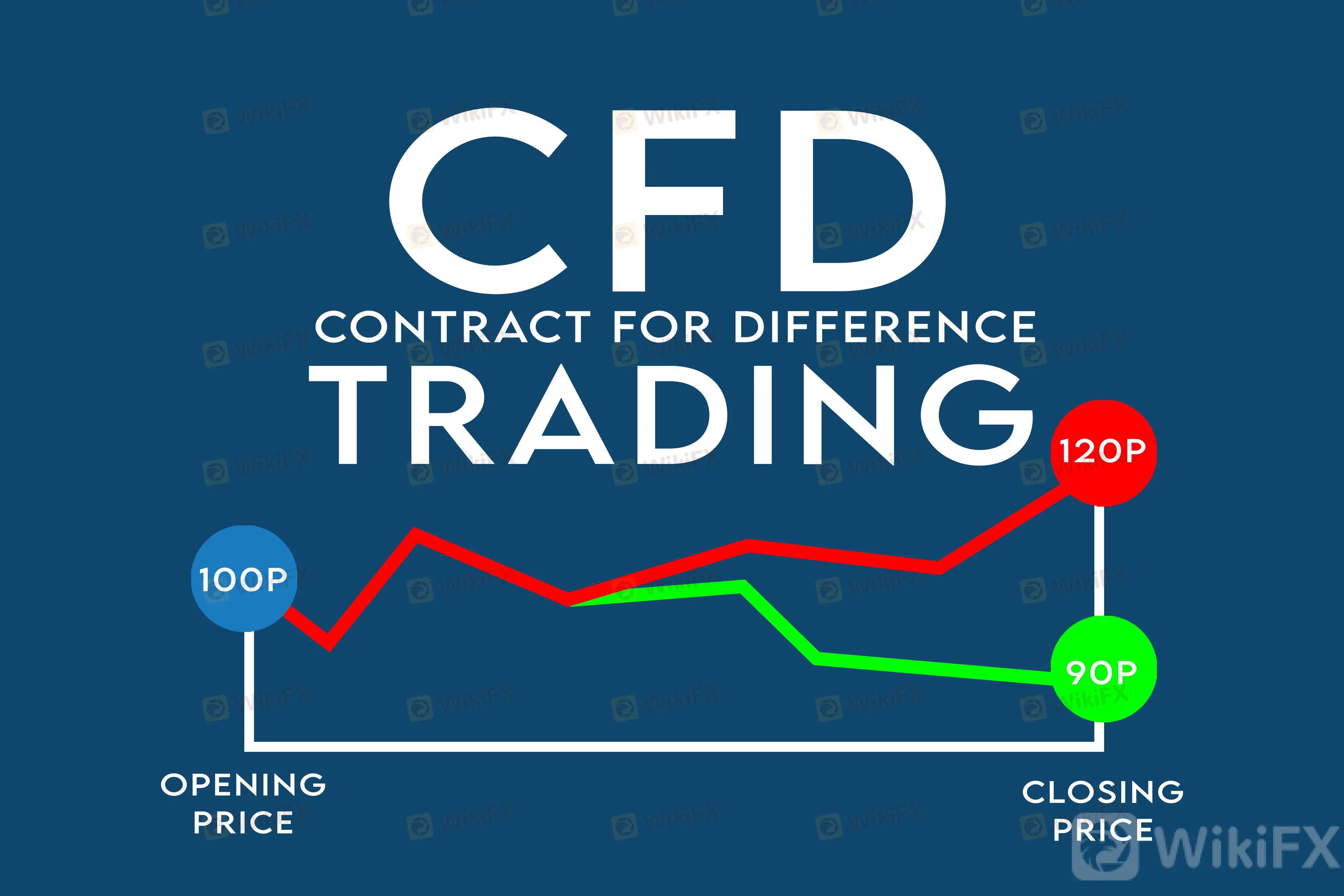

The main difference between CFDs and traditional trading is that with CFDs, you never own the underlying market. This brings several advantages, including the option to go short as well as long.

To open a short CFD position, you sell your chosen number of contracts instead of buying them. Then, when you want to close your trade, you buy the same number of CFDs.

Doing this enables you to profit when markets fall in price, which adds a whole extra dimension to your trading.

Say you've researched a stock but believe that it‘s in for some tough times. Instead of searching for a new opportunity, you could short the company with a CFD, earning a profit if its share price falls. However, if the stock rises instead, you’ll earn a loss.

You don't have to borrow any funds to short a CFD. It's the same process as going long, just the other way around. In all markets where we offer CFDs you can choose to buy or sell. You can pick individual stocks, whole indices (baskets of stocks like the FTSE 100 in the UK or the S&P 500 in the US), or commodities like oil or gold.

Retain your capital by using leverage

Another benefit to never owning the assets you're trading is leverage. Leverage enables you to open positions without paying for their total value. Instead, you pay a deposit known as your margin.

This works because you're only speculating on the price movements of markets, not buying them outright. You may be aware of leverage in forex trading. Its the same principle in CFD trading.

For example, let's say the margin required to trade shares in AMC Entertainment is 30% with a Canadian Dollar-based account. So, to trade $10,000 of shares in AMC you would need $3,000 of your own funds.This means you can avoid tying up all your available capital in just a few positions.

However, it's important to remember that your profit or loss will be based on the full $10,000. If AMC shares move 5% against you, you lose $500, which is a significant portion of your margin. Because of this, using risk management tools – such as stop-loss orders and take profits – is advised.

Whenever you trade with leverage, it is important you understand all the inherent risks involved. Leveraged trading increases your opportunity to profit but also increases risk. Its essential that traders maintain the indicated margin requirements for all open positions in order to avoid any unexpected liquidation of trading positions.

CFDs ‘mirror’ traditional trading

CFDs aren't the only way of trading financial markets without purchasing any assets. There are lots of other derivatives: including futures, options and spread betting.

However, if you're used to the concepts of traditional trading and investing, you might find CFDs a bit easier to understand than other derivatives. That's because with CFD trading, you're buying and selling contracts designed to mirror the assets they represent.

A single CFD tends to represent the standard unit of trading of its underlying market. To set your position size, you decide how many contracts to buy or sell.

If you want to buy the equivalent of 50 AMC Entertainment shares, for instance, you simply buy 50 CFDS in AMC Entertainment stock. If youre speculating that the stock price of AMC is headed downwards, you sell 50 CFDs in AMC.

Trade stocks, indices and commodities

As previously touched on, you can choose from a wide range of markets. Some traders like to focus on CFD stocks by taking positions on individual companies, while others will diversify into both indices and commodities.

One thing to bear in mind is the wide range of minimum margin requirements, the amount you need to hold on deposit in order to take advantage of leverage. This varies quite considerably between asset types and sectors but to help you we have a minimum margin requirements page that provides all the necessary information.

Hedge with CFDs

Remember that you can use CFDs to take short positions? As well as profiting from falling markets, this can be a useful way of offsetting the risk from negative moves in your investment portfolio.

For example, say you hold 1,000 shares in Apple, but are worried that the tech sector has been overbought. You could sell your stock, but that would close your position entirely.

Using CFDs, you can open a short position on 1,000 Apple CFD. Then, any negative moves in your portfolio will earn you a profit from your CFD position, cancelling out the loss.

If tech stocks start to climb again, you can close your CFD position in the knowledge your Apple holding remains untouched.

Try out trading risk free

If you want to see how CFD trading works in practice, you can open a demo account. Demo accounts give you access to the price movements of the same markets that funded account-holders are actively trading. But you get that access with virtual funds. That means you can experience how trading works with none of the risk.

A demo account gives you $50,000 in virtual funds to trade on the live prices of our full range of markets. You'll get complete, unlimited access to all the features and tools of our platform for 30 days, and theres no obligation to convert to a funded account afterwards.

Alternatively, you could go straight to live trading. If you want to start trading CFDs immediately, follow these four steps:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.