Abstract:The derivatives-focused exchange from Deutsche Borse will help buy-side customers in the EU clear their OTC interest rate derivatives holdings.

This is a further step in support of the legislative goals of bringing more Euro Clearing within the EU and, as a result, reducing dependence on CCPs outside the EU.

The goal of the new initiative is to reward EU consumers who use their accounts. Despite the fact that the war for euro-clearing is still ongoing, Eurex's promise to share earnings is attracting clearing business from rivals in the UK. Since Britain officially left the EU in December, clearing euro derivatives has become a Brexit battleground. This is because Brussels wants to build up the bloc's capital market and make it less dependent on London.

“With this targeted incentive program for buy-side clients, we show our strong commitment to a market-led solution that is meant to speed up the development of a liquid, EU-based alternative for clearing OTC interest rate swaps.” “Especially in light of ongoing uncertainty, changing interest rates, and an increased need to hedge a broader marketplace through greater clout.”

Eurex also said that the high rise of index derivatives from one year to the next continued, increasing by 24% from 56.9 million traded contracts to 70.4 million. The volume of interest rate derivatives traded increased by 2% this year, from 52.2 million contracts last year to 53.2 million contracts this year. When compared to the same month last year, equity derivatives contracts plummeted by 31% in October, from 22.5 million to 15.6 million. Total contracts traded on Eurex increased by 6%, from 131.8 to 139.4 million.

From October 2021 to October 2022, the amount of notional outstanding volumes in OTC clearance went up by 38%. At the end of October, the total outstanding volume was EUR 28,379 billion, which was up from EUR 20,499 billion the year before. Interest rate swaps and overnight index swaps both went up by 21%, while the total outstanding volume went up by 100%. Average daily volumes that were cleared went up by more than four times. Interest rate swaps went up by 22% and overnight index swaps went up by 10%.

The average daily term-adjusted volume on Eurex Repo went from EUR 192.6 billion to EUR 253.3 billion, a 32% increase from the previous year. The GC Pooling market increased by 22% year on year, while the Repo Market increased by 36%.

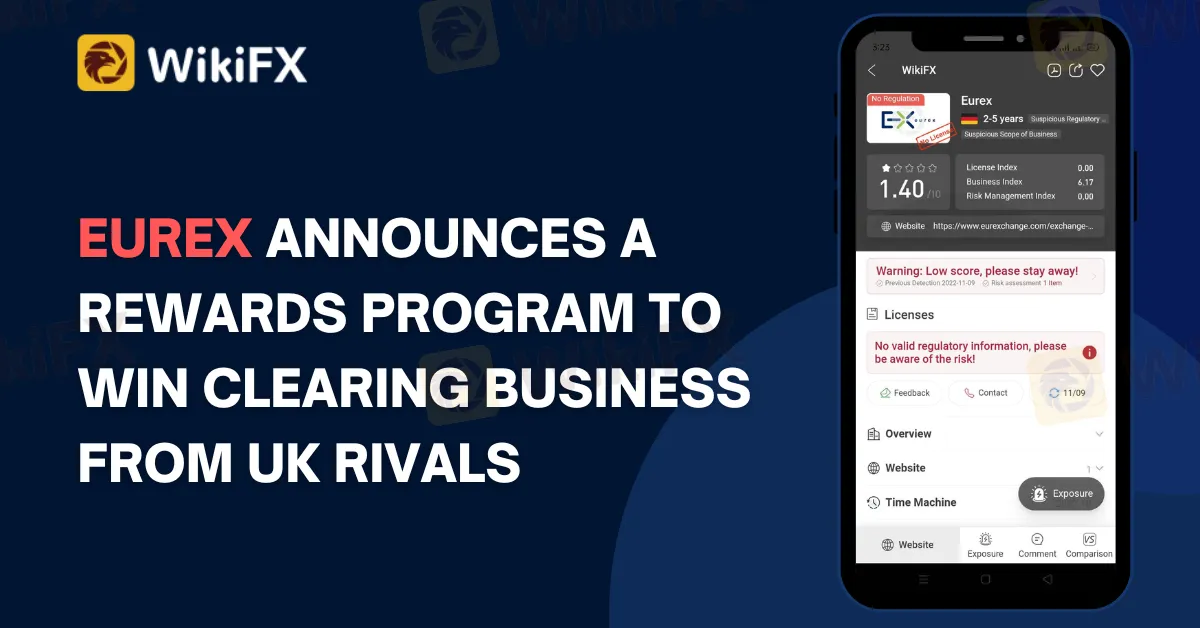

Here's how to use the WikiFX Mobile App to spot your chosen broker.

The WikiFX App is a search engine for forex trading. It is available as an online app and a mobile app.

To search Eurex through the WikiFX App

First: Launch the WikiFX App on your browser. To access the mobile app, type www.wikifx.com or download the app from the App Store or Google Play Store and install it on your phone.

Second: The search box in the WikiFX App should be visible in the top right corner of the screen. Enter the broker's name, such as Eurex, then press enter.

Third: Anticipate a flood of results, including copied websites.

Fourth: Choose the correct broker based on their official website URL.

Fifth: After selecting the appropriate broker, you should see all of the information you want, including complaints from its traders and reviews. If it's accurate, you should be able to see their offices based on their locations, as well as their licenses or regulating agencies.

If you want assistance, please contact WikiFX Support using the information provided below.

Eurex web address: https://www.wikifx.com/en/dealer/4131281276.html

Stay tuned for more Brokers news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.