Abstract:OANDA Japan updates trading hours for Turkish Lira pairs (TRY/JPY, EUR/TRY, USD/TRY) starting August 11, 2025, aiming to address liquidity challenges in Forex trading.

OANDA Japan Inc., an affiliate of the worldwide online trading platform OANDA Corporation, has announced a substantial modification regarding OANDA Japanese TRY trading schedules. Starting August 11, 2025, the operational hours for Turkish Lira currency combinations, featuring TRY/JPY, EUR/TRY, and USD/TRY, will experience a major restructuring.

Previously, market participants benefited from almost continuous accessibility from Monday early hours through nearly Saturday dawn (US time zones). Nevertheless, the Turkish Lira Forex trading schedule modification will now restrict trading operations to Monday through Friday, spanning 4:00 PM to 1:00 AM Central European Standard Time, and 3:00 PM until midnight during Central European Summer Time.

This transformation primarily addresses the problematic situation generated by continuous volatility surrounding the Turkish Lira within financial markets. OANDA Japan referenced consistently weak Turkish Lira liquidity Forex OANDA encounters, particularly during the Asian early morning trading periods, resulting in remarkably unstable price distribution and challenging trading circumstances.

Therefore, OANDA has established OANDA Japanese TRY limitations by relocating trading windows to European time zones when liquidity typically becomes higher and trading environments are more stable. This tactical approach seeks to safeguard traders by guaranteeing more dependable and liquid market conditions for the TRY/JPY, EUR/TRY, and USD/TRY trading modification.

OANDA Japan maintains alertness and dedication to observing market developments carefully. The brokerage has committed to quickly notify clients of any forthcoming adjustments or significant updates concerning these currency combinations.

About OANDA

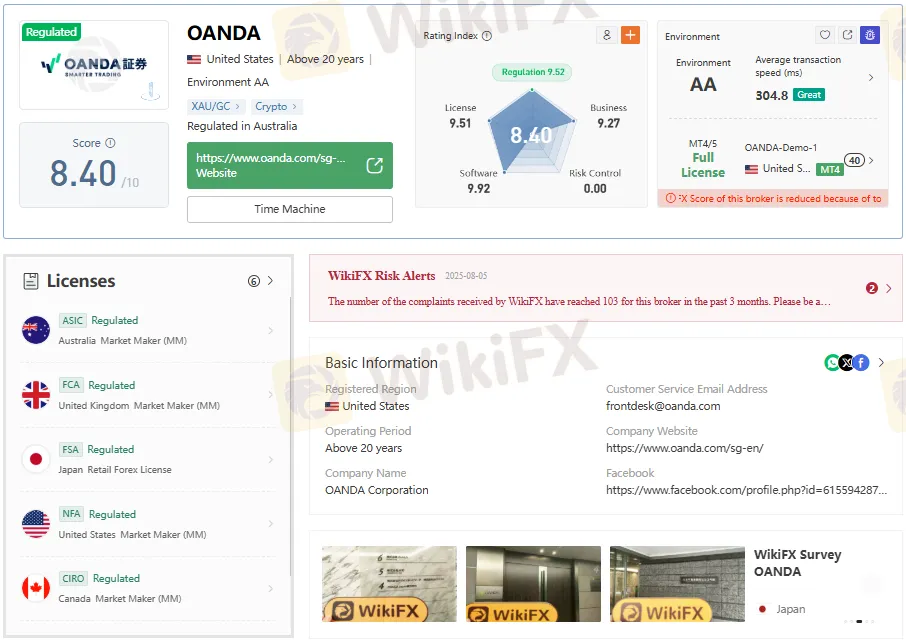

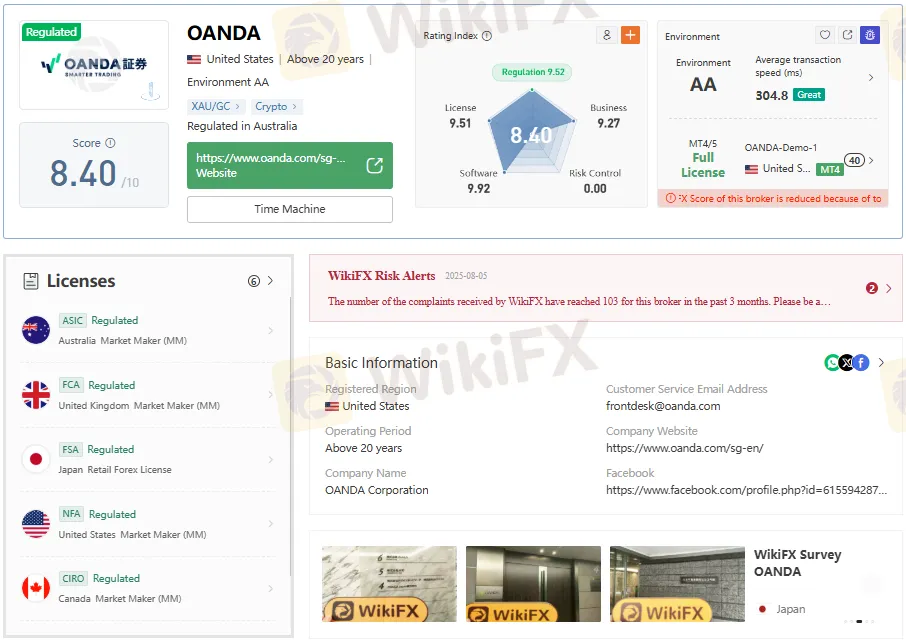

OANDA Corporation represents a distinguished online forex brokerage recognized for transparent pricing and an extensive range of currency pairs trading, delivering clients globally with advanced trading solutions.

This modification to Turkish Lira Forex trading schedules represents a crucial decision for traders depending on TRY pairs, harmonizing market realities with improved trading stability and investor protection.

Don't miss the latest news of your chosen forex broker. Download and install the WikiFX app on your phone by scanning the QR code below.