JPMorgan CFO Sounds Alarm on Risky Stablecoin Yields

JPMorgan CFO warns high-return stablecoins could endanger financial stability as global regulators move toward tighter digital asset rules.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Crypto-related scams cost U.S. investors $9.3 billion in 2024, marking a 66% surge from the previous year, with seniors and fake investment schemes among the hardest hit.

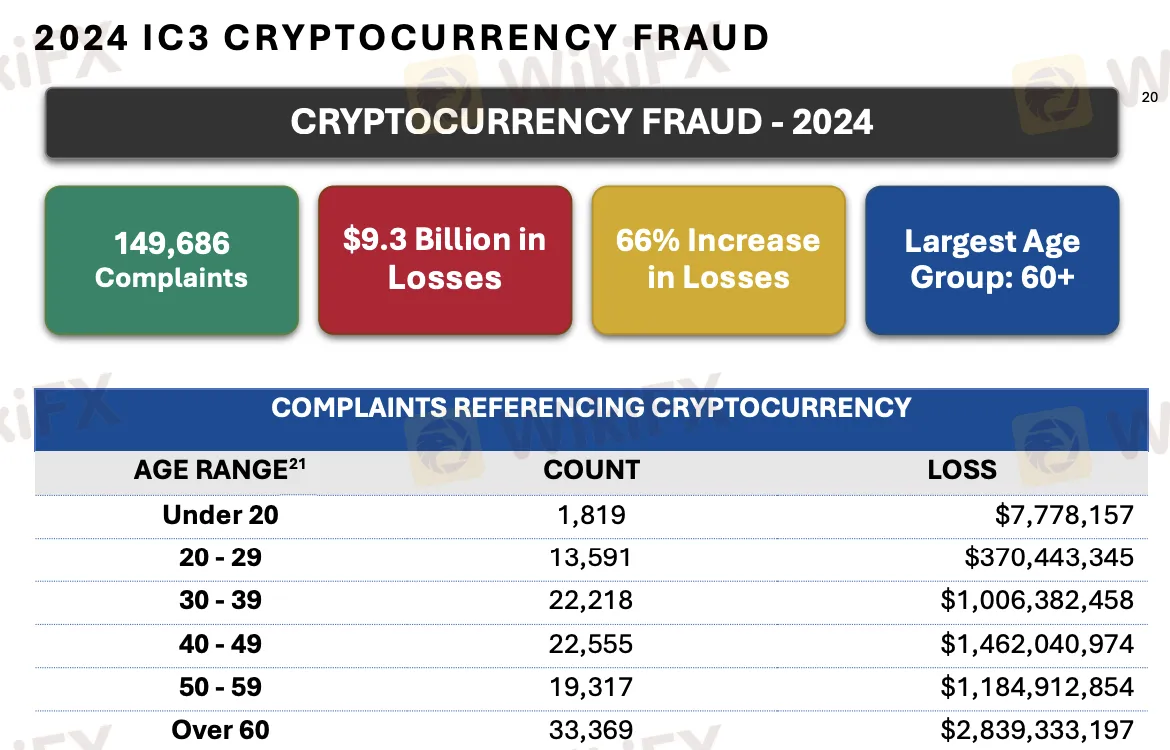

The U.S. Federal Bureau of Investigation (FBI) has released its 2024 Internet Crime Complaint Center (IC3) annual report, and the numbers are startling. Losses linked to cryptocurrency scams reached $9.3 billion last year, up 66% from $5.6 billion in 2023, signaling a major escalation in the scale and sophistication of digital asset fraud.

More than 140,000 complaints involving cryptocurrency were filed to the IC3 in 2024, with individuals over the age of 60 comprising a large and growing share of victims. The report states that seniors accounted for over 33,000 cases, with total reported losses of $2.8 billion—a near tripling compared to the figure five years ago.

These scams often leveraged sophisticated narratives promising high returns or falsely claimed regulatory backing to gain investor trust. One of the most common methods involved fake investment platforms that encouraged users to deposit crypto into wallets controlled by scammers.

While investment fraud accounted for the largest monetary losses, the IC3 noted that “sextortion” schemes were the most frequently reported. In these scams, attackers manipulated images or videos to create explicit content, then extorted victims for cryptocurrency payments. Additionally, fraud involving crypto ATMs and kiosks saw a notable uptick.

With generative AI becoming more accessible, the FBI expects a rise in convincing deepfake scams and manipulated voice impersonation cases in 2025. According to Chainalysis, illicit crypto transaction volume globally reached $41 billion in 2024, with a quarter of it tied to fraud, extortion, or hacks.

In 2024 alone, the FBIs “Operation Level Up” initiative helped prevent an estimated $285 million in losses by intercepting ongoing scams. Despite such efforts, the agency cautions that recovery is often difficult once funds are transferred through complex crypto laundering schemes involving cross-border actors.

Authorities are calling for broader consumer education and enhanced KYC (Know Your Customer) standards across platforms. The report also reiterates the importance of reporting suspicious activity as early as possible.

Cryptocurrency remains a double-edged sword—empowering innovation while opening doors to abuse. As scammers adopt more advanced methods and target vulnerable demographics, education, early reporting, and platform accountability will be key to curbing further losses. Authorities recommend that users verify the legitimacy of all investment opportunities and avoid sending crypto assets to unknown parties.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

JPMorgan CFO warns high-return stablecoins could endanger financial stability as global regulators move toward tighter digital asset rules.

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

Police busted 97 online scam cases and seized more than RM5 million, in a series of integrated operations conducted in the capital throughout last year.

A global crypto transparency era begins as 48 countries enforce CARF rules; data-sharing to combat tax evasion expands worldwide by 2029.