Abstract:High leverage has been favored by adventurous investors. Even if the fund you invest in is not much, investors still have the opportunity to obtain huge returns, as long as high leverage is offered by brokers.

That is the reason why many traders are willing to take the risk for a huge profit. However, fraudulent brokers take advantage of the thought to get you into their traps. And Marlpark must be one of them.

An Experienced Broker with a New-Born Domain

Marlpark claimed it was a broker with many years of experience. The lie was easy to tell and easy to be exposed. By checking the creation date of its domain, we could tell that the domain was created on 31 January 2022, less than even one year. How could Marlpark be an experienced broker? It is a red flag.

Suspected Registration

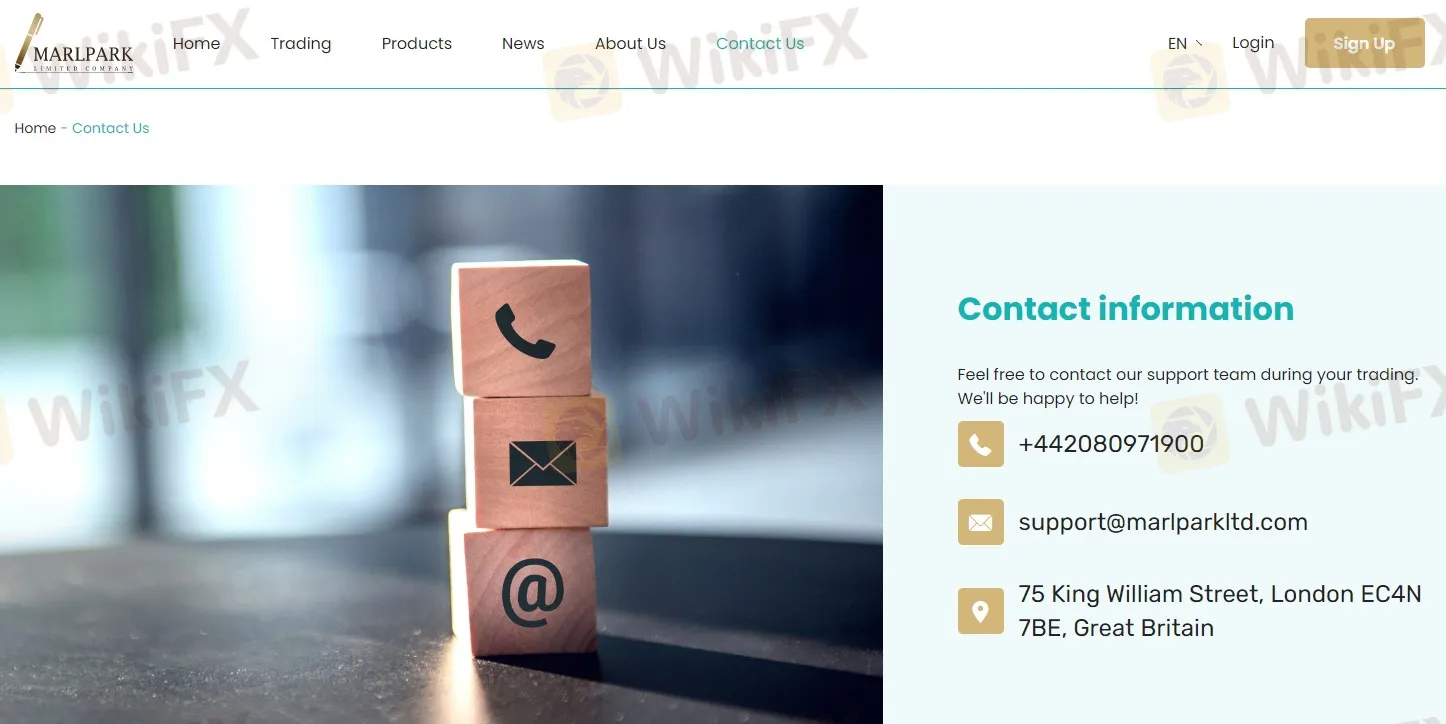

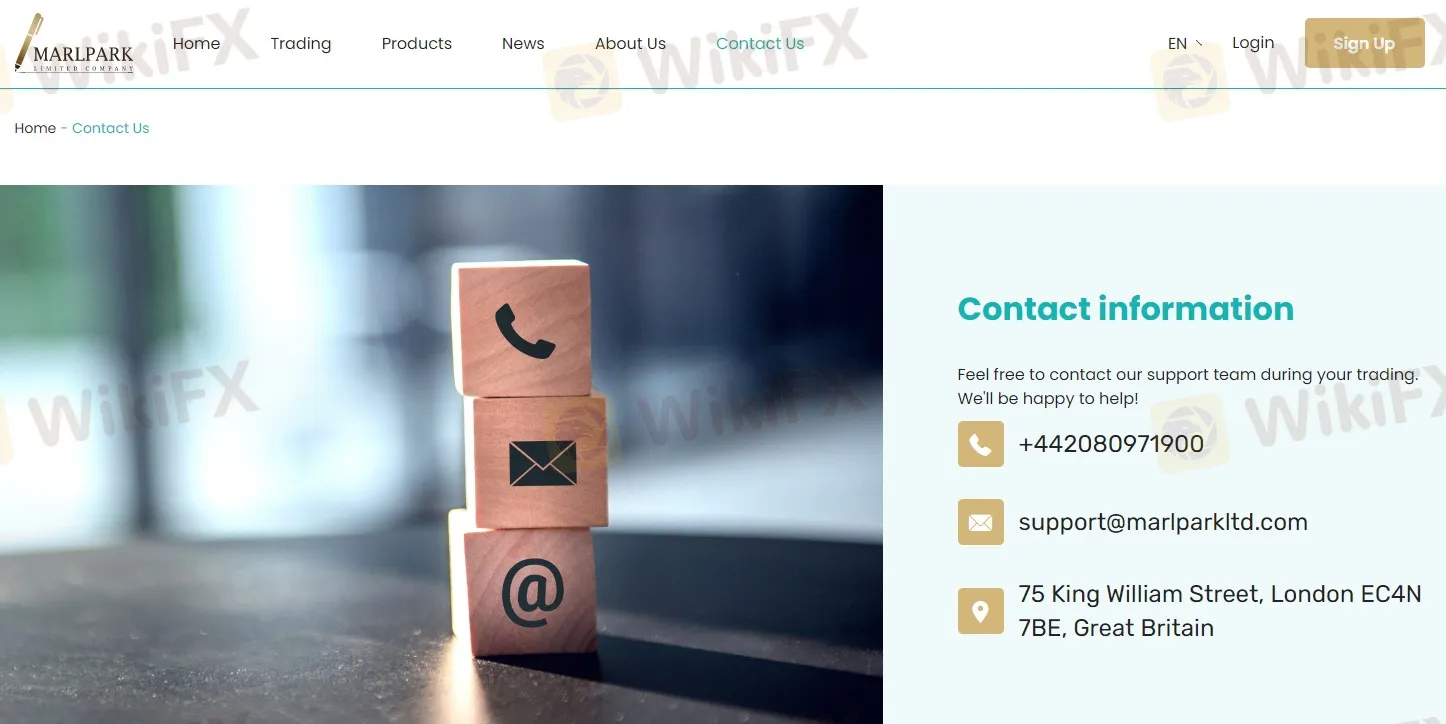

Marlpark claimed to be a UK-based company and presented company number 02141098 on its website. By searching in Companies House of United Kingdom register, a company named Marlpark Limited could be found. However, there was no website or other information that could prove the registration belonged to the broker Marlpark. Even if it was confirmed that Marlpark had been registered with CH, it can not be proved that Marlpark was an authorized broker.

Warning from UK FCA

According to United Kingdom laws, a broker that provides financial services shall be regulated by the United Kingdom Financial Conduct Authority (UK FCA). Though Marlpark had no authorization from UK FCA, its name could still be found on this regulator's website.

On 7 July 2022, UK FCA issued a warning, reminding the public that Marlpark is an unlicensed broker. According to the regulator, this broker was providing financial services illegally. Moreover, UK FCA also believed the company that registered with Companies House of United Kingdom has no association with Marlpark.

1:500 Leverage

Marlpark said it would provide investors with leverage of 1:500, as other brokers were lowering their leverage around the world. The words made Marlpark sound like a broker that thought about traders. But the truth is not like that. Setting restrictions was a way of protecting investors' funds. According to UK FCA, the maximum leverage limit of major currency pairs that any regulated forex broker could provide to retail customers is 1:30, which was much less than 1:500.

Many regulators set restrictions on leverage because high leverage may easily cause huge losses in an instant, especially to a new trader. Investing is risky. If you blindly pursue high leverage for profit, you may end up losing all of money.

Based on the above information, we can conclude that Marlpark is an unregulated forex broker. A wise investor will never choose to trade with it.