Abstract:Is KOT4X a reliable broker? Read our review to explore trader experiences, key features, spreads, and leverage to help you make an informed decision.

KOT4X continues to draw attention in the trading community, raising an important question: Is KOT4X a good broker? In order to provide clarity, this article examines real user experiences, platform features, and transparency, using verified details shown on comprehensive broker review platforms.

With countless broker options available, traders are increasingly selective. KOT4X has made a name for itself by catering to various trading preferences, but what do real traders—and not just marketing claims—say about this platform? This article provides an unbiased look at KOT4X by focusing on concrete details and authentic feedback to help you make an informed decision.

KOT4X Overview

KOT4X is an online forex and CFD broker that offers access to a wide range of instruments, including currencies, indices, commodities, and cryptocurrencies. The platform provides the popular MetaTrader 4 (MT4) software, known for its user-friendly interface and advanced trading tools. KOT4X supports different account types with variable spreads and leverage options up to 1:500, appealing to both beginners and experienced traders.

Key Features and Trading Conditions

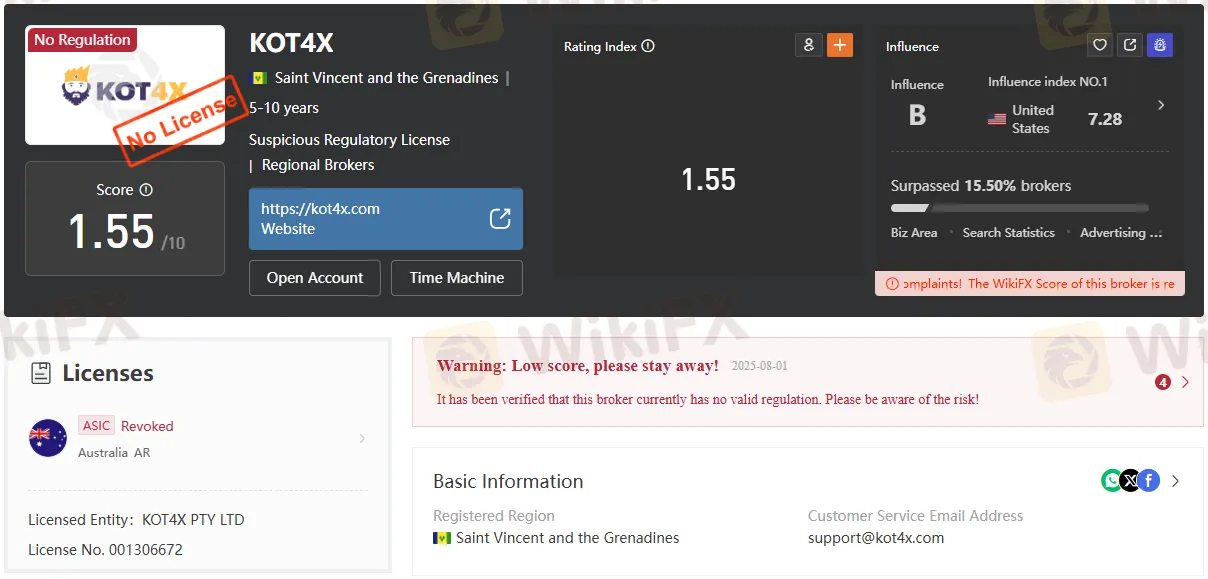

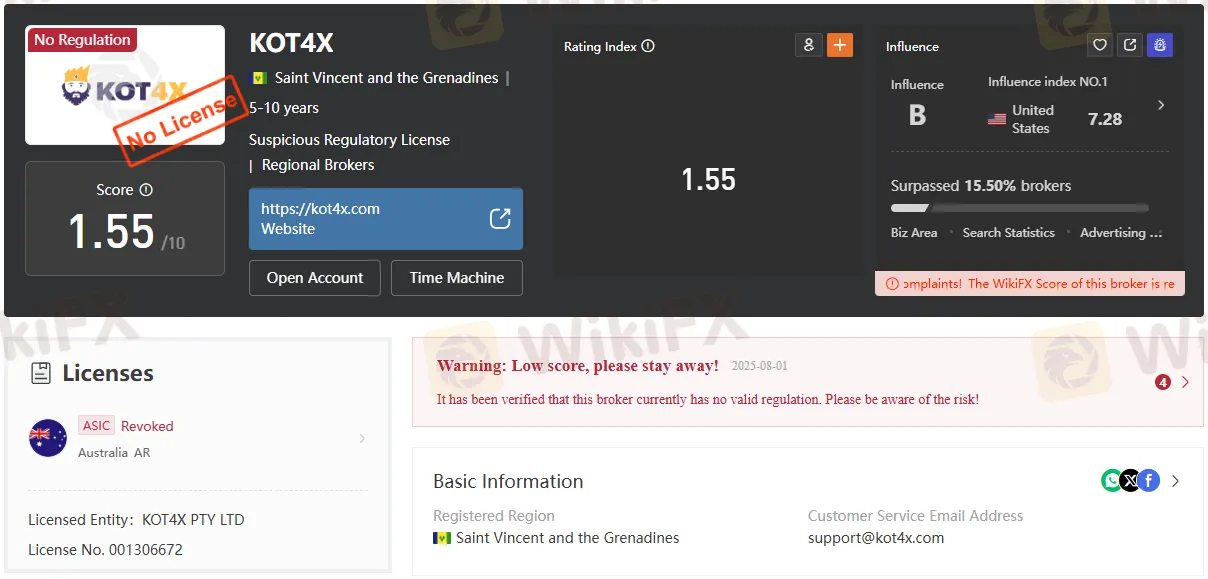

- Regulation and Security: Based offshore, KOT4X operates without oversight from top-tier regulatory authorities. While traders can use advanced security features such as account encryption and two-factor authentication, some may notice the absence of major regulatory certifications.

- Minimum Deposit and Funding: KOT4X allows funding exclusively with cryptocurrencies like Bitcoin, which means traders will need to convert fiat currency to crypto before making deposits. The minimum deposit is typically low, enabling entry-level access for most users.

- Spreads and Fees: The broker advertises competitive spreads, but actual trading costs may fluctuate depending on the account type and market conditions. Comprehensive fee details and past spread data are clearly presented on their official broker profile pages.

- Account Types: KOT4X provides various account options (Standard, Pro, VAR, and MINI), catering to different trading styles and priorities. All accounts have access to major tradeable assets and use the MT4 terminal.

- Transparency: The platforms performance metrics—including spread variance and server execution speeds—are listed for public review. Historic downtime data and user dashboards are also shared to boost transparency.

User Reviews: Real Feedback from Traders

- Positive Impressions: Many traders praise KOT4Xs easy account setup, broad asset selection, and quick processing of withdrawals when using cryptocurrencies. The ability to use high leverage is seen as advantageous by experienced traders seeking flexibility.

- Critical Feedback: Some users have marked concerns about the risk of unregulated brokers, such as limited recourse in case of disputes. A few reviews cite delays in customer service response times or occasional issues with withdrawal processing. Accessibility may be a challenge for those unfamiliar with cryptocurrencies as funding methods.

- Overall Ratings: KOT4X maintains a moderate average user rating. The scores reflect a mixture of satisfaction with trading tools and account flexibility, balanced against apprehensions regarding regulatory status and fiat funding limitations.

Trust, Transparency, and Conclusion

KOT4X stands out for its user-focused trading features, especially its range of account types, platform accessibility, and transparency about trading statistics and performance. However, potential clients should be aware of the brokers offshore registration and the unique risks tied to an unregulated status. As with any trading decision, users are advised to weigh the advantages and disadvantages and to consult several user reviews to achieve a balanced perspective.

Ultimately, whether KOT4X is a good broker depends on individual preferences and risk tolerance. The broker offers compelling features for those comfortable with crypto-based funding and seeking flexibility, while conservative traders may prefer alternatives with strict regulatory oversight. Traders should always conduct their own due diligence before making an investment decision.

Protect your trades and trade with confidence. Scan the QR code to download the WikiFX app—your trusted tool to verify broker regulation, read real trader reviews, and avoid risky, unregulated brokers.