Abstract:Starting your trading journey with a reliable and licensed broker is crucial. In the fast-paced world of forex trading, partnering with an unregulated broker can expose you to significant financial risks. Therefore, in this article we’ll let you know the steps to verify if a broker is legit or not ?

Starting your trading journey with a reliable and licensed broker is crucial. In the fast-paced world of forex trading, partnering with an unregulated broker can expose you to significant financial risks. Therefore, in his article well let you know the steps to verify if a broker is legit or not ?

1. Why Choosing a Legit Forex Broker is Important?

A legit forex broker ensures transparency, fund safety, fair trading conditions, and proper dispute handling. Regulated brokers operate under strict guidelines laid down by financial authorities like FMA (New Zealand), FCA (UK), or ASIC (Australia). So, if youve ever asked, “How do I know if a forex trader is legit?”, the answer lies in proper regulation and accountability.

2. How to Verify if a Forex Broker is Legit?

If you're wondering, how to check if a broker is legit, heres a step-by-step guide to help you make a safe choice.

a. Verify the License Number

Every genuine broker must display its license number on its website. Look for this number in the footer, ‘About Us’, or legal section of the site. This is your starting point to confirm their regulatory claims.

b. Recheck with the Regulators Official Register

Visit the official website of the claimed regulator (e.g., FMA NZ). Use their license search tool to verify the license number. If the broker doesnt appear in the database, it's likely unregulated or falsely claiming regulation.

c. Search for Negative News

Type the brokers name into a search engine with terms like “scam”, “complaints”, or “fraud”. This helps you quickly spot patterns and identify whether others have had bad experiences.

d. Read the Broker Reviews

Check third-party platforms like Trustpilot, Forex Peace Army, or Reddit. Reviews from real users can reveal insights into withdrawal issues, customer service quality, and suspicious behavior.

e. Spot the Red Flags

Common red flags include:

• Promises of guaranteed profits

• Unsolicited trading calls or emails

• Poor website quality

• Pressure to deposit large sums quickly

3. What to Do if Your Broker is Not Legit?

If you suspect youve signed up with an unregulated or fraudulent broker, act quickly:

• Stop deposits immediately

• Request withdrawal of any remaining funds

• Report the broker to the relevant regulatory authority

• Leave reviews online to warn others

Conclusion

Still asking, “How do you know if a forex company is legit?” The answer lies in due diligence. Taking time to verify a forex broker, check credentials, read reviews, and spot red flags will save you from potential scams and secure your trading journey.

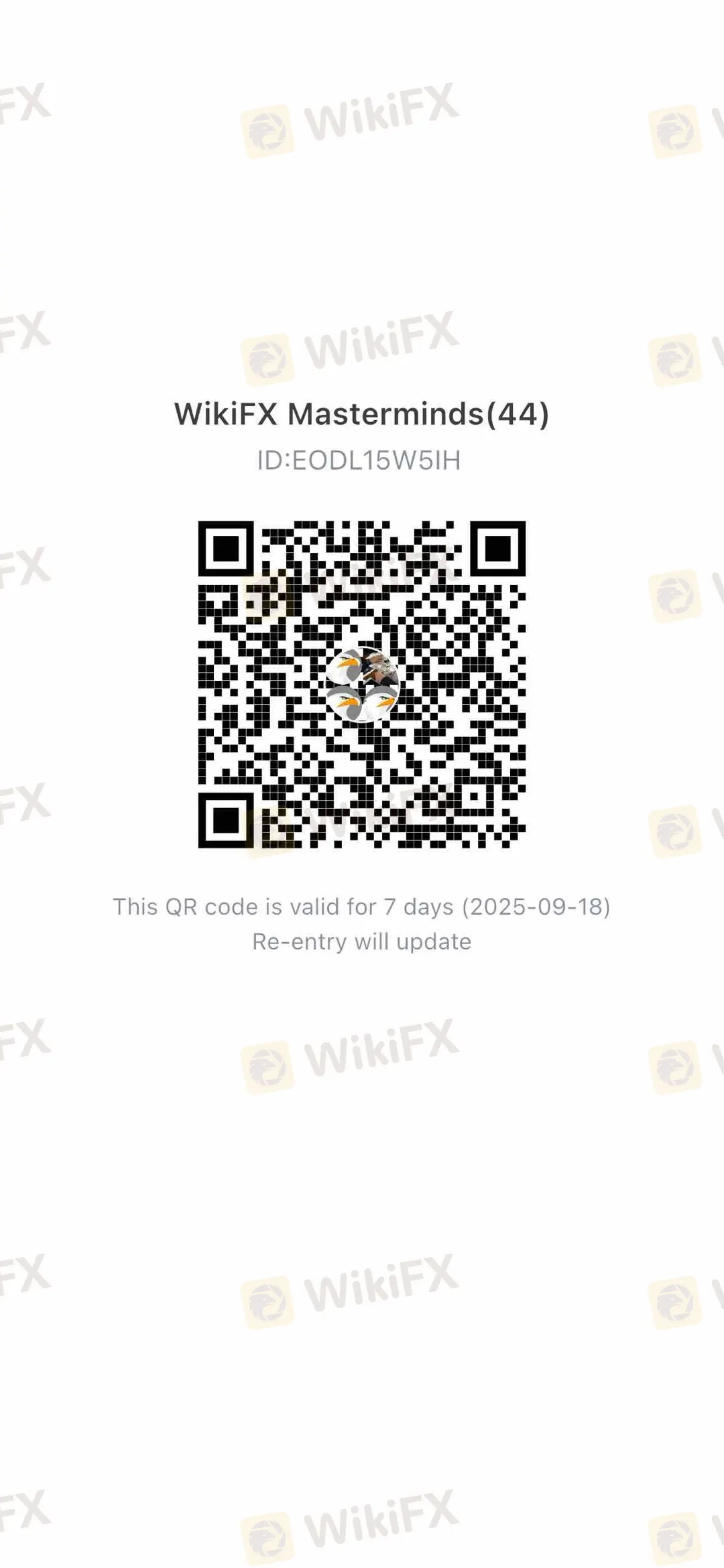

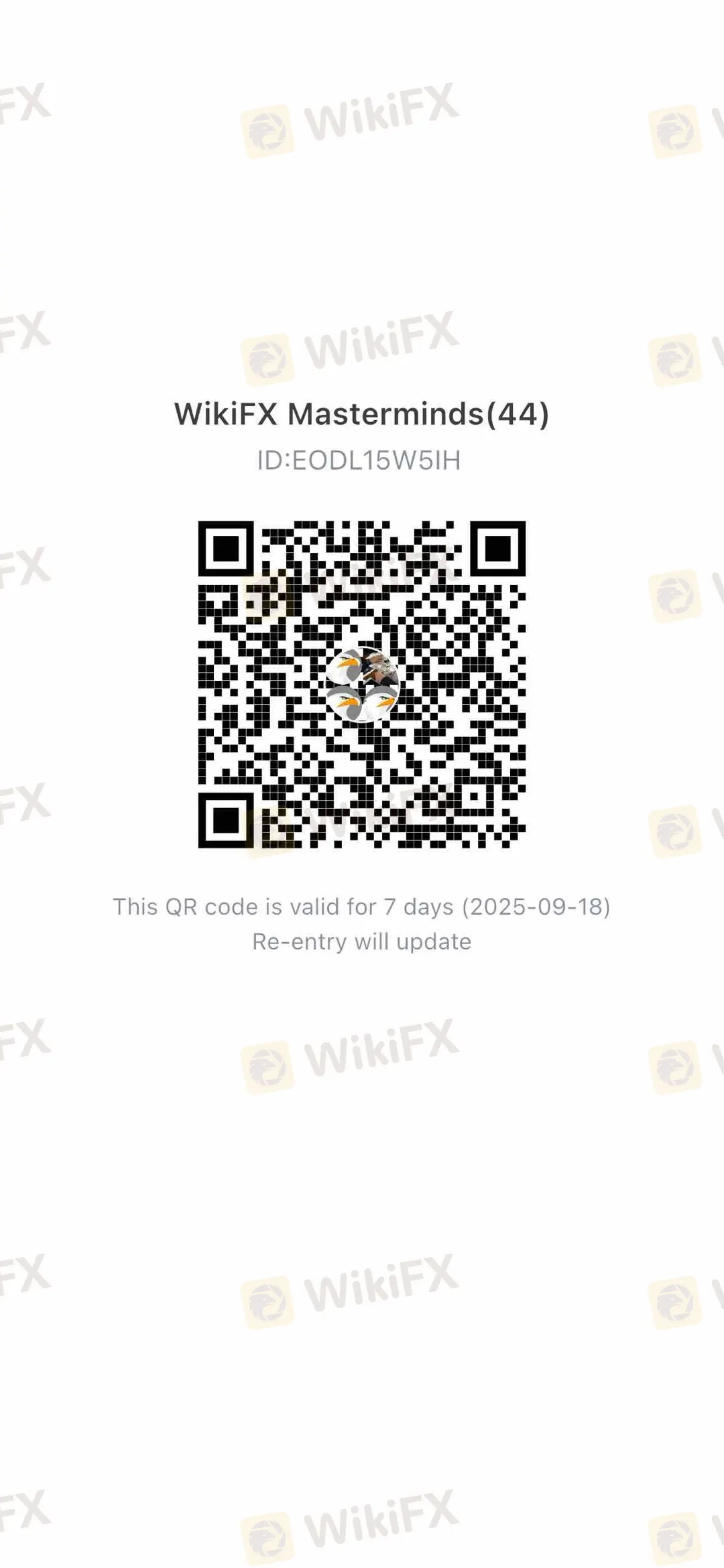

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!