Simulated Trading Competition Experience Sharing

Champion Strategy Revealed: Get a Head Start on Winning

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

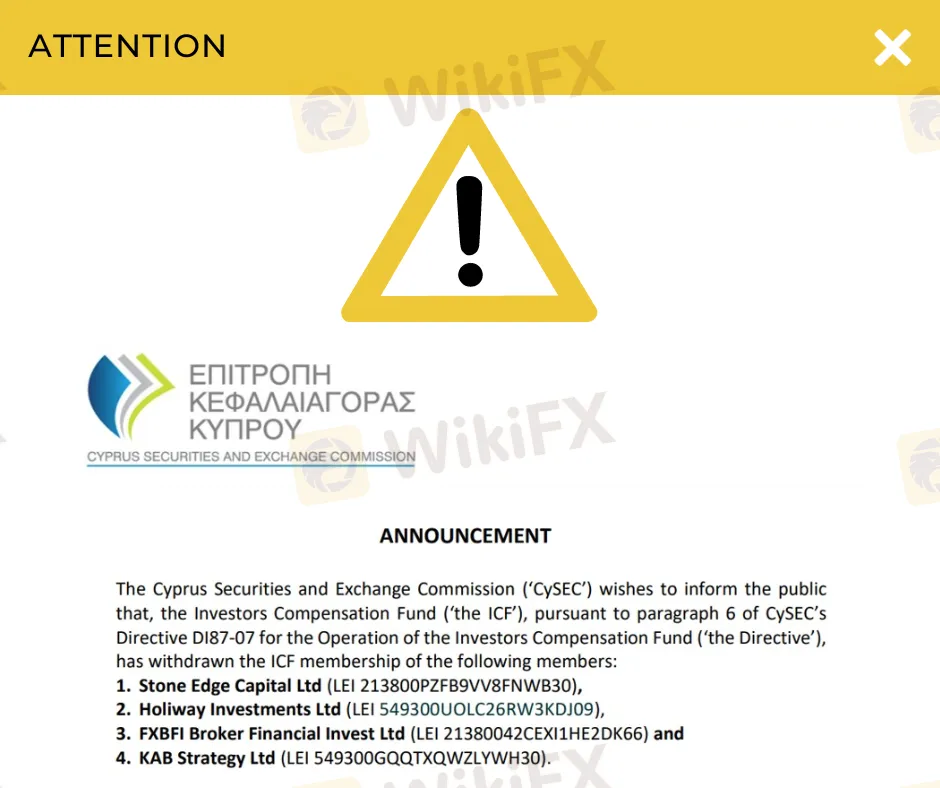

Abstract:CySEC withdraws membership from four major firms, exposing issues like voluntary license renunciations and regulatory compliance lapses.

The Cyprus Securities and Exchange Commission (CySEC) has recently disclosed the withdrawal of membership for four investment firms based in Cyprus by the Investors Compensation Fund (ICF). The affected entities include Stone Edge Capital Ltd, Holiway Investments Ltd, FXBFI Broker Financial Invest Ltd, and KAB Strategy Ltd.

The decision to revoke the membership of these firms stems from CySEC's choice to withdraw their Cyprus Investment Firm (CIF) authorizations, as officially stated by the regulatory body. Despite this development, clients covered by the four firms will retain the ability to file compensation claims for investment activities conducted prior to the withdrawal of membership. Eligibility criteria for such claims are outlined in CySEC's directives.

Established to provide compensation for covered investors in cases where the CIF fails to meet its obligations, the ICF operates under the regulatory mandate that all Cyprus Investment Firms must be its members. Consequently, when CySEC withdraws the CIF license of a firm, the ICF automatically terminates its membership.

KAB Strategy's license withdrawal, disclosed in the latter part of 2023, resulted from the company's voluntary renunciation. Meanwhile, FXBFI Broker Financial Invest also voluntarily relinquished its license, but only after facing a series of enforcement actions against the company due to deficiencies in anti-money laundering (AML) and combating the financing of terrorism (CFT) policies, controls, and procedures. This led to a €50,000 penalty imposed on FXBFI, the operator of 101investing.

In the cases of Stone Edge Capital and Holiway Investments, CySEC's investigations revealed violations of CIF authorization terms, prompting the cancellation of their licenses. In May, CySEC highlighted Stone Edge Capital's non-compliance with organizational standards, citing a lack of adequate systems to identify money laundering transactions. Additionally, the firm neglected to implement internal reporting systems and procedures.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Champion Strategy Revealed: Get a Head Start on Winning

The formation of the SkyLine Guide 2026 Thailand judge panel has officially begun. This year’s selection brings important upgrades to both the evaluation mechanism and participation approach, further emphasizing the role of local perspectives and authentic investor experiences within the judging framework.

WikiFX Elite Club Focus is a monthly publication created exclusively for members of the WikiFX Elite Club. It spotlights the individuals, ideas, and actions that are genuinely driving the forex industry toward greater transparency, professionalism, and long-term sustainability.

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!