简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

JP Markets Review: Is This FX Broker Really Worth Investing? Know the Truth!

Abstract:When it comes to investing in forex, selecting the right broker is a key decision. In this detailed JP Markets Review, we’ll explore whether JPMarkets broker, a South Africa-based Forex and CFD broker, lives up to its claims. Is it one of the best regulated forex brokers, or should traders be cautious?

When it comes to investing in forex, selecting the right broker is a key decision. In this detailed JP Markets Review, well explore whether JPMarkets broker, a South Africa-based Forex and CFD broker, lives up to its claims. Is it one of the best regulated forex brokers, or should traders be cautious?

JPMarkets is a Forex Broker Focused on South Africa

JPMarkets is a forex broker that is registered in South Africa and primarily caters to South African clients. While the platform is technically available to global users, its services are limited and more localized. For those looking for broad, international online forex trading platforms, this could be a limitation.

JPMarkets Regulation – Is It Enough?

Though JPMarkets regulation is valid in South Africa, it doesnt meet the standard of global regulation offered by top-tier authorities like FCA or ASIC. Traders looking for security should consider best regulated forex brokers with a global reputation and tighter oversight.

Only One Platform Available

One of the main concerns found in this JP Markets Review is that the broker only offers the MetaTrader trading platform. While MetaTrader is widely used, many modern traders expect a variety of forex trading tools and custom features. Online forex trading platforms today often include mobile apps, web-based platforms, and tools for strategy automation—none of which are highlighted by JPMarkets.

High Trading Costs & Limited Account Options

JPMarkets comes with several financial barriers. The minimum deposit is $300, which is higher than most entry-level brokers. Moreover, there are no cent accounts available. This makes the broker less attractive for beginners who want to start small.

The platform is known for high trading fees, which may reduce profitability for both short-term and long-term traders. For those evaluating how to choose a forex broker, these fees are an important factor to consider.

Lack of Transparency

One of the biggest red flags in this JP Markets Review is the lack of transparency on the website. Key information such as spreads, commission structures, and account types is either unclear or missing altogether. For a company that handles client funds, this lack of clarity is concerning.

Conclusion

This JP Markets Review shows that while JPMarkets is a legally registered Forex and CFD broker, it falls short in many areas-limited platforms, high fees, and low transparency. If you are serious about investing in forex, it's wise to compare other forex trading online brokers that offer better conditions, lower fees, and a higher level of regulatory trust.

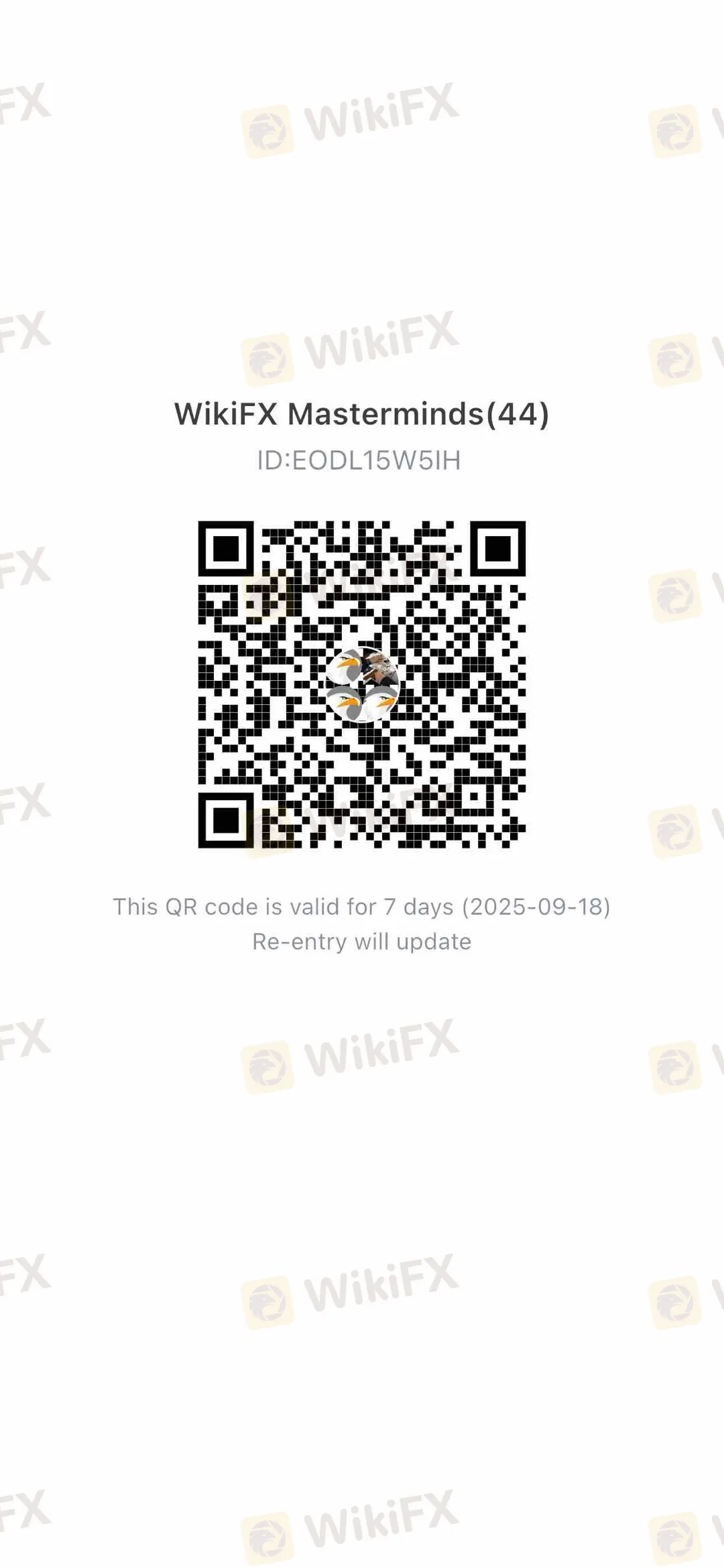

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Currency Calculator