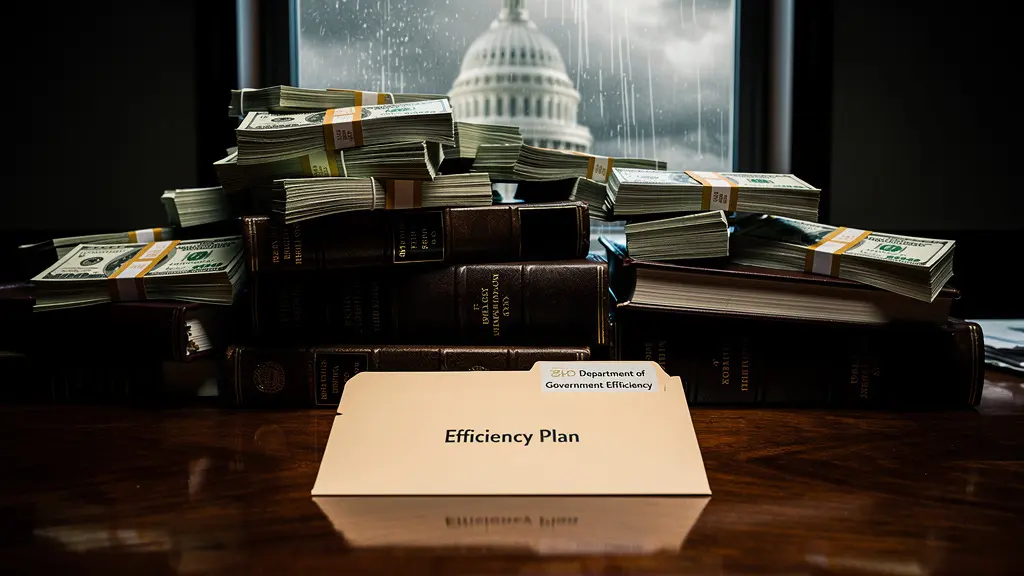

US Fiscal Monitor: Efficiency Office Cuts Jobs, But Spending Hits New Highs

The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms failure to include essential information in suspicious activity reports (SARs) over a four-year period.

SARs are critical tools for law enforcement, designed to provide insights into transactions that may indicate illegal activities. Under federal law, broker-dealers are required to file SARs that detail any unusual or suspicious transactions. The SEC emphasised that incomplete or inaccurate reporting undermines the effectiveness of these reports, depriving regulatory agencies and law enforcement of the intelligence needed to address financial crimes.

The SECs investigation revealed that Webull, Lightspeed, and Paulson had submitted SARs with missing or insufficient details between 2018 and 2022, failing to meet the required standards. As part of the settlement, Webull and Paulson also committed to hiring compliance consultants to enhance their anti-money-laundering programmes, demonstrating an effort to address these shortcomings.

Jason Burt, Director of the SECs Denver Regional Office, stated that the omissions in the SARs hindered the ability of law enforcement to gather timely and valuable intelligence. He reiterated the pivotal role of SARs in safeguarding market integrity and ensuring compliance with federal regulations.

The investigation, spearheaded by the SEC‘s Denver Regional Office in collaboration with the Financial Industry Regulatory Authority (FINRA), highlights the regulator’s focus on ensuring broker-dealers uphold their obligations to report potential financial misconduct accurately.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an "A" ranking in Influence according to our data, with significant traffic coming from Mexico, Brazil, Colombia, and Indonesia.

If you are looking into the Indonesian forex market, you have likely crossed paths with MIFX (Monex Investindo Futures). They are significantly influential in Southeast Asia, particularly Indonesia, with a footprint expanding into Malaysia and Vietnam. But popularity doesn't always equal safety.

VenturyFX is a relatively new brokerage established in 2023 with its headquarters located in Mauritius. While the broker serves clients internationally, notably in regions such as Brazil/Colombia/Spain/Mexico, it currently operates without valid regulatory oversight. The broker holds a WikiFX Score of 1.37, which is considered low and indicates a high-risk environment for traders.