Abstract:This article is a review of FX Live Capital. It reveals many facts about the broker, including issues with its regulation and red flags that it tries to hide. This is a scam alert article, and traders and investors should read it until the end.

This article is a review of FX Live Capital. It reveals many facts about the broker, including issues with its regulation and red flags that it tries to hide. This is a scam alert article, and traders and investors should read it until the end.

Offshore Regulation

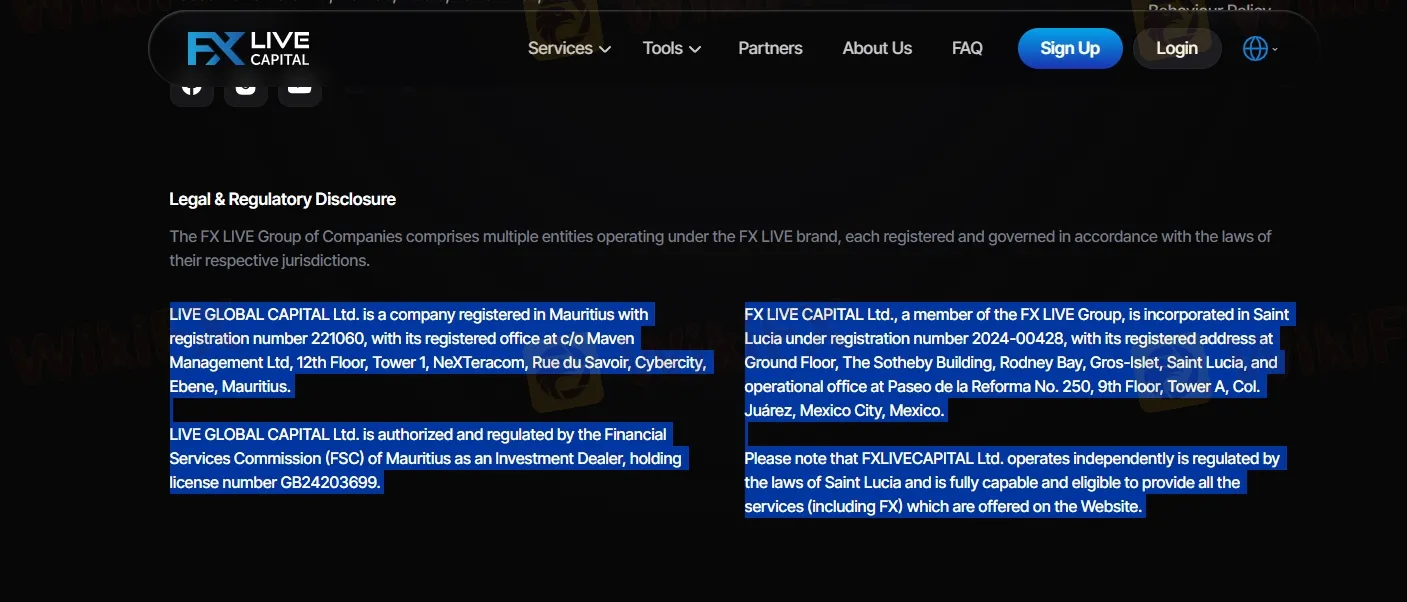

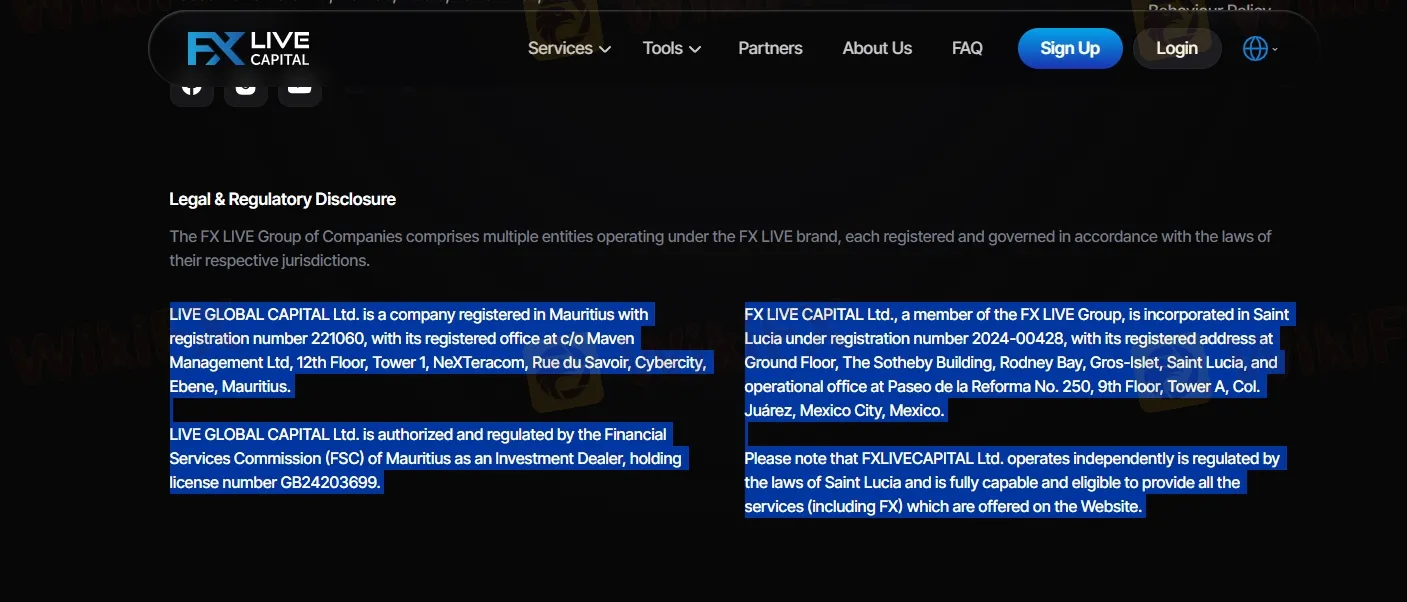

According to the broker, FXLiveCapital is registered in Saint Lucia under registration number 2024-00428, with its official address at The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia. The company also operates offices in Mexico, Argentina, and Dubai, indicating a broad international presence.

However, it is important to note that offshore regulation, such as registration in Saint Lucia, does not provide strong safety or investor protection. These jurisdictions typically lack strict oversight, which can leave traders exposed to higher risks.

Access to MT4/ MT5 ?

FXLive Capital provides traders with access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available under their “Zero Commission” account option. These platforms are offered in both desktop and mobile formats, giving users the convenience to monitor and execute trades on the go or from their personal workspace. With a wide range of tools and features, the platforms are built to support a smooth and flexible trading experience across all devices.

Is FXLive Capital a Prop Firm?

FXLive Capital is not a proprietary trading firm(PROP Trading Firm) As stated in its Google Play description, the company focuses on providing CRM and software solutions specifically designed for brokers, prop firms, and fund managers. Its platform helps these financial professionals manage their operations more efficiently, enhance client interaction, connect with trading platforms, and boost overall productivity.

FXLive Capital on WikiFX

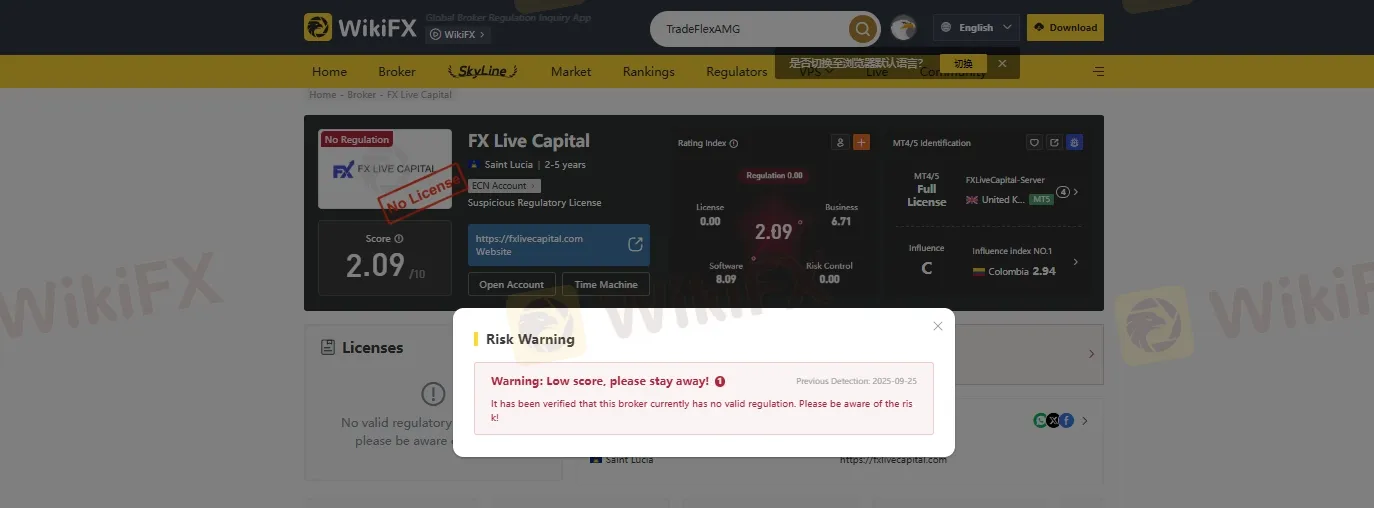

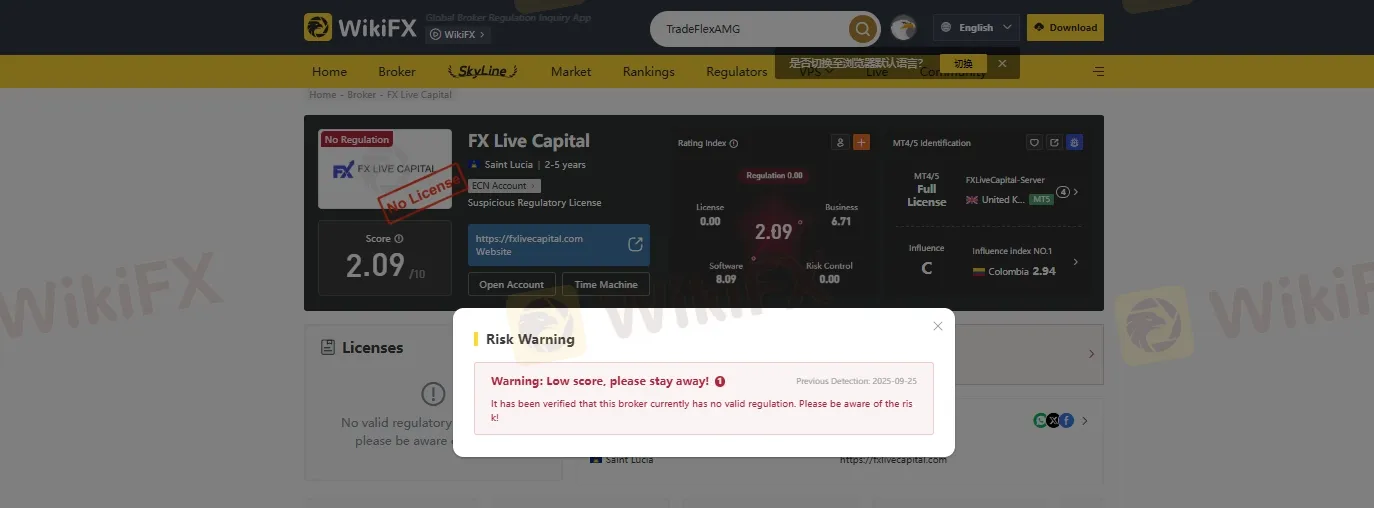

In our FXLive Capital review, we discovered that WikiFX, a well-known third-party platform that evaluates and rates forex brokers, gave this broker an alarmingly low score of 2.09 out of 10. This rating reflects serious concerns regarding the brokers credibility and operational transparency.

In addition to the poor score, WikiFX also issued a strong warning against FXLive Capital. The platform highlighted multiple red flags, including a lack of transparency and the absence of proper regulatory oversight. Due to these issues, FXLive Capital categorized as a high-risk, low-score broker, advising traders and investors to stay away from this platform to avoid potential financial loss.

Conclusion: Should You Trust FXLive Capital?

Based on everything revealed in this FXLive Capital review, this broker raises multiple red flags. From offshore regulation and unclear business operations to an extremely low score on WikiFX and official warnings, the risks associated with FXLive Capital are too significant to ignore.

Even though the broker offers MT4 and MT5, these platforms alone do not guarantee safety or legitimacy. The overall lack of transparency, absence of strong regulation, and poor third-party ratings make FXLive Capital a broker to avoid.