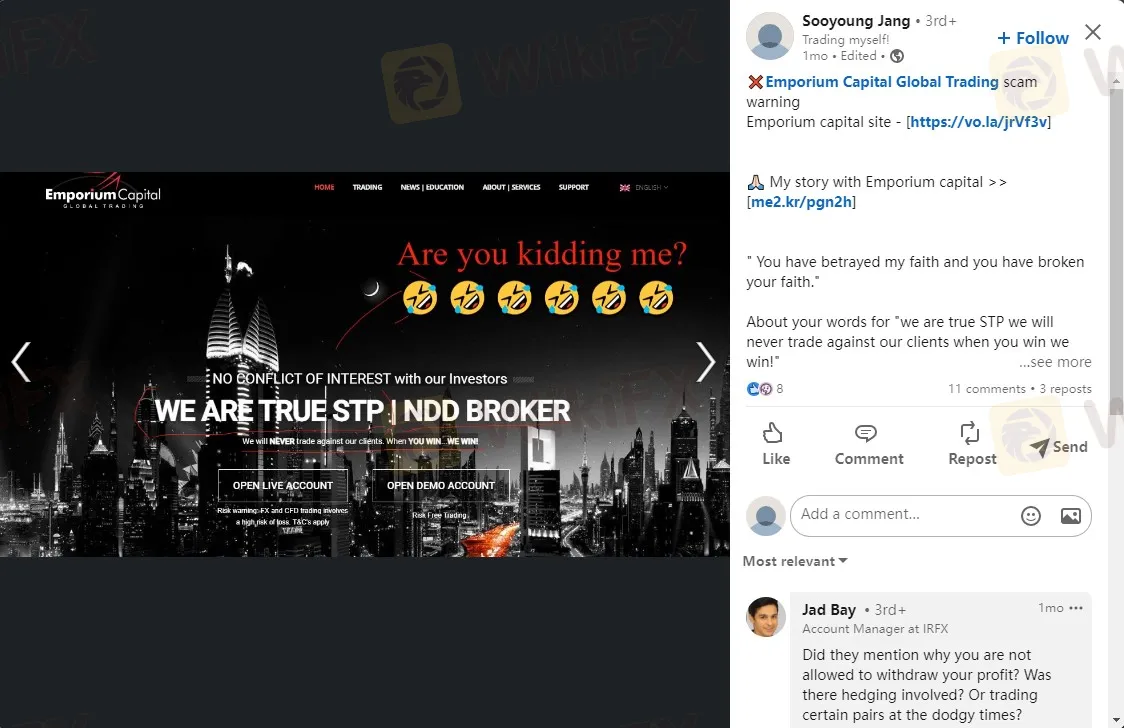

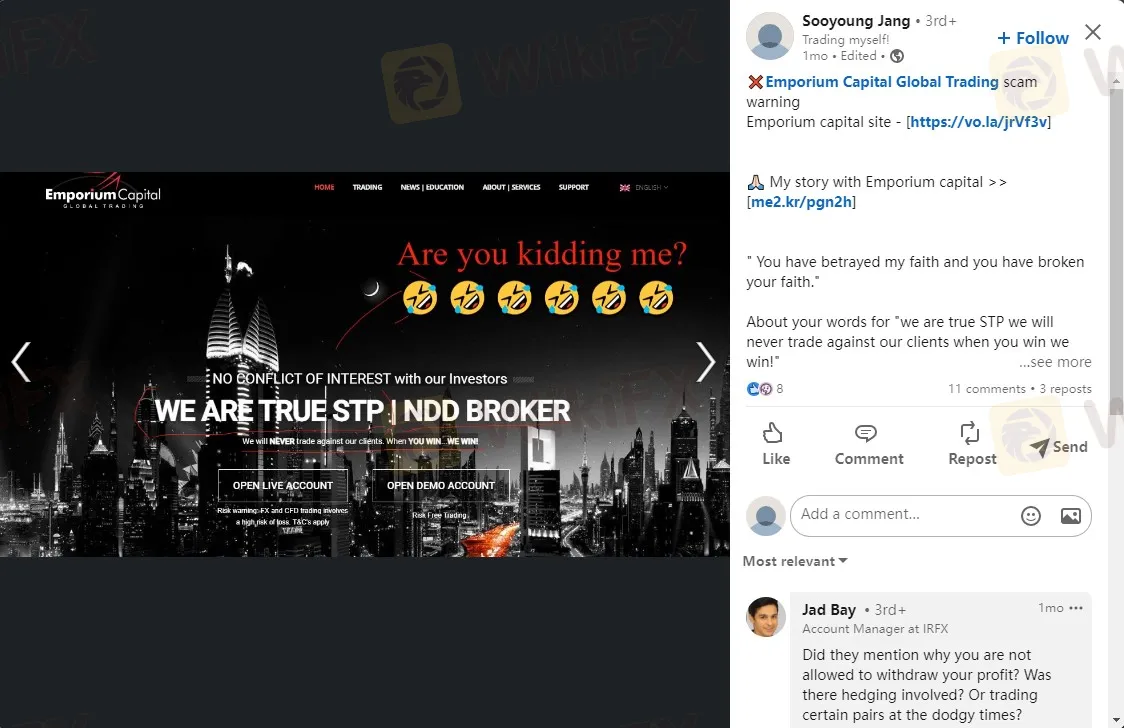

Abstract:"We are true STP broker. We will never trade against our clients when YOU WIN...WE WIN!"

This slogan was prominently displayed on Emporium Capital's website, demonstrating to investors that the broker was committed to making money for them.

However, one disappointed trader, named Sooyoung Jang, found the slogan ironic because of what happened between the broker and her. “You have betrayed my faith and you have broken your faith.” is what she said to this broker. What made the client so angry?

About Emporium Capital Regulation

Emporium Capital is a forex broker registered in Saint Vincent and the Grenadines (25845 IBC 2020) and regulated by Cyprus Securities and Exchange Commission (CySEC), license number 358/18.

In addition, the broker also claims to be “regulated” by Agency for Regulation and Development of the Financial Market of The Republic of Kazakhstan. However, the company name is not on the list of the registry. And the agency is not a forex regulatory body.

Why did Jang choose Emporium Capital?

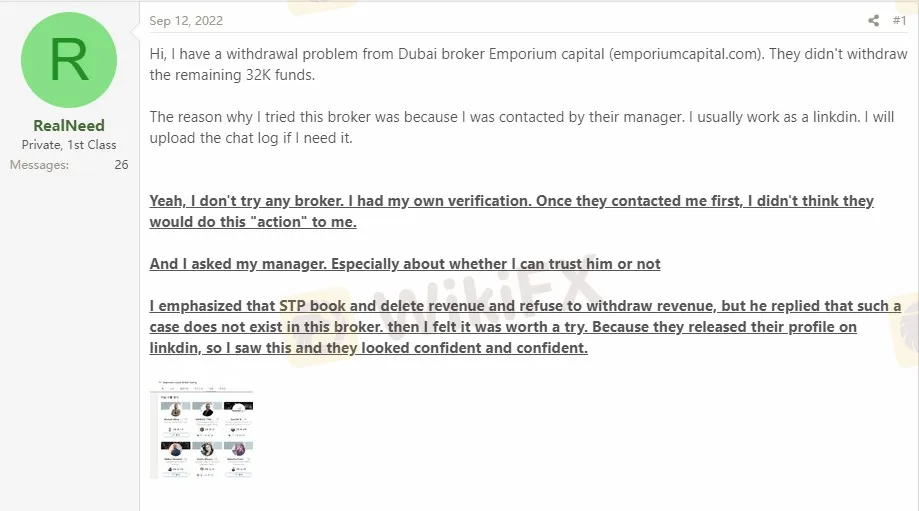

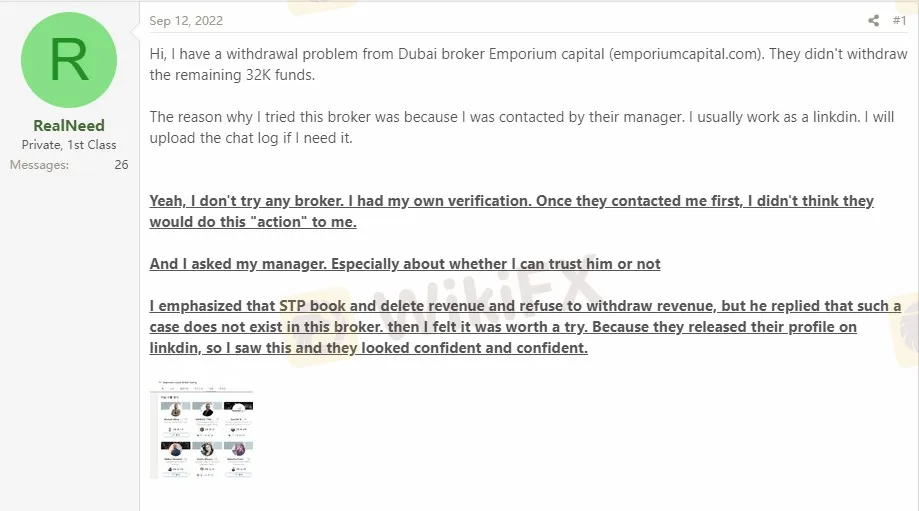

According to Jang, a manager of Emporium Capital got in touch with Jang and talked to her on Linkedin. During the communication, Jang asked this manager if she could trust him. And the manager also said that when investing with this broker, there are no cases when the broker deducts the investor's earnings or refuses to withdraw funds.

In addition, another reason why Jang trusts Emporium Capital is that many of its employees' profiles are displayed on Linkedin.

At last, these reasons led Jang to trust this company and trade here for a month and a half.

What Made Jang's Accusation?

Jang said that she had withdrawl issue with Emporium Capital. According to her post, She has about $32,000 funds in her account. And the problem emerged when she submitted a $20,000 withdrawal request.

The broker sent her an email stating that her account engaged in prohibited high-risk trading activity, which led the firm to believe that she had abused the trading system and violated the Terms of Business, and that the account was under investigation. Additionally, the broker also suspects that Jang deliberately slowed down the update of market prices by using multiple simultaneous logged-in trading accounts. Due to the above, the company will close her account and remove $28,428 from the account.

Jang was dissatisfied with this reply and demanded that the entire balance be withdrawn from her account. However, the broker only agreed to refund the remainder of the $23,693 deposit, which is $3,693. Of course, Jang did not agree to this settlement, claiming that she had actually invested more than $30,000 and had lost $7,000 during her investment.

Regarding the company's statement that she violated the Term of Business, Jang responded that she had never received any documents regarding the trading and rules policy. In addition, she accused the company of hiding the fact that it was doing a B+Book deal while she had asked for an A+Book STP.

Although she tried to log into her account to gather evidence, she was unable to do so because the broker had closed her account. However, Jang decided to file a complaint with CySEC.