Abstract:Southeast Asian currencies with a high level of risk were the poorest performers on Tuesday, with the Malaysian ringgit and Indonesian rupiah down 1% and 0.7%, respectively.

Most Asian currencies moved little on Tuesday in anticipation of Federal Reserve Chair Jerome Powell's speech, although the Australian dollar rose after the Reserve Bank lifted interest rates and signaled more rises were on the way.

The Australian dollar rose 0.7% to $0.6929, closing in on the crucial 0.7 barriers versus the US dollar. The Reserve Bank of Australia lifted interest rates by 25 basis points, as predicted, and indicated that more rises were on the way as it battled runaway inflation.

Broader Asian currencies were under pressure ahead of Powell's speech at the Economic Club of Washington, D.C. Later on in the day. After stronger-than-expected nonfarm payroll statistics lifted the dollar and Treasury rates last week, the Fed Chair's views on inflation and monetary policy will be widely monitored.

The US dollar lost ground against a basket of currencies on Tuesday, with the dollar index and dollar index futures both down 0.1%. However, the majority of the gains recorded since Friday, after the payrolls report, were kept by both instruments.

The payroll statistics increased market expectations for further Fed rate rises this year, dampening the outlook for Asian currencies as the yield spread between risky and low-risk rates narrows.

The Chinese yuan increased by 0.1%, while the South Korean won increased by 0.4%.

The Japanese yen climbed 0.3% as media stories stoked speculation over who would be the next Governor of the Bank of Japan. According to Reuters, the contenders to replace outgoing governor Haruhiko Kuroda will be announced by next week.

Kuroda's replacement confronts the difficult job of combining the BOJ's ultra-easy monetary policy with rising inflation and market expectations for a hawkish shift. However, the yen has benefitted from speculation about the bank's eventual hawkish stance.

Southeast Asian currencies with a high level of risk were the poorest performers on Tuesday, with the Malaysian ringgit and Indonesian rupiah down 1% and 0.7%, respectively.

Even though consumer price index inflation was substantially greater than projected in January, the Philippine peso fell 0.9%. While the result is anticipated to prompt the Philippine central bank to raise interest rates further, it also indicates that the archipelago's economy would face more strain.

The Indian rupee was under pressure as markets anticipated the Reserve Bank of India meeting on Wednesday. The central bank is anticipated to raise rates one more time before calling a halt to its current rate rise cycle.

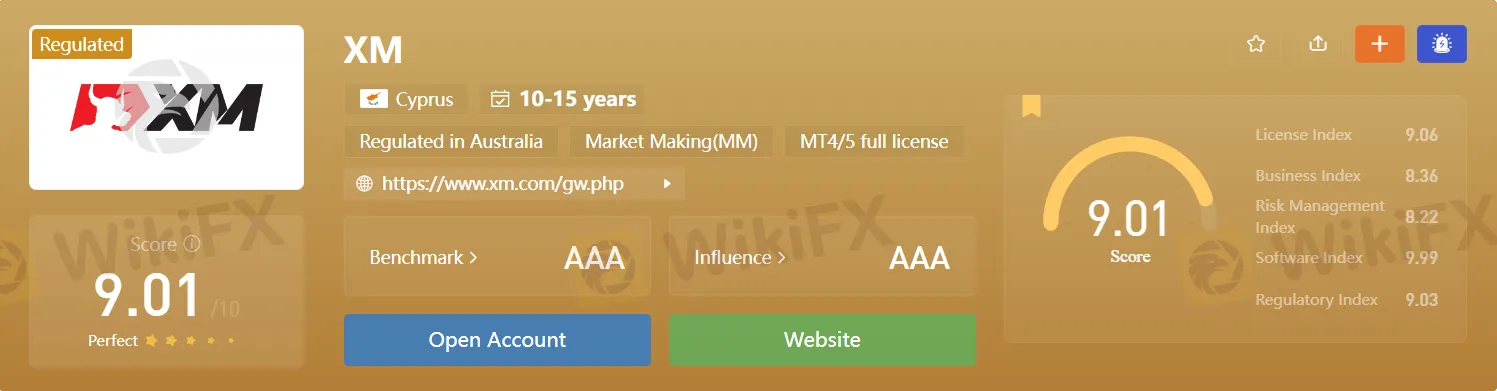

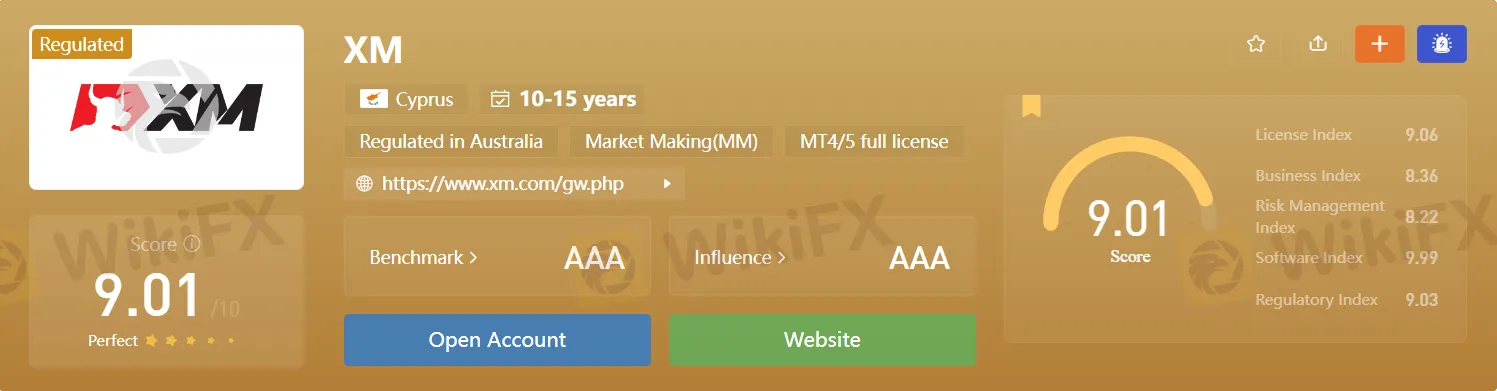

Install the WikiFX App on your smartphone to keep up to speed on current events.

Download link: https://www.wikifx.com/en/download.html?source=fma3