Abstract:Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them.

Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them. These are, in reality, scam brokers, and you need to Fraud alert while investing in the forex market.

What is a Cloned Broker Scam?

A cloned broker scam is a type of financial fraud where scammers create a fake investment platform by copying the name, logo, website, and license number of a legitimate, licensed broker. Their goal is to trick investors into believing they are dealing with a trusted company. These fake brokers often create professional-looking websites and documents that closely resemble the real firm, making it hard to spot the difference.

They may contact potential victims through social media, emails, or phone calls, offering high returns or guaranteed profits. Once a victim deposits money, the scammers may delay withdrawals, demand extra fees, or disappear entirely. Because these clone brokers are not officially licensed, investors who fall for them are not protected under financial laws or regulations.

How Do Cloned Brokers Trick Investors?

Cloned brokers use many tactics to appear legitimate:

• They create professional-looking websites that copy real brokers details.

• They may show fake licenses or registration numbers.

• They use social media ads, emails, or phone calls to lure investors.

• They promise guaranteed profits, high returns, or zero risk—which is a major red flag.

How to Protect Yourself from Scam Brokers?

Investing in the financial markets can be rewarding, but it also comes with risks especially the risk of falling into the hands of scam brokers. These fake brokers often operate under false identities and make convincing offers that can easily trap even cautious investors. Here's how you can protect yourself:

1. Verify the Brokers License

Always check if the broker is licensed by a recognised financial authority, such as the Securities Commission Malaysia (SC), the FCA (UK), or the SEC (US), SEBI(India). A licensed broker is regulated and must follow strict rules to protect investors. You can verify their registration by visiting the official website of the regulator.

2. Avoid Unregulated Brokers

Never invest with brokers who are not listed or registered with a legitimate authority. Scam brokers often operate without licenses, which means theyre not bound by any legal obligations and offer no protection for your funds.

3. Cross-Check Contact Information

Scam brokers may clone the name and license number of a real company but use different contact details. Always compare the phone number, email, and web address with those listed on the regulators site to ensure you're dealing with the legitimate company.

4. Do Not Fall for “Too Good to Be True” Promises

If a broker promises guaranteed profits, no-risk trading, or unrealistically high returns, its almost certainly a scam. Real investments involve risk, and no legitimate broker can guarantee returns.

5. Test with a Demo Account First

Before investing real money, use a demo account to test the brokers platform. This will help you understand how their system works, assess customer service, and identify any suspicious behavior.

6. Read Online Reviews

Search for independent reviews from trusted sources or investor forums. See if other people have raised complaints or reported issues. If a broker has a history of delayed withdrawals or poor communication, it's a red flag.

7. Do Your Research

Take time to research the brokers background, history, and reputation. Look up their registration number, company location, and regulatory standing. A few minutes of research can save you from a major financial loss.

8. Do Not Rush

Scammers often pressure you to make quick decisions. Dont let urgency or fear of missing out push you into investing. Take your time, ask questions, and proceed only when you feel confident and fully informed.

9. Report Suspicious Activity

If you suspect a broker is fake or behaving unethically, report it to your countrys financial authority. In Malaysia, you can report scams to the Securities Commission Malaysia. Your report may help prevent others from becoming victims.

10. Keep Records

Always save emails, chat messages, payment receipts, and transaction histories. These documents can be crucial if you need to file a complaint, seek legal help, or recover your funds.

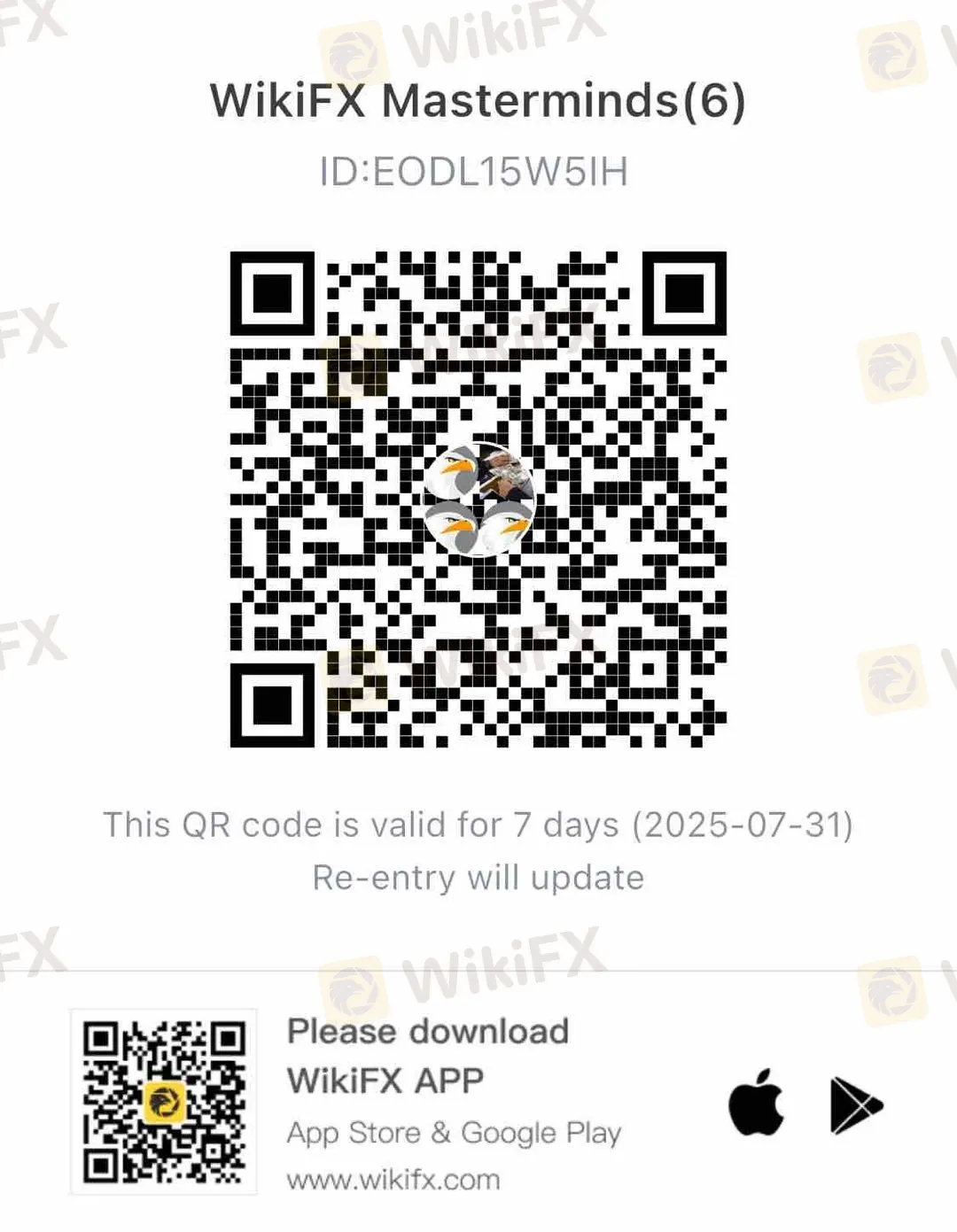

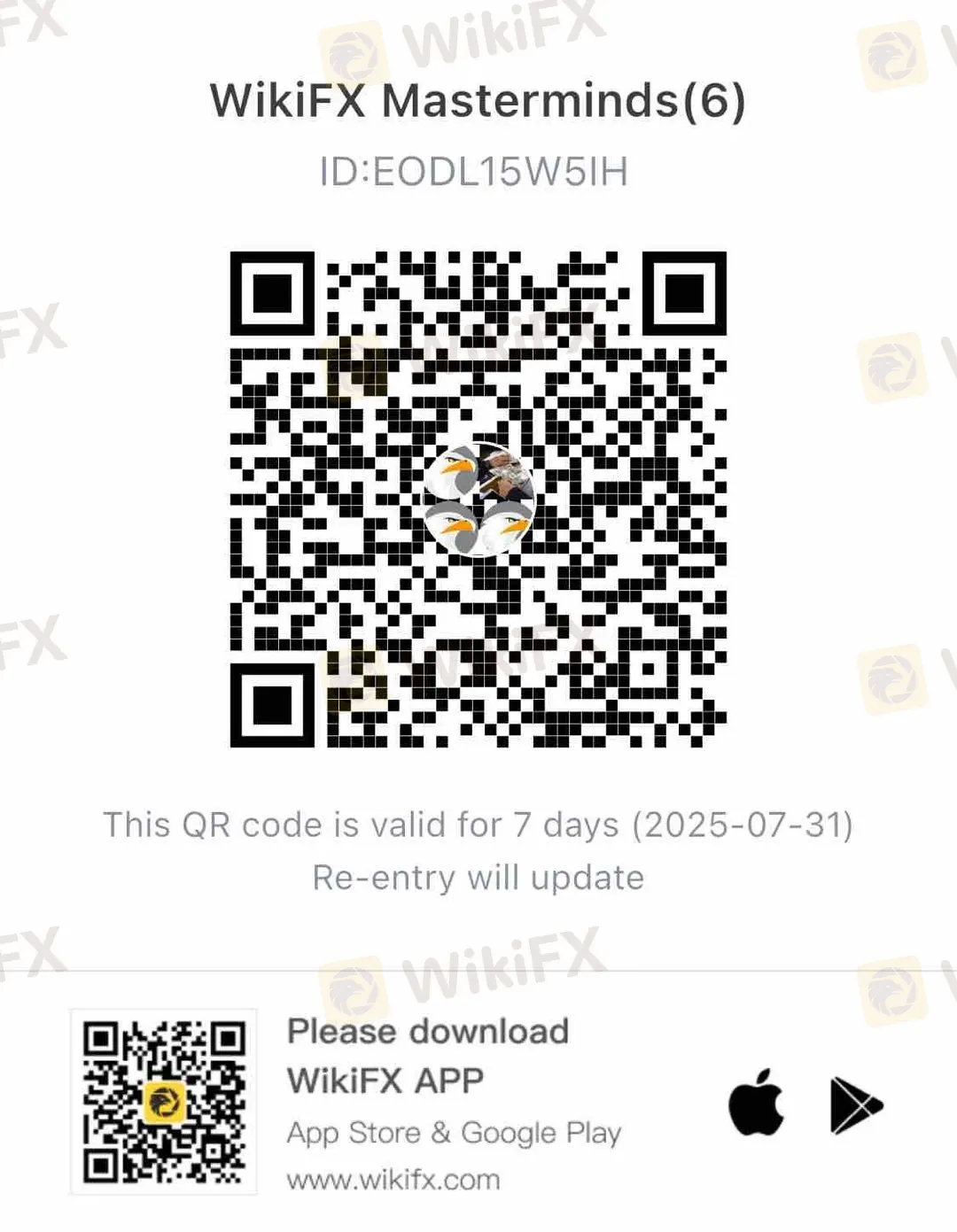

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!