Abstract:Many forex brokers run utopian schemes to lure investors and traders. 70Trades is not different from such brokers. It uses the same tactics to swindle people's money. In this 70Trades review, we will give you an insight about the broker and let you know - is it a Scam or safe choice?

Many forex brokers run utopian schemes to lure investors and traders. 70Trades is not different from such brokers. It uses the same tactics to swindle people's money. In this 70Trades review, we will give you an insight about the broker and let you know — is it a Scam or Safe choice ?

Is 70Trades a Scam?

According to 70trades website, It is owned by Securcap Securities Limited with registration number 8416393-1, registered at Office 4, Suite C2, Orion Mall, Palm Street, Victoria, Mahe, Seychelles, authorized by the Seychelles Financial Services Authority with license number SD012. The group of companies includes Wanakena Ltd (registration number 379327) registered at Arch. Makariou III, 73, Office 301, 1070 Nicosia, Cyprus.

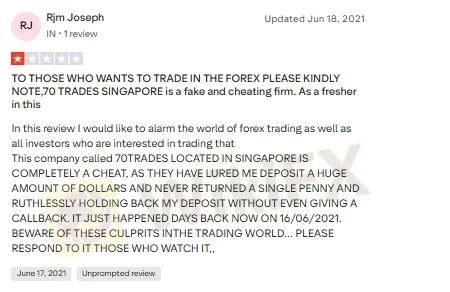

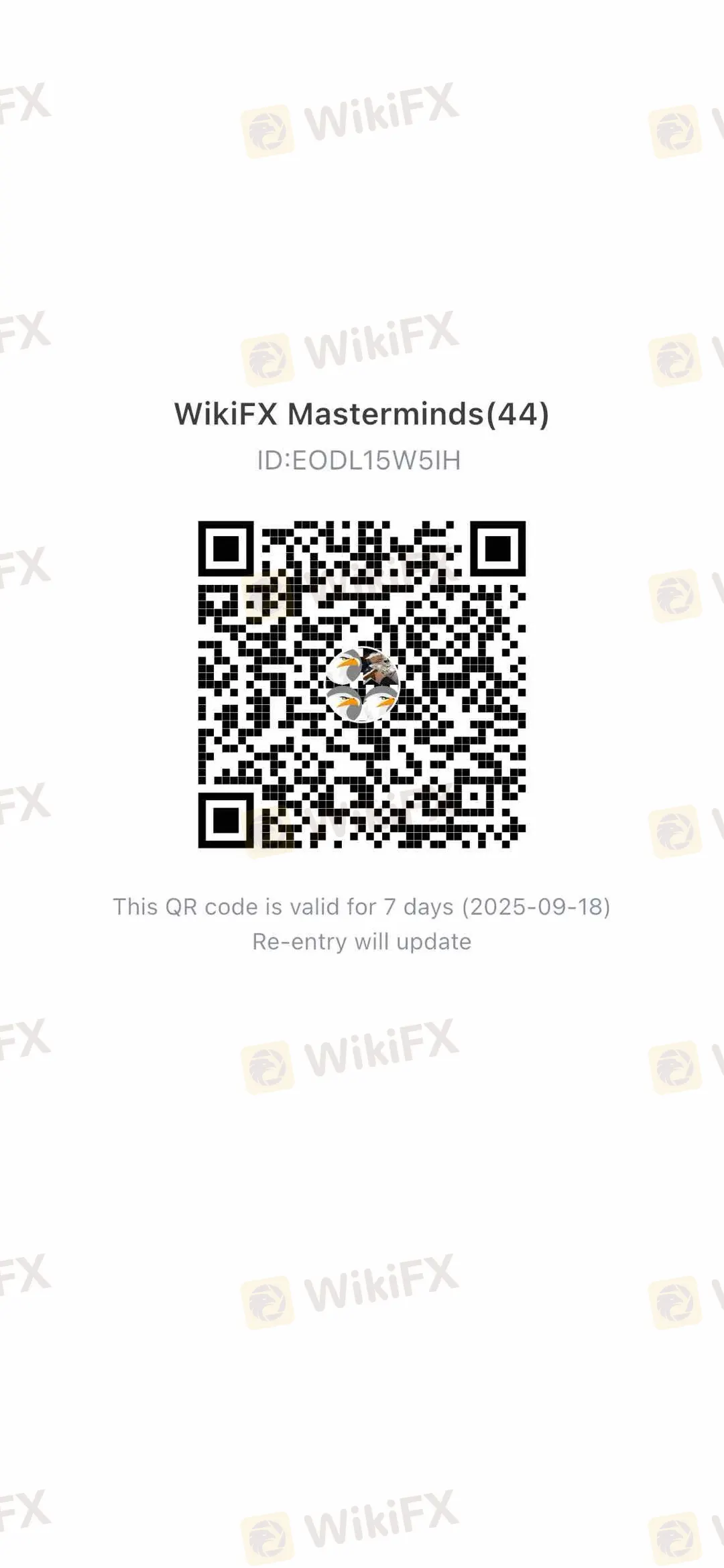

User Reviews About 70Trades

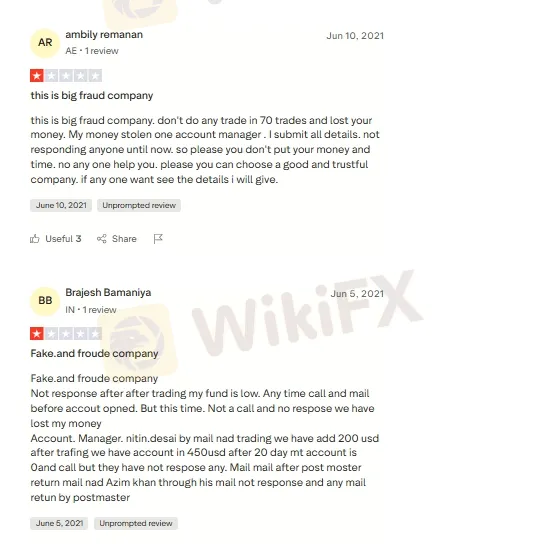

1. Fraud Company

After researching broker reviews, we found multiple users complaining that 70Trades is a fraudulent company. One user detailed how the broker uses tactics to swindle people's money. According to them, the company informs users that they have lost their money, and then encourages them to invest more under the pretense of recovering it.

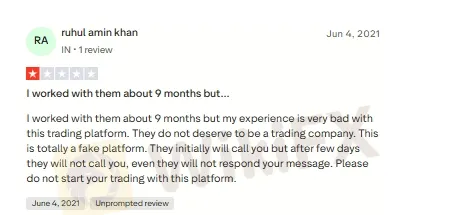

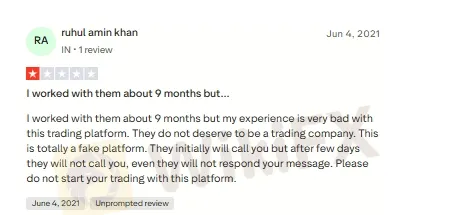

2. Fake Trading Platform

A user who traded with 70Trades for about 9 months shared a very negative experience. He stated that this company does not deserve to be called a trading platform and labeled it as completely fake. He added that although the company initially calls you frequently, they stop all communication after a few days and dont even respond to messages.

3. Account Manager is scammer

Real users have accused one of the companys managers, Nitin Desai, of misappropriating their funds. One user mentioned that even after filing a complaint, there was no response from the company. Another user claimed that he initially deposited $200, and after some trades, his account balance rose to $450, but the company did not allow him to withdraw the amount.

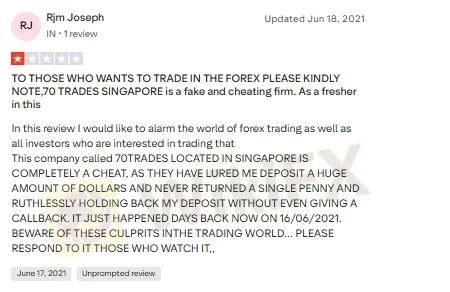

4. 70Trades (Singapore) is a Fraud

A user from Singapore reported that 70Trades is a scam company. He said the broker lured him into depositing a large amount of money and never returned a single penny. The user also stated that the company is ruthlessly withholding his deposit without giving him any callback, and warned others: “Beware of these culprits in the trading world.”

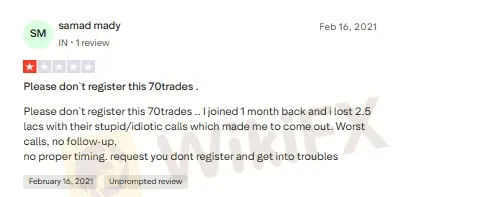

5. Poor Customer Support

One user claimed to have lost ₹2.5 lakhs after registering and funding his account with 70Trades. He described their customer service calls as “stupid and idiotic,” and said they never followed up properly, leaving him in a miserable situation.

Conclusion

We hope you can now identify whether 70Trades (70Trades.com) is legitimate or a scam. Be cautious and invest your money carefully.

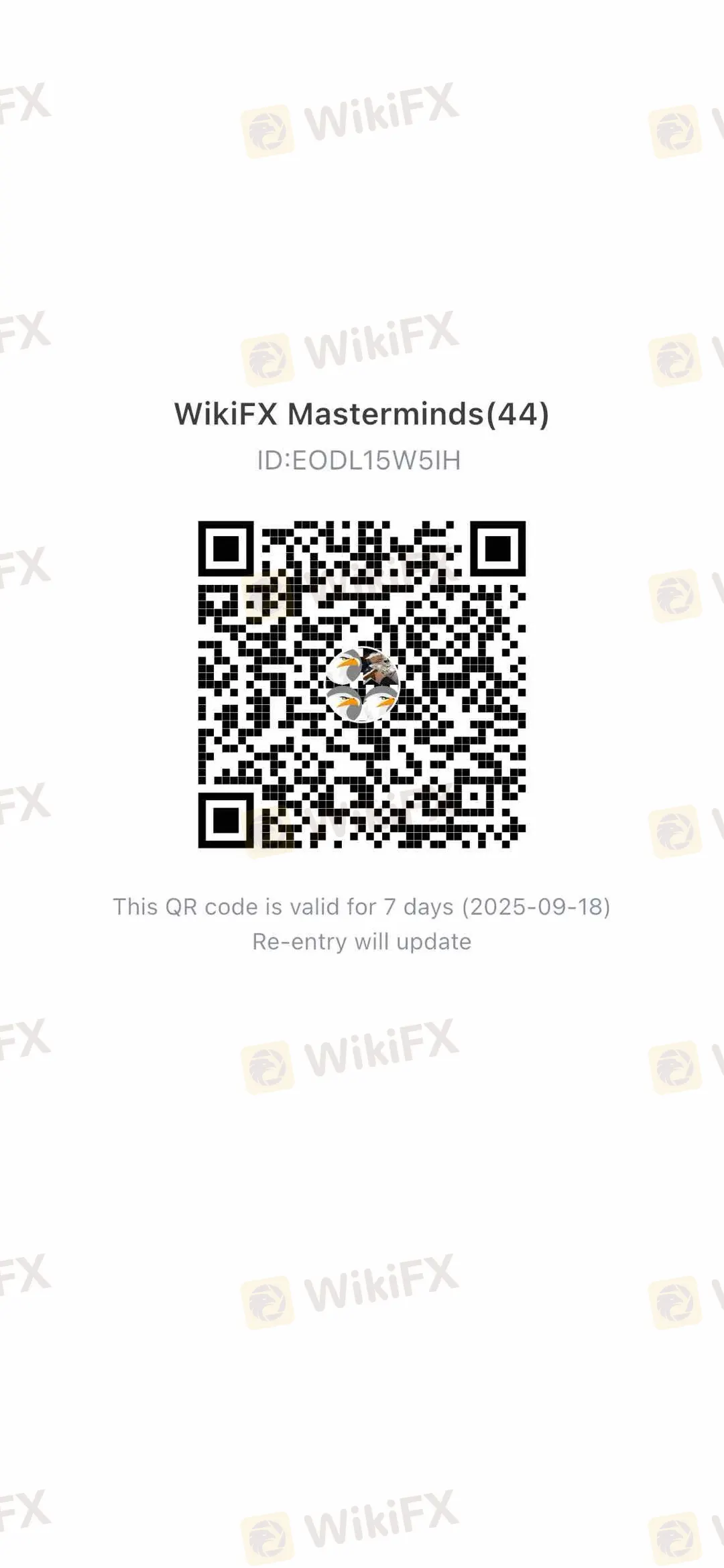

WikiFX Invites you

Are You a Forex Trader or Investor Who's Tired of Jumping Between Platforms Just to Stay Updated? What if you could get all the must-know forex news — in one place, every day — to help you trade smarter and avoid scams?

Yes, its possible!

Join the WikiFX Community Group and get access to real, verified forex news no noise, no fluff.

> 1. Scan the QR code below

> 2. Download the WikiFX Pro App

> 3. Open the app and tap the Scan icon (top right corner)

> 4. Scan the QR code again to complete the process

> 5. Welcome to the group