Abstract:Explore the UK's FTSE surge with Exness. Learn about its impact on trading and how Autochartist and Tickmill tools can help strategize your trades.

A remarkable increase in the UK's FTSE (UK100) has caught the attention of market observers worldwide. Over the past two weeks, the FTSE has seen an impressive 5.92% surge, skyrocketing from $7,224 to $7,652. This upward trend seems relentless, and some media outlets suggest that this UK index has the potential for even more growth. However, the question that remains is whether there's any foundation for this optimistic outlook. In this article, we delve into the UK's economic situation and what it means for trading.

Forecasting the trajectory of a nation's economy is far from an exact science. And if a country's economic pillars appear to be weakening, a buoyant viewpoint could turn out to be a precarious strategy. This scenario became a reality for the UK when it voted to leave the European Union in 2016. This decision resulted in a decade of economic challenges, which were, at the time, deemed manageable by the Bank of England and the UK Treasury.

Estimations of the exact cost of EU membership for the UK vary, but figures frequently hover around £7-£8 billion. The Centre for Economics and Business Research (CEBR) released a report indicating that post-Brexit, the UK is now losing approximately £9.5 billion per year. Additionally, the citizens' dissatisfaction with shouldering specific EU-related costs hasn't eased. Brexit dealt a hefty blow to the British economy, the ripple effects of which are still being felt across the nation.

The UK's economic woes were further exacerbated by the global COVID pandemic and the ongoing energy crisis. Any progress the UK had made was swiftly erased, pushing the nation towards a state of economic hardship. An alarming 14.5 million Brits are currently living in poverty – that equates to more than a fifth of the population. The UK economy now teeters on the precipice of recession, burdened by stubbornly high inflation rates, and disrupted by pay strikes affecting railways, schools, and even hospitals.

Despite these challenging circumstances, no concrete plans or definitive strategies have been proposed to reverse this downturn. This lack of action might suggest a bearish trend in the coming months. However, it's crucial not to jump to conclusions just yet. Investors and traders interested in UK-based assets should familiarize themselves with the latest insights from Barrons and other trusted financial sources before making their moves.

About Exness

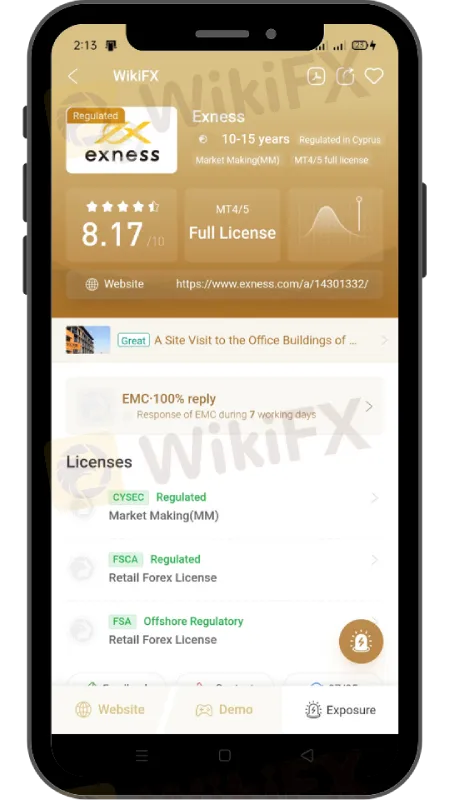

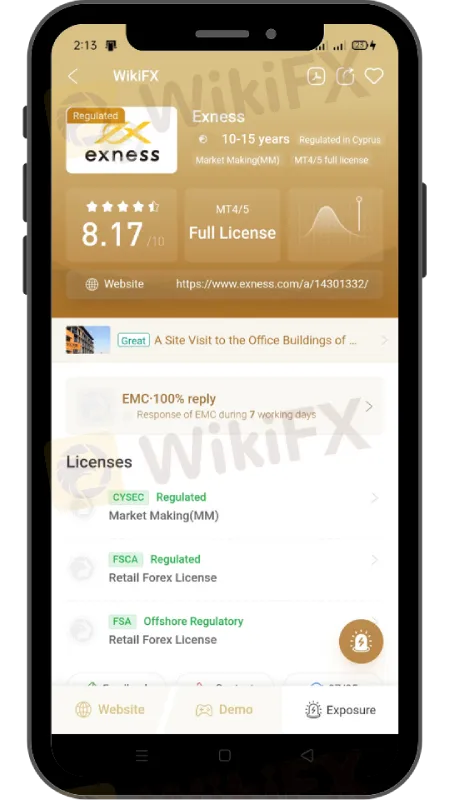

Exness is a leading international online trading platform offering a broad range of financial markets, including forex, stocks, indices, and commodities. Regulated by several financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, Exness provides clients with a safe and transparent trading environment. They are also recognized for their commitment to delivering excellent customer service and advanced trading tools to assist their clients in making informed trading decisions.

To stay updated on the latest financial news and trends, consider downloading and installing the WikiFX App on your smartphone. This handy tool provides up-to-date news that can significantly affect your trading decisions. Download the App here: https://www.wikifx.com/en/download.html.

Remember, in trading, knowledge is power. Arm yourself with the most accurate and timely information, and let tools such as the technical Exness platform guide you in navigating the financial markets. Always trade wisely and responsibly.