Abstract:Groww is an India-based broker that is gaining popularity rapidly in the country. You will often see its ads on YouTube and other social media platforms. This broker is promoting itself aggressively. But before you invest with this broker, here are 5 red flags you should know.

Groww is an India-based broker that is gaining popularity rapidly in the country. You will often see its ads on YouTube and other social media platforms. This broker is promoting itself aggressively. But before you invest with this broker, here are 5 red flags you should know.

1. Limited investment options- Groww offers a simplified investment platform, but one of its key limitations is the lack of access to certain market segments. Users cannot trade in commodities or currencies, which restricts portfolio diversification for more advanced or active traders. This limited range of investment products may not meet the needs of those looking for a broader exposure to financial markets beyond equities and mutual funds.

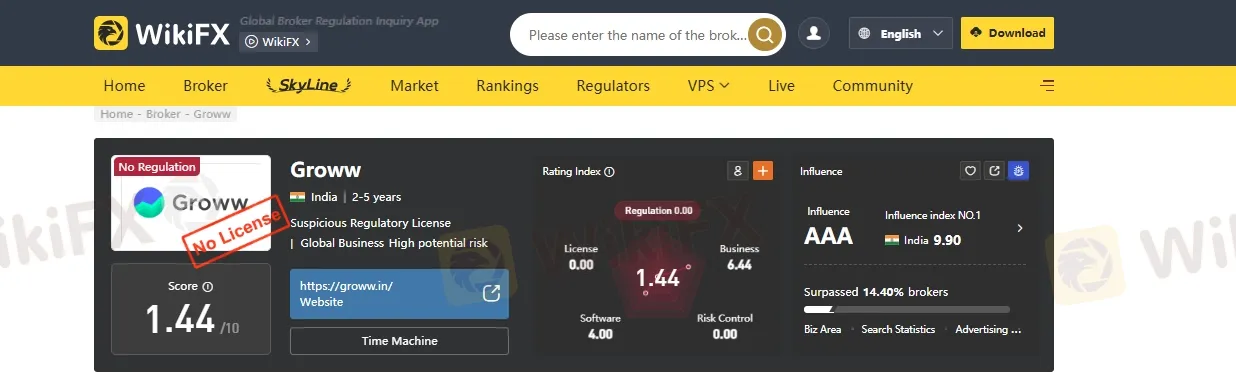

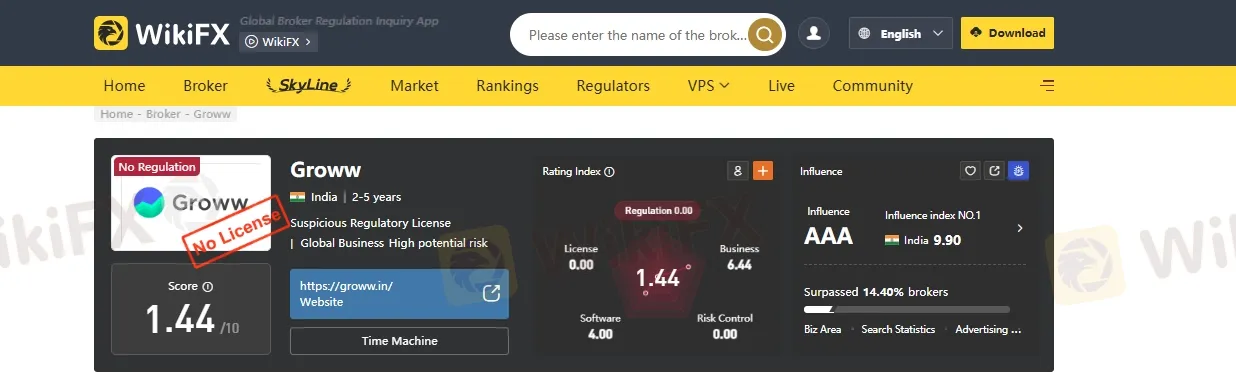

2. Low score - On WikiFX, a website that checks the trustworthiness of forex and crypto brokers, Groww got a very low score of 1.44 out of 10. This shows there are concerns about how well the company is regulated, how transparent it is, and how well it protects its users. A low score usually means the broker doesnt have strong licenses and may not follow important rules for safety and fairness.

3. Lack of Real-Time Customer Support- One of the major drawbacks of Groww is the absence of 24/7 live customer support. Unlike traditional brokers or more advanced platforms, Groww does not provide immediate assistance through phone or live chat. Instead, users must rely on email or ticket-based systems, which often lead to delayed responses. This can be particularly frustrating during time-sensitive situations, such as trading errors, technical glitches, or failed transactions. For investors who need quick resolutions—especially during market hours—this lack of real-time support can result in missed opportunities or financial losses. The limited support infrastructure may also leave new investors feeling uncertain or unsupported when navigating complex investment issues.

4. Lacks Physical branch assistance - Groww operates entirely as an online platform and does not provide any physical branch support. This can be a drawback for users who prefer in-person assistance or need help resolving complex issues. Without branch offices, all customer service is handled digitally, which may lead to delays or limited support for urgent concerns.

5. Lack of Margin Trading facility- Groww does not offer a margin trading facility, which can be a limitation for active traders looking to leverage their positions. Without margin trading, users must invest using only the funds available in their account, reducing flexibility for those who wish to take larger positions or execute short-term strategies. This makes Groww less suitable for high-frequency or leveraged trading.

How to Protect Yourself from Scam Brokers

1. Verify the License of Brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Do not Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Do not Rush

9. Report Suspicious Activity

10. Keep Records

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!