Abstract:The Forex market is a jungle full of complex trades, high risks, and unpredictable moves. Without the right knowledge, you’re an easy target. In this environment, information is your only weapon. Many scam brokers are out there, ready to take advantage of uninformed traders. In this article, you will learn about another unlicensed broker: Quest.

The Forex market is a jungle full of complex trades, high risks, and unpredictable moves. Without the right knowledge, youre an easy target. In this environment, information is your only weapon. Many scam brokers are out there, ready to take advantage of uninformed traders. In this article, you will learn about another unlicensed broker: Quest. Stay scam-alert and learn the 6 warning signs you need to watch out for.

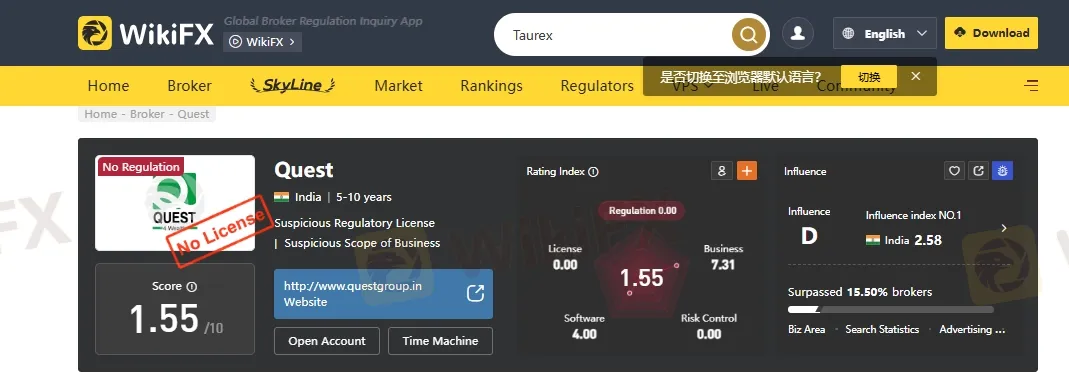

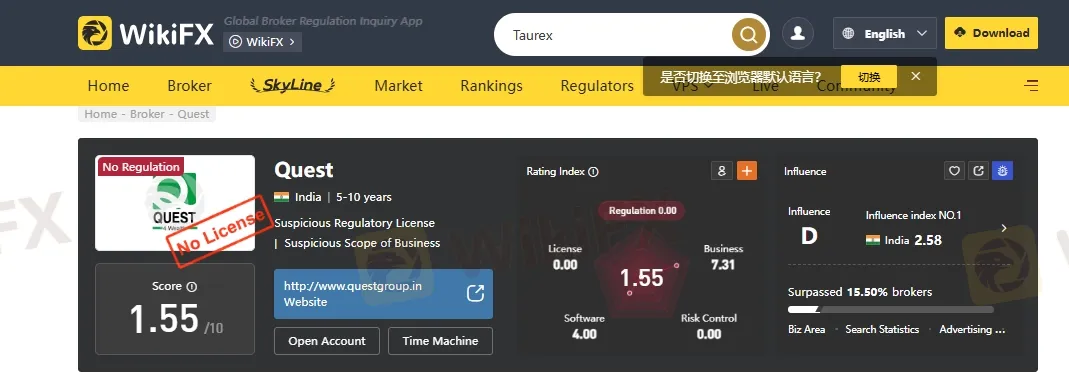

1. No Regulation- Serious Red Flag - One of the most critical factors when choosing a Forex broker is regulation. A regulated broker is overseen by financial authorities that enforce rules to protect traders and ensure fair business practices. When a broker is unregulated, there is no legal framework holding them accountable which means your funds are at serious risk.

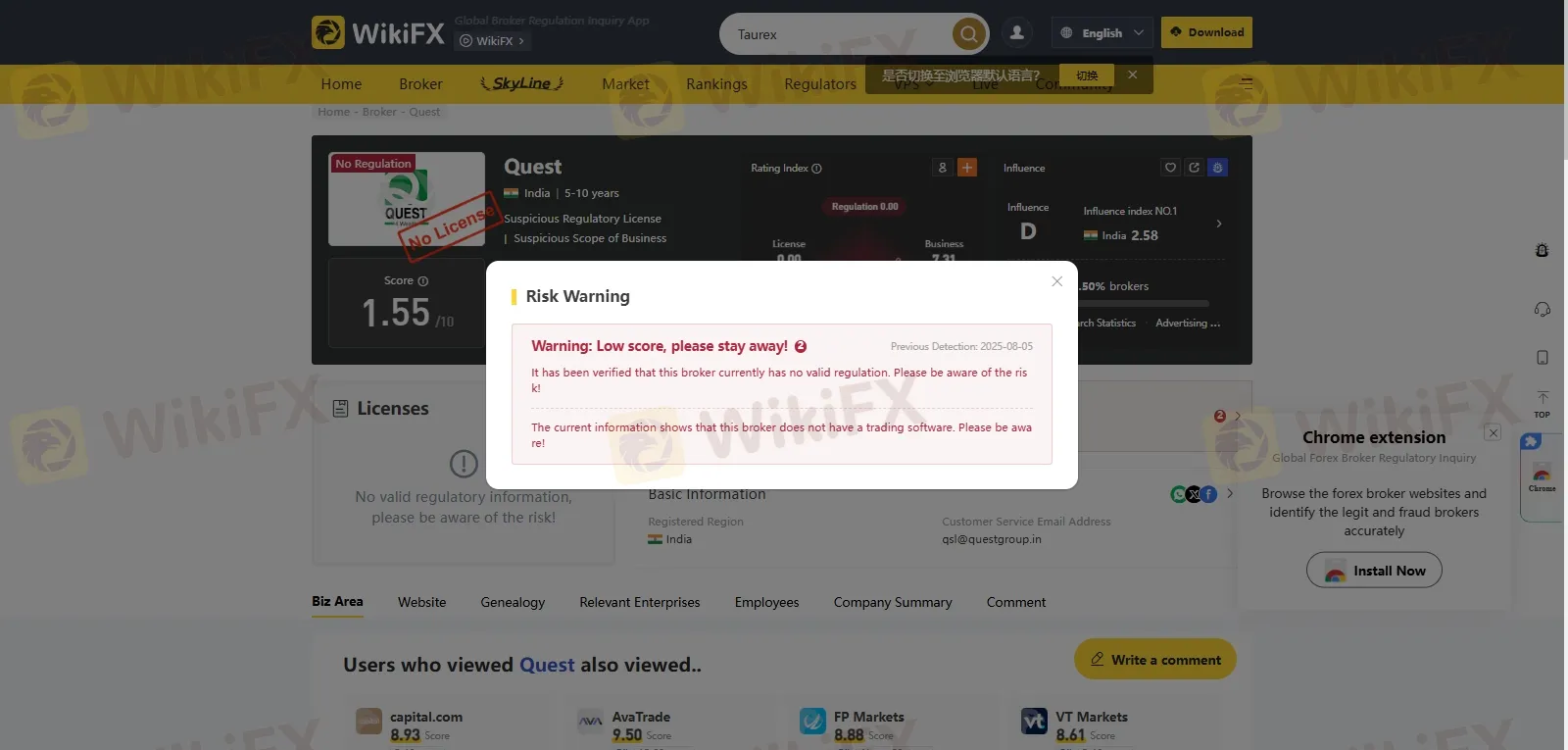

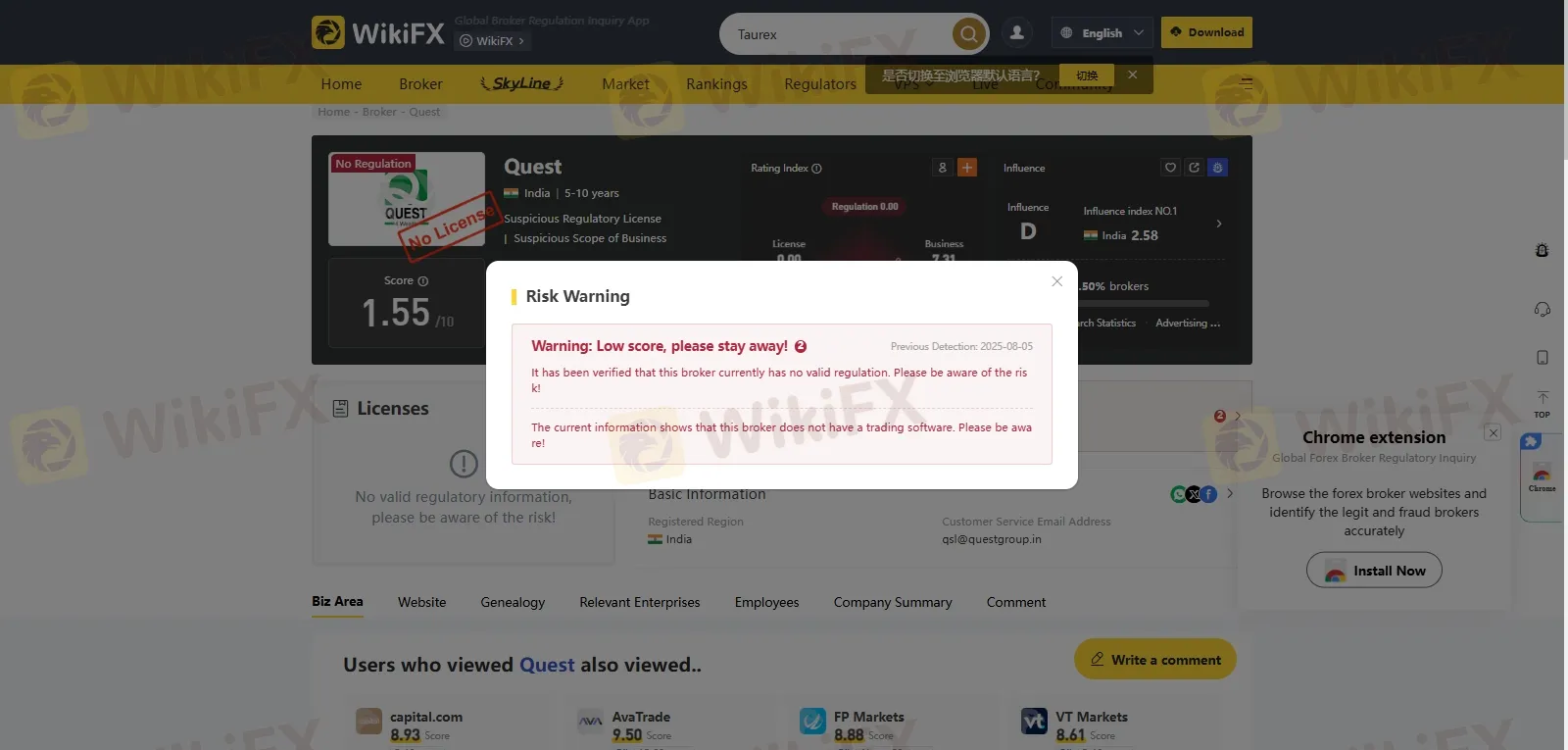

2. Official Warning Issued by WikiFX- Another major red flag is that WikiFX has issued a formal warning against Quest. This is a serious matter. When a platform dedicated to broker verification raises an alert, traders should take notice immediately. WikiFX says - Warning: Low score, please stay away!2

It has been verified that this broker currently has no valid regulation. Please be aware of the risk! The current information shows that this broker does not have a trading software. Please be aware!

3. Extremely Low Credibility Score- One of the biggest red flags when evaluating any broker is their credibility score. A low score is a strong indication that the broker is unreliable and potentially dangerous. In the case of Quest, we checked its rating on WikiFX, a well-known platform that evaluates Forex brokers based on regulation, user reviews, operational history, and more. Quest received a shockingly low score of just 1.55 out of 10. This score is not just a number — it reflects serious concerns about the brokers legitimacy. A score this low means Quest has virtually no credibility, and trusting them with your funds could result in major losses.

4. Risk of Withdrawal Issues or Hidden Fees- Unregulated brokers often delay or obstruct client withdrawals, hide fees, or claim technical glitches. Industry warning lists for bogus brokers frequently highlight these exact issues including refusal to permit withdrawal of funds that clients have deposited.

5. Poor Transparency & Website Quality-Quests online presence appears inconsistent and unprofessional, raising questions about its legitimacy. It may resemble a pyramid marketing structure rather than a regulated brokerage

6. Absence of feedback- A well-functioning broker typically serves dozens, if not thousands, of retail or institutional clients. A brokerage firm without a single verified customer review—on platforms like Google, Trustpilot, or even trading forums is often: Deliberately staying under the radarBoth scenarios are concerning. A broker with no client feedback means you cant verify the quality of service, trade execution, customer support, or withdrawal reliability.

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!