Abstract:Are you witnessing withdrawal denials at One Financial Markets? Does the broker also charge additional fees, such as an account upgrade fee? Is high spread always the case with One Financial Markets? Do you frequently encounter trading losses? These red flags strongly suggest that One Financial Markets may not be a trustworthy broker. In this article, we will share negative trader comments against the broker.

Are you witnessing withdrawal denials at One Financial Markets? Does the broker also charge additional fees, such as an account upgrade fee? Is high spread always the case with One Financial Markets? Do you frequently encounter trading losses? These red flags strongly suggest that One Financial Markets may not be a trustworthy broker. In this article, we will share negative trader comments against the broker.

List of Top Trader Accusations Against One Financial Markets

Additional Fee for Fund Withdrawals

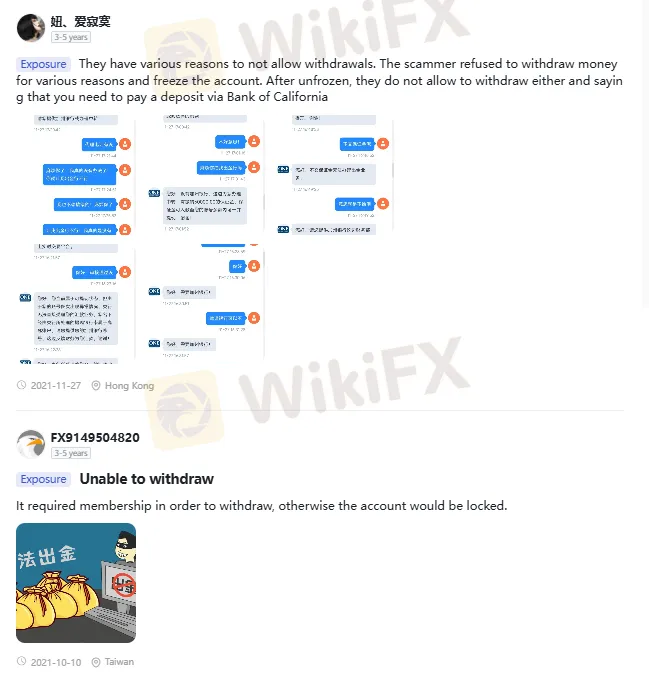

Traders frequently face restrictions on fund withdrawals at One Financial Markets. These include the levying of additional fees. As per many traders, the broker charges 30% of the account balance as an account upgrade fee. Paying them will make them eligible for withdrawals. Some traders, on the other hand, express disappointment over the additional charge on the withdrawal amount. Here are two screenshots explaining this critical issue at One Financial Markets.

Deliberate Freezing of Trading Account

One Financial Markets is also known for intentionally freezing the accounts of traders. Interestingly, the broker makes the trader pay the margin for frozen accounts, which, to a great extent, indicates that it is a scam forex broker. Sharing a screenshot that explains this problem.

Withdrawal Denial Issues Hurt Traders

Traders have been constantly denied access to fund withdrawals. They cannot even contact the customer support team to address their queries and get them resolved on time. Here are multiple complaints regarding this issue.

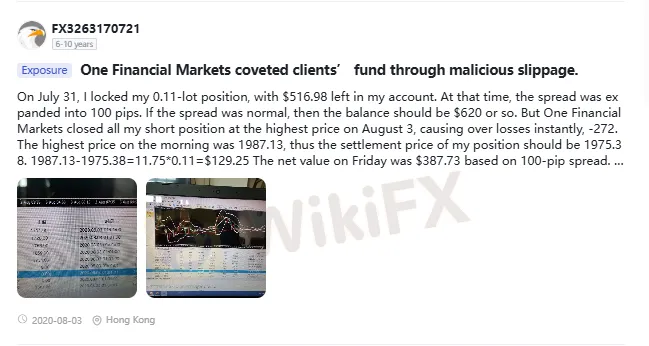

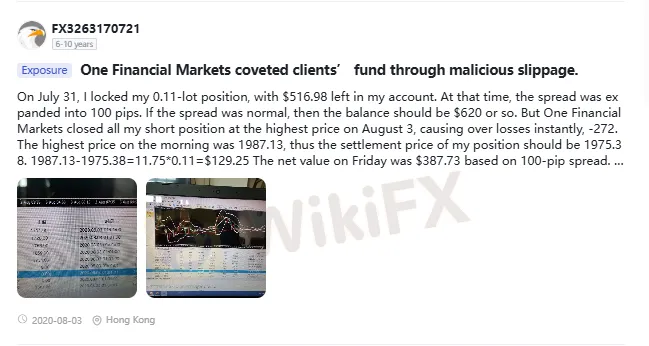

High Spreads Draining Out Investor Capital

High spreads can always come to haunt traders at One Financial Markets. This has caused losses for the traders. Here is the screenshot wherein a trader was caught in no mans land with losses due to increased spreads.

How Does WikiFX See One Financial Markets?

The trading risks remain evident with One Financial Markets as the broker does not hold a regulatory license from any competent financial authority. With no obligation to disclose operational details to the regulator, it scams traders in the name of additional fees and inexplicable rules. We have given this broker just 1.60 out of 10.

Want to Stay Updated About the Latest Forex News? Join the WikiFX Masterminds Community!

Here is how you can join it.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congrats, you have become a community member.