Abstract:The foreign exchange (forex) trading platform OctaFX has been added to Bank Negara Malaysia's (BNM) list of Financial Consumer Alerts. By doing this, the central bank has made it clear that the platform is neither authorized nor permitted by BNM's regulations.

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert list to include foreign exchange (forex) trading platform OctaFX. With this, the central bank has clarified that the platform is neither authorised nor approved under the regulations administered by BNM.

In its statement, BNM noted that OctaFX‘s website, as well as official accounts on social media platforms have all been added into the Financial Consumer Alert list. These include the platform’s Facebook, Twitter, Instagram, YouTube, and LinkedIn accounts.

BNM also explained that the Financial Consumer Alert list acts as a guide for investors, so that they are aware of entities and schemes that “may have been wrongly perceived or represented as being licensed or regulated by BNM”. Additionally, the list is updated based on information that is shared by members of the public, with necessary assessments conducted on the reported entities and schemes.

Aside from BNM, the Securities Commission Malaysia (SC), too, had previously added OctaFX to its own Investor Alert List. It was listed based on the justification that the platform had been carrying out capital market activities of dealing in derivatives without a licence, and for operating a recognised market without authorisation from the SC.

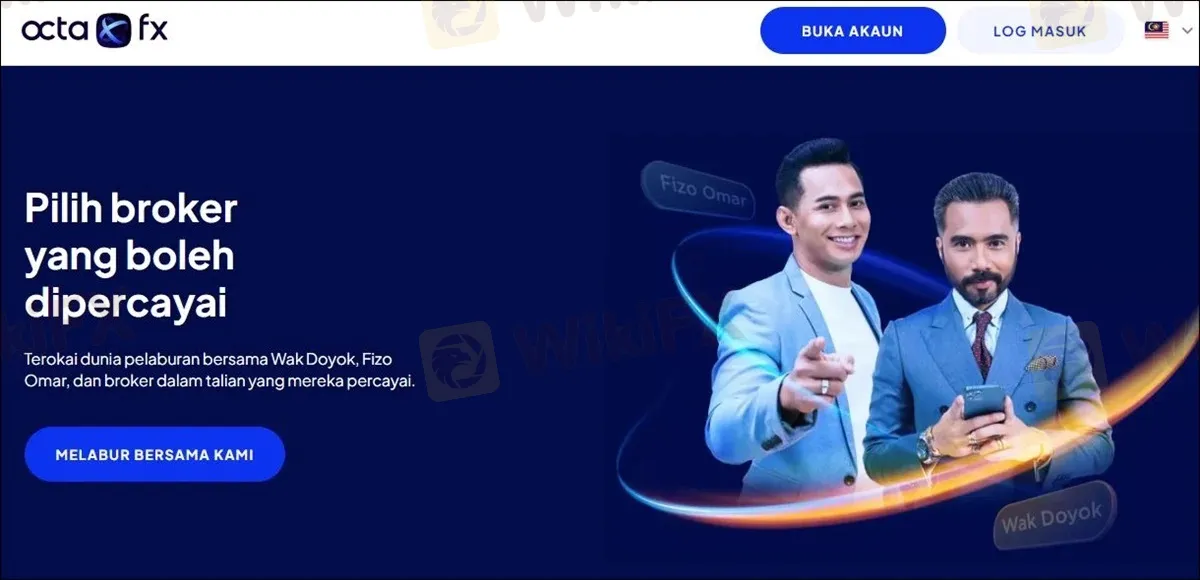

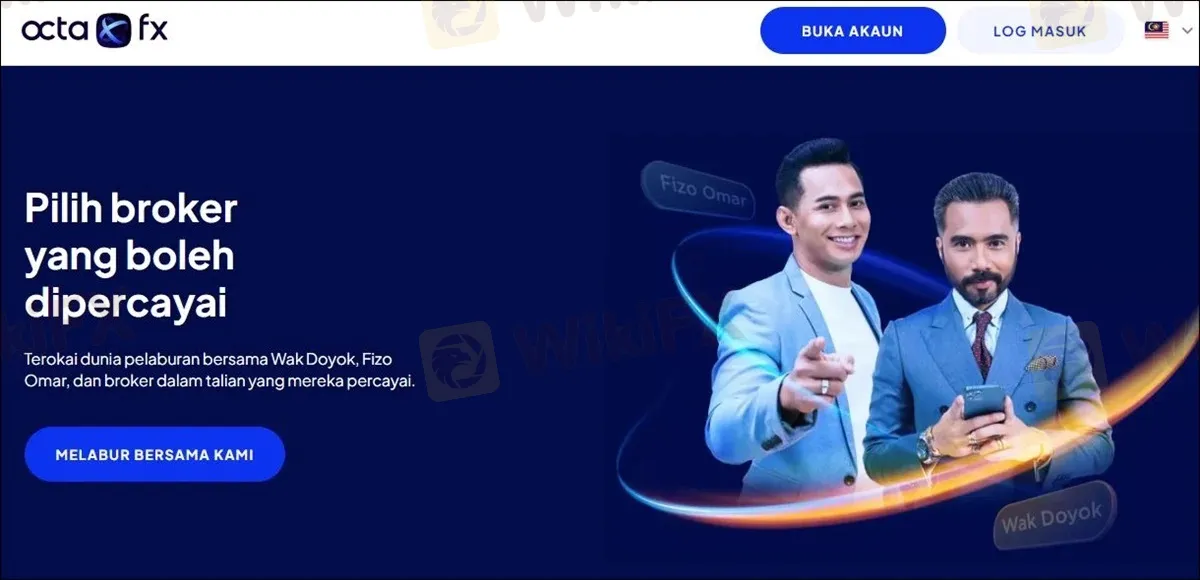

Meanwhile, OctaFX is an international forex broker with presence in over 100 countries globally. Within Malaysia, it has been gradually gaining interest and traction among investors due to its extensive advertisement campaigns, with celebrities such as Fizo Omar and Wak Doyok appearing as “ambassadors”. At the time of writing, the website for OctaFX is still live, along with its social media accounts (such as Facebook).