Abstract:Pepperstone has built a global reputation as a forex and CFD broker, and it frequently highlights its network of international licences. Yet, when examined through WikiFX, the picture becomes more complex.

Pepperstone has built a global reputation as a forex and CFD broker, and it frequently highlights its network of international licences. Yet, when examined through WikiFX, the picture becomes more complex. While not currently on the Securities Commission Malaysias Investor Alert List, this does not mean the broker is automatically safe for Malaysian investors.

WikiScore: Not Without Concerns

WikiFX provides Pepperstone with a relatively balanced WikiScore, acknowledging its regulated presence in several jurisdictions. However, the score also reflects caution. The platform lists a variety of complaints lodged by traders through the Exposure section. These include grievances about delayed withdrawals, unfair spreads, sudden account restrictions, and unresponsive customer service.

For any broker, even one with regulatory licences, the number and seriousness of complaints should not be dismissed. They point to real-world issues traders have experienced, some of which involve direct risks to their funds.

View WikiFXs full review on Pepperstone here: https://www.wikifx.com/en/dealer/0361453884.html

Pepperstones Licences: A Mixed Picture

On paper, Pepperstone holds an impressive spread of licences:

- ASIC (Australia) – Market Maker (MM), Regulated

- CySEC (Cyprus) – Market Maker (MM), Regulated

- FCA (United Kingdom) – Straight Through Processing (STP), Regulated

- DFSA (Dubai) – Retail Forex Licence, Regulated

- SCB (Bahamas) – Retail Forex Licence, Offshore

- BaFin (Germany) – Common Financial Service Licence, but flagged as “Exceeded”

The range of licences seems reassuring. However, WikiFX points out that Pepperstones activities under BaFin in Germany exceed the approved business scope, raising questions about oversight. Offshore licences, such as the one in the Bahamas, also offer weaker investor protection compared with stricter regulators like the FCA or ASIC.

Not on the SC Alert List, But Still Risky

For Malaysians, it is critical to note that Pepperstone is not licensed by the Securities Commission Malaysia. This means that if problems arise, the SC cannot intervene, and traders have no recourse under Malaysian law.

Pepperstone‘s absence from the SC’s Investor Alert List should not give a false sense of security. The SC list is not exhaustive, and not all unlicensed or problematic brokers are immediately flagged. Traders should remember that regulation in other jurisdictions does not automatically extend protections to Malaysian clients.

In other words, unless a broker is directly licensed by the SC, Malaysians remain exposed if disputes occur.

Complaints from Traders | What WikiFX Users Report

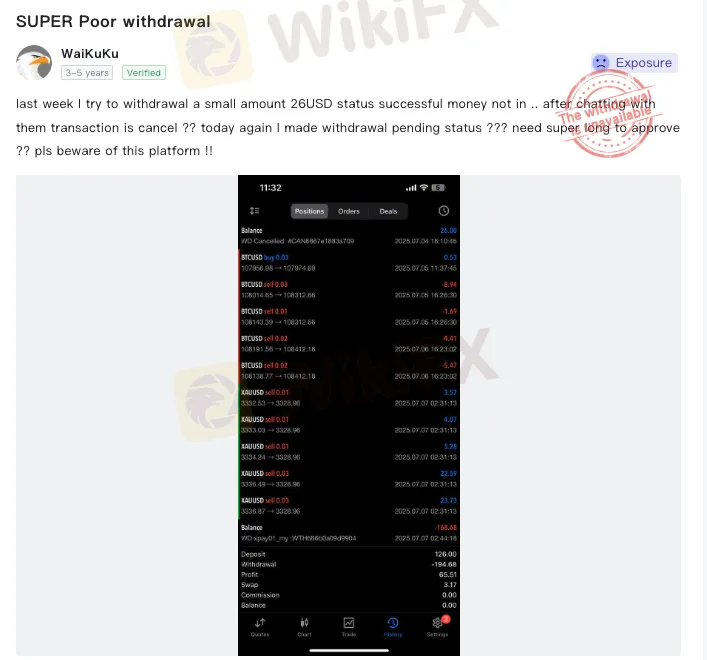

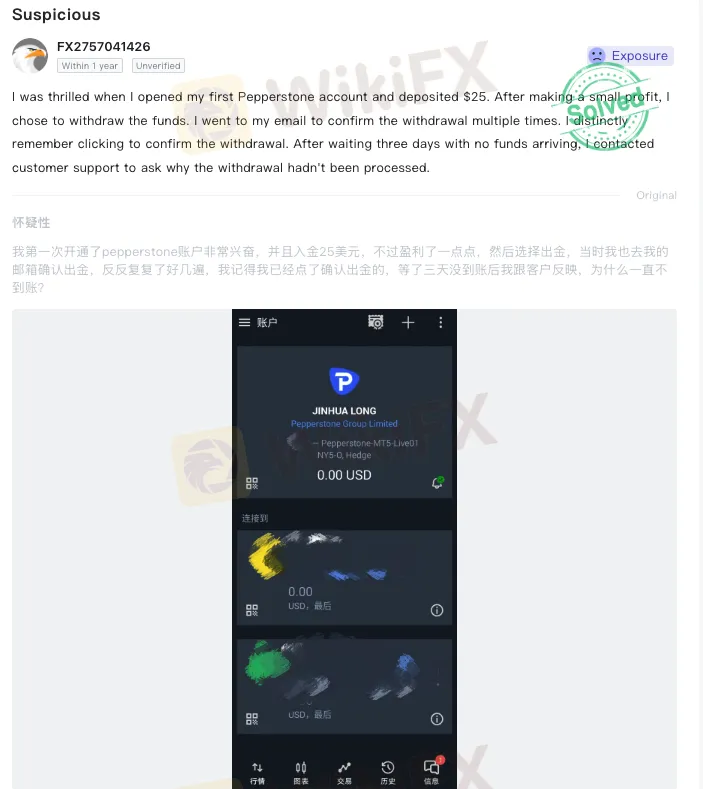

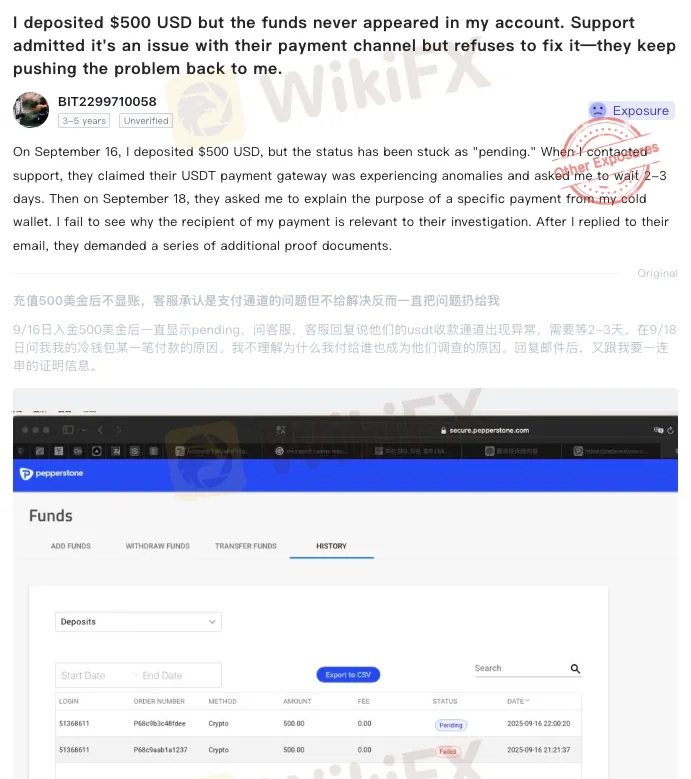

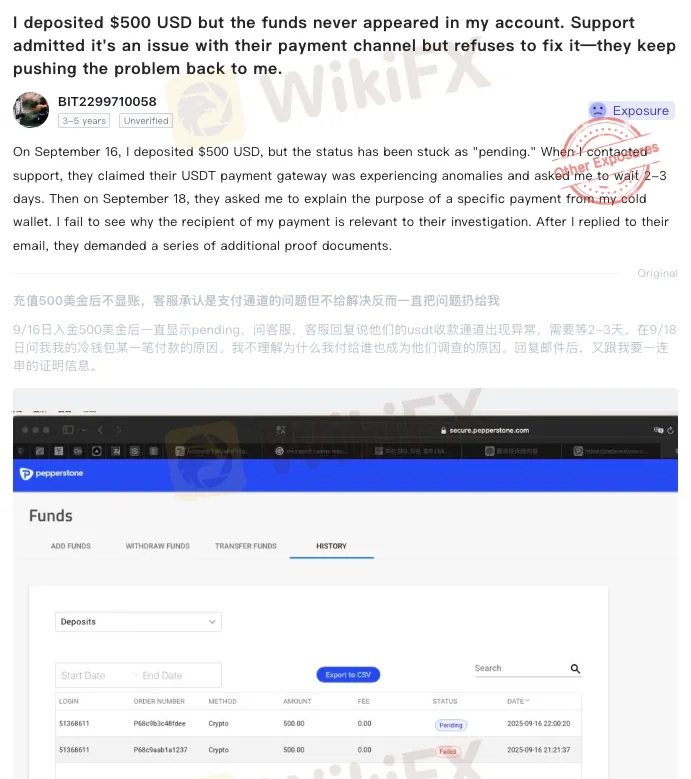

The Exposure page on WikiFX features several troubling reports from Pepperstone clients. Among them:

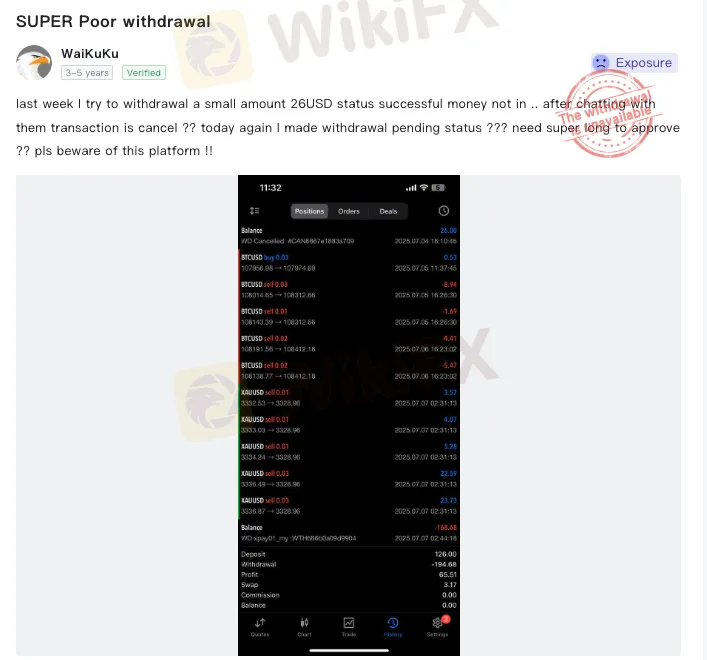

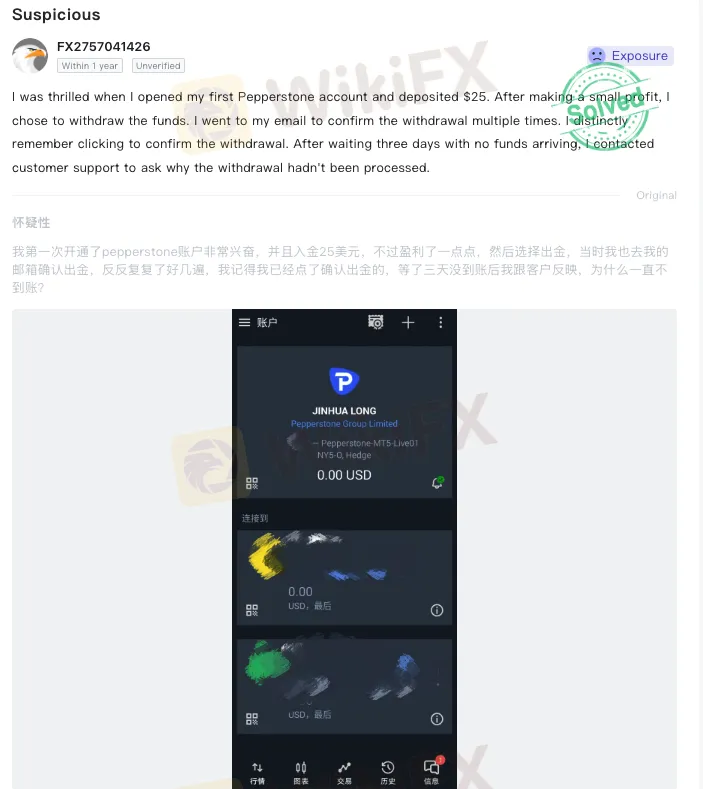

- Traders have reported that their withdrawals were delayed or rejected, leaving them unable to access funds.

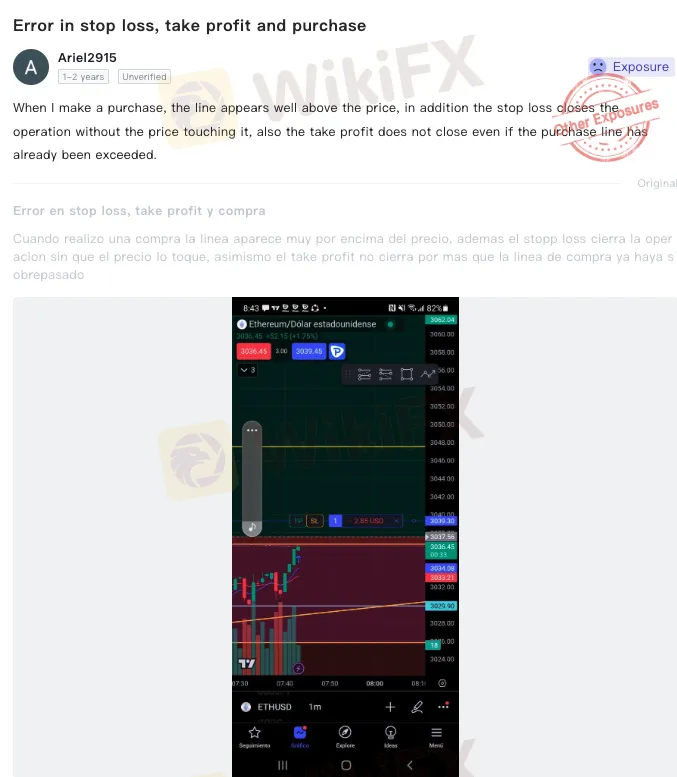

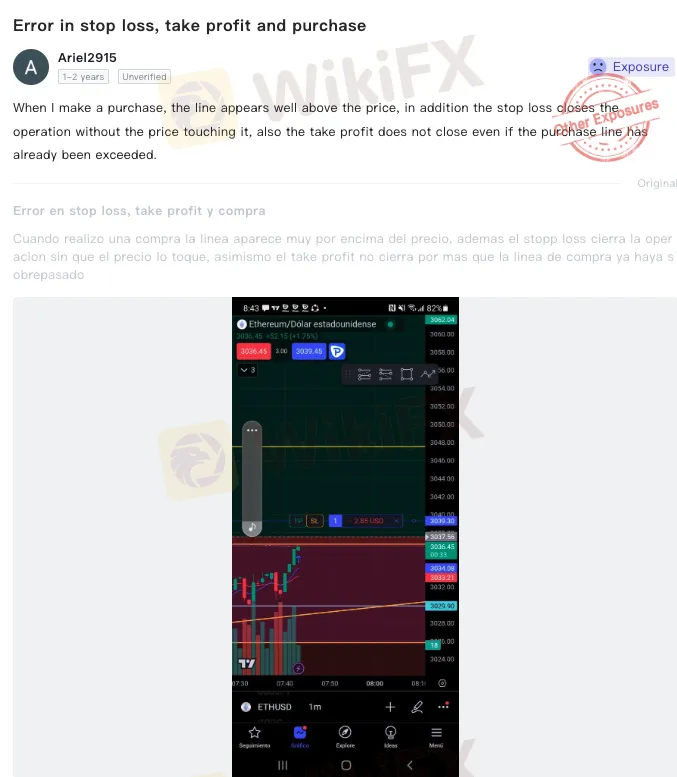

- Some users claimed to face unfair trading conditions, such as sudden changes in spreads or slippage that worked against their positions.

- Others described abrupt account restrictions, especially after profitable trades, combined with a lack of clear explanation from the broker.

- Customer support was described as slow and unhelpful, adding to the frustration of already stressed traders.

While Pepperstone enjoys a larger international profile than many small offshore brokers, these complaints show that even well-known names can create certain difficulties for clients.

WikiFX‘s Reminder

Pepperstone’s regulatory footprint may look impressive at first glance, but Malaysian traders must take a more cautious view. The broker is not licensed by the SC, it faces complaints from clients about withdrawal and trading issues, and one of its licences (BaFin in Germany) has already been flagged for exceeding its authorised scope.

The absence of Pepperstone from the SCs Investor Alert List does not mean it is safe. It only means it has not yet been flagged locally.