Abstract:Do you feel dissatisfied with your overall trading experience at eXcentral? Does the forex broker refuse to entertain your withdrawal requests? Have you been bereft of your hard-earned capital because of constant losing trades at eXcentral? Have eXcentral officials pushed you into risky trades under the lure of guaranteed profits? These experiences have been shared by many traders on review platforms. In this article, we have shared their negative reviews of the broker.

Do you feel dissatisfied with your overall trading experience at eXcentral? Does the forex broker refuse to entertain your withdrawal requests? Have you been bereft of your hard-earned capital because of constant losing trades at eXcentral? Have eXcentral officials pushed you into risky trades under the lure of guaranteed profits? These experiences have been shared by many traders on review platforms. In this article, we have shared their negative reviews of the broker.

Complaints That Tarnish eXcentral Across Review Platforms

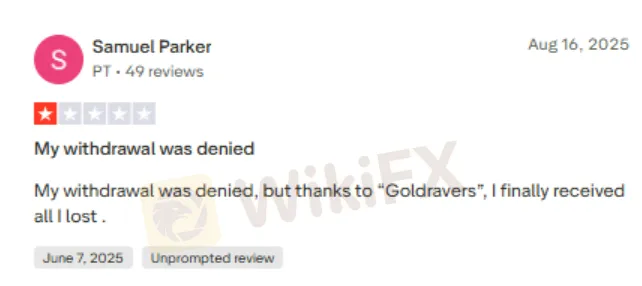

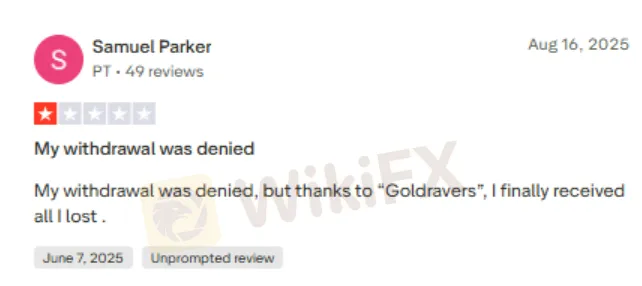

Legal Help Sought to Recover Stuck Funds

Many traders have complained that eXcentral purposely denies them fund withdrawal access. Their withdrawal requests remain pending for months as the broker does not entertain them. Some of them had to go legal to recover their funds. Here are some screenshots that explain the situation.

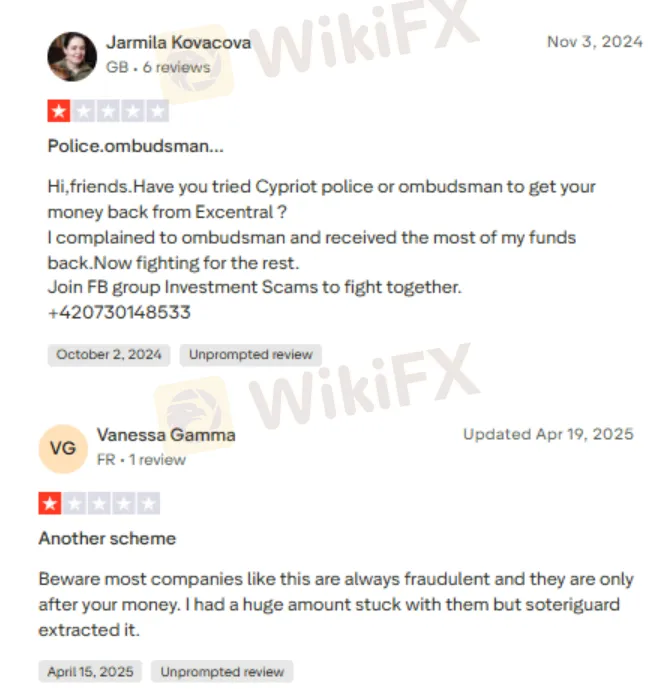

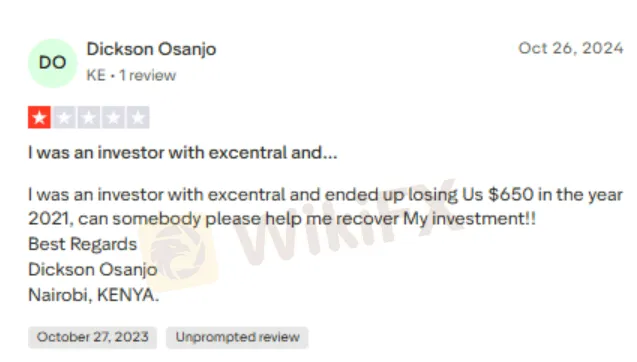

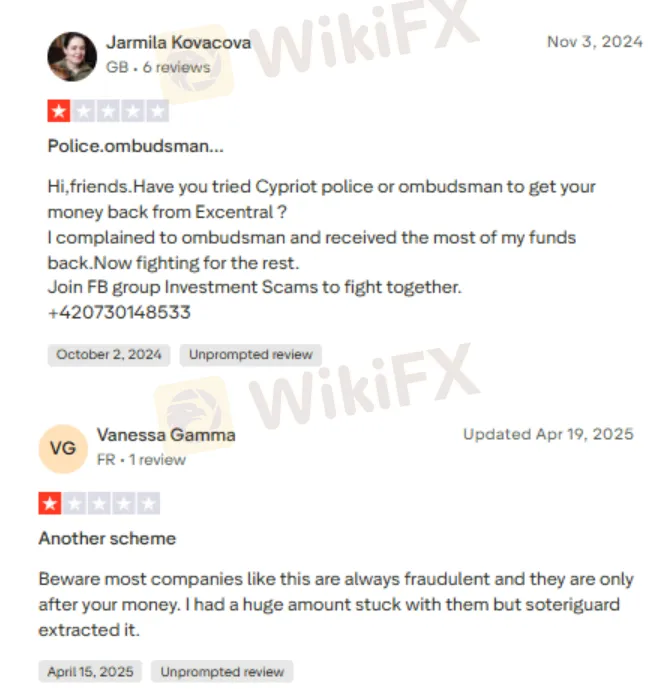

650 USD Lost, Searching Haplessly for Recovery

Among the complaints, we found one where a trader admitted to having lost 650 USD in a year. The trader is haplessly searching for recovery assistance. The screenshot shared below explains the situation.

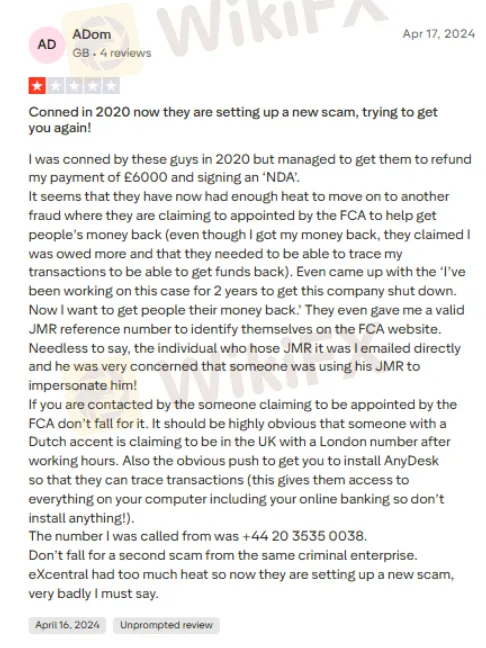

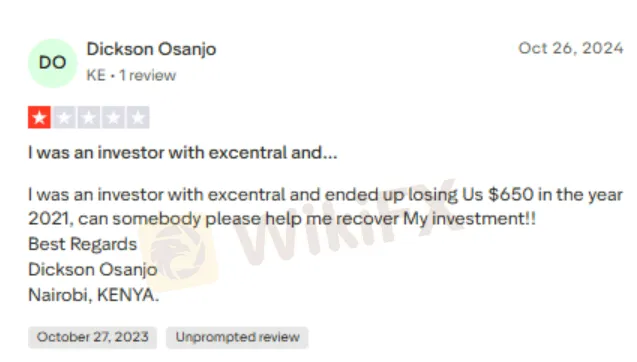

The Impersonation Case to Deceive Investors Further

A trader claimed after a former eXcentral official after scamming him tried to scam further by claiming that he was appointed by the FCA to help traders recover their funds from the company. The official even showed a JMR reference number; however, that was turned out to be fake. Please check the screenshot below detailing how the incident unfolded for the trader.

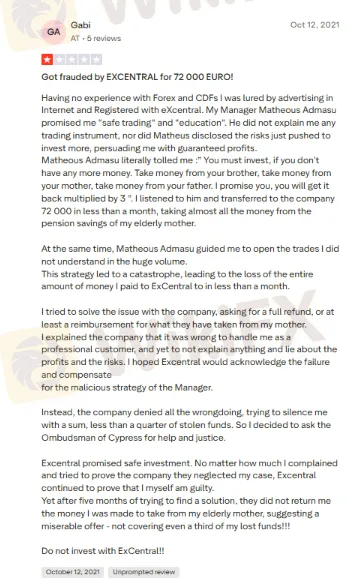

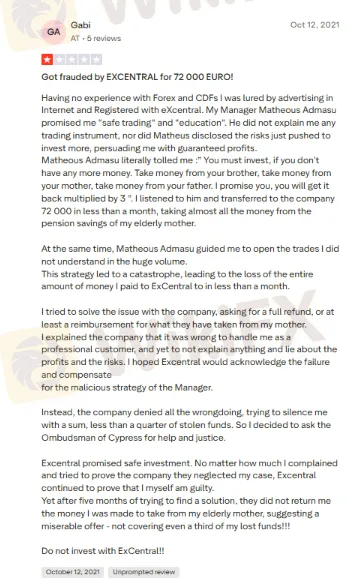

The Guaranteed Profit Lure Rightfully Turned False

Some traders, especially those new to forex trading, have been lured into investing through the ‘guaranteed profit’ propaganda proposed by eXcentral officials. The officials even tell traders to borrow money from anyone, be it relatives or friends, and invest through the platform. However, as forex trading involves risks despite enormous profit potentials, traders do face losses. One trader lost the entire amount invested, and shared his review online. Check the screenshot explaining the traders financial misery.

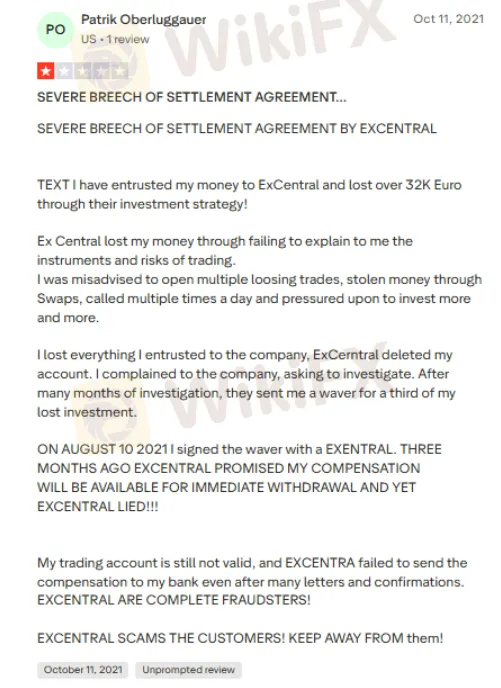

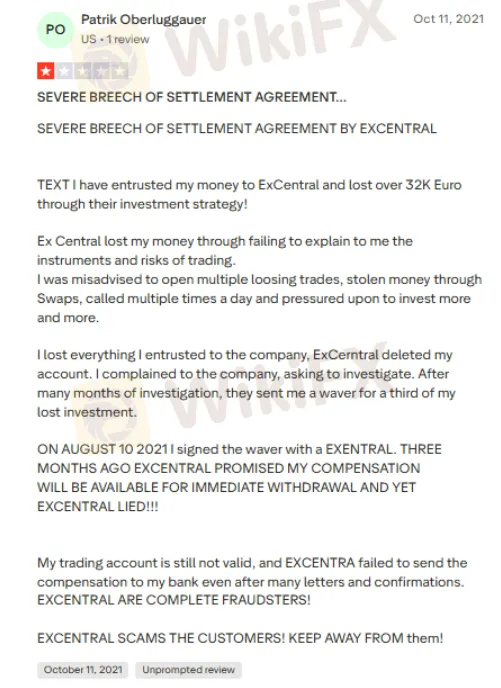

Poor Investment Advisory Led to Massive Capital Losses

Traders have been losing their capital because of numerous investment scam practices employed by eXcentral, including poor trading strategies. They have been wrongly advised to open losing trades, besides being manipulated through illicit execution of swaps. All of these have led to massive capital losses for traders. One trader has specifically complained about this problem online. Here is the traders review.

What Does the WikiFX Team Have to Say on It?

Upon investigation, the WikiFX team found eXcentral to be a counterfeit dealer, explaining the reason for losses traders witnessed here. If you have invested here, take the legal route to recover your capital soon. Also, those who are yet to invest in forex should choose a regulated broker to stay away from scams. On WikiFX, the worlds leading broker regulation inquiry app, you can find a list of regulated and unregulated brokers. This makes your broker selection seamless.

Stay updated about the latest forex scams and other financial news on WikiFX Masterminds.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.