IG Adopts AI to Strengthen UK Marketing Compliance

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:This article highlights the distressing experience of Gowri, a 29-year-old from India, who fell victim to the deceptive practices of this broker. In the back of the article we arranged a few small questions, each answer to the chance to win a bonus.

This article highlights the distressing experience of Gowri, a 29-year-old from India, who fell victim to the deceptive practices of this broker. In the back of the article we arranged a few small questions, each answer to the chance to win a bonus.

A Promising Start Turns into a Nightmare

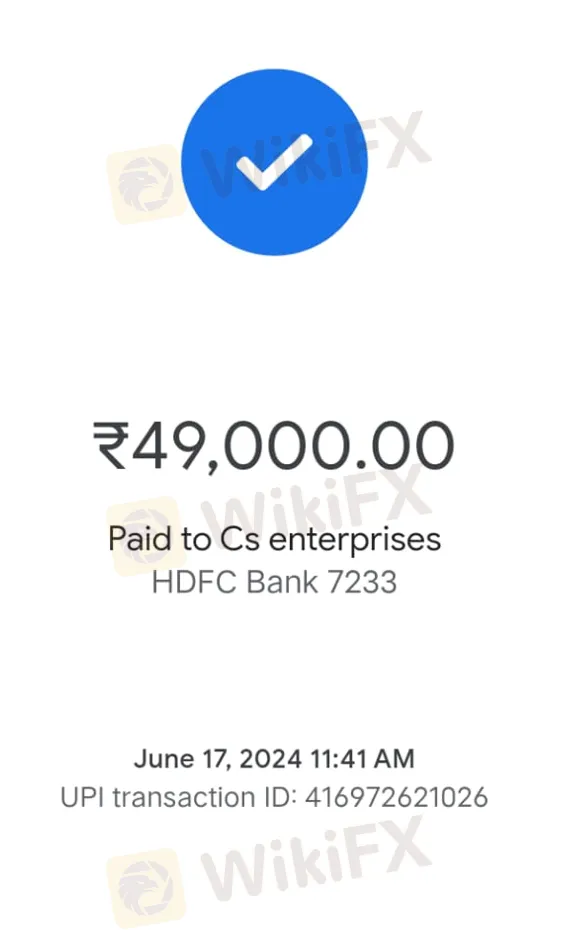

The victim was drawn to the world of forex with hopes of financial growth. He joined Nation Traders and invested a substantial sum of $2,500, unaware that he was walking into a trap. Despite initial promises, Gowris experience quickly turned sour as he lost his entire investment without being able to withdraw any funds.

False Promises and Misleading Tactics

The ordeal did not end there. The broker convinced Gowri to deposit an additional $1,000 with the assurance that this new account would yield significant gains. Indeed, Gowri saw his trading account balance grow to $3,000, only to be told that he could withdraw $1,000 after making yet another payment of $500. However, the withdrawal was never processed, and Gowri has yet to receive any payments from his accounts.

An Unrelenting Pursuit for Justice

Desperate for help, Gowri reached out to WikiFX, hoping to recover his lost funds. His story is a stark reminder of the dangers lurking in the unregulated corners of the forex market. Brokers like Nation Traders prey on the hopes of traders, only to leave them with empty promises and significant financial losses.

A Warning to Aspiring Traders

Nation Traders‘ abysmally low WikiFX score of 1.28/10 is not just a number; it’s a red flag. It reflects the experiences of traders like Gowri who have been deceived and left with nothing but regret. Aspiring traders must exercise extreme caution when choosing a broker, ensuring they select one with a solid reputation and regulatory oversight.

Conclusion

Gowri Sankar‘s experience with Nation Traders serves as a powerful warning. In the world of forex trading, due diligence is crucial. Traders must thoroughly research any broker before entrusting them with their hard-earned money. Nation Traders’ low WikiFX score is a testament to its unreliability and the financial harm it has caused to traders like Gowri. Don't let yourself become the next victim; stay informed, stay cautious, and always prioritize your financial security.

Questions

Do you know how many exposures WikiFX has received in the last three months about Nation Traders?

Do you know how many risk alerts WikiFX gave to Nation Traders?

Addition

Please scan the QR code to join our private group, which has a lucky draw every day, Participate in the group and have a chance to win a cash prize of $10!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

When traders think about choosing a new broker, two main questions come up: Is ZarVista safe or a scam? And what are the common ZarVista complaints? These questions get to the heart of what matters most—keeping your capital safe. This article gives you a detailed look at ZarVista's reputation using public information, government records, and real experiences from people who used their services. Our research starts with an important fact that shapes this whole review. WikiFX, a website that checks brokers independently, gives ZarVista a trust score of only 2.07 out of 10. This very low rating comes with a clear warning: "Low score, please stay away!" The main reason for this low score is the large number of user complaints. This finding shows that ZarVista might be risky to use. To get the complete picture, we will look at the broker's government approval status, examine the specific complaints from users, check any positive reviews to be fair, and give you a final answer based on fact