PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Over $172,000 lost in POSB phishing scams since April. Learn how to protect yourself from banking fraud with these crucial safety tips.

Since April, phishing scams targeting POSB customers have led to at least $172,000 in losses. The police have received 13 reports related to these scams, where cybercriminals impersonate the bank to steal personal information.

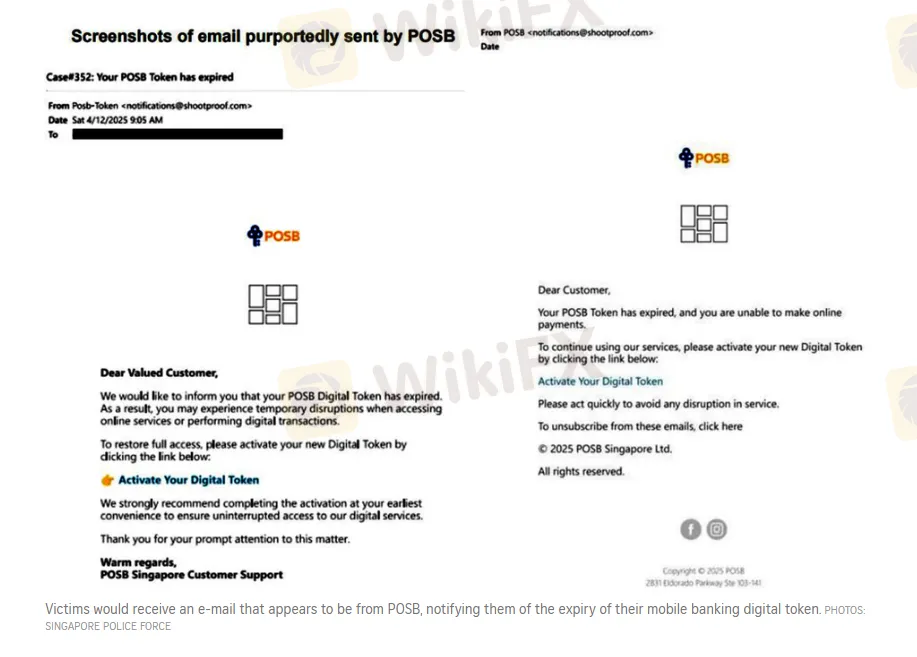

Victims receive an email that appears to be from POSB, claiming that their mobile banking digital token is about to expire. The email urges them to activate or update their token by clicking on a link provided in the message.

However, this link directs them to a fraudulent website designed to steal sensitive information. Once victims enter their banking credentials, card numbers, and one-time passwords, their accounts are compromised. Unauthorized transactions, often in foreign currencies, typically alert them to the scam.

On May 6, police issued a public warning, advising people to avoid clicking on links in suspicious emails, SMS messages, or communications from platforms like iMessage or Androids rich communication services, which claim to be from banks.

To prevent such attacks, customers are encouraged to set transaction limits on their internet banking and utilize features like Money Lock. Money Lock allows users to digitally secure their savings in an account from which no funds can be withdrawn, adding an extra layer of protection.

Singapore experienced a record $1.1 billion in scam losses in 2024, highlighting the growing threat of phishing fraud. Victims are urged to stay cautious and avoid interacting with unsolicited messages or clicking on unknown links.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

Malaysian authorities have carried out a sudden, large-scale crackdown in Kuala Lumpur, detaining hundreds of undocumented foreigners and suspected online scam workers. The operation signals a tougher enforcement stance, with frontline operators targeted amid a broader regional push against scam networks.

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.