Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The article discusses the role of the CNMV in governing Spain's stock exchanges and protecting the financial system and investors. However, it also highlights the ongoing issue of unlicensed organizations operating in the Spanish financial markets, posing risks and endangering investors.

The Spanish National Securities Market Commission, or Comisión Nacional del Mercado de Valores (CNMV), is in charge of monitoring and governing the country's stock exchanges. Its goal is to safeguard the Spanish financial system's effectiveness and openness while also defending investors and preserving market equilibrium.

Despite the CNMV's efforts, unlicensed organizations are still able to function in the Spanish financial markets, endangering investors and the financial system's image.

Entities that function without the required CNMV permission are known as unauthorized organizations. These organizations may include dishonest businesses, unlicensed agents, or investment advisers.

WikiFX as a global forex brokers regulatory inquiry app has also been receiving negative reports about the listed entities and has found out that they are unregistered and have no authorization to do financial business even with international authorities.

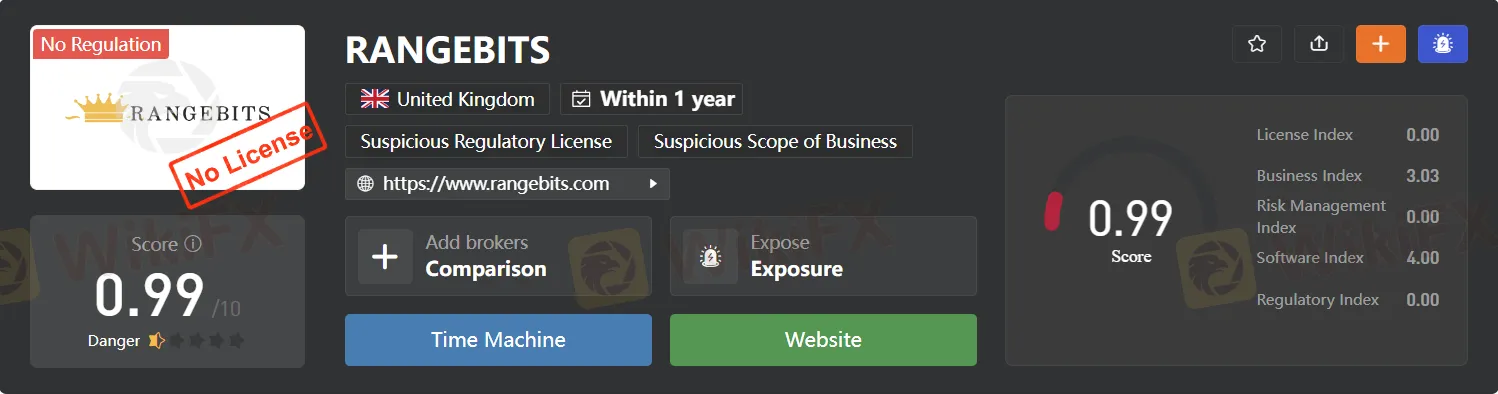

RANGEBITS

GLOVES INVESTS

GOLDMINES

MARKET GOLD

The potential for deception is one of the primary dangers connected to illegal organizations. These organizations have the potential to mislead investors by making inflated return promises, fast profit guarantees, or aggressive sales techniques. After taking the money from investors, they might vanish with it or use it for illegal activities, leaving investors with nothing.

Unauthorized parties can subject investors to additional risks, such as badly handled or uncontrolled assets, in addition to scams. These assets are vulnerable to poor administration, money being wasted, or even failure, if proper supervision isn't provided.

Investors should always confirm that the organizations they are interacting with are approved by the CNMV in order to safeguard themselves. You can review the CNMV's public registry of approved organizations or get in touch with the CNMV personally to accomplish this.

It is crucial that the CNMV keep up its efforts to find and punish illegal organizations. This can be accomplished by stepping up monitoring, working with other foreign law enforcement agencies, and launching public awareness initiatives.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Exposed: Amaraa Capital is a forex scam. Protect your funds—read this detailed scam alert now and avoid risky forex investments.

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.