Abstract:When a broker or its agent asks you to transfer money into an unusual or unrelated account, treat it as a serious warning. This practice is one of the most common signs of a scam in online trading, and ignoring it can cost you your savings!

In the fast-evolving world of online trading, brokers act as the gateway for retail and institutional investors to access global financial markets. While many brokers operate under strict regulatory frameworks and uphold ethical standards, there remains a concerning number of fraudulent entities that exploit unsuspecting traders. One of the most common warning signs of a potential scam is when an introductory broker, broker representative, or even the broker itself requests clients to transfer money to alternative or unrelated accounts. If you overlook this “hint”, it could turn into a costly mistake of a lifetime!

Why This Practice Raises Concern

A legitimate and regulated broker operates with clear financial procedures. Clients‘ funds are typically deposited into segregated bank accounts that are transparent, audited, and protected under the supervision of financial regulators. These accounts are used solely for client trading activities, ensuring that investors’ money remains safe and traceable.

By contrast, when a broker requests clients to transfer money into different accounts, particularly personal accounts, overseas bank details, or third-party payment processors, it raises serious red flags. Such practices are often employed by fraudulent brokers attempting to obscure the trail of funds. Once money is diverted in this manner, it becomes significantly harder for traders to recover their capital if disputes arise.

Signs of Unethical Operations

A genuine broker has no reason to ask clients to deposit money outside of its officially registered corporate account. If you encounter requests to move funds elsewhere, this may indicate:

- Lack of regulatory oversight: The broker may not be properly licensed or may be operating under false claims of regulation.

- Attempts to bypass compliance: Genuine brokers must comply with anti-money laundering (AML) and know your customer (KYC) rules. Shifting funds to multiple or unrelated accounts can be a way to circumvent these requirements.

- Preparation for fraud or misappropriation: Once money leaves the official channels, it may be funnelled into the personal accounts of scam operators, with little or no intention of providing trading services.

- Absence of accountability: Regulated brokers provide receipts and transaction records. Fraudulent brokers often avoid official channels to ensure no paper trail remains.

Simply put, this behaviour is inconsistent with ethical business operations.

How a Genuine Broker Operates

Reputable brokers make transparency their cornerstone. Clients are always informed about:

- Where funds are deposited: Official corporate accounts, usually held with well-established banks.

- How funds are protected: Segregated accounts ensure client funds are not used for the companys operational expenses.

- Withdrawal processes: Clear timelines and documented procedures are provided for clients to access their capital.

A genuine broker would never jeopardise its reputation and regulatory status by instructing clients to bypass official deposit channels.

What Traders Should Do If This Happens

If you are ever asked to transfer money into accounts other than those officially listed by your broker, treat it as a serious red flag. Here are immediate steps to take:

- Do not proceed with the transfer. Protect your funds first and foremost.

- Gather evidence. Keep all emails, chat logs, account numbers, and instructions provided by the broker. Screenshots and written confirmations can be invaluable.

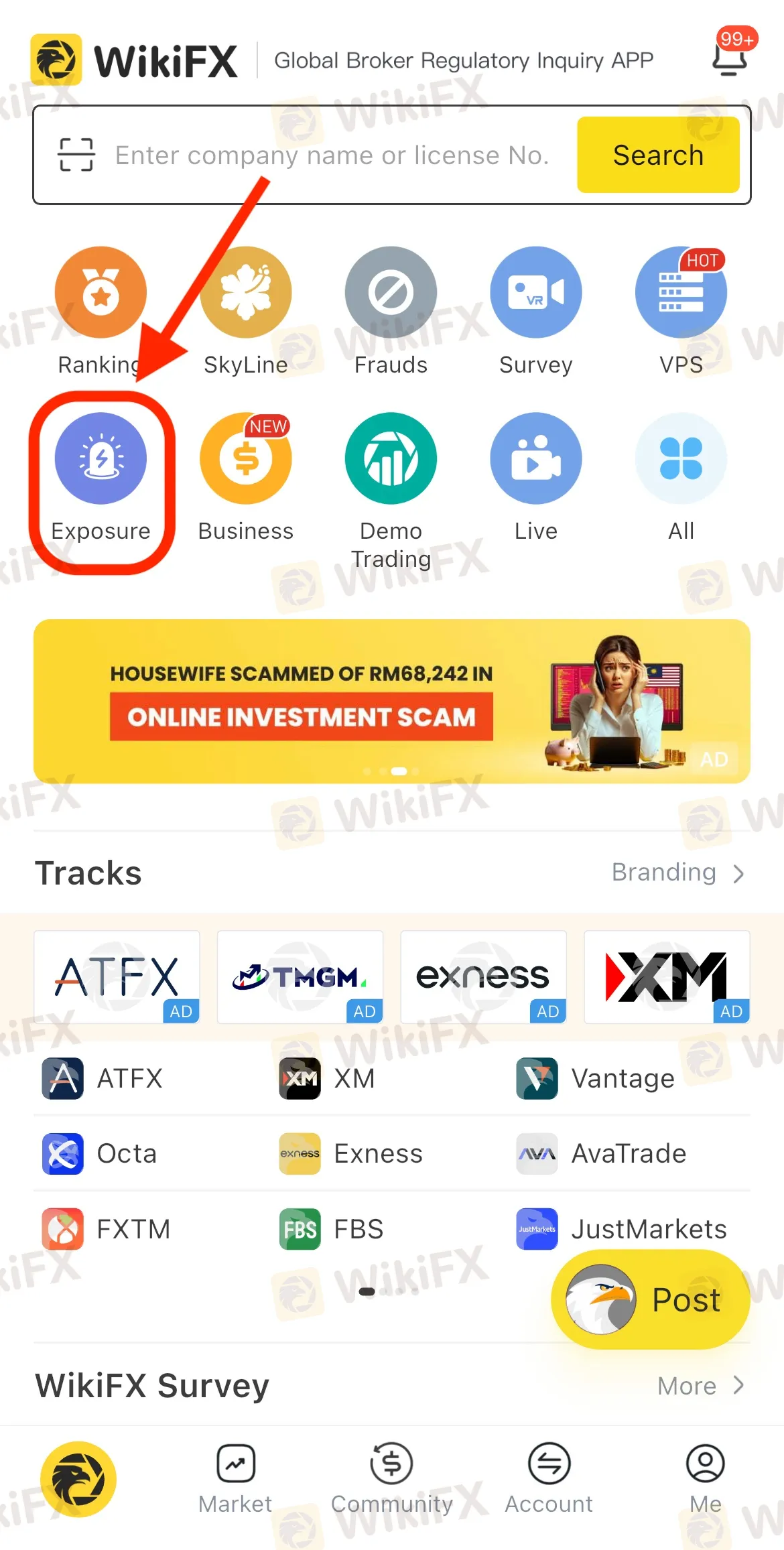

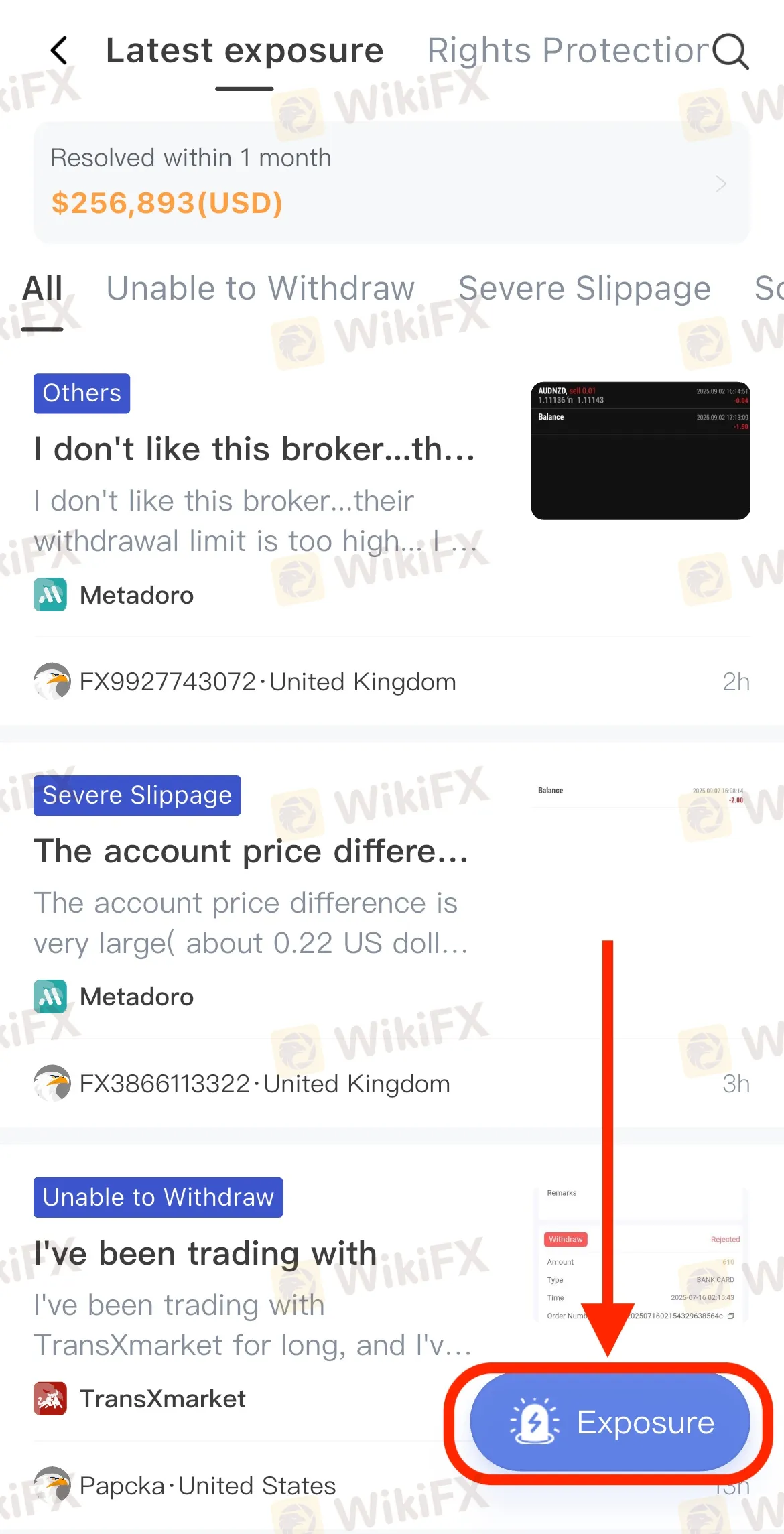

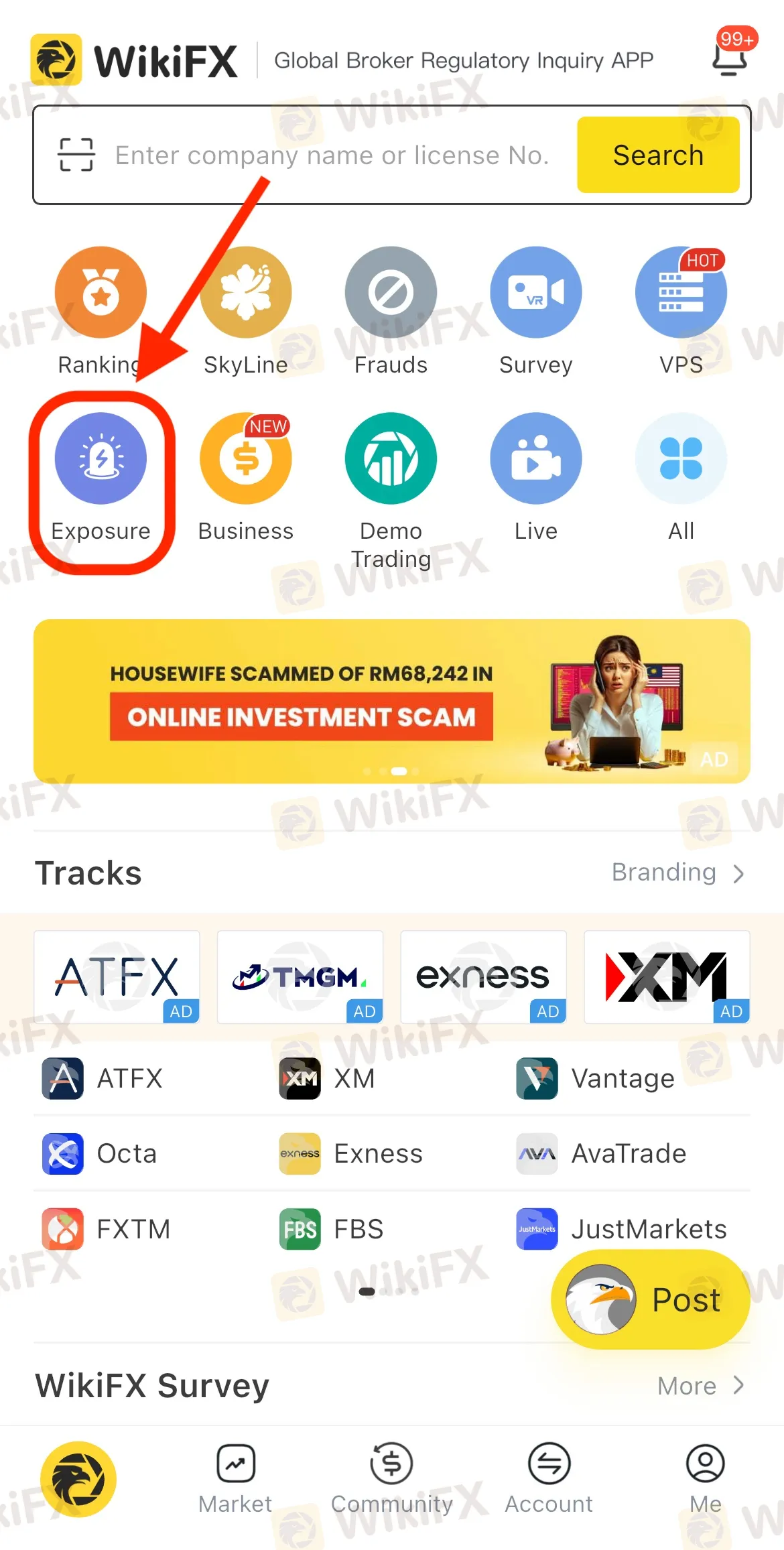

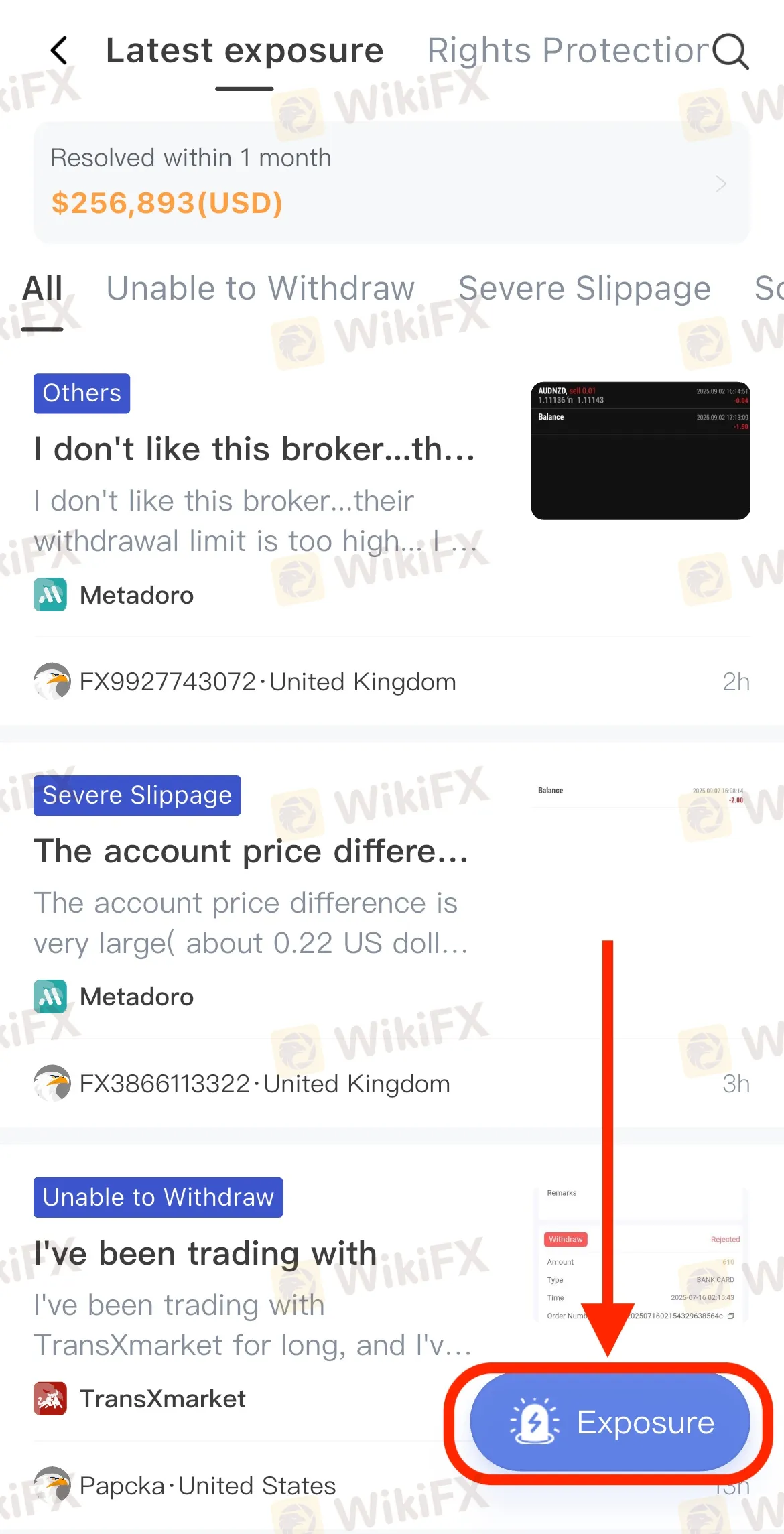

- Seek independent support. Contact WikiFX as soon as possible.

WikiFX provides 100% free, independent investigations into broker disputes. Our mission is to protect traders worldwide by verifying the legitimacy of brokers and exposing unethical practices. While outcomes may vary depending on the complexity of the case, our team will make every possible attempt to resolve disputes and assist traders in safeguarding their interests.

Download our app for free from Google Play or App Store today.