Abstract:CMC Markets Singapore Invest Pte. Ltd., the Singapore subsidiary, is anticipated to soft-launch CMC Invest at the end of 1Q 2023, allowing customers a multi-product single platform to trade international and local equities, ETFs, futures, and options, pending final regulatory permission.

“This news represents a significant milestone and validation for CMC Markets. Our company has been delivering CFDs in Singapore since 2007, but the CMSI Capital Markets Services Licence will enable us to provide our customers with more solid investment products such as shares and ETFs.”

The Monetary Authority of Singapore has given CMC Markets regulatory in-principle permission for a capital markets services license (CMSL) to enable online and mobile trading of internationally listed shares, exchange-traded funds, futures, and options.

CMC Markets Singapore Invest Pte. Ltd., the Singapore subsidiary, is anticipated to soft-launch CMC Invest at the end of 1Q 2023, allowing customers a multi-product single platform to trade international and local equities, ETFs, futures, and options, pending final regulatory permission.

CMC Invest will provide 0% commission and real-time pricing to customers in certain markets like as Singapore, the United States, and Australia. CMC Markets already holds CMC Invest licenses in the UK and Australia.

Meanwhile,

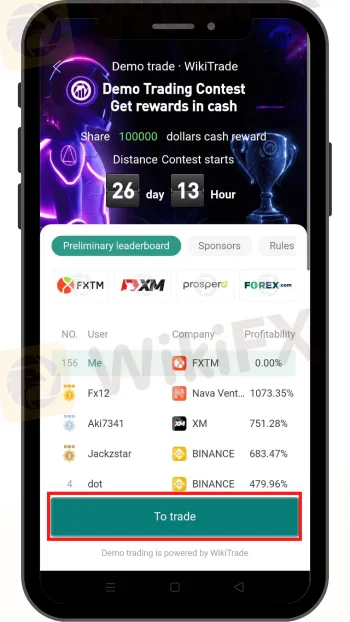

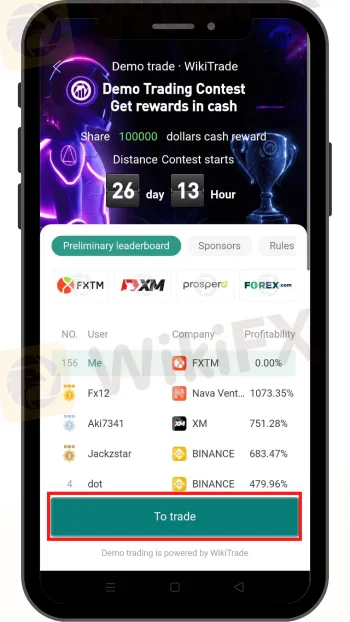

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

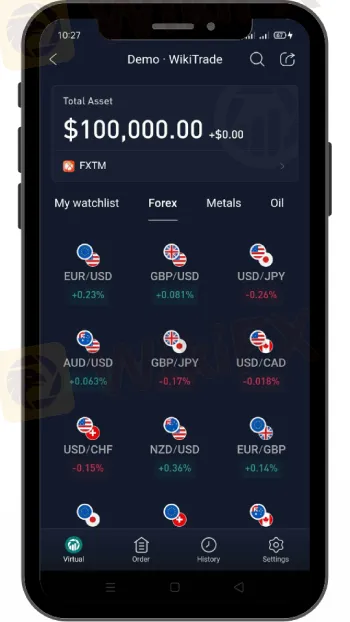

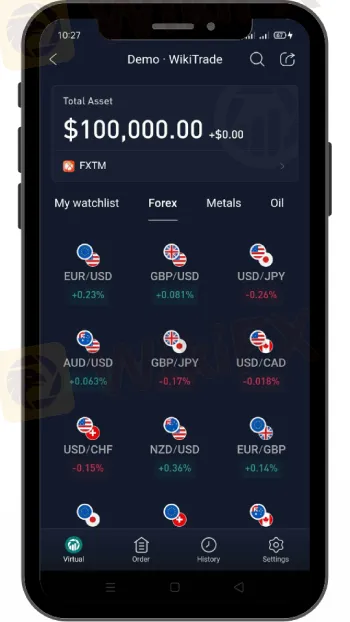

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Good luck and enjoy your trading experience!

CMC Expands Into 12 New Markets

CMC Markets, founded in 1989, is a prominent brokerage business that services retail and institutional customers via regulated offices and branches in 12 countries, with a substantial presence in the United Kingdom, Australia, Germany, and Singapore.

Clients may trade up to 10,000 financial instruments spanning equities, indices, foreign currencies, commodities, and treasuries using CFDs, spread bets (in the UK and Ireland only), and stockbroking services in Australia.

The recent surge in multi-asset trading has prompted CMC Markets to develop CMC Invest, which will soon be available to Singapore citizens, giving them access to worldwide and local equities, ETFs, futures, and options.

“This news represents a big milestone and confirmation for CMC Markets,” said Christopher Forbes, Head of CMC Invest Singapore. Our company has been providing CFDs in Singapore since 2007, but the CMSI Capital Markets Services Licence will enable us to provide our customers with more solid investment products such as shares and ETFs.

“We know that Singapore is a sophisticated market when it comes to the financial services sector and we opted to establish CMC Invest here owing to its excellent corporate governance infrastructure and regulator. This underscores our commitment to Singapore, and we look forward to providing our customers with a new world-class platform.”

CMC Invest, based in the United Kingdom, has launched the Plus Plan

CMC Invest has unveiled a new Plus plan in the United Kingdom, giving flexible stocks and shares ISAs, a USD currency wallet, and a broader investment selection for a monthly custodial cost of £10.

The UK investing platform's new strategy, which includes a flexible stocks and shares ISA and allows clients to construct an investment portfolio that fits them, is aimed at consumers who wish to contribute up to £20,000 per tax year and shelter their investment returns from tax.

Only a few investment providers provide flexible ISAs, which enable users to withdraw money from their ISA and re-invest it within the same tax year without affecting their ISA limits.

In the United Kingdom, the dividend allowance and yearly capital gains tax exemption will be reduced from £12,300 in the current fiscal year to £6,000 in 2023/24 and £3,000 in 2024/25. As a result, flexible ISAs are a very appealing option for clients.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3