Abstract:Alpha FX Markets is an Unregulated Scam Broker You Need to Be Aware Of. Why are we calling it a scam? Because we have read various real user reviews about Alpha FX Markets that raise serious red flags. Check out this article until the end.

Alpha FX Markets is an Unregulated Scam Broker You Need to Be Aware Of. Why are we calling it a scam? Because we have read various real user reviews about Alpha FX Markets that raise serious red flags. Check out this article until the end.

Is Alpha FX Trade Legit?

Crypto Alpha FX Trade is not regulated by any top-tier financial authority such as ASIC, FCA, SEBI, etc. That alone is a major reason to avoid investing with them.

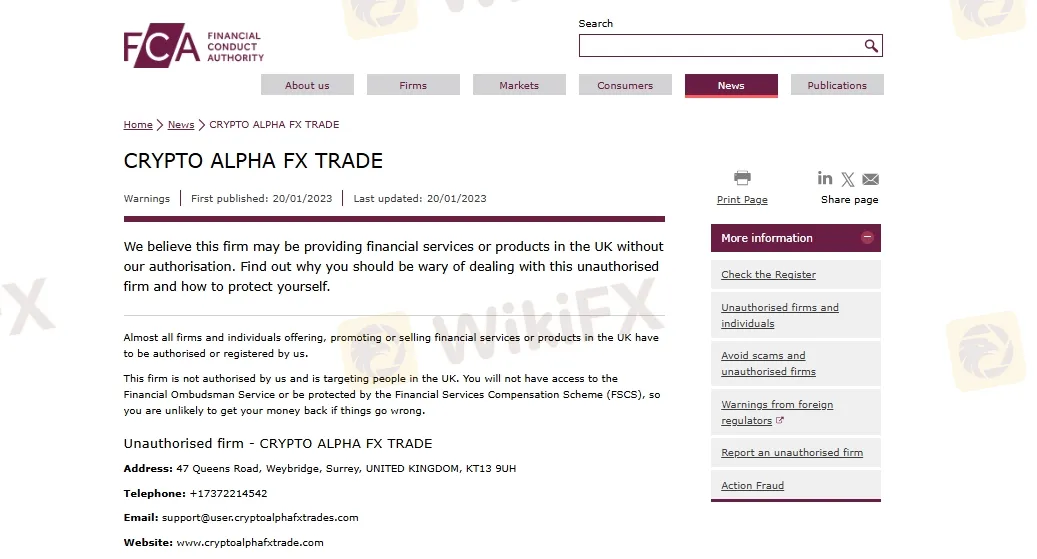

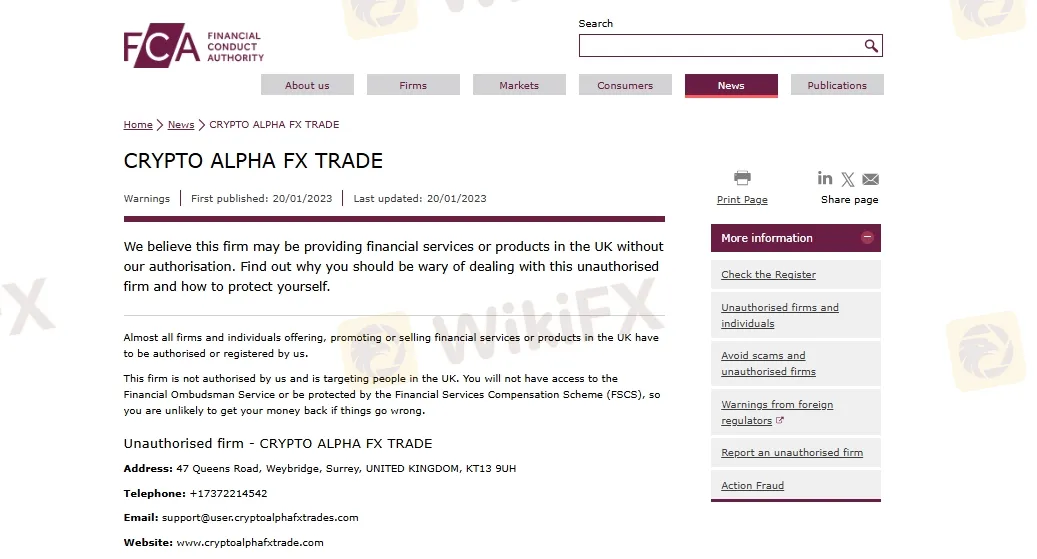

FCA Warning Against Crypto Alpha FX Trade

In 2023, the UKs Financial Conduct Authority (FCA) issued an official warning against Crypto Alpha FX Trade, alerting investors and traders to stay away from this broker.

Customer Support Details

Alpha FX Markets provides the following contact details:

USA Address:186 Paloma St, Winters, Texas (TX), 79567, USA

UK Address: 3 Duckpit Lane, Ensdon, United Kingdom

Business Hours:

Monday - Saturday, 8 AM - 5 PM

Email: support@alphafxmarket.com

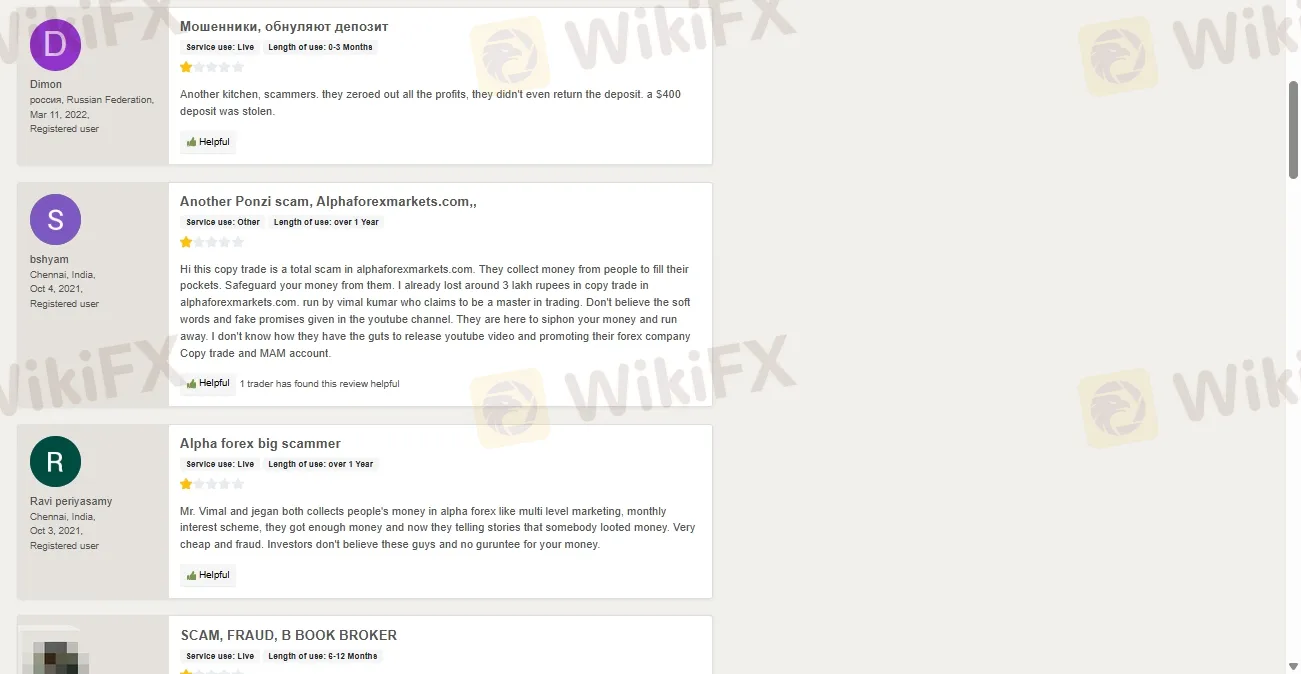

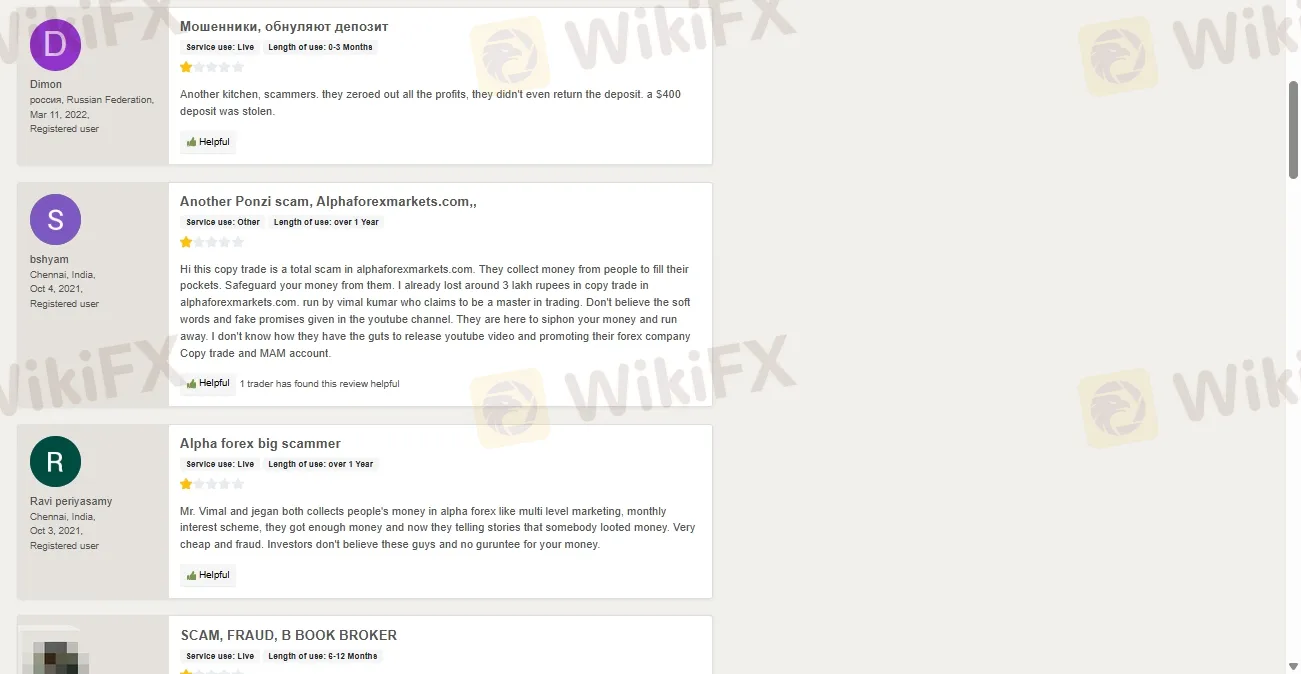

Customer Reviews

In this Alpha Markets review, you'll also find real user feedback about AlphaFX Market. Read the reviews below and stay cautious.

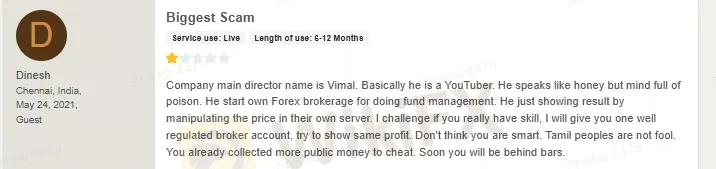

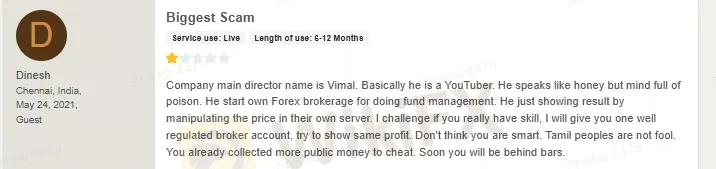

1. Price Manipulation Allegations

One user exposed AlphaFX Market and its main director, Vimal, claiming that he lures people in with fake, lucrative promises. The user alleged that Vimal manipulates prices on their private server and cheats unsuspecting investors.

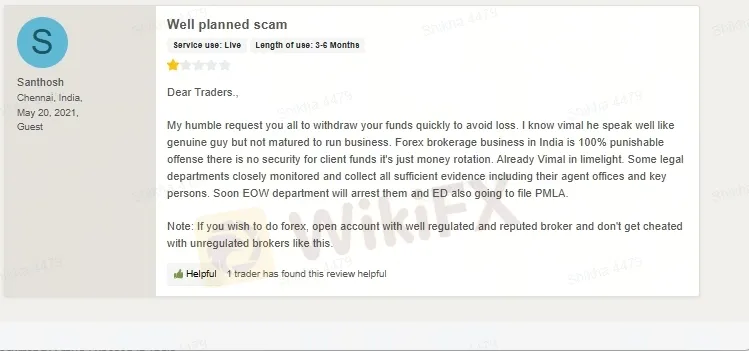

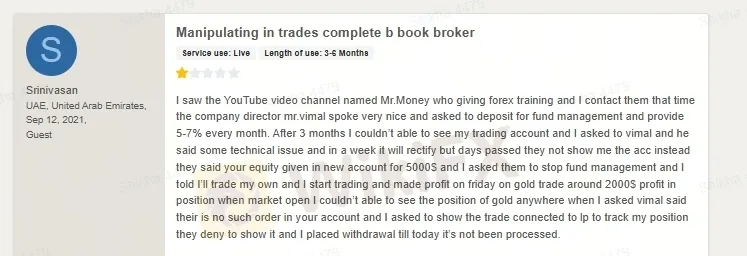

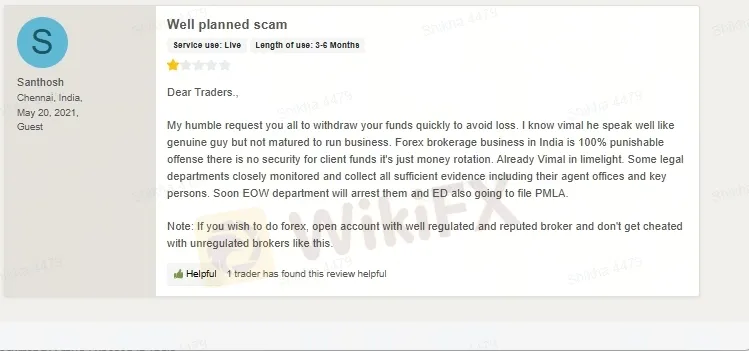

2. A Well-Planned Scam

Another user raised similar concerns, saying Vimal speaks politely but has “poison behind his sweet talk.” The reviewer accused him of running a well-orchestrated scam and warned other traders to withdraw their funds immediately to avoid losses.

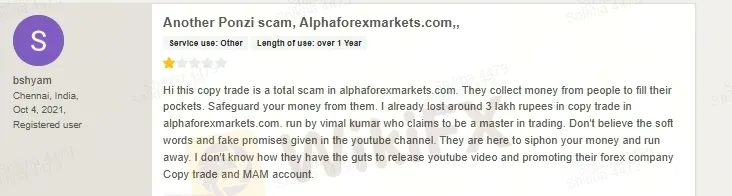

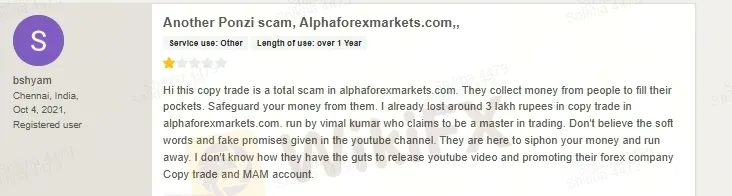

3. Ponzi Scheme Suspected

One reviewer labeled Vimal as the mastermind behind what appears to be a Ponzi scheme. He described Vimal as a well-trained speaker skilled in deception and warned that the platform is unregulated, offering no safety for investor funds.

4. Fake Bonus Scheme

A user claimed the broker runs misleading bonus schemes for example, offering a “30% withdrawal bonus” if you don‘t touch your deposit for 3 months. Initially, the broker claims, “Your money is guaranteed. If you lose it, we’ll cover the loss.” However, after a loss actually occurred, the broker stopped responding entirely.

5. Money Loss

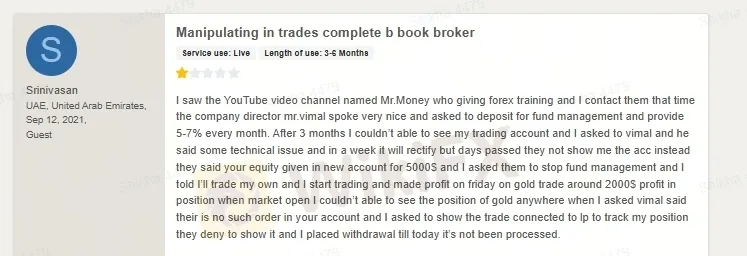

Another victim shared that he got in touch with Vimal, the director of AlphaFX Markets through a YouTube channel called Mr. Money. At first, Vimal spoke politely and offered fund management services. The user deposited money, but after 3 months, he was no longer able to access his trading account. What happened next is shown in the screenshot below read it and beware.

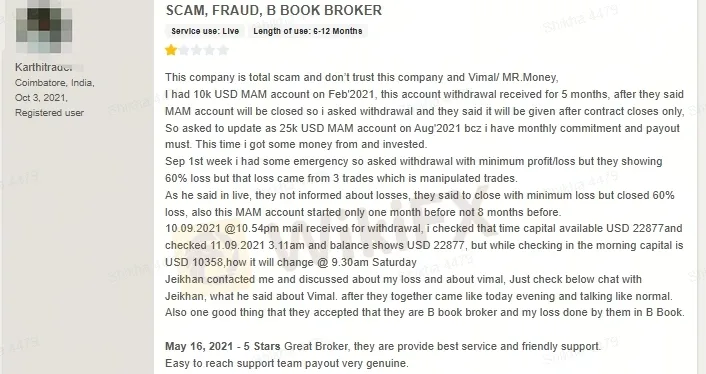

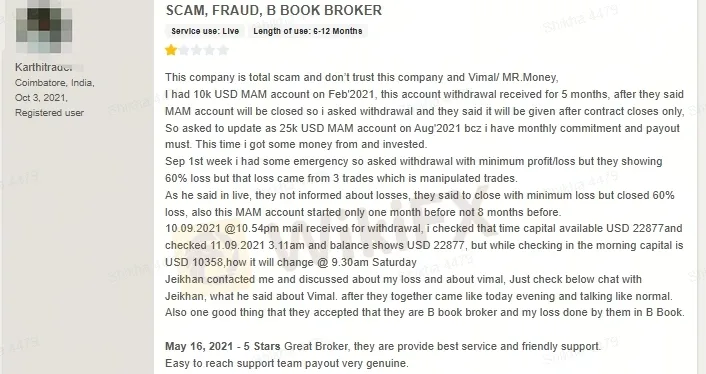

6 .Broker operates Scam Model

The user had a $10,000 MAM account starting in February 2021 and received withdrawals for five months. Later, they upgraded to a $25,000 MAM account due to monthly payout commitments. In September, when requesting a withdrawal, they were shown a sudden 60% loss from three manipulated trades. Despite confirming the capital was available, the balance dropped overnight. Jeikhan admitted the broker operates a scam model, and the loss was caused internally.

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!